Form 12277 Irs

Form 12277 Irs - Web notice of federal tax lien relief when there is a notice of federal tax lien (nftl) filed, there are various options for relief depending on your circumstances. Getting the irs to withdraw a lien can be a huge benefit for your clients. Web how to complete irs tax form 12277. Ad access irs tax forms. Web the irs lien release form (form 12277) is a form that would release a taxpayer from a lien imposed by the internal revenue service (irs), once the debt has been satisfied. Web a federal tax lien is a legal claim to your property (such as real property, securities and vehicles), including property that you acquire after the lien arises. If the irs approves your request, this form allows them to remove the lien from from public record. Web requesting a withdrawal of the filed notice of federal tax lien. Get ready for tax season deadlines by completing any required tax forms today. Web potential employers or creditors can still access public records that show you have a tax lien on your property.

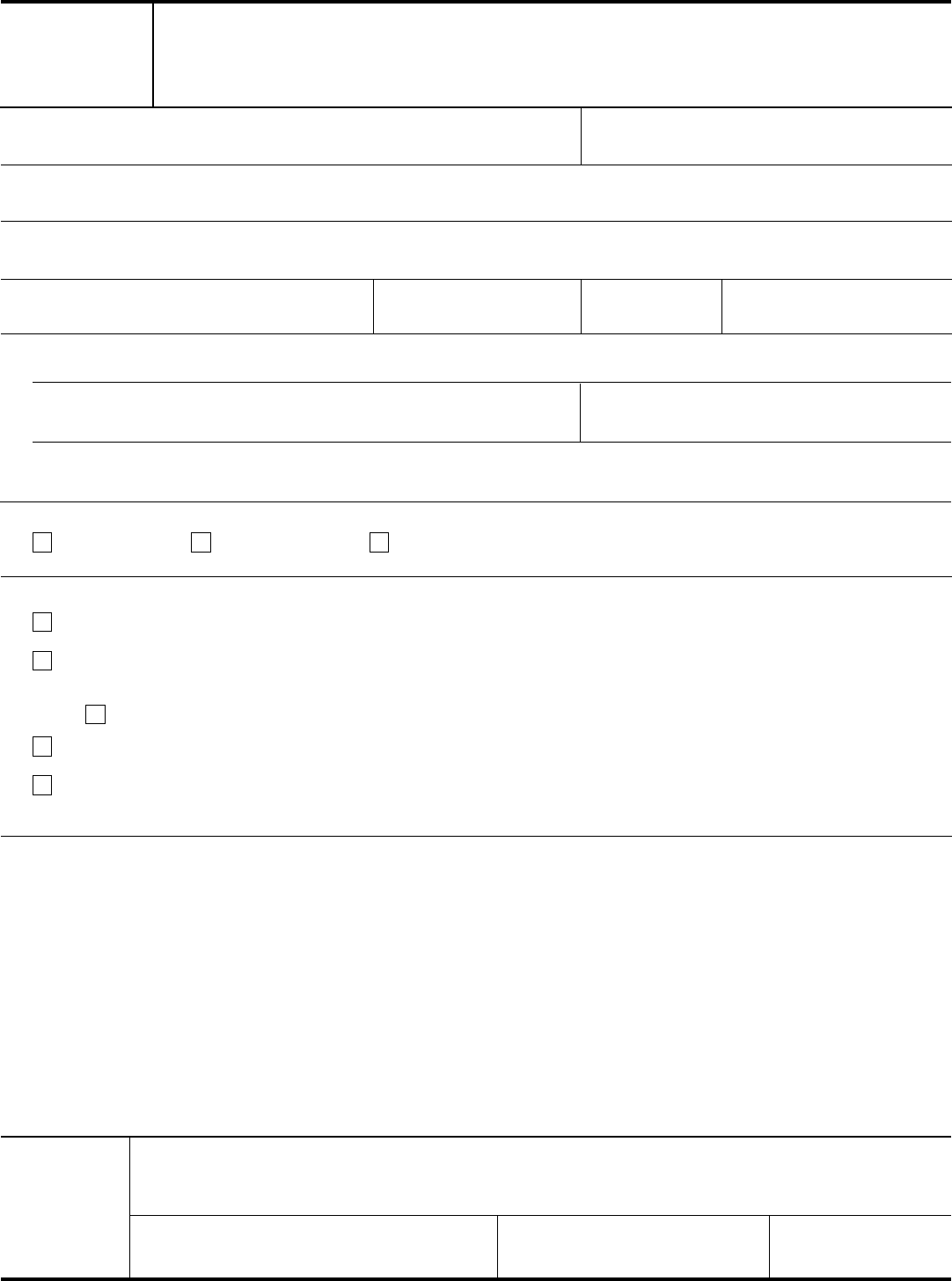

Web how to complete irs tax form 12277. Web today we’re tackling irs form 12277, application for withdrawal of federal tax lien. Read our short guide to figure out the. Download or email form 12277 & more fillable forms, register and subscribe now! Web form 12277 came about from the irs fresh start initiative, which offers options to taxpayers to allow them to improve their standings with the irs and get back on track. Web form 12277, application for withdrawal of filed form 668 (y), notice of federal tax lien (internal revenue code section 6323 (j) download. Complete, edit or print tax forms instantly. You will need form 12277 called application for withdrawal of filed notice of federal tax lien. Web the irs lien release form (form 12277) is a form that would release a taxpayer from a lien imposed by the internal revenue service (irs), once the debt has been satisfied. The form is two pages long.

Web september 06, 2019 purpose (1) this transmits a revision to irm 5.12.9, federal tax lien, withdrawal of notice of federal tax lien. The form is two pages long. Complete, edit or print tax forms instantly. Web how to complete irs tax form 12277. Web requesting a withdrawal of the filed notice of federal tax lien. Web form 12277 (october 2011) department of the treasury — internal revenue service application for withdrawal of filed form 668(y), notice of federal tax lien (internal. If the irs approves your request, this form allows them to remove the lien from from public record. Read our short guide to figure out the. Download or email form 12277 & more fillable forms, register and subscribe now! Web need help filling out irs form 12277?

Form 12277 Edit, Fill, Sign Online Handypdf

Web how to complete irs tax form 12277. Web this article will walk you through irs form 12277, which is the tax form taxpayers use to obtain a withdrawal of a filed tax lien. Read our short guide to figure out the. Web the irs lien release form (form 12277) is a form that would release a taxpayer from a.

How to fill out IRS Form 12277 for lien removal Archives Business Tax

Web form 12277, application for withdrawal of filed form 668 (y), notice of federal tax lien (internal revenue code section 6323 (j) download. Web form 12277 came about from the irs fresh start initiative, which offers options to taxpayers to allow them to improve their standings with the irs and get back on track. Web requesting a withdrawal of the.

IRS Form 12277 Instructions

Read our short guide to figure out the. Web the irs lien release form (form 12277) is a form that would release a taxpayer from a lien imposed by the internal revenue service (irs), once the debt has been satisfied. Web september 06, 2019 purpose (1) this transmits a revision to irm 5.12.9, federal tax lien, withdrawal of notice of.

Form 12277 Edit, Fill, Sign Online Handypdf

Web taxpayers may apply for a withdrawal using irs form 12277, application for withdrawal of filed form 668(y), notice of federal tax lien. Web report error it appears you don't have a pdf plugin for this browser. Complete, edit or print tax forms instantly. Get ready for tax season deadlines by completing any required tax forms today. Web today we’re.

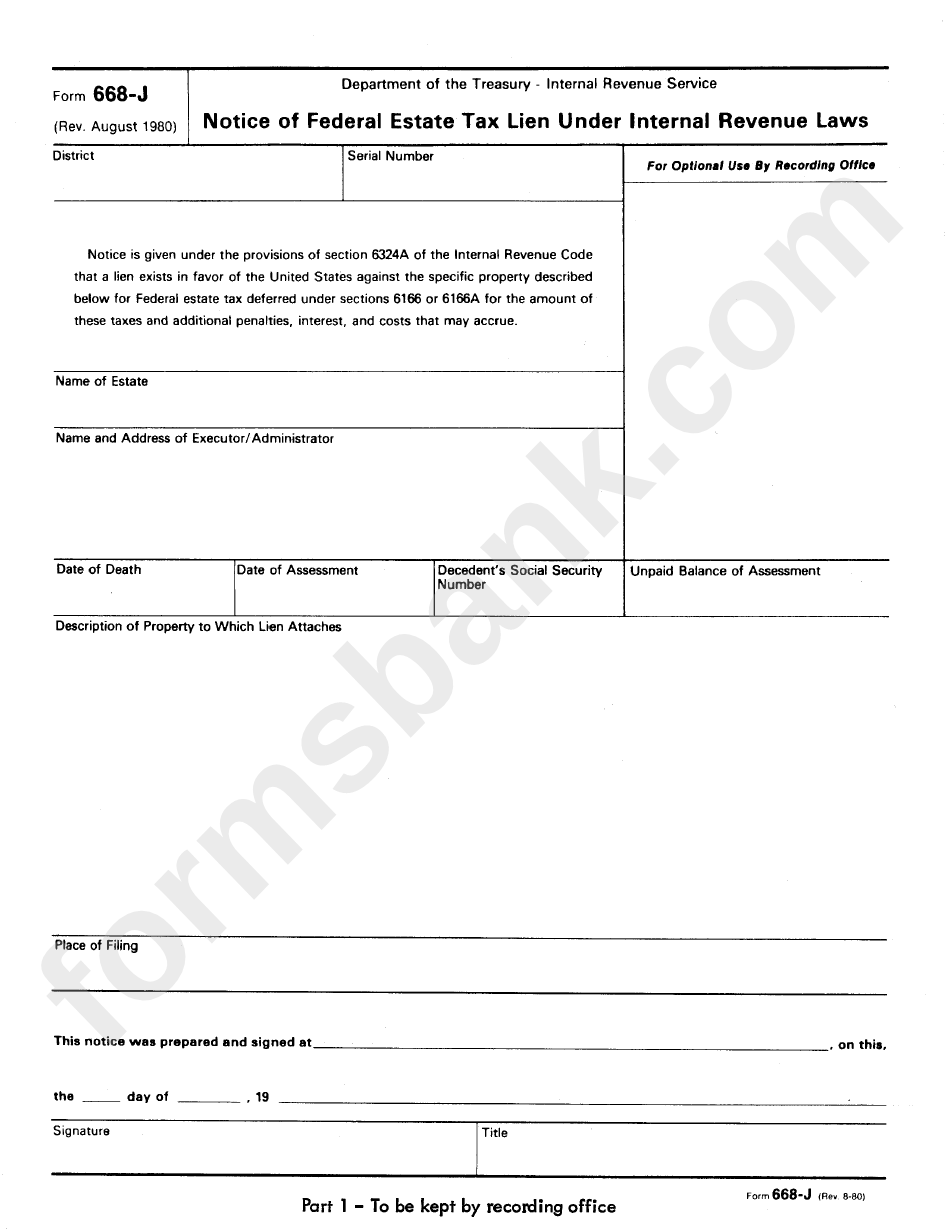

Form 668J Notice Of Federal Estate Tax Lien Under Internal Revenue

Web potential employers or creditors can still access public records that show you have a tax lien on your property. The form is two pages long. Web this article will walk you through irs form 12277, which is the tax form taxpayers use to obtain a withdrawal of a filed tax lien. Web september 06, 2019 purpose (1) this transmits.

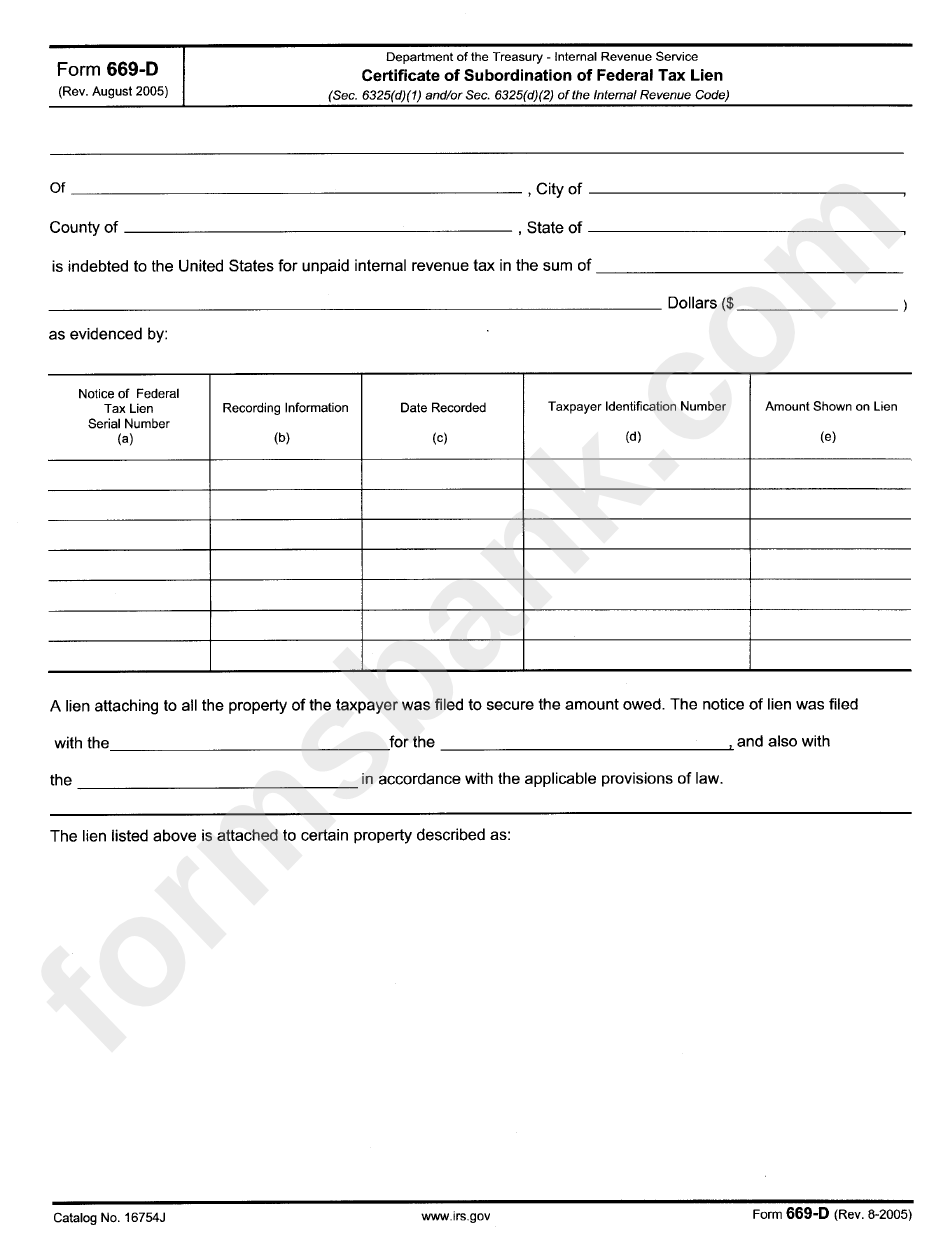

Form 669D Certificate Of Subordination Of Federal Tax Lien printable

Web how to complete irs tax form 12277. Download or email form 12277 & more fillable forms, register and subscribe now! Web taxpayers may apply for a withdrawal using irs form 12277, application for withdrawal of filed form 668(y), notice of federal tax lien. Web notice of federal tax lien relief when there is a notice of federal tax lien.

Form 12277 Edit, Fill, Sign Online Handypdf

Web this article will walk you through irs form 12277, which is the tax form taxpayers use to obtain a withdrawal of a filed tax lien. Web september 06, 2019 purpose (1) this transmits a revision to irm 5.12.9, federal tax lien, withdrawal of notice of federal tax lien. Get ready for tax season deadlines by completing any required tax.

File IRS Form 12277 to resolve a claim against your property

Download or email form 12277 & more fillable forms, register and subscribe now! Web potential employers or creditors can still access public records that show you have a tax lien on your property. Web the irs lien release form (form 12277) is a form that would release a taxpayer from a lien imposed by the internal revenue service (irs), once.

Form 12277 Instructions 2021 2022 IRS Forms Zrivo

Page one you fill out and send to us. Web irs form 12277 is the option to resolve from a resolved tax lien. Ad download or email form 12277 & more fillable forms, register and subscribe now! Web form 12277, application for withdrawal of filed form 668 (y), notice of federal tax lien (internal revenue code section 6323 (j) download..

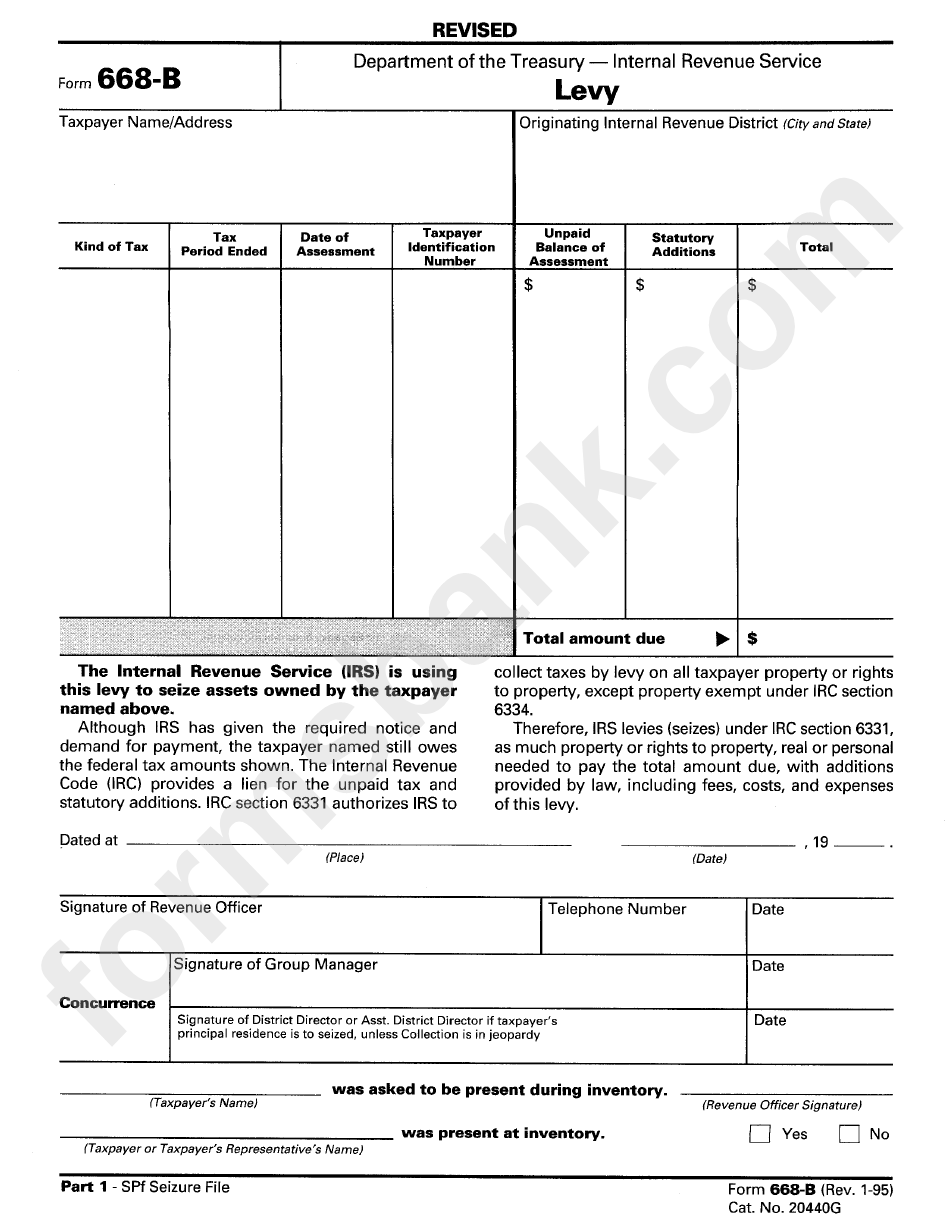

Form 668B Levy Department Of The Treasury printable pdf download

Getting the irs to withdraw a lien can be a huge benefit for your clients. Complete, edit or print tax forms instantly. Download or email form 12277 & more fillable forms, register and subscribe now! Web irs form 12277 is the option to resolve from a resolved tax lien. Read our short guide to figure out the.

Web Taxpayers May Apply For A Withdrawal Using Irs Form 12277, Application For Withdrawal Of Filed Form 668(Y), Notice Of Federal Tax Lien.

Web today we’re tackling irs form 12277, application for withdrawal of federal tax lien. Complete, edit or print tax forms instantly. Web notice of federal tax lien relief when there is a notice of federal tax lien (nftl) filed, there are various options for relief depending on your circumstances. Web need help filling out irs form 12277?

Web The Irs Lien Release Form (Form 12277) Is A Form That Would Release A Taxpayer From A Lien Imposed By The Internal Revenue Service (Irs), Once The Debt Has Been Satisfied.

Get ready for tax season deadlines by completing any required tax forms today. You will need form 12277 called application for withdrawal of filed notice of federal tax lien. Web potential employers or creditors can still access public records that show you have a tax lien on your property. Web september 06, 2019 purpose (1) this transmits a revision to irm 5.12.9, federal tax lien, withdrawal of notice of federal tax lien.

Ad Download Or Email Form 12277 & More Fillable Forms, Register And Subscribe Now!

Web a federal tax lien is a legal claim to your property (such as real property, securities and vehicles), including property that you acquire after the lien arises. Web how to complete irs tax form 12277. Web requesting a withdrawal of the filed notice of federal tax lien. Ad access irs tax forms.

This Can Negatively Impact Your Credit Even After You’ve Resolved Your.

Read our short guide to figure out the. Web one of the difficult to comprehension papers here is irs form 12277 that is developed to withdraw the previously filed irs form 668 (y). Web form 12277 (october 2011) department of the treasury — internal revenue service application for withdrawal of filed form 668(y), notice of federal tax lien (internal. If the irs approves your request, this form allows them to remove the lien from from public record.