Florida Form F 1065

Florida Form F 1065 - A limited liability company with a corporate partner,. In addition, the corporate owner of an llc classified as a partnership for florida and. Florida corporate income/franchise tax return for 2022 tax year. A limited liability company with a corporate partner, if classified as a partnership for federal tax purposes,. Web benefits of forming a florida llc to enjoy statutory protection for your florida business, you must establish an llc. Web form 1065 2021 u.s. A limited liability company with a corporate partner,. Return of partnership income department of the treasury internal revenue service go to www.irs.gov/form1065 for instructions and the latest information. Get ready for tax season deadlines by completing any required tax forms today. Ad get ready for tax season deadlines by completing any required tax forms today.

Web form f 1065 florida partnership information return. A limited liability company with a corporate partner,. A limited liability company with a corporate partner, if classified as a partnership for federal tax purposes,. Advantages of this business entity include:. Complete, edit or print tax forms instantly. A limited liability company with a corporate partner,. If the due date falls on a saturday, sunday, or federal or. Get ready for tax season deadlines by completing any required tax forms today. In addition, the corporate owner of an llc classified as a partnership for florida and. A limited liability company with a corporate partner,.

Return of partnership income department of the treasury internal revenue service go to www.irs.gov/form1065 for instructions and the latest information. Get ready for tax season deadlines by completing any required tax forms today. Web 5 rows we last updated the florida partnership information return with instructions r.01/16 in january. In addition, the corporate owner of an llc classified as a partnership for florida and. Ad get ready for tax season deadlines by completing any required tax forms today. A limited liability company with a corporate partner,. If the due date falls on a saturday, sunday, or federal or state holiday,. Florida partnership information return with instructions: Web form 1065 2021 u.s. Web benefits of forming a florida llc to enjoy statutory protection for your florida business, you must establish an llc.

Florida Form F 1065 ≡ Fill Out Printable PDF Forms Online

Advantages of this business entity include:. 2.6k views 9 years ago. Web form 1065 2021 u.s. Web 5 rows we last updated the florida partnership information return with instructions r.01/16 in january. If the due date falls on a saturday, sunday, or federal or state holiday,.

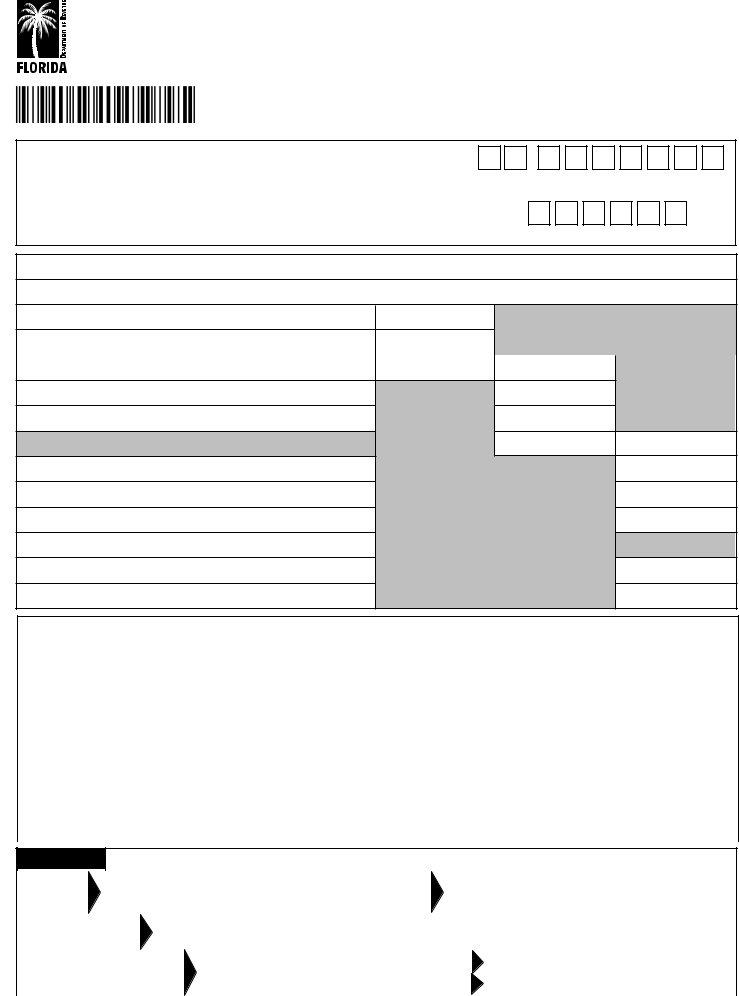

F 1120 2016 form Fill out & sign online DocHub

Get ready for tax season deadlines by completing any required tax forms today. Web form f 1065 florida partnership information return. A limited liability company with a corporate partner,. A limited liability company with a corporate partner,. 2.6k views 9 years ago.

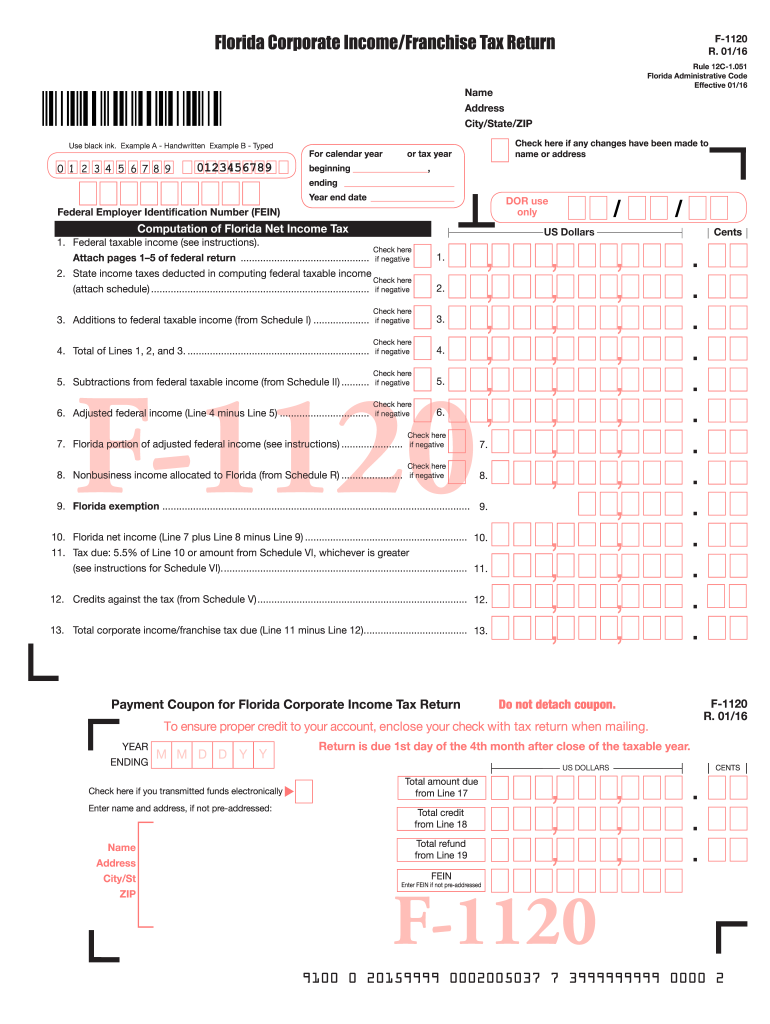

Form F1065 Download Printable PDF or Fill Online Florida Partnership

A limited liability company with a corporate partner,. In addition, the corporate owner of an llc classified as a partnership for florida and. Web 5 rows we last updated the florida partnership information return with instructions r.01/16 in january. Florida corporate income/franchise tax return for 2022 tax year. If the due date falls on a saturday, sunday, or federal or.

f1065 Fill Online, Printable, Fillable Blank form1065

Florida partnership information return with instructions: Every florida partnership having any partner subject to the florida corporate income tax code is required to file form f. A limited liability company with a corporate partner,. If the due date falls on a saturday, sunday, or federal or state holiday,. Ad get ready for tax season deadlines by completing any required tax.

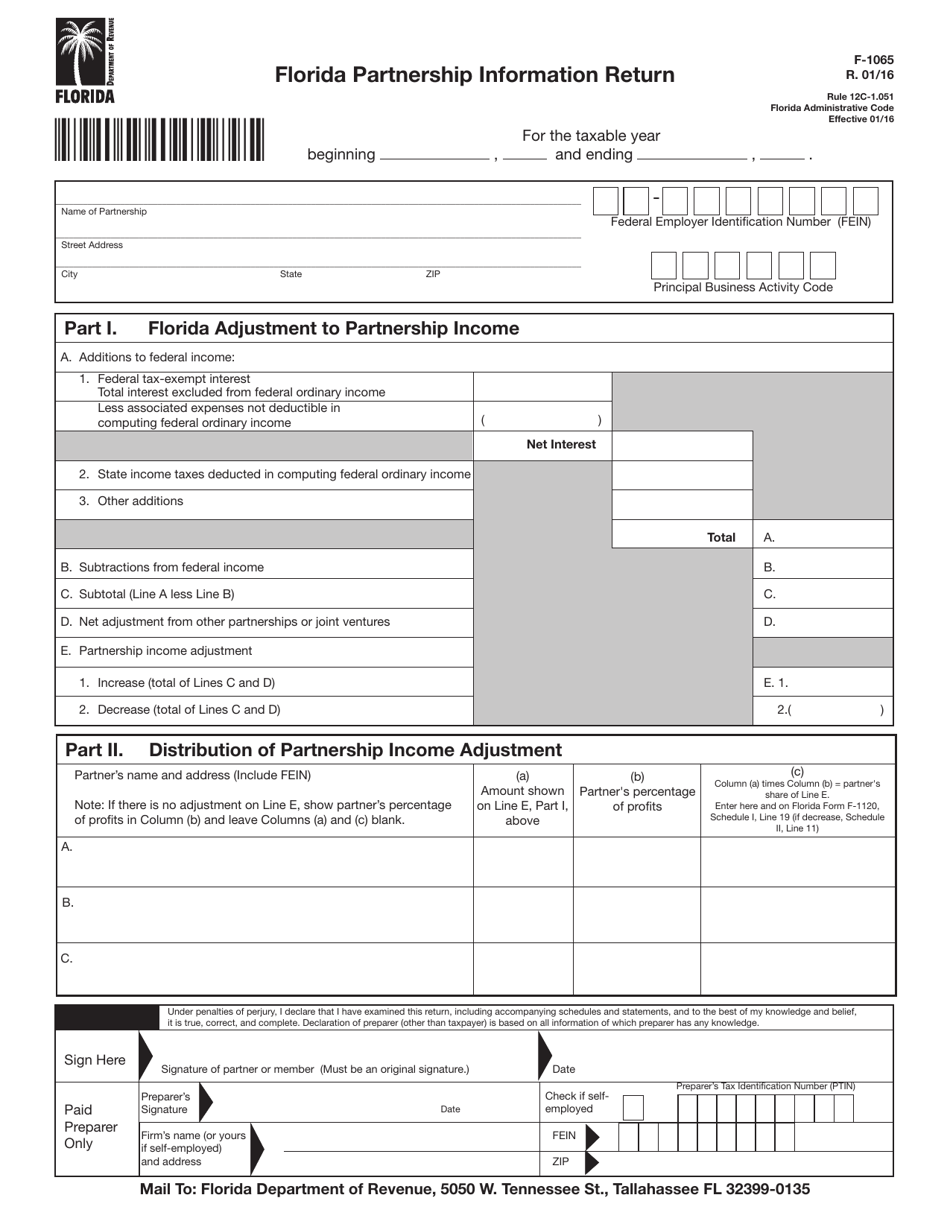

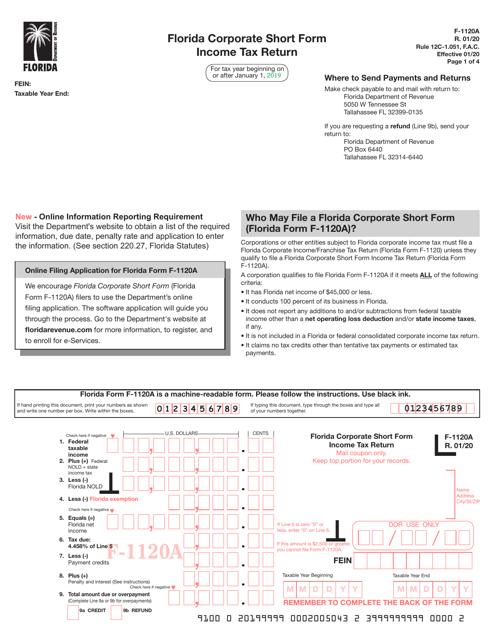

2019 Form FL F1120A Fill Online, Printable, Fillable, Blank pdfFiller

A limited liability company with a corporate partner,. A limited liability company with a corporate partner, if classified as a partnership for federal tax purposes,. Get ready for tax season deadlines by completing any required tax forms today. If the due date falls on a saturday, sunday, or federal or state holiday,. A limited liability company with a corporate partner,.

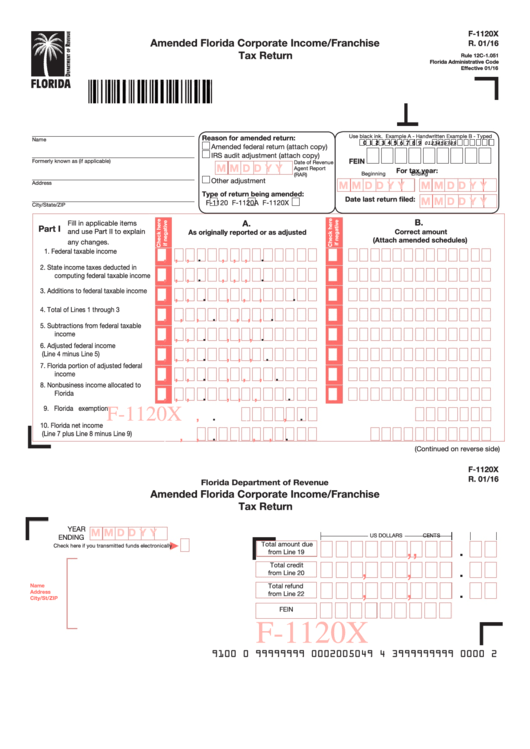

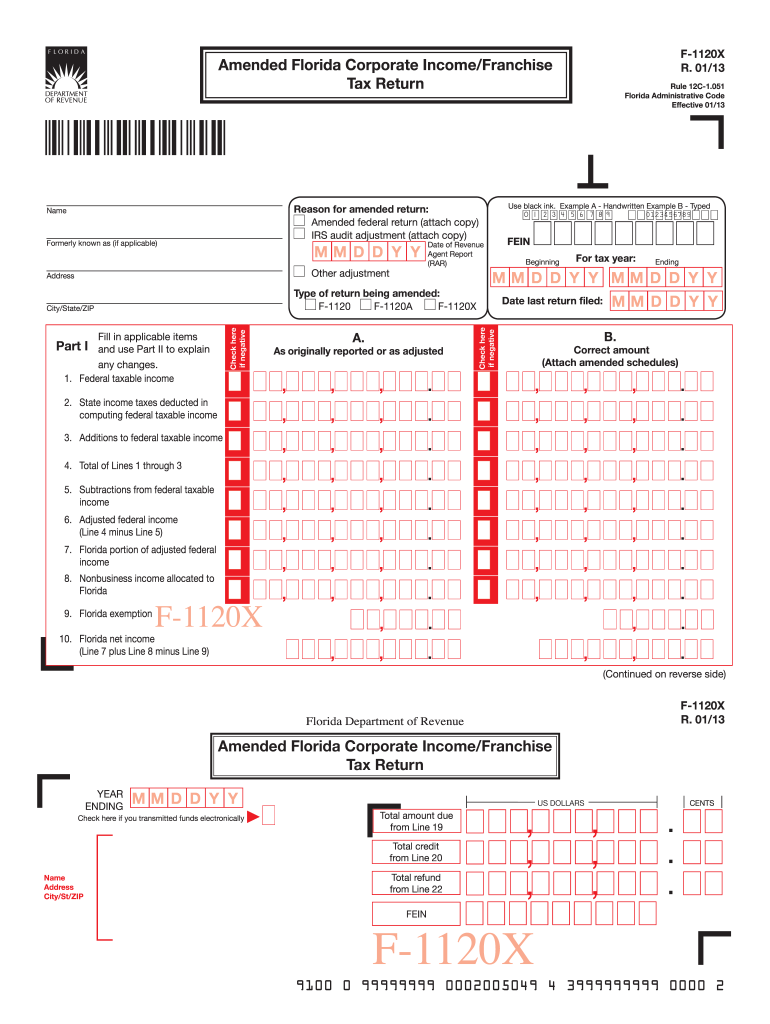

Form F1120x Amended Florida Corporate Tax Return

If the due date falls on a saturday, sunday, or federal or state holiday,. Advantages of this business entity include:. If the due date falls on a saturday, sunday, or federal or. Web benefits of forming a florida llc to enjoy statutory protection for your florida business, you must establish an llc. Get ready for tax season deadlines by completing.

Form F 1120 Fill Out and Sign Printable PDF Template signNow

Return of partnership income department of the treasury internal revenue service go to www.irs.gov/form1065 for instructions and the latest information. Florida corporate income/franchise tax return for 2022 tax year. A limited liability company with a corporate partner, if classified as a partnership for federal tax purposes,. Complete, edit or print tax forms instantly. Advantages of this business entity include:.

U.S Tax Return for Partnership , Form 1065 Meru Accounting

Florida partnership information return with instructions: Complete, edit or print tax forms instantly. If the due date falls on a saturday, sunday, or federal or state holiday,. Ad get ready for tax season deadlines by completing any required tax forms today. A limited liability company with a corporate partner,.

Form F1120A Download Printable PDF or Fill Online Florida Corporate

Get ready for tax season deadlines by completing any required tax forms today. Web form 1065 2021 u.s. A limited liability company with a corporate partner,. Ad get ready for tax season deadlines by completing any required tax forms today. A limited liability company with a corporate partner,.

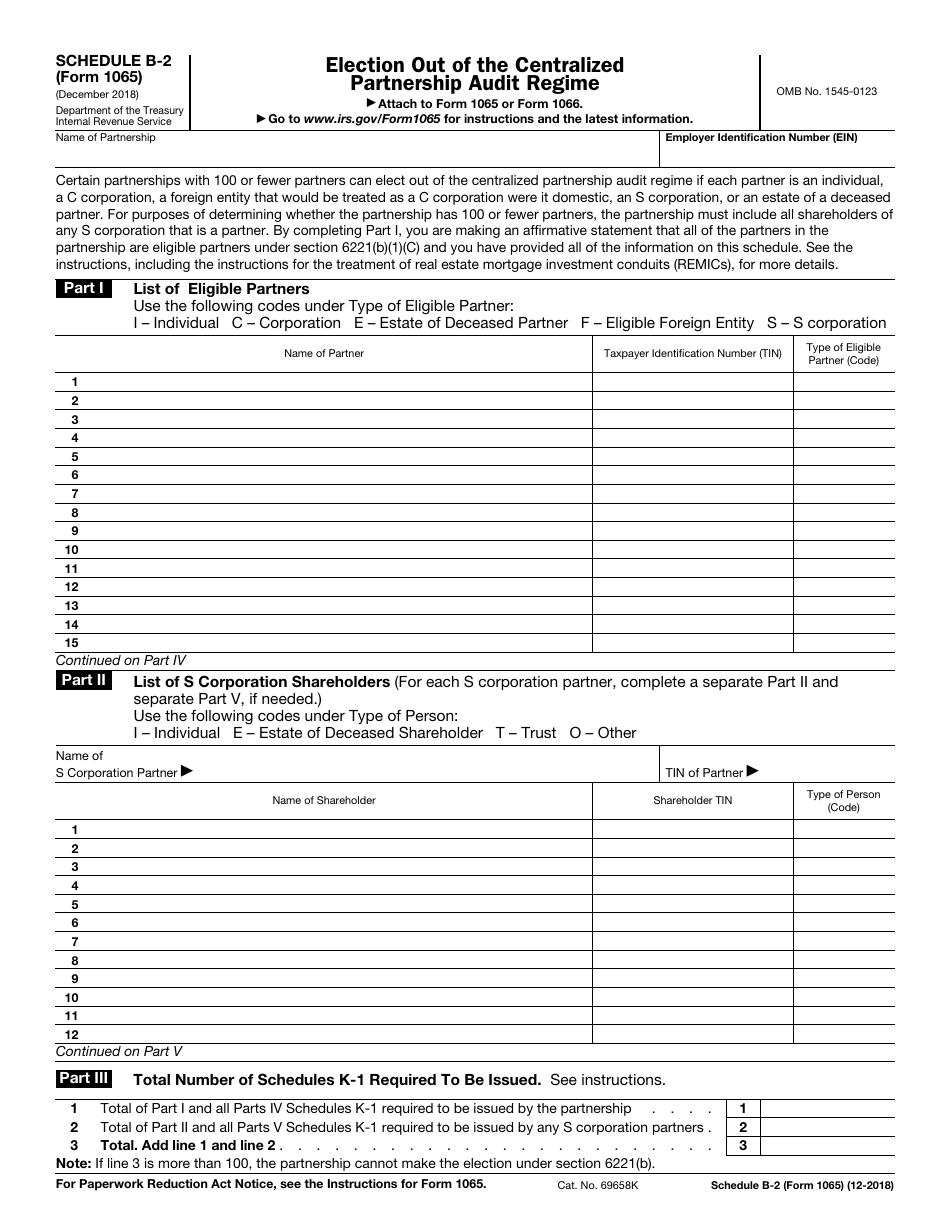

IRS Form 1065 Schedule B2 Download Fillable PDF or Fill Online

Florida partnership information return with instructions: Web 5 rows we last updated the florida partnership information return with instructions r.01/16 in january. Complete, edit or print tax forms instantly. Every florida partnership having any partner subject to the florida corporate income tax code is required to file form f. Advantages of this business entity include:.

Complete, Edit Or Print Tax Forms Instantly.

Web form 1065 2021 u.s. Web benefits of forming a florida llc to enjoy statutory protection for your florida business, you must establish an llc. Return of partnership income department of the treasury internal revenue service go to www.irs.gov/form1065 for instructions and the latest information. Every florida partnership having any partner subject to the florida corporate income tax code is required to file form f.

Complete, Edit Or Print Tax Forms Instantly.

In addition, the corporate owner of an llc classified as a partnership for florida and. Ad get ready for tax season deadlines by completing any required tax forms today. A limited liability company with a corporate partner,. A limited liability company with a corporate partner,.

A Limited Liability Company With A Corporate Partner,.

A limited liability company with a corporate partner, if classified as a partnership for federal tax purposes,. Florida partnership information return with instructions: Web 5 rows we last updated the florida partnership information return with instructions r.01/16 in january. Florida corporate income/franchise tax return for 2022 tax year.

Web Form F 1065 Florida Partnership Information Return.

Get ready for tax season deadlines by completing any required tax forms today. 2.6k views 9 years ago. Advantages of this business entity include:. If the due date falls on a saturday, sunday, or federal or state holiday,.