Form 1125-A 2022

Form 1125-A 2022 - Finished goods or merchandise are sold reduce purchases by items withdrawn Return of partnership income, is used to calculate the net income, profit or loss, of partnerships. 816 subscribers subscribe 183 views 1 month ago iowa if you maintain inventories of raw materials, finished. The cost of goods sold. However, to use the form, a business must meet particular requirements that are generally entities that create goods to sell them. Corporation income tax return for calendar year 2022 or tax year beginning, 2022, ending , 20 go to www.irs.gov/form1120 for instructions and the latest information. Web form 1120 department of the treasury internal revenue service u.s. This calculation must be separately reported on the return as set forth below. Form 1065 , the u.s. Web federal — cost of goods sold download this form print this form it appears you don't have a pdf plugin for this browser.

Finished goods or merchandise are sold reduce purchases by items withdrawn This calculation must be separately reported on the return as set forth below. The cost of goods sold. Web form 1120 department of the treasury internal revenue service u.s. However, to use the form, a business must meet particular requirements that are generally entities that create goods to sell them. Return of partnership income, is used to calculate the net income, profit or loss, of partnerships. Corporation income tax return for calendar year 2022 or tax year beginning, 2022, ending , 20 go to www.irs.gov/form1120 for instructions and the latest information. Web federal — cost of goods sold download this form print this form it appears you don't have a pdf plugin for this browser. Web a small business taxpayer (defined below), may use a method of accounting for inventories that either: (1) treats inventories as nonincidental materials and supplies, or (2) conforms to the taxpayer's financial accounting treatment of inventories.

Web federal — cost of goods sold download this form print this form it appears you don't have a pdf plugin for this browser. Form 1065 , the u.s. Name employer identification number note: (1) treats inventories as nonincidental materials and supplies, or (2) conforms to the taxpayer's financial accounting treatment of inventories. However, to use the form, a business must meet particular requirements that are generally entities that create goods to sell them. Finished goods or merchandise are sold reduce purchases by items withdrawn Web a small business taxpayer (defined below), may use a method of accounting for inventories that either: Corporation income tax return for calendar year 2022 or tax year beginning, 2022, ending , 20 go to www.irs.gov/form1120 for instructions and the latest information. Web form 1120 department of the treasury internal revenue service u.s. This calculation must be separately reported on the return as set forth below.

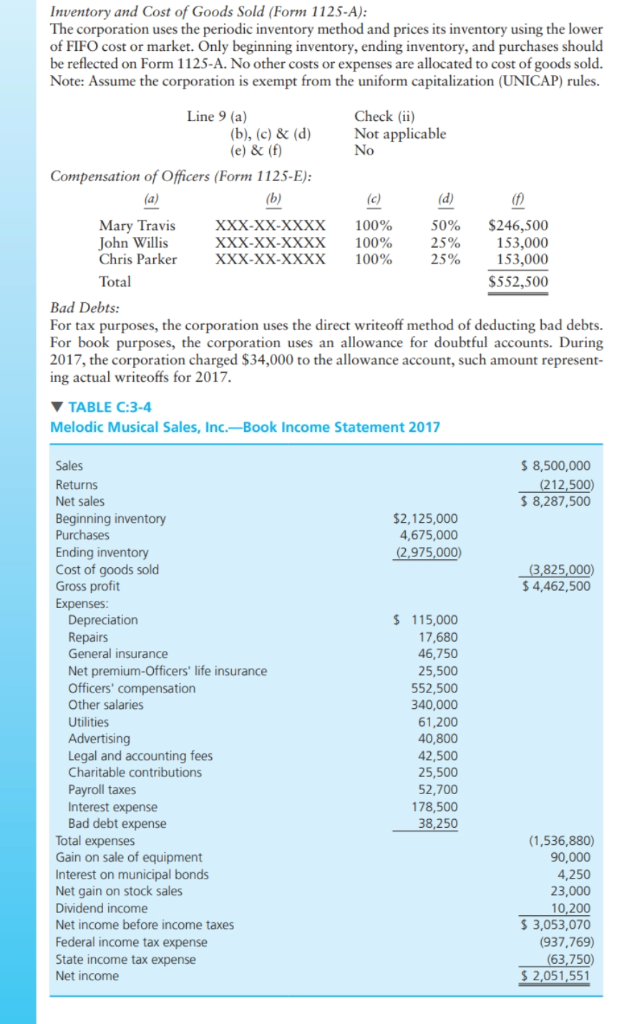

TAX FORM/RETURN PREPARATION PROBLEMS Melodic Musical

The cost of goods sold. This calculation must be separately reported on the return as set forth below. However, to use the form, a business must meet particular requirements that are generally entities that create goods to sell them. (1) treats inventories as nonincidental materials and supplies, or (2) conforms to the taxpayer's financial accounting treatment of inventories. 816 subscribers.

Form 1125 E Fill Out and Sign Printable PDF Template signNow

This calculation must be separately reported on the return as set forth below. 816 subscribers subscribe 183 views 1 month ago iowa if you maintain inventories of raw materials, finished. Web a small business taxpayer (defined below), may use a method of accounting for inventories that either: (1) treats inventories as nonincidental materials and supplies, or (2) conforms to the.

Figure 52. Example of DA Form 1125R

Web form 1120 department of the treasury internal revenue service u.s. (1) treats inventories as nonincidental materials and supplies, or (2) conforms to the taxpayer's financial accounting treatment of inventories. This calculation must be separately reported on the return as set forth below. A small business taxpayer is not required to capitalize costs under section 263a. Form 1065 , the.

Form 1125A Edit, Fill, Sign Online Handypdf

The cost of goods sold. 816 subscribers subscribe 183 views 1 month ago iowa if you maintain inventories of raw materials, finished. Web form 1120 department of the treasury internal revenue service u.s. Form 1065 , the u.s. Name employer identification number note:

Form 1125 a 2018 Fill out & sign online DocHub

This calculation must be separately reported on the return as set forth below. Web form 1120 department of the treasury internal revenue service u.s. Return of partnership income, is used to calculate the net income, profit or loss, of partnerships. Web a small business taxpayer (defined below), may use a method of accounting for inventories that either: (1) treats inventories.

Form 1125 Download Fillable PDF or Fill Online Resident's Request to

This calculation must be separately reported on the return as set forth below. Return of partnership income, is used to calculate the net income, profit or loss, of partnerships. (1) treats inventories as nonincidental materials and supplies, or (2) conforms to the taxpayer's financial accounting treatment of inventories. A small business taxpayer is not required to capitalize costs under section.

20172023 Form CA EZIZ IMM1125 Fill Online, Printable, Fillable, Blank

816 subscribers subscribe 183 views 1 month ago iowa if you maintain inventories of raw materials, finished. The cost of goods sold. Return of partnership income, is used to calculate the net income, profit or loss, of partnerships. Finished goods or merchandise are sold reduce purchases by items withdrawn Name employer identification number note:

Form 1125E2020 Compensation of Officers Nina's Soap

Name employer identification number note: Return of partnership income, is used to calculate the net income, profit or loss, of partnerships. Web federal — cost of goods sold download this form print this form it appears you don't have a pdf plugin for this browser. (1) treats inventories as nonincidental materials and supplies, or (2) conforms to the taxpayer's financial.

Form 1125A Cost of Goods Sold (2012) Free Download

Name employer identification number note: Corporation income tax return for calendar year 2022 or tax year beginning, 2022, ending , 20 go to www.irs.gov/form1120 for instructions and the latest information. Form 1065 , the u.s. Web a small business taxpayer (defined below), may use a method of accounting for inventories that either: A small business taxpayer is not required to.

Form 10 Attachment Sequence 10 Things To Avoid In Form 10 Attachment

816 subscribers subscribe 183 views 1 month ago iowa if you maintain inventories of raw materials, finished. Return of partnership income, is used to calculate the net income, profit or loss, of partnerships. Finished goods or merchandise are sold reduce purchases by items withdrawn The cost of goods sold. This calculation must be separately reported on the return as set.

Web Form 1120 Department Of The Treasury Internal Revenue Service U.s.

Web a small business taxpayer (defined below), may use a method of accounting for inventories that either: Corporation income tax return for calendar year 2022 or tax year beginning, 2022, ending , 20 go to www.irs.gov/form1120 for instructions and the latest information. A small business taxpayer is not required to capitalize costs under section 263a. Web federal — cost of goods sold download this form print this form it appears you don't have a pdf plugin for this browser.

The Cost Of Goods Sold.

Form 1065 , the u.s. Finished goods or merchandise are sold reduce purchases by items withdrawn 816 subscribers subscribe 183 views 1 month ago iowa if you maintain inventories of raw materials, finished. (1) treats inventories as nonincidental materials and supplies, or (2) conforms to the taxpayer's financial accounting treatment of inventories.

Return Of Partnership Income, Is Used To Calculate The Net Income, Profit Or Loss, Of Partnerships.

Name employer identification number note: However, to use the form, a business must meet particular requirements that are generally entities that create goods to sell them. This calculation must be separately reported on the return as set forth below.