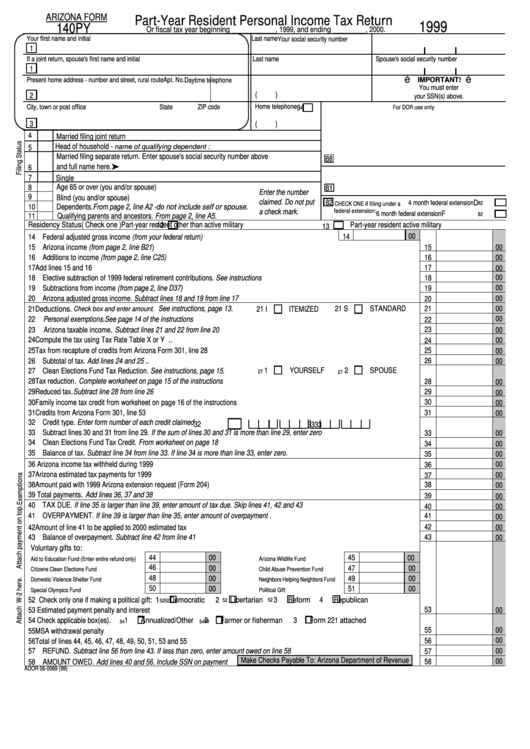

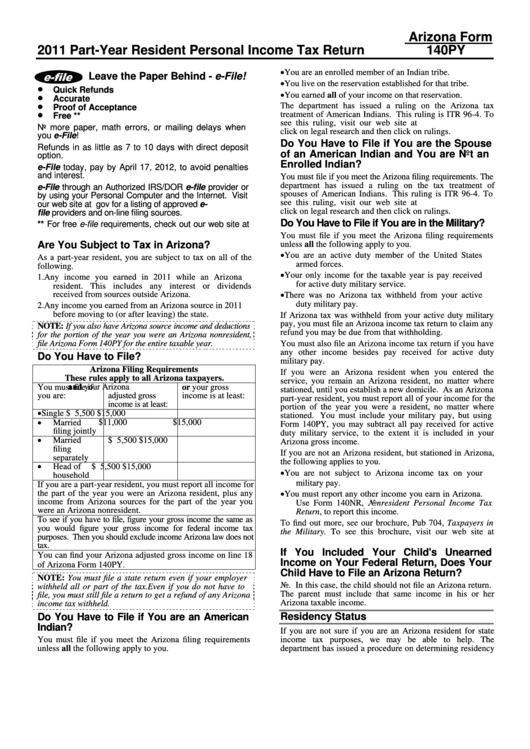

Arizona Part Year Resident Tax Form

Arizona Part Year Resident Tax Form - File a form 140py if you were an arizona resident for less than 12 months during 2019. You moved out of arizona. Residency status 101 for income tax. Arizona state income tax forms for tax year 2022 (jan. Web common arizona income tax forms & instructions. You moved into arizona with the intent of becoming a resident. This form is used by residents who file an individual. The most common arizona income tax form is the arizona form 140. Web the correct amount to enter on line 6c is the total amount of charitable contributions made in 2020 for which you are claiming a tax credit for the current tax year. Web who must usepersonal income tax return arizona form 140py?

Web common arizona income tax forms & instructions. File a form 140py if you were an arizona resident for less than 12 months during 2019. Arizona state income tax forms for tax year 2022 (jan. You moved into arizona with the intent of becoming a resident. We last updated arizona form 140py in february 2023 from the arizona. Web the correct amount to enter on line 6c is the total amount of charitable contributions made in 2020 for which you are claiming a tax credit for the current tax year. Residency status 101 for income tax. File a form 140py if you were an arizona resident for less than 12 months during 2021. This form is used by residents who file an individual. The most common arizona income tax form is the arizona form 140.

Web the correct amount to enter on line 6c is the total amount of charitable contributions made in 2020 for which you are claiming a tax credit for the current tax year. You are required to determine a percentage of. Web are you subject to tax in arizona? Web common arizona income tax forms & instructions. Arizona state income tax forms for tax year 2022 (jan. You moved into arizona with the intent of becoming a resident. Residency status 101 for income tax. File a form 140py if you were an arizona resident for less than 12 months during 2019. This form is used by residents who file an individual. Web who must usepersonal income tax return arizona form 140py?

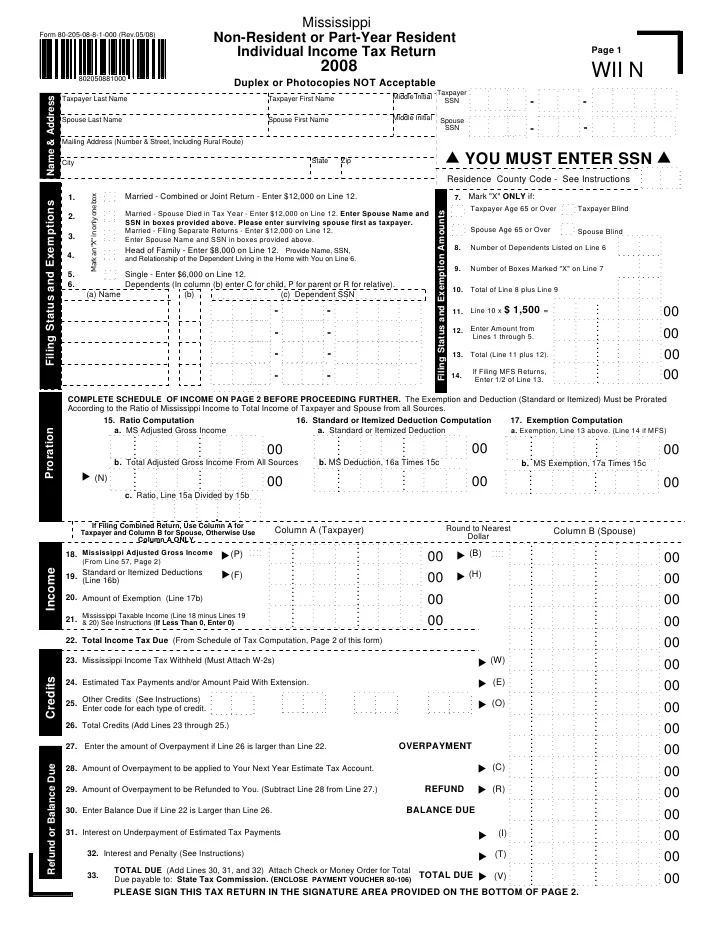

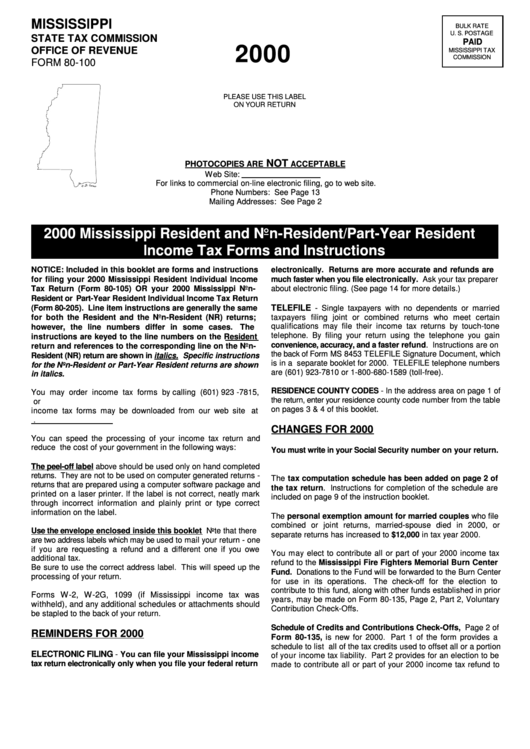

NonResident & Part Year Resident Tax Return

Any income you earned in 2021 while an arizona resident. Arizona state income tax forms for tax year 2022 (jan. Web common arizona income tax forms & instructions. The most common arizona income tax form is the arizona form 140. File a form 140py if you were an arizona resident for less than 12 months during 2021.

Form 1 NRPY Mass Nonresident Part Year Resident Tax Return YouTube

File a form 140py if you were an arizona resident for less than 12 months during 2019. The most common arizona income tax form is the arizona form 140. Web who must usepersonal income tax return arizona form 140py? File a form 140py if you were an arizona resident for less than 12 months during 2021. Web the correct amount.

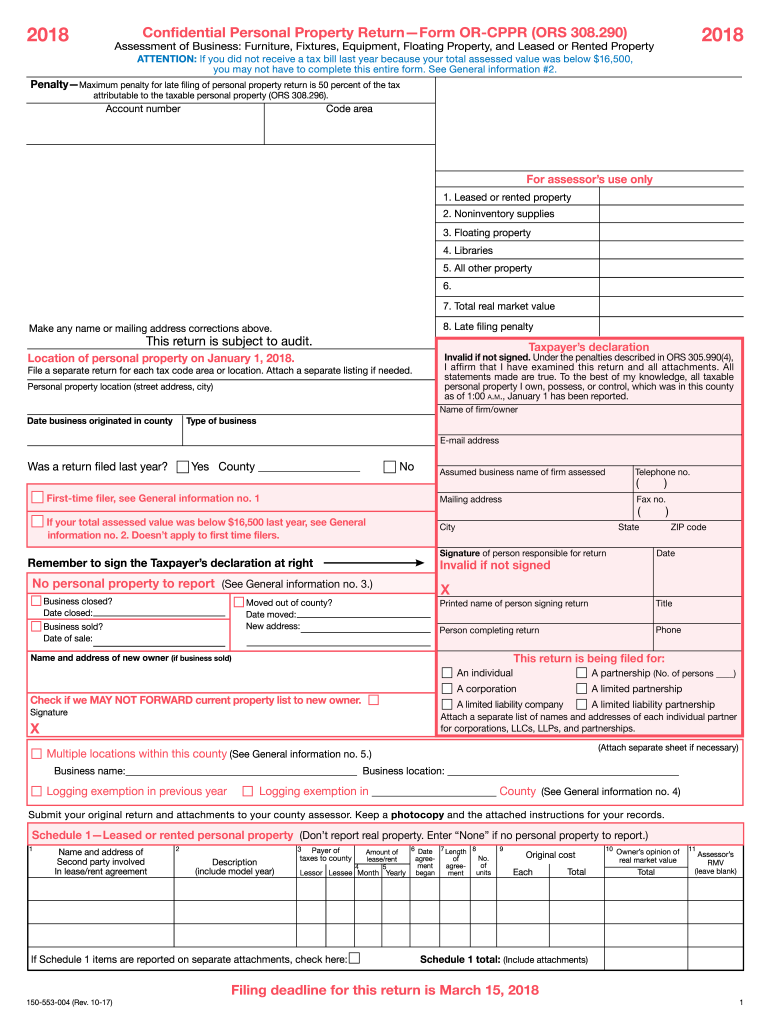

Oregon Form 40 2021 Printable Printable Form 2022

Web who must usepersonal income tax return arizona form 140py? Arizona state income tax forms for tax year 2022 (jan. Residency status 101 for income tax. We last updated arizona form 140py in february 2023 from the arizona. File a form 140py if you were an arizona resident for less than 12 months during 2019.

Arizona Form 140py PartYear Resident Personal Tax Return

Web who must usepersonal income tax return arizona form 140py? We last updated arizona form 140py in february 2023 from the arizona. Arizona state income tax forms for tax year 2022 (jan. You moved into arizona with the intent of becoming a resident. You are required to determine a percentage of.

Form 80100 Instructions Mississippi Resident And NonResident/part

Arizona state income tax forms for tax year 2022 (jan. File a form 140py if you were an arizona resident for less than 12 months during 2019. You moved into arizona with the intent of becoming a resident. Web the correct amount to enter on line 6c is the total amount of charitable contributions made in 2020 for which you.

Instructions For Arizona Form 140py PartYear Resident Personal

Web the correct amount to enter on line 6c is the total amount of charitable contributions made in 2020 for which you are claiming a tax credit for the current tax year. You are required to determine a percentage of. Any income you earned in 2021 while an arizona resident. The most common arizona income tax form is the arizona.

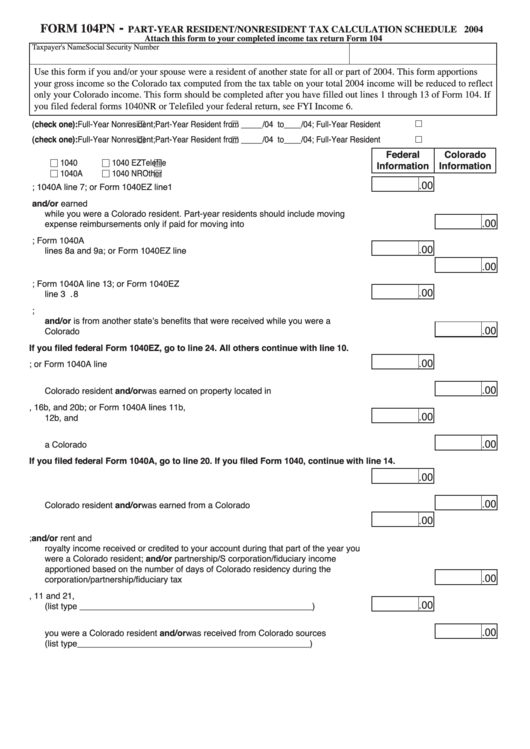

Fillable Form 104pn PartYear Resident/nonresident Tax Calculation

You moved into arizona with the intent of becoming a resident. Web common arizona income tax forms & instructions. File a form 140py if you were an arizona resident for less than 12 months during 2019. Web the correct amount to enter on line 6c is the total amount of charitable contributions made in 2020 for which you are claiming.

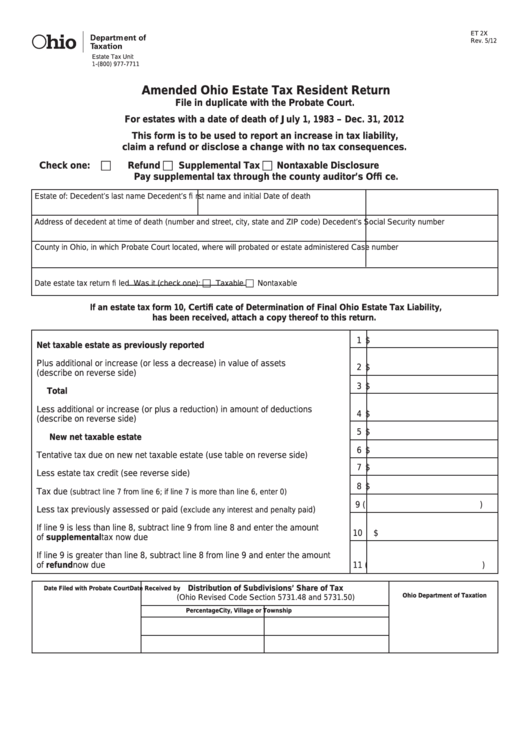

Fillable Form Et 2x Amended Ohio Estate Tax Resident Return printable

Residency status 101 for income tax. The most common arizona income tax form is the arizona form 140. You moved out of arizona. Web common arizona income tax forms & instructions. File a form 140py if you were an arizona resident for less than 12 months during 2021.

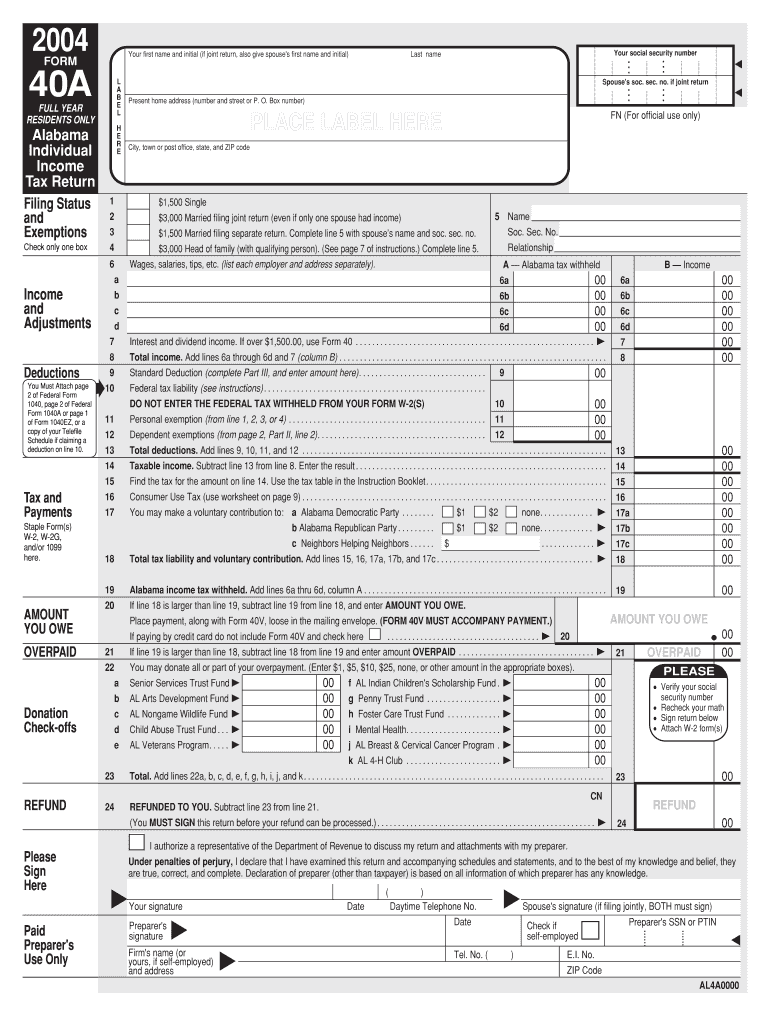

Form 40 Alabama Fill Out and Sign Printable PDF Template signNow

Web are you subject to tax in arizona? The most common arizona income tax form is the arizona form 140. Web who must usepersonal income tax return arizona form 140py? Web the correct amount to enter on line 6c is the total amount of charitable contributions made in 2020 for which you are claiming a tax credit for the current.

Top 22 Virginia Form 760 Templates free to download in PDF format

You moved into arizona with the intent of becoming a resident. We last updated arizona form 140py in february 2023 from the arizona. Web the correct amount to enter on line 6c is the total amount of charitable contributions made in 2020 for which you are claiming a tax credit for the current tax year. You moved out of arizona..

Any Income You Earned In 2021 While An Arizona Resident.

Web who must usepersonal income tax return arizona form 140py? Web the correct amount to enter on line 6c is the total amount of charitable contributions made in 2020 for which you are claiming a tax credit for the current tax year. The most common arizona income tax form is the arizona form 140. File a form 140py if you were an arizona resident for less than 12 months during 2021.

You Are Required To Determine A Percentage Of.

You moved into arizona with the intent of becoming a resident. We last updated arizona form 140py in february 2023 from the arizona. File a form 140py if you were an arizona resident for less than 12 months during 2019. This form is used by residents who file an individual.

You Moved Into Arizona With The Intent Of Becoming A Resident.

Web who must usepersonal income tax return arizona form 140py? Web are you subject to tax in arizona? Arizona state income tax forms for tax year 2022 (jan. You moved out of arizona.

Web Common Arizona Income Tax Forms & Instructions.

Residency status 101 for income tax.