Form 8868 Due Date

Form 8868 Due Date - An organization will only be allowed an extension of 6 months for a return for a tax year. Web if a nonprofit follows the calendar year, its taxes are due by may 17, 2021. Web information about form 8868, application for extension of time to file an exempt organization return, including recent updates, related forms, and instructions on how to file. Extending the time for filing a return does not extend the time for paying tax. However, if the 15th day of the 5th month falls between april 15 and june 15, the due date to file the extension is july 15, 2022. Web the due date to file form 8868 is the 15th day of the fifth month after the end of your accounting period. Service in a combat zone The best way to file the form before the deadline to avoid penalties is to fill it with online portals like tax2efile. Web 8868 application for automatic extension of time to file an exempt organization return department of the treasury internal revenue service file by the due date for filing your return. The extension doesn’t extend the time to pay any tax due.

The best way to file the form before the deadline to avoid penalties is to fill it with online portals like tax2efile. Web information about form 8868, application for extension of time to file an exempt organization return, including recent updates, related forms, and instructions on how to file. | go to www.irs.gov/form8868 for the latest information. Web 8868 application for automatic extension of time to file an exempt organization return department of the treasury internal revenue service file by the due date for filing your return. However, if the 15th day of the 5th month falls between april 15 and june 15, the due date to file the extension is july 15, 2022. Extending the time for filing a return does not extend the time for paying tax. Do not file for an extension of time by attaching form 8868 to the exempt An organization will only be allowed an extension of 6 months for a return for a tax year. Web the due date to file form 8868 is the 15th day of the fifth month after the end of your accounting period. For the calendar tax year filers, extension form 8868 is due by july 15, 2022.

Web if a nonprofit follows the calendar year, its taxes are due by may 17, 2021. Extending the time for filing a return does not extend the time for paying tax. | go to www.irs.gov/form8868 for the latest information. The extension doesn’t extend the time to pay any tax due. Web the due date to file form 8868 is the 15th day of the fifth month after the end of your accounting period. For the calendar tax year filers, extension form 8868 is due by july 15, 2022. Web information about form 8868, application for extension of time to file an exempt organization return, including recent updates, related forms, and instructions on how to file. The best way to file the form before the deadline to avoid penalties is to fill it with online portals like tax2efile. However, if the 15th day of the 5th month falls between april 15 and june 15, the due date to file the extension is july 15, 2022. Service in a combat zone

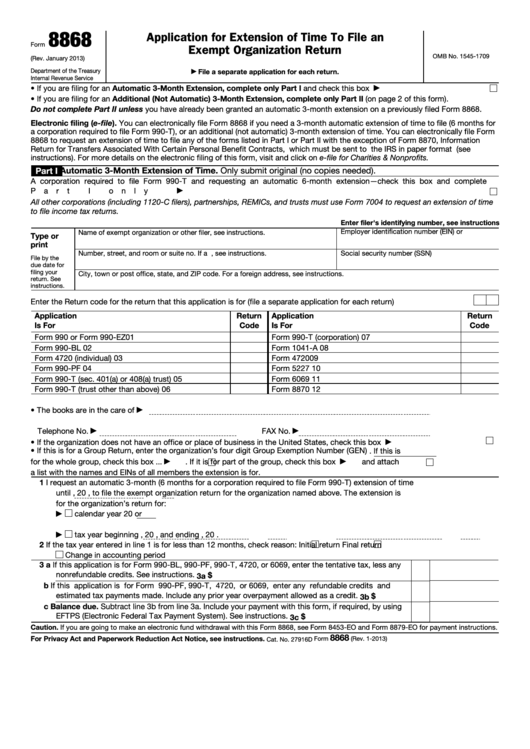

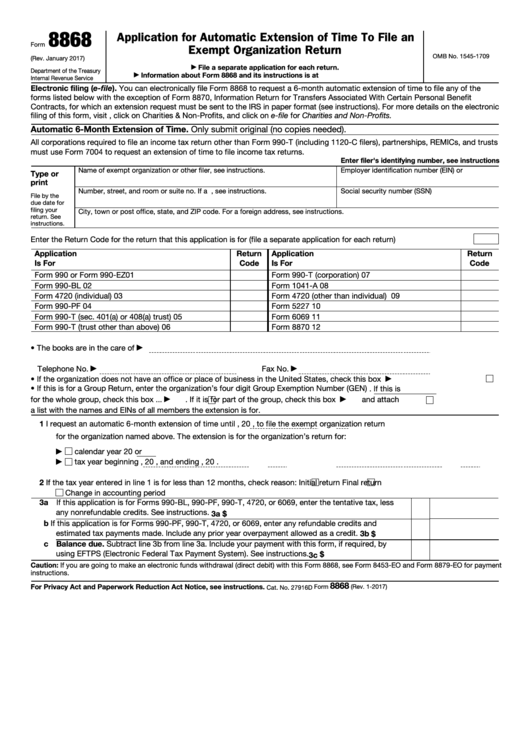

Form 8868 Fillable and Editable PDF Template

For the calendar tax year filers, extension form 8868 is due by july 15, 2022. Service in a combat zone An organization will only be allowed an extension of 6 months for a return for a tax year. | go to www.irs.gov/form8868 for the latest information. Do not file for an extension of time by attaching form 8868 to the.

Fillable Form 8868 Application For Extension Of Time To File An

Do not file for an extension of time by attaching form 8868 to the exempt However, if the 15th day of the 5th month falls between april 15 and june 15, the due date to file the extension is july 15, 2022. The best way to file the form before the deadline to avoid penalties is to fill it with.

Many taxexempt organizations must file information returns by May 15

Service in a combat zone However, if the 15th day of the 5th month falls between april 15 and june 15, the due date to file the extension is july 15, 2022. Web form 8870, information return for transfers associated with certain personal benefit contracts pdf; Web if a nonprofit follows the calendar year, its taxes are due by may.

File Form 8868 Online Efile 990 Extension with the IRS

Web form 8870, information return for transfers associated with certain personal benefit contracts pdf; The extension doesn’t extend the time to pay any tax due. Extending the time for filing a return does not extend the time for paying tax. | go to www.irs.gov/form8868 for the latest information. Web if a nonprofit follows the calendar year, its taxes are due.

Form 8868 Application for Extension of Time to File an Exempt

An organization will only be allowed an extension of 6 months for a return for a tax year. Web if a nonprofit follows the calendar year, its taxes are due by may 17, 2021. Extending the time for filing a return does not extend the time for paying tax. For the calendar tax year filers, extension form 8868 is due.

If You Filed a Form 8868 Extension in May, it’s Time to File Your

Extending the time for filing a return does not extend the time for paying tax. Web information about form 8868, application for extension of time to file an exempt organization return, including recent updates, related forms, and instructions on how to file. If they follow a different fiscal year, their due date is the fifteenth day of the fifth month..

Form 8868 Application for Extension of Time to File an Exempt

An organization will only be allowed an extension of 6 months for a return for a tax year. Service in a combat zone For the calendar tax year filers, extension form 8868 is due by july 15, 2022. Web the due date to file form 8868 is the 15th day of the fifth month after the end of your accounting.

Women Truckers 2290 tax efiling ThinkTrade Inc Blog

The extension doesn’t extend the time to pay any tax due. Extending the time for filing a return does not extend the time for paying tax. Web information about form 8868, application for extension of time to file an exempt organization return, including recent updates, related forms, and instructions on how to file. Web form 8870, information return for transfers.

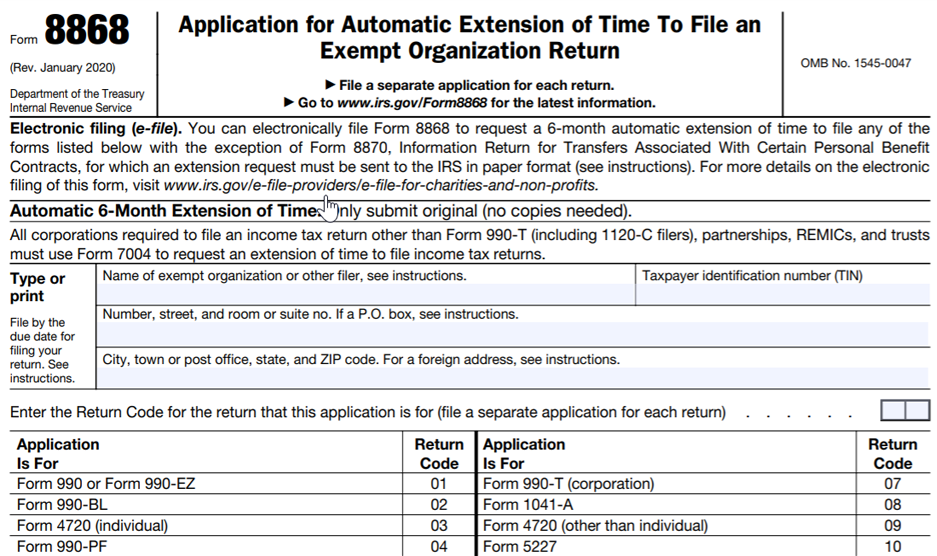

IRS Form 8868 Download Fillable PDF or Fill Online Application for

Web form 8870, information return for transfers associated with certain personal benefit contracts pdf; Do not file for an extension of time by attaching form 8868 to the exempt Web information about form 8868, application for extension of time to file an exempt organization return, including recent updates, related forms, and instructions on how to file. If they follow a.

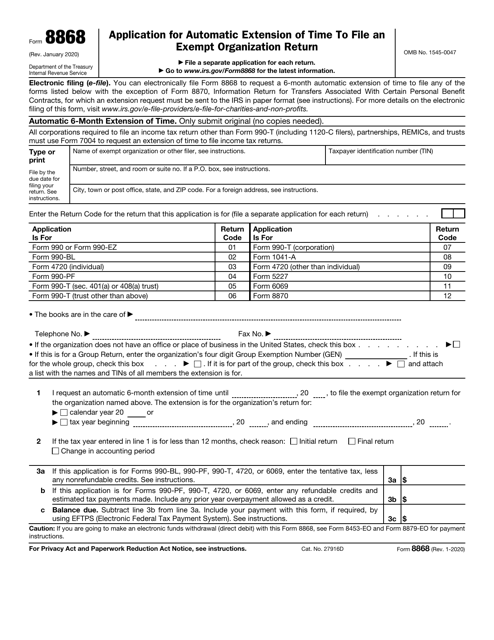

Fillable Form 8868 Application For Automatic Extension Of Time To

Service in a combat zone Extending the time for filing a return does not extend the time for paying tax. Web the due date to file form 8868 is the 15th day of the fifth month after the end of your accounting period. Web information about form 8868, application for extension of time to file an exempt organization return, including.

Do Not File For An Extension Of Time By Attaching Form 8868 To The Exempt

Web form 8870, information return for transfers associated with certain personal benefit contracts pdf; The best way to file the form before the deadline to avoid penalties is to fill it with online portals like tax2efile. Service in a combat zone Extending the time for filing a return does not extend the time for paying tax.

The Extension Doesn’t Extend The Time To Pay Any Tax Due.

However, if the 15th day of the 5th month falls between april 15 and june 15, the due date to file the extension is july 15, 2022. An organization will only be allowed an extension of 6 months for a return for a tax year. Web information about form 8868, application for extension of time to file an exempt organization return, including recent updates, related forms, and instructions on how to file. Web if a nonprofit follows the calendar year, its taxes are due by may 17, 2021.

Web The Due Date To File Form 8868 Is The 15Th Day Of The Fifth Month After The End Of Your Accounting Period.

Web 8868 application for automatic extension of time to file an exempt organization return department of the treasury internal revenue service file by the due date for filing your return. For the calendar tax year filers, extension form 8868 is due by july 15, 2022. | go to www.irs.gov/form8868 for the latest information. If they follow a different fiscal year, their due date is the fifteenth day of the fifth month.