941 Form 2020 Quarter 1

941 Form 2020 Quarter 1 - Employer s quarterly federal tax return created date: Use the april 2020 revision of form 941 to report employment taxes for the second quarter of 2020, and use the january 2020 revision of form 941 to report. July 2021) adjusted employer’s quarterly federal tax return or claim for. Ad access irs tax forms. Complete, edit or print tax forms instantly. You'll be able to obtain the blank form from the pdfliner. Under these facts, you would qualify for the second and third. Web 01 fill and edit template 02 sign it online 03 export or print immediately where to find a blank form 941 for 2020? Web report for this quarter of 2020 (check one.) 1: See the instructions for line 36.

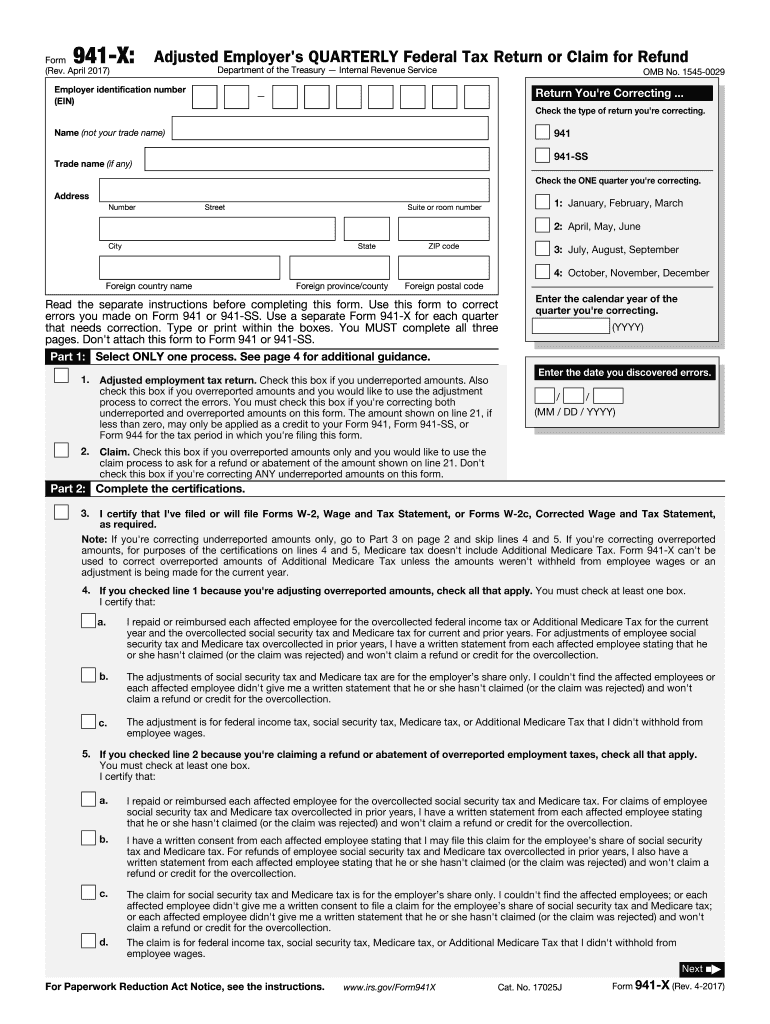

Therefore, any corrections to the. Off to the right side,. Web the employee retention credit for wages paid march 13, 2020, through march 31, 2020, is claimed on form 941 for the second quarter of 2020; Web if you file those in quickbooks desktop, you can follow the steps below to see those federal 941 from the 4th quarter of 2021. Web purpose of form 941. Web they were $45 in the second quarter of 2020, $85 in the third quarter and $75 in the fourth quarter. Complete, edit or print tax forms instantly. Employer s quarterly federal tax return created date: Ad irs 941 inst & more fillable forms, register and subscribe now! Who must file form 941?

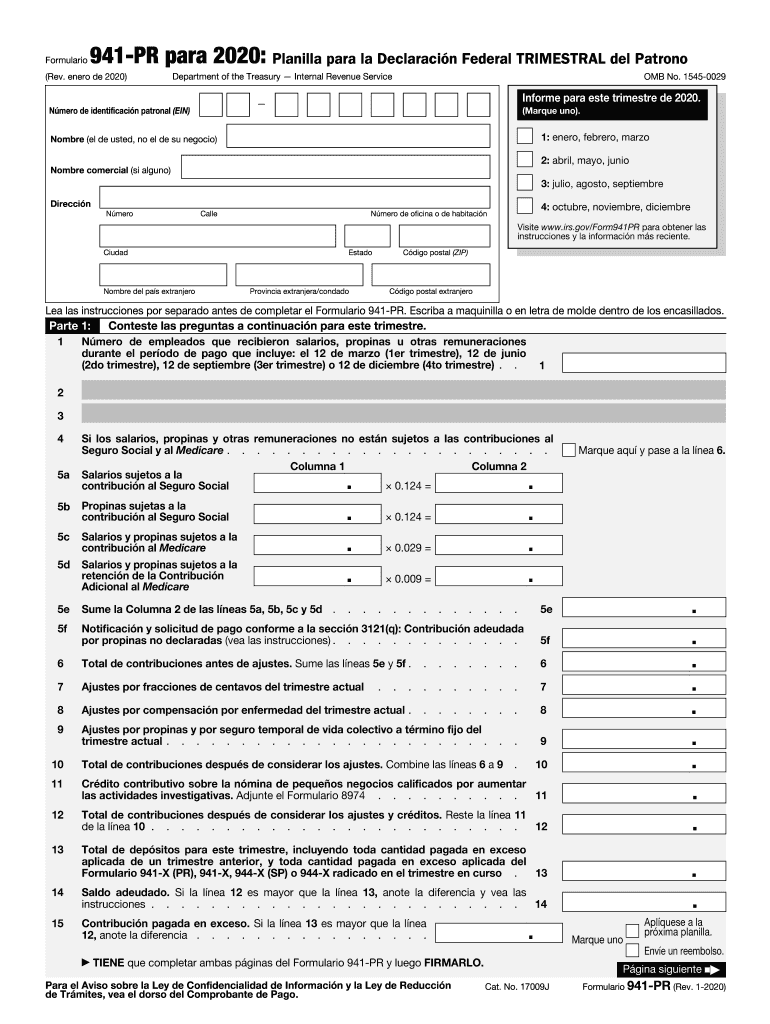

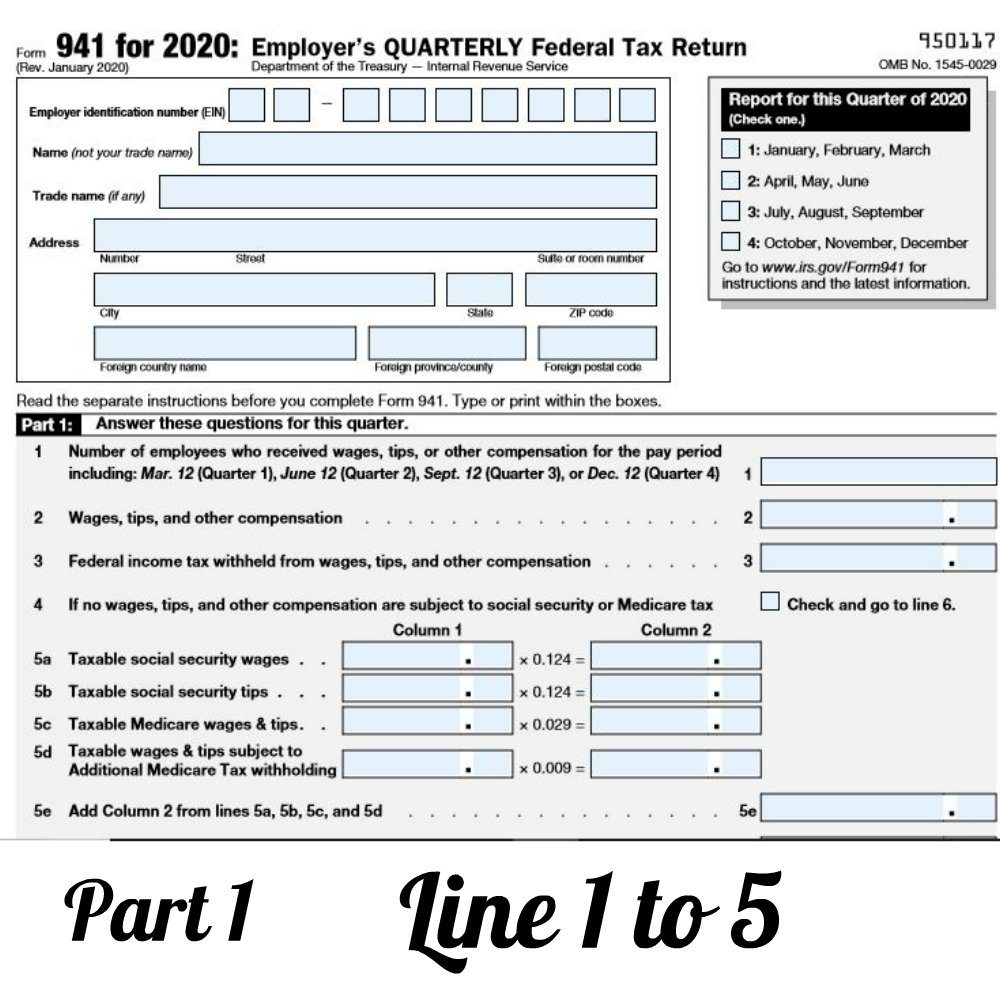

July 2021) adjusted employer’s quarterly federal tax return or claim for. Web if you file those in quickbooks desktop, you can follow the steps below to see those federal 941 from the 4th quarter of 2021. Web the employee retention credit for wages paid march 13, 2020, through march 31, 2020, is claimed on form 941 for the second quarter of 2020; January 2020) employer’s quarterly federal tax return department of the treasury — internal revenue service 950117 omb no. Web fill out business information. Web 01 fill and edit template 02 sign it online 03 export or print immediately where to find a blank form 941 for 2020? You'll be able to obtain the blank form from the pdfliner. Upload, modify or create forms. Upload, modify or create forms. Web report for this quarter of 2020 (check one.) 1:

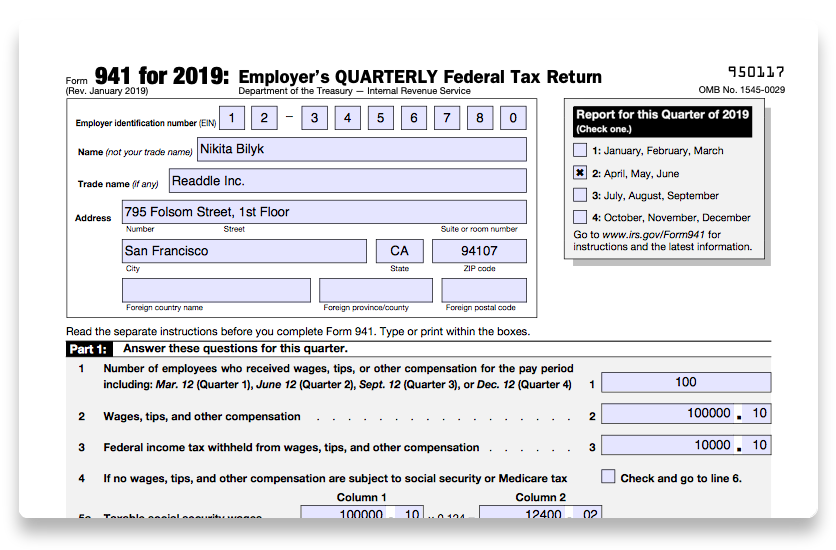

New 941 form for second quarter payroll reporting

Employer s quarterly federal tax return created date: Web fill out business information. January 2020) employer’s quarterly federal tax return department of the treasury — internal revenue service 950117 omb no. Web report for this quarter of 2020 (check one.) 1: Web the deadline for filing form 941 for the 3rd quarter of 2020 is october 31, 2020.

941 Form 2020 941 Forms

Web the deadline for filing form 941 for the 3rd quarter of 2020 is october 31, 2020. Use the april 2020 revision of form 941 to report employment taxes for the second quarter of 2020, and use the january 2020 revision of form 941 to report. Therefore, any corrections to the. You'll be able to obtain the blank form from.

941 form 2018 Fill out & sign online DocHub

Web report for this quarter of 2020 (check one.) 1: Yellen issued the following statement on the recent decision by fitch ratings. Try it for free now! Ad access irs tax forms. Web dallas, july 26, 2023 — at&t inc.

How to fill out IRS Form 941 2019 PDF Expert

Web fill out business information. You'll be able to obtain the blank form from the pdfliner. Upload, modify or create forms. Upload, modify or create forms. Ad access irs tax forms.

941 Form Fill Out and Sign Printable PDF Template signNow

Web employer's quarterly federal tax return for 2021. Web dallas, july 26, 2023 — at&t inc. Because this is a saturday this year, the deadline to file this form will actually be. Employer s quarterly federal tax return created date: Off to the right side,.

Form 941 3Q 2020

You can go to click this link to open and furnish the. Ad access irs tax forms. Go to the employee menu. Web employer's quarterly federal tax return for 2021. July 2020) employer’s quarterly federal tax return 950120 omb no.

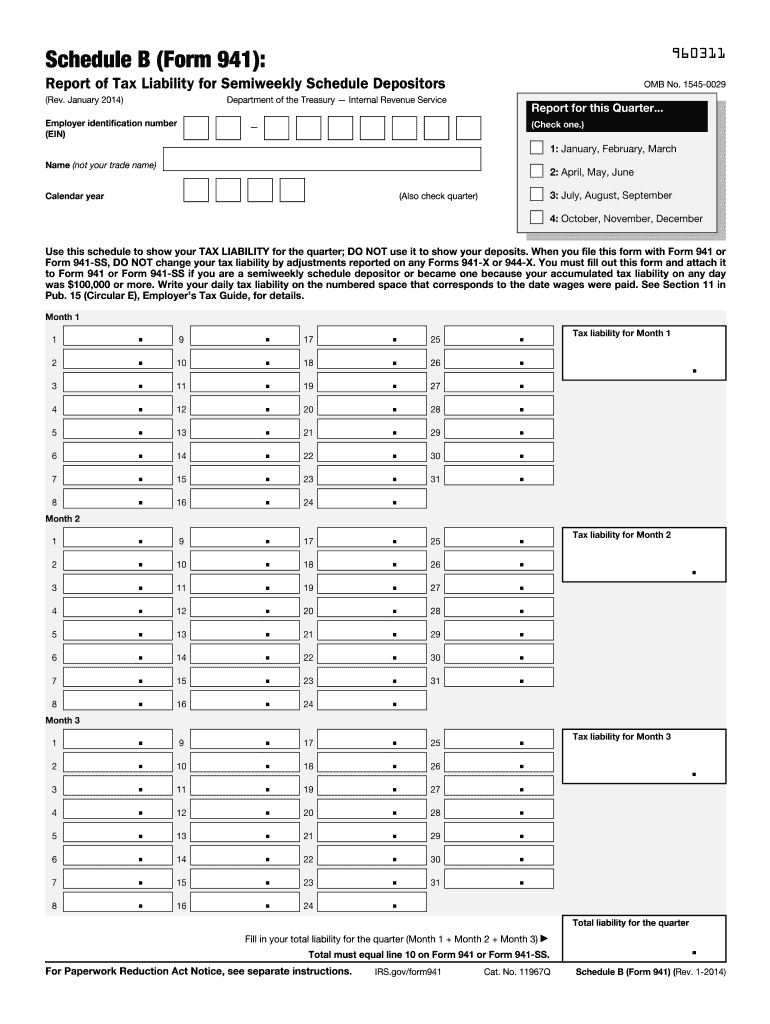

2014 Form IRS 941 Schedule B Fill Online, Printable, Fillable, Blank

Go to the employee menu. July 2021) adjusted employer’s quarterly federal tax return or claim for. At the top portion of form 941, fill in your ein, business name, trade name (if applicable), and business address. Upload, modify or create forms. Therefore, any corrections to the.

How to Fill Out 2020 Form 941 Employer’s Quarterly Federal Tax Return

July 2020) employer’s quarterly federal tax return 950120 omb no. Web the employee retention credit for wages paid march 13, 2020, through march 31, 2020, is claimed on form 941 for the second quarter of 2020; Because this is a saturday this year, the deadline to file this form will actually be. How should you complete form 941? Web the.

2020 Form IRS Instructions 941 Fill Online, Printable, Fillable, Blank

Go to the employee menu. Ad access irs tax forms. Web if you file those in quickbooks desktop, you can follow the steps below to see those federal 941 from the 4th quarter of 2021. Check the type of return you’re correcting. Who must file form 941?

2020 Form IRS 941SS Fill Online, Printable, Fillable, Blank pdfFiller

Yellen issued the following statement on the recent decision by fitch ratings. See the instructions for line 36. July 2020) employer’s quarterly federal tax return 950120 omb no. Try it for free now! Use the april 2020 revision of form 941 to report employment taxes for the second quarter of 2020, and use the january 2020 revision of form 941.

Under These Facts, You Would Qualify For The Second And Third.

Web the deadline for filing form 941 for the 3rd quarter of 2020 is october 31, 2020. Web they were $45 in the second quarter of 2020, $85 in the third quarter and $75 in the fourth quarter. Complete, edit or print tax forms instantly. You'll be able to obtain the blank form from the pdfliner.

Try It For Free Now!

Yellen issued the following statement on the recent decision by fitch ratings. Web the finalized third version of form 941 for 2020, which is to be used for the third and fourth quarters of 2020, was released sept. At the top portion of form 941, fill in your ein, business name, trade name (if applicable), and business address. Go to the employee menu.

Because This Is A Saturday This Year, The Deadline To File This Form Will Actually Be.

Web report for this quarter of 2020 (check one.) 1: Web report for this quarter of 2020 (check one.) 1: Web the employee retention credit for wages paid march 13, 2020, through march 31, 2020, is claimed on form 941 for the second quarter of 2020; July 2021) adjusted employer’s quarterly federal tax return or claim for.

Off To The Right Side,.

Upload, modify or create forms. Web if you file those in quickbooks desktop, you can follow the steps below to see those federal 941 from the 4th quarter of 2021. Check the type of return you’re correcting. For employers who withhold taxes from employee's paychecks or who must pay the employer's portion of.