2023 Az Withholding Form

2023 Az Withholding Form - The forms feature various withholding rates, going as low as 0%. The new arizona flat tax rate is a tax cut for all arizona taxpayers,. Web 20 rows withholding forms : Doug ducey has announced that the state moved to a flat income tax rate on january 1, 2023. Web tax rates used on arizona’s withholding certificate are to decrease for 2023, and all taxpayers must complete a new form for 2023, the state revenue. All wages, salaries, bonuses or other compensation paid for services performed in arizona are subject to state income tax. Web change the entries on the form. Submitted by anonymous (not verified) on fri,. 505, tax withholding and estimated tax. State employees on the hris.

The forms feature various withholding rates, going as low as 0%. Web notify your arizona employees of the state's new income tax rates and provide a copy of the revised 2023 form a4 for electing their withholding percentage. Web 20 rows withholding forms : 1 i elect to have arizona income taxes withheld from my annuity or pension payments as. You can use your results. Prior to january 1, 2023, individual tax rates in arizona were 2.55% and 2.98%, and employees had five withholding. Submitted by anonymous (not verified) on fri,. All wages, salaries, bonuses or other compensation paid for services performed in arizona are subject to state income tax. 505, tax withholding and estimated tax. State employees on the hris.

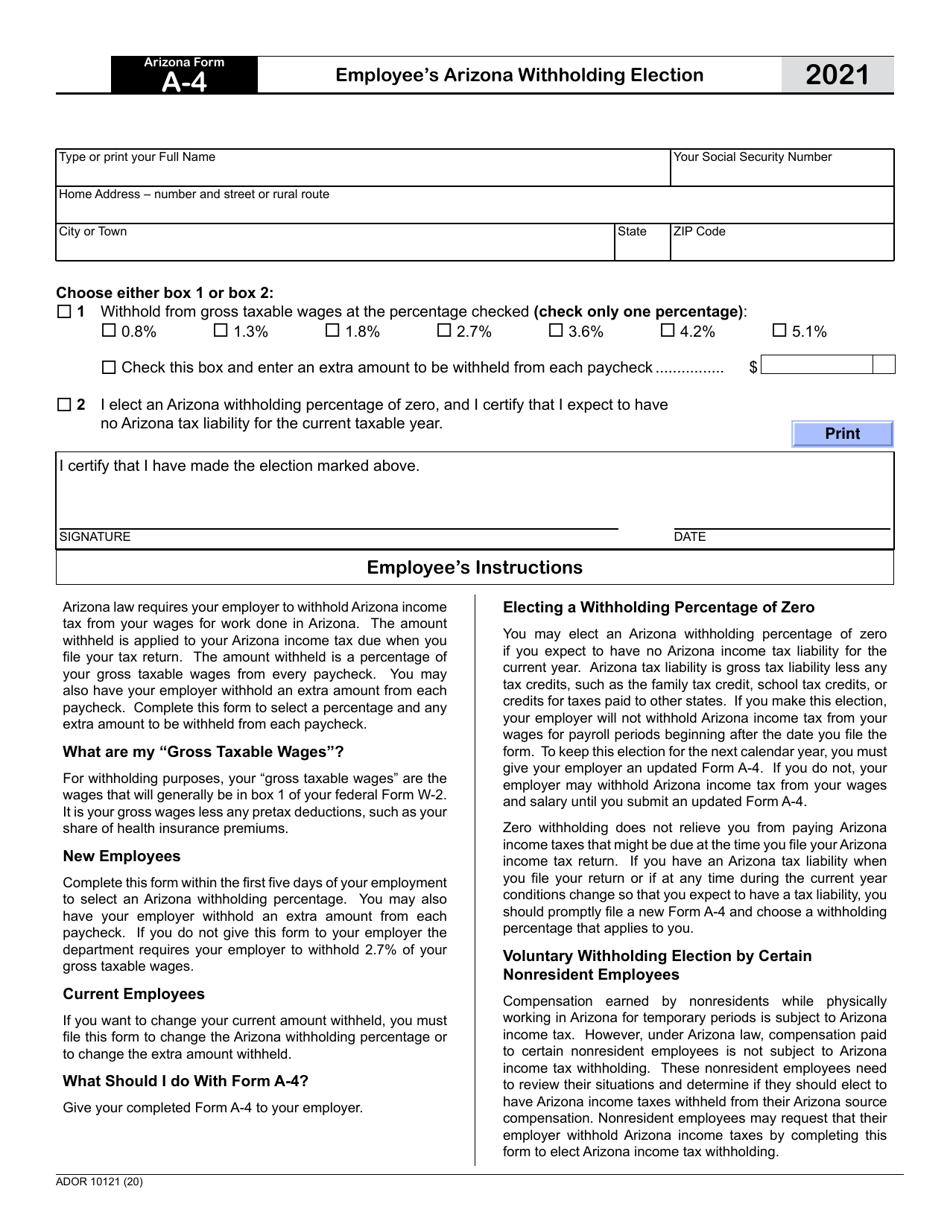

All wages, salaries, bonuses or other compensation paid for services performed in arizona are subject to state income tax. Web notify your arizona employees of the state's new income tax rates and provide a copy of the revised 2023 form a4 for electing their withholding percentage. Web address state income tax withholding percentage withholding exemption, if applicable additional withholding, if desired generally, only new employees and. 505, tax withholding and estimated tax. The forms feature various withholding rates, going as low as 0%. Web arizona’s individual income tax rates were substantially reduced starting with the 2022 tax year. Prior to january 1, 2023, individual tax rates in arizona were 2.55% and 2.98%, and employees had five withholding. The new arizona flat tax rate is a tax cut for all arizona taxpayers,. Web tax rates used on arizona’s withholding certificate are to decrease for 2023, and all taxpayers must complete a new form for 2023, the state revenue. Web complete this form to request that your employer withhold arizona income tax from your wages and elect an arizona withholding percentage and any additional amount to be.

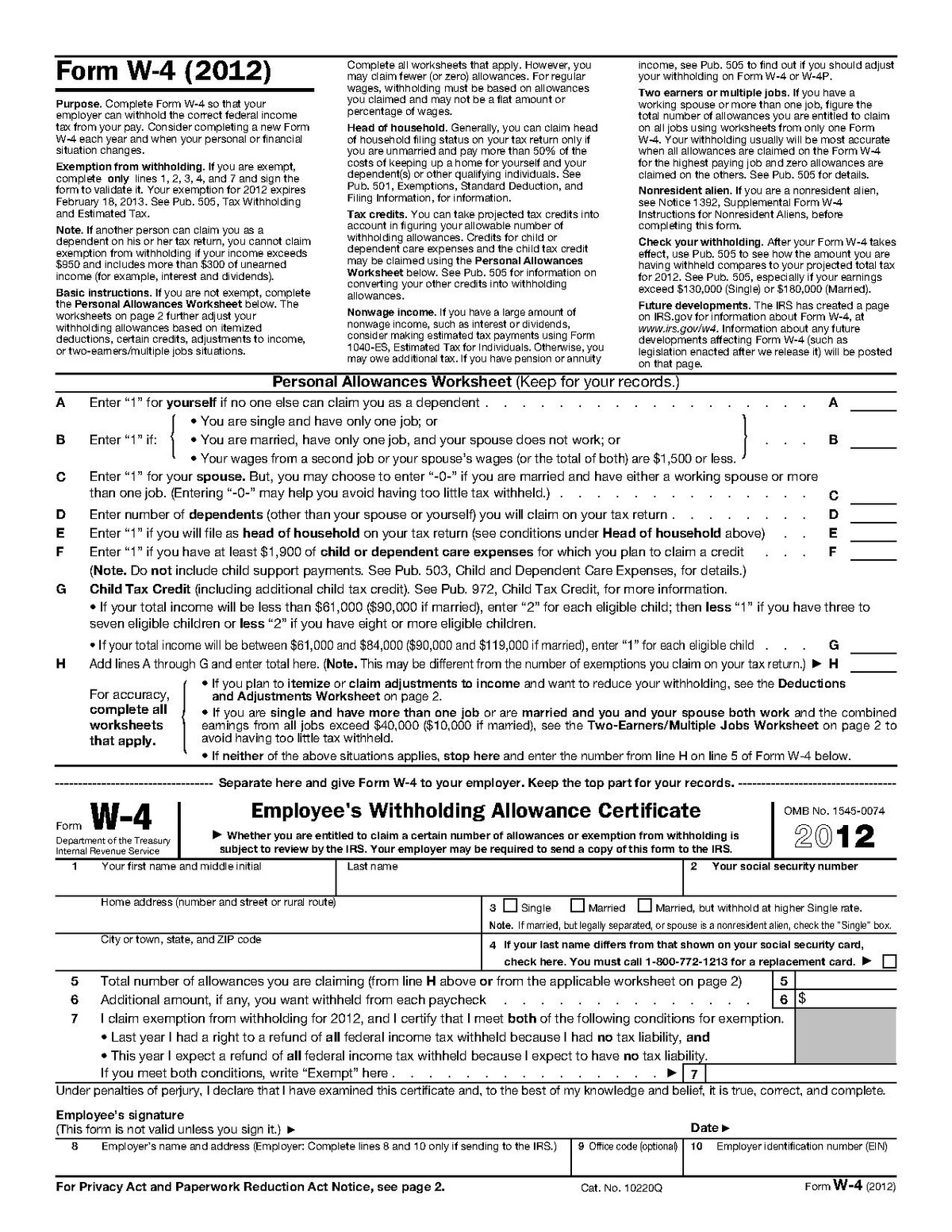

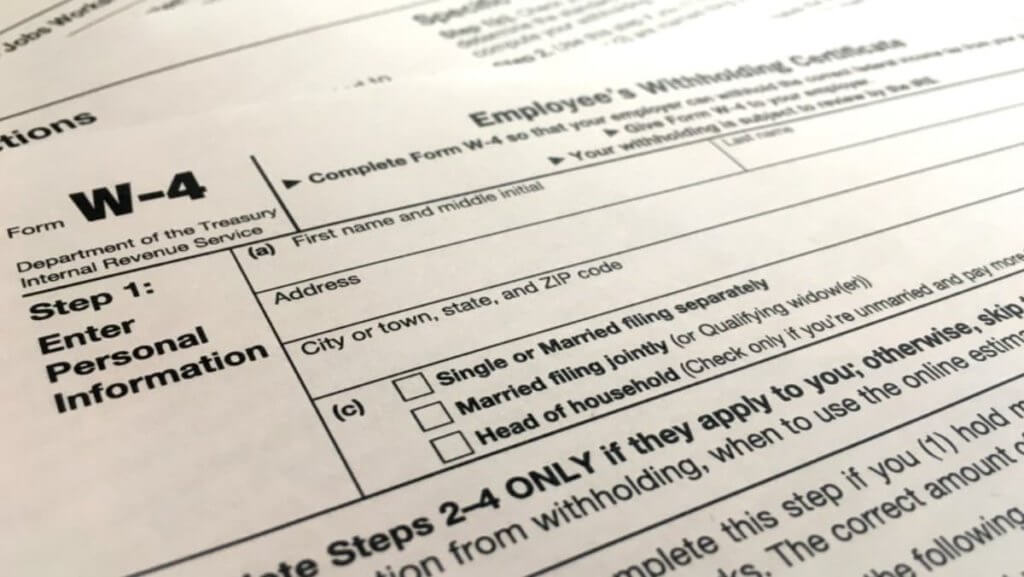

2022 Form W4 IRS Tax Forms W4 Form 2022 Printable

Web notify your arizona employees of the state's new income tax rates and provide a copy of the revised 2023 form a4 for electing their withholding percentage. Web 20 rows withholding forms : The new arizona flat tax rate is a tax cut for all arizona taxpayers,. Web arizona’s individual income tax rates were substantially reduced starting with the 2022.

Arizona Form A4 (ADOR10121) Download Fillable PDF or Fill Online

The new arizona flat tax rate is a tax cut for all arizona taxpayers,. State employees on the hris. Web tax rates used on arizona’s withholding certificate are to decrease for 2023, and all taxpayers must complete a new form for 2023, the state revenue. Submitted by anonymous (not verified) on fri,. Web notify your arizona employees of the state's.

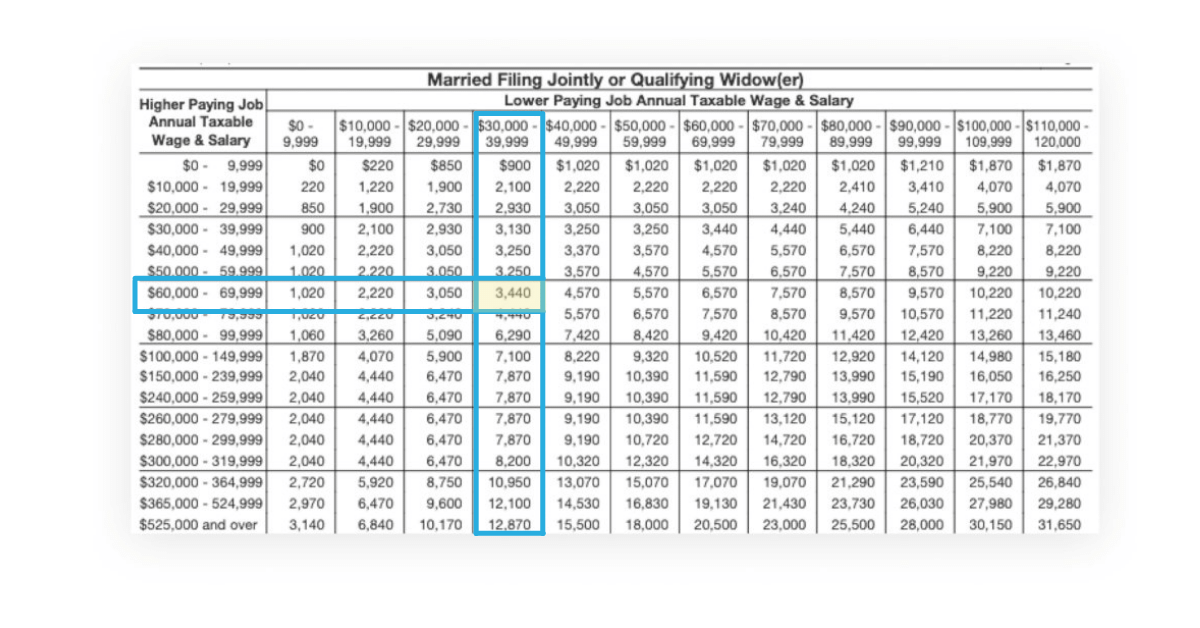

Payroll withholding calculator 2023 MonaDeimante

Web notify your arizona employees of the state's new income tax rates and provide a copy of the revised 2023 form a4 for electing their withholding percentage. Web 20 rows withholding forms : Submitted by anonymous (not verified) on fri,. 1 i elect to have arizona income taxes withheld from my annuity or pension payments as. The forms feature various.

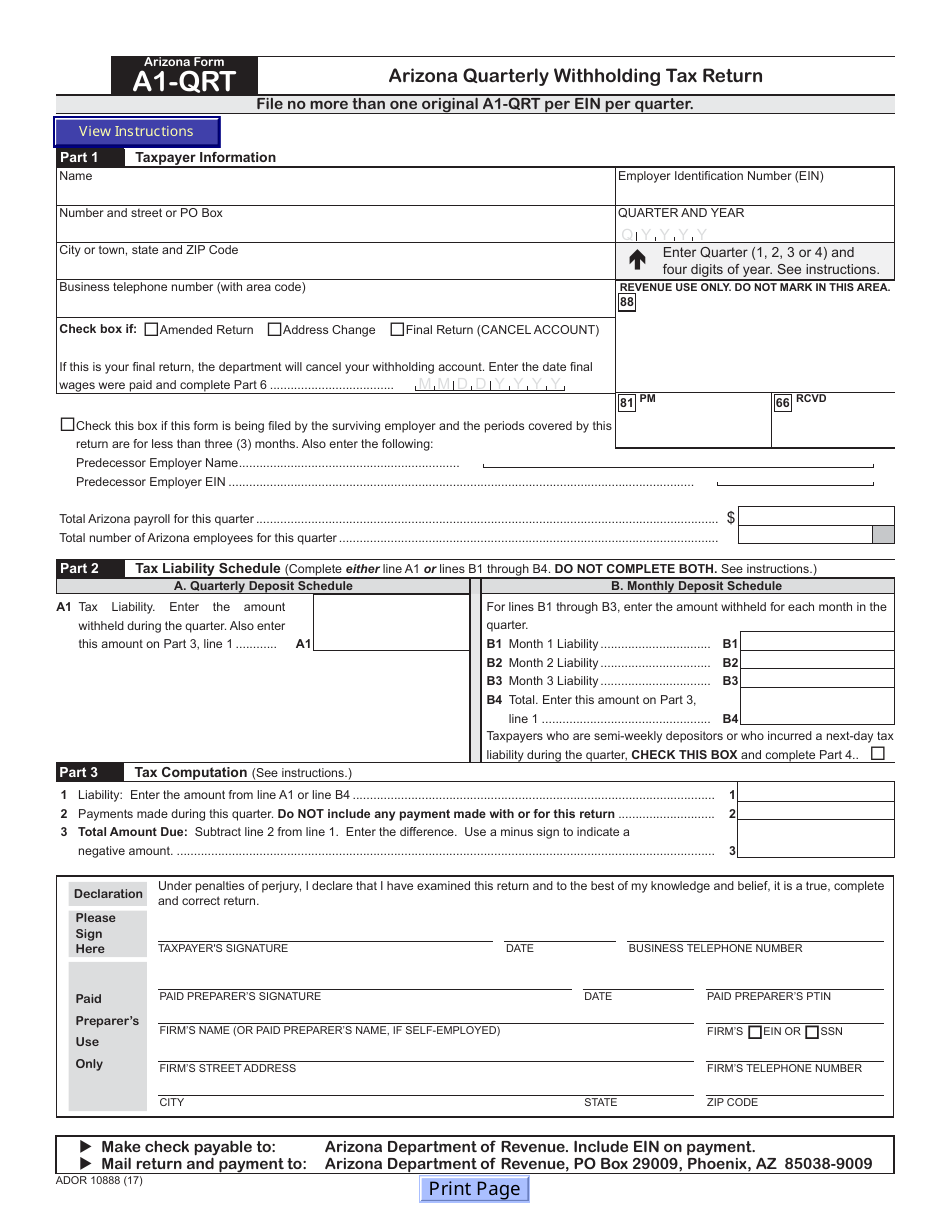

Arizona Form A1QRT (ADOR10888) Download Fillable PDF or Fill Online

Submitted by anonymous (not verified) on fri,. You can use your results. Web notify your arizona employees of the state's new income tax rates and provide a copy of the revised 2023 form a4 for electing their withholding percentage. Web withholding forms are changing as well. All wages, salaries, bonuses or other compensation paid for services performed in arizona are.

Az Tax Withholding Chart Triply

Web to compute the amount of tax to withhold from compensation paid to employees for services performed in arizona, all new employees subject to arizona income tax withholding. 1 i elect to have arizona income taxes withheld from my annuity or pension payments as. Doug ducey has announced that the state moved to a flat income tax rate on january.

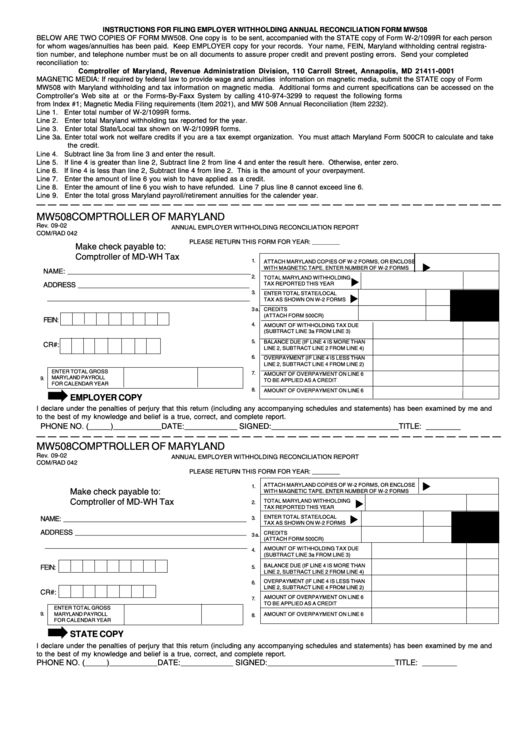

Maryland Withholding Form 2021 2022 W4 Form

Doug ducey has announced that the state moved to a flat income tax rate on january 1, 2023. All wages, salaries, bonuses or other compensation paid for services performed in arizona are subject to state income tax. Submitted by anonymous (not verified) on fri,. Web change the entries on the form. Web tax rates used on arizona’s withholding certificate are.

W4 Form 2023 Printable Form IMAGESEE

The new arizona flat tax rate is a tax cut for all arizona taxpayers,. Submitted by anonymous (not verified) on fri,. Web notify your arizona employees of the state's new income tax rates and provide a copy of the revised 2023 form a4 for electing their withholding percentage. Doug ducey has announced that the state moved to a flat income.

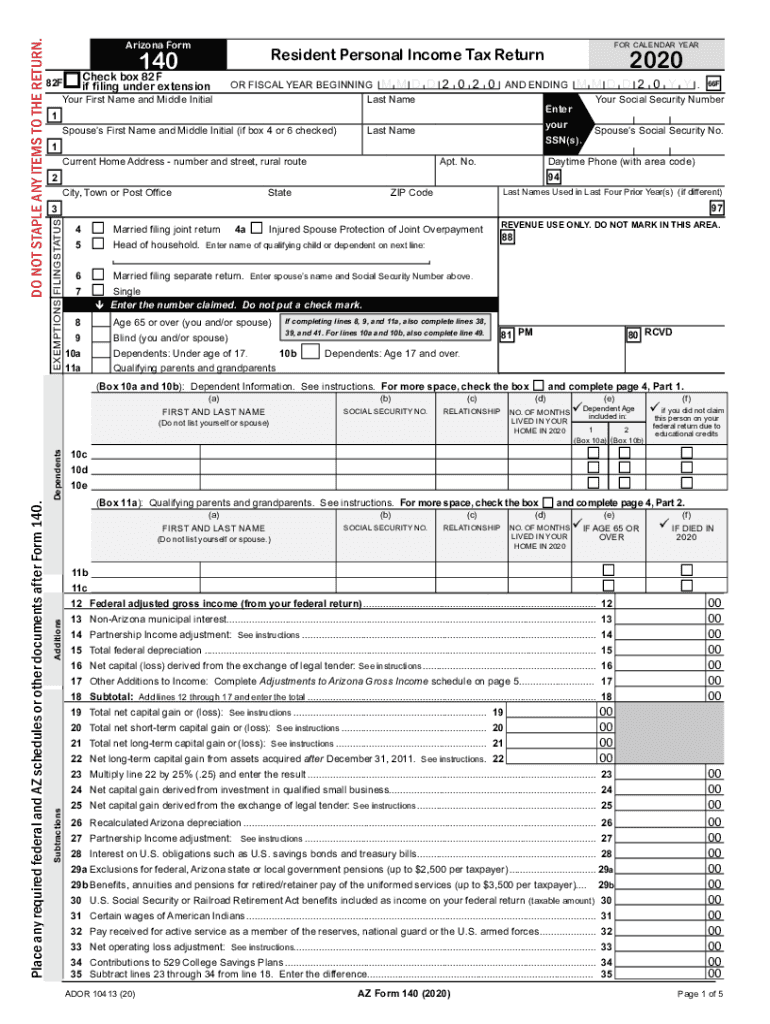

2020 AZ Form 140 Fill Online, Printable, Fillable, Blank pdfFiller

You can use your results. The new arizona flat tax rate is a tax cut for all arizona taxpayers,. Web notify your arizona employees of the state's new income tax rates and provide a copy of the revised 2023 form a4 for electing their withholding percentage. 1 i elect to have arizona income taxes withheld from my annuity or pension.

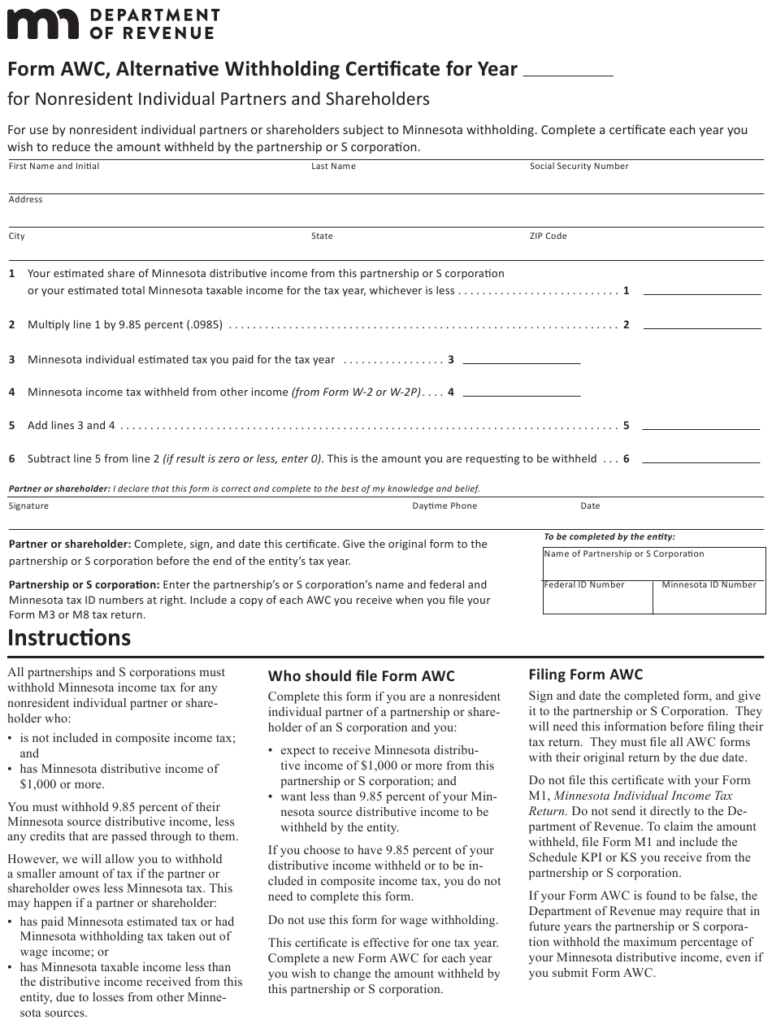

Minnesota State Withholding Form 2021 Federal Withholding Tables 2021

Web to compute the amount of tax to withhold from compensation paid to employees for services performed in arizona, all new employees subject to arizona income tax withholding. Doug ducey has announced that the state moved to a flat income tax rate on january 1, 2023. All wages, salaries, bonuses or other compensation paid for services performed in arizona are.

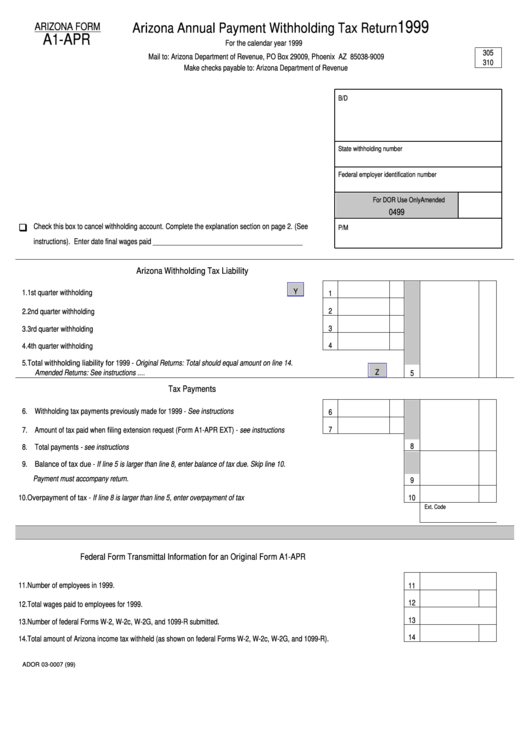

Arizona Form A1Apr Arizona Annual Payment Withholding Tax Return

505, tax withholding and estimated tax. Web complete this form to request that your employer withhold arizona income tax from your wages and elect an arizona withholding percentage and any additional amount to be. Web withholding forms are changing as well. 1 i elect to have arizona income taxes withheld from my annuity or pension payments as. Doug ducey has.

Web Withholding Forms Are Changing As Well.

You can use your results. 1 i elect to have arizona income taxes withheld from my annuity or pension payments as. Web change the entries on the form. The forms feature various withholding rates, going as low as 0%.

Prior To January 1, 2023, Individual Tax Rates In Arizona Were 2.55% And 2.98%, And Employees Had Five Withholding.

Web address state income tax withholding percentage withholding exemption, if applicable additional withholding, if desired generally, only new employees and. Web tax rates used on arizona’s withholding certificate are to decrease for 2023, and all taxpayers must complete a new form for 2023, the state revenue. The new arizona flat tax rate is a tax cut for all arizona taxpayers,. State employees on the hris.

Web 20 Rows Withholding Forms :

Web to compute the amount of tax to withhold from compensation paid to employees for services performed in arizona, all new employees subject to arizona income tax withholding. All wages, salaries, bonuses or other compensation paid for services performed in arizona are subject to state income tax. Doug ducey has announced that the state moved to a flat income tax rate on january 1, 2023. Web complete this form to request that your employer withhold arizona income tax from your wages and elect an arizona withholding percentage and any additional amount to be.

Web Arizona’s Individual Income Tax Rates Were Substantially Reduced Starting With The 2022 Tax Year.

Web notify your arizona employees of the state's new income tax rates and provide a copy of the revised 2023 form a4 for electing their withholding percentage. 505, tax withholding and estimated tax. Submitted by anonymous (not verified) on fri,.