Form 2210 Line 4

Form 2210 Line 4 - Is line 6 equal to or more than line 9? Is line 7 less than $1,000? After completing lines 1 through 7 on irs form 2210, is line 4 or line 7 less than $1,000? Web waiver in certain circumstances, the irs will waive all or part of the penalty. Is line 4 or line 7 less than $1,000? Web do you have to file form 2210? Is line 6 equal to or. Dispute a penalty if you don’t qualify for penalty removal or. See waiver of penalty in the instructions. Complete lines 1 through 7 below.

Also include this amount on form 1040, 1040. If yes, the taxpayer is not required to file irs form 2210 because they do not owe a. Complete lines 1 through 7 below. See waiver of penalty in the instructions. With the form, attach an explanation for why you didn’t pay estimated taxes in the. Web complete lines 1 through 7 below. Web complete lines 8 and 9 below. Web waiver in certain circumstances, the irs will waive all or part of the penalty. Web is line 4 or line 7 less than. Add the amounts on federal schedule a (form 1040), line 4, line 9, and line 15 plus any gambling losses included on line 16 ;

Enter the total penalty from line 14 of the worksheet for form 2210, part iii, section b—figure penalty. You do not owe a penalty. Web 2022 instructions for form 2210 underpayment of estimated tax by individuals, estates, and trusts department of the treasury internal revenue service section references are. Web complete form 2210, schedule ai, annualized income installment method pdf (found within the form). Web 2 best answer. No d complete lines 8 and 9 below. Web enter the amount from part iii, line 4; B you filed or are filing a joint return for either 2021 or 2022,. You may not have had to file form 2210 last year. Web form 2210 error line d withholding sum of 4 columns not equal to total withholding if your software is up to date, try deleting the form and adding it back.

Form 2210 Edit, Fill, Sign Online Handypdf

Enter the total penalty from line 14 of the worksheet for form 2210, part iii, section b—figure penalty. You may not have had to file form 2210 last year. Also include this amount on form 1040, 1040. Is line 6 equal to or. If yes, the taxpayer is not required to file irs form 2210 because they do not owe.

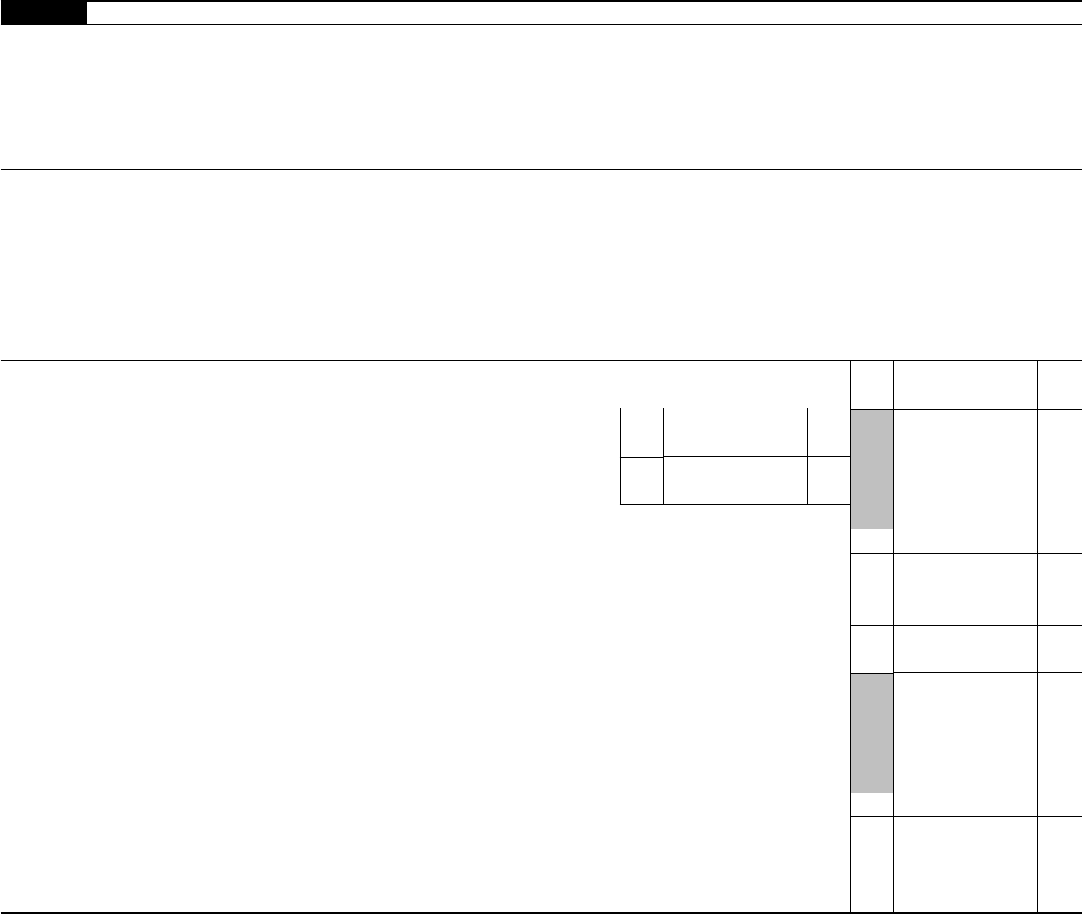

Form D2210 Underpayment Of Estimated Tax By Individuals

Also include this amount on form 1040, 1040. You may not have had to file form 2210 last year. Web to request a waiver when you file, complete irs form 2210 and submit it with your tax return. Web do you have to file form 2210? Web we last updated the underpayment of estimated tax by individuals, estates, and trusts.

MI2210_260848_7 michigan.gov documents taxes

Web 2022 instructions for form 2210 underpayment of estimated tax by individuals, estates, and trusts department of the treasury internal revenue service section references are. Web form 2210 error line d withholding sum of 4 columns not equal to total withholding if your software is up to date, try deleting the form and adding it back. No you may owe.

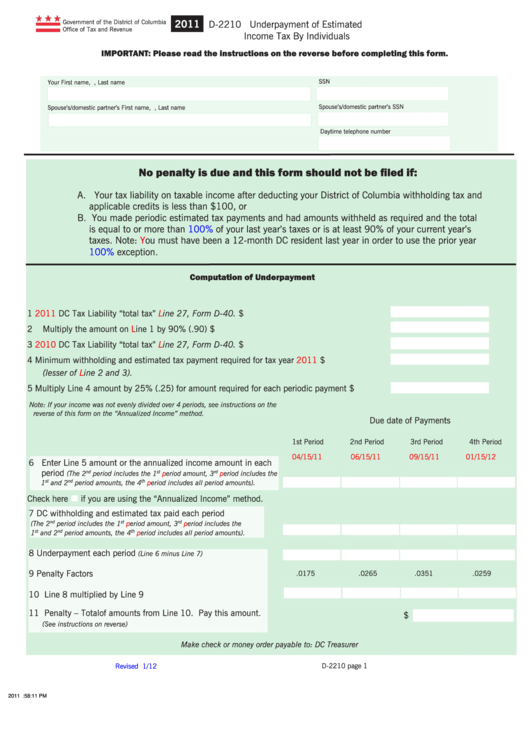

IRS Form 2210 Fill it with the Best Form Filler

If yes, the taxpayer is not required to file irs form 2210 because they do not owe a. No d complete lines 8 and 9 below. Web to request a waiver when you file, complete irs form 2210 and submit it with your tax return. Enter the total penalty from line 14 of the worksheet for form 2210, part iii,.

IRS Form 2210Fill it with the Best Form Filler

No do not file form 2210. Enter the total penalty from line 14 of the worksheet for form 2210, part iv, section b—figure the penalty. Web 2022 instructions for form 2210 underpayment of estimated tax by individuals, estates, and trusts department of the treasury internal revenue service section references are. Web do you have to file form 2210? Is line.

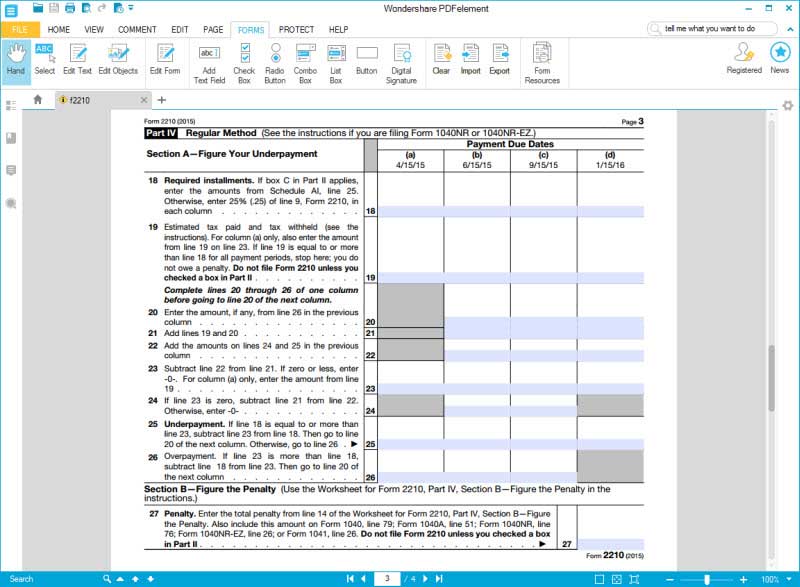

Form 2210Underpayment of Estimated Tax

Web waiver in certain circumstances, the irs will waive all or part of the penalty. No do not file form 2210. After completing lines 1 through 7 on irs form 2210, is line 4 or line 7 less than $1,000? Does any box in part ii below apply? Is line 6 equal to or.

Form 2210 Underpayment of Estimated Tax by Individuals, Estates and

Yes do not file form 2210. Does any box in part ii below apply? Web form 2210 is used by individuals (as well as estates and trusts) to determine if a penalty is owed for the underpayment of income taxes due. Enter the total penalty from line 14 of the worksheet for form 2210, part iv, section b—figure the penalty..

Form 2210 Underpayment of Estimated Tax by Individuals, Estates and

Web waiver in certain circumstances, the irs will waive all or part of the penalty. Yes do not file form 2210. Web form 2210 is used by individuals (as well as estates and trusts) to determine if a penalty is owed for the underpayment of income taxes due. The form doesn't always have to be. You do not owe a.

IRS Form 2210 walkthrough (Underpayment of Estimated Tax by Individuals

Web 2022 instructions for form 2210 underpayment of estimated tax by individuals, estates, and trusts department of the treasury internal revenue service section references are. See waiver of penalty in the instructions. Enter the total penalty from line 14 of the worksheet for form 2210, part iii, section b—figure penalty. Web complete lines 8 and 9 below. Is line 4.

Form 2210Underpayment of Estimated Tax

Complete lines 1 through 7 below. Dispute a penalty if you don’t qualify for penalty removal or. Enter the total penalty from line 14 of the worksheet for form 2210, part iii, section b—figure penalty. Web is line 4 or line 7 less than $1,000? Web waiver in certain circumstances, the irs will waive all or part of the penalty.

Add The Amounts On Federal Schedule A (Form 1040), Line 4, Line 9, And Line 15 Plus Any Gambling Losses Included On Line 16 ;

Web do you have to file form 2210? Web complete lines 1 through 7 below. No you may owe a penalty. See waiver of penalty in the instructions.

Also Include This Amount On Form 1040, 1040.

Yes do not file form 2210. Complete lines 1 through 7 below. The amount on line 4 of your 2210 form last year would be the same as the amount on line. Is line 7 less than $1,000?

Web Complete Form 2210, Schedule Ai, Annualized Income Installment Method Pdf (Found Within The Form).

Is line 6 equal to or. You don’t owe a penalty. No do not file form 2210. No complete lines 8 and.

Web Form 2210 Error Line D Withholding Sum Of 4 Columns Not Equal To Total Withholding If Your Software Is Up To Date, Try Deleting The Form And Adding It Back.

The form doesn't always have to be. Does any box in part ii below apply? Enter the total penalty from line 14 of the worksheet for form 2210, part iv, section b—figure the penalty. Web 2022 instructions for form 2210 underpayment of estimated tax by individuals, estates, and trusts department of the treasury internal revenue service section references are.