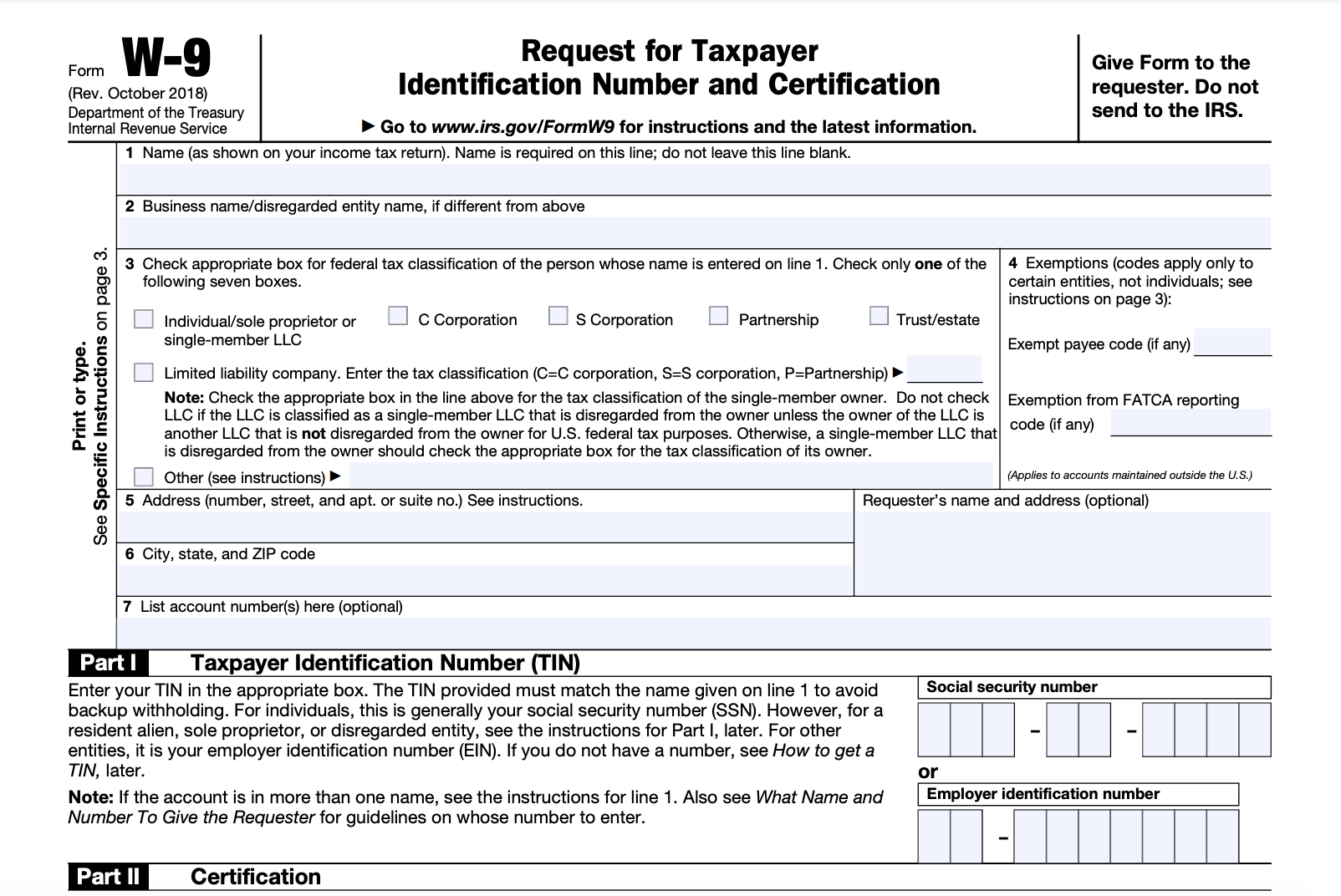

Electronic Signature W9 Form

Electronic Signature W9 Form - Name (as shown on your income tax return). Do not leave this line blank. By signing it you attest that: It can be in many forms and created by many technologies. Make sure you save the form to your computer. In order to use an electronic signature, you must be using a secure electronic signature service that complies with the irs’s requirements. Before you start, you will need two things: Web a w9 tax form is an irs tax document in the form of a helpful guide, which helps independent contractors in completing their tax obligations for the calendar year. Add an electronic signature feature permanently in your systems and adapt to your multichannel strategy. What is backup withholding, later.

What is backup withholding, later. The template uses special formula logic for social security and employee identification numbers to ensure the signer enters the correct information. Web the framework will guide how the irs executes electronic transactions and will be an essential component of an irs online authorization capability. Person (including a resident alien), to provide your correct tin. This can be a social security number or the employer identification number (ein) for a business. Web customized electronic signature modules that are fully integrated into your information system. An electronic signature certificate recognized by editors, as well as french and european governments. If you are a u.s. For federal tax purposes, you are considered a u.s. What is backup withholding, later.

Web take the following steps below to use the w9 online signature functionality within a few minutes: What is backup withholding, later. This can be a social security number or the employer identification number (ein) for a business. Do not leave this line blank. Person (including a resident alien), to provide your correct tin. Give strong evidence that the digital certificate owner signed the document or record recognize tampering and invalidate the signature if the document changes in any way Person (including a resident alien), to provide your correct tin. The electronic signature must identify the payee or borrower submitting the electronic form and must authenticate and verify the submission. Web the irs does accept electronic signatures for w9 forms. Before you start, you will need two things:

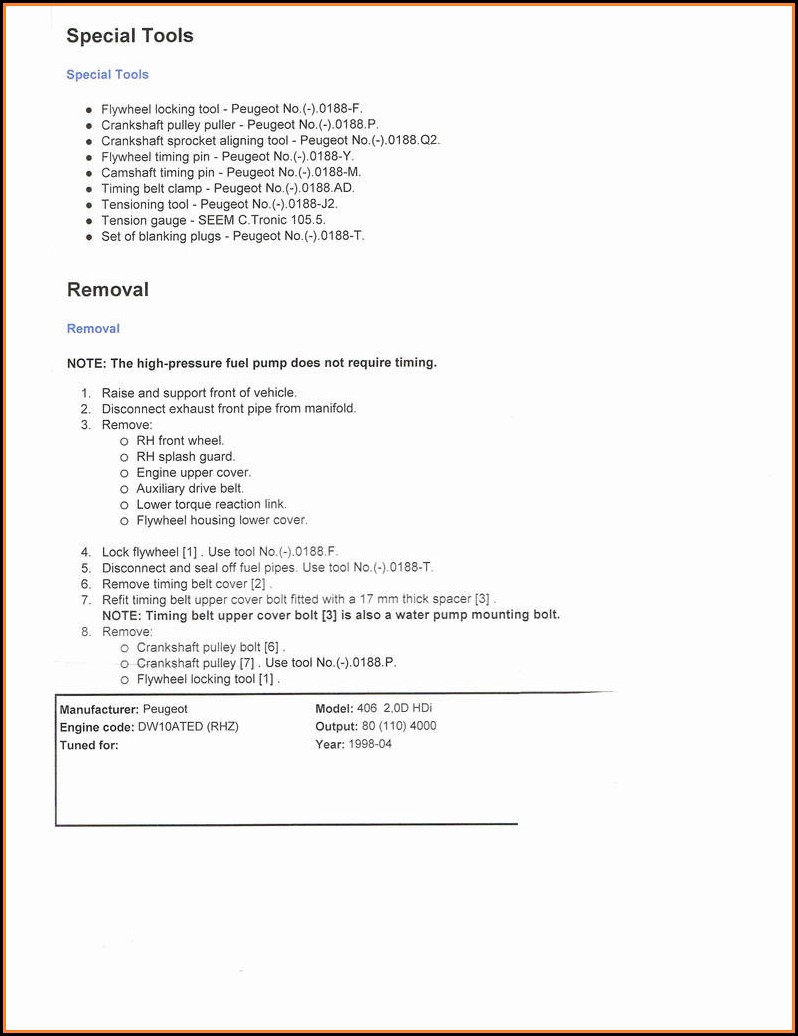

W9 Electronic Signature [SwiftCloud Template] W9 eSign (Taxpayer ID)

Name (as shown on your income tax return). This service must include a secure method of signing documents, as well as a way to validate the identity of the signer. An electronic signature certificate recognized by editors, as well as french and european governments. Give strong evidence that the digital certificate owner signed the document or record recognize tampering and.

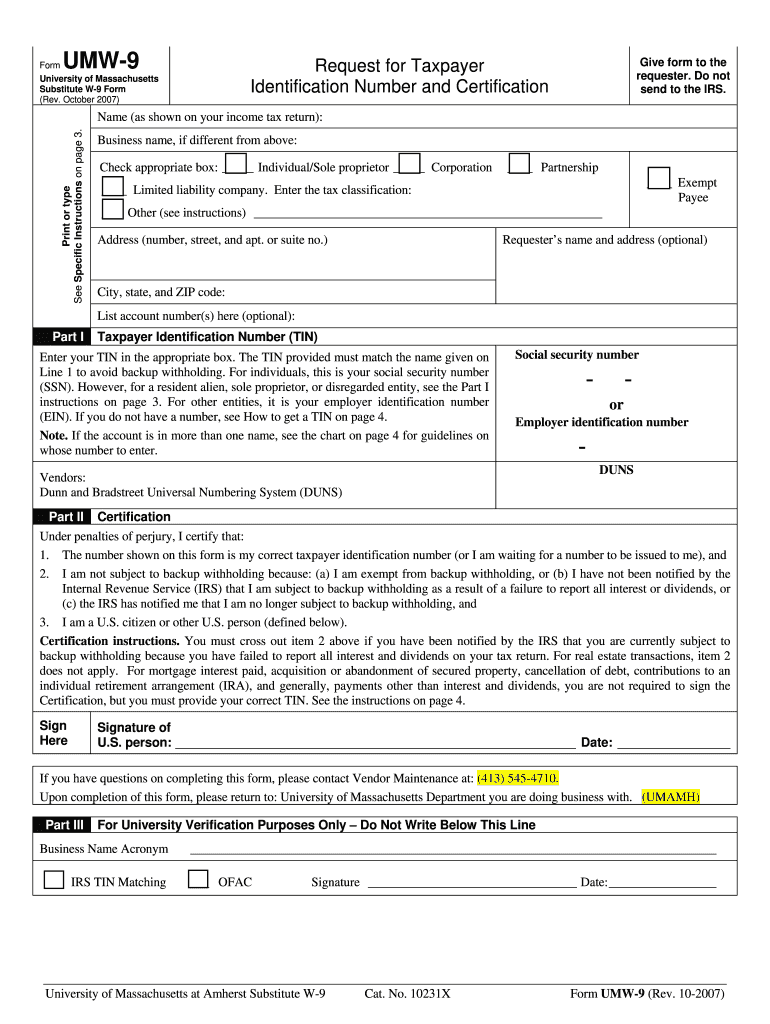

W9 Download and Print PDF Templates

Name (as shown on your income tax return). Web take the following steps below to use the w9 online signature functionality within a few minutes: A typed name typed on a signature block; Person (including a resident alien), to provide your correct tin. A scanned or digitized image of a handwritten.

W9 Form Fill Out the IRS W9 Form Online for 2019 Smallpdf

You can download a blank w9 form, to get a picture of what we are talking about. Before you start, you will need two things: By signing it you attest that: An electronic signature certificate recognized by editors, as well as french and european governments. Add an electronic signature feature permanently in your systems and adapt to your multichannel strategy.

Irs Form 990 N Electronic Filing System User Guide Form Resume

This includes their name, address, employer identification number (ein), and other vital information. If you are a u.s. The tin you gave is correct. Name (as shown on your income tax return). In order to use an electronic signature, you must be using a secure electronic signature service that complies with the irs’s requirements.

Interactive Form W9 Form from Electronic Signature

Add an electronic signature feature permanently in your systems and adapt to your multichannel strategy. Person (including a resident alien), to provide your correct tin. For federal tax purposes, you are considered a u.s. Name is required on this line; This includes their name, address, employer identification number (ein), and other vital information.

W9 2007 Fill Out and Sign Printable PDF Template signNow

Make sure you save the form to your computer. Person (including a resident alien), to provide your correct tin. Web customized electronic signature modules that are fully integrated into your information system. With esignw9.com, you can request that your vendors complete the w9 tax form & electronically sign it. The tin you gave is correct.

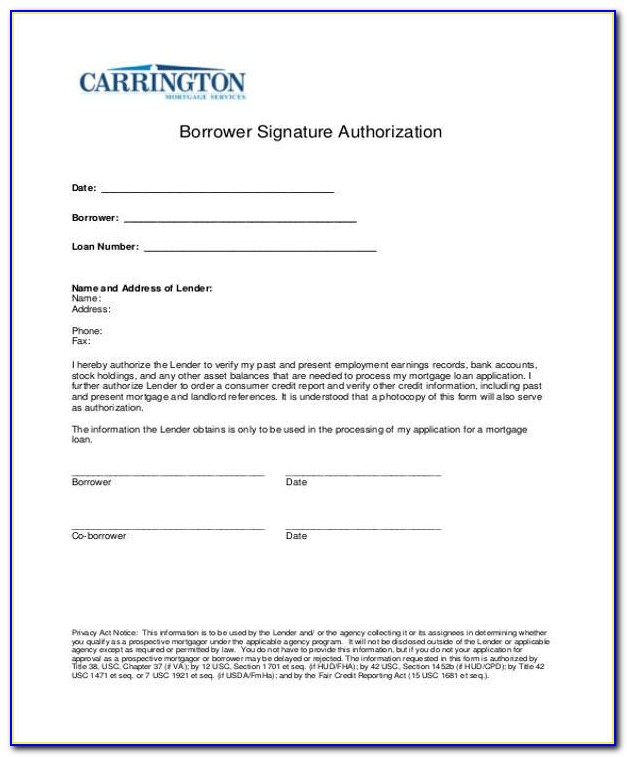

Hipaa Signature Form For Employees To Sign Form Resume Examples

Person (including a resident alien), to provide your correct tin. What is backup withholding, later. Add an electronic signature feature permanently in your systems and adapt to your multichannel strategy. For federal tax purposes, you are considered a u.s. A scanned or digitized image of a handwritten.

How To Esign The W9 for VMC Electronic Signature FREE YouTube

In 1869, the new hampshire supreme court was the first to verify the enforceability of an. This service must include a secure method of signing documents, as well as a way to validate the identity of the signer. A typed name typed on a signature block; The template uses special formula logic for social security and employee identification numbers to.

Fillable W 9 Form With Signature Form Resume Examples

This information is used when filing. With esignw9.com, you can request that your vendors complete the w9 tax form & electronically sign it. Web the framework will guide how the irs executes electronic transactions and will be an essential component of an irs online authorization capability. Do not leave this line blank. Web the irs does accept electronic signatures for.

W9 Forms 2021 Printable Free Calendar Printable Free

Web jul 22, 2021 knowledge. The template uses special formula logic for social security and employee identification numbers to ensure the signer enters the correct information. Person (including a resident alien), to provide your correct tin. Make sure you save the form to your computer. Name (as shown on your income tax return).

Web The Framework Will Guide How The Irs Executes Electronic Transactions And Will Be An Essential Component Of An Irs Online Authorization Capability.

For federal tax purposes, you are considered a u.s. The electronic signature must identify the payee or borrower submitting the electronic form and must authenticate and verify the submission. In order to use an electronic signature, you must be using a secure electronic signature service that complies with the irs’s requirements. Name is required on this line;

Person (Including A Resident Alien), To Provide Your Correct Tin.

Name (as shown on your income tax return). By signing it you attest that: This includes their name, address, employer identification number (ein), and other vital information. The template uses special formula logic for social security and employee identification numbers to ensure the signer enters the correct information.

Acceptable Electronic Signature Methods Include:

It can be in many forms and created by many technologies. Pandadoc’s signature tool allows you to create a legally binding signature that you can type, upload, or draw. What is backup withholding, later. Web the irs will accept a wide range of electronic signatures.

Add An Electronic Signature Feature Permanently In Your Systems And Adapt To Your Multichannel Strategy.

Person (including a resident alien) and to request certain certifications and claims for exemption. Web jul 22, 2021 knowledge. This information is used when filing. The tin you gave is correct.

![W9 Electronic Signature [SwiftCloud Template] W9 eSign (Taxpayer ID)](https://swiftcrm.com/wp-content/uploads/2019/01/W9-esign.jpg)