Form 3921 Deadline

Form 3921 Deadline - It is a requirement by law for corporations to fill out form 3921 by specific dates. Web every corporation which in any calendar year transfers to any person a share of stock pursuant to that person's exercise of an incentive stock option described in section. Web if you are a startup that has employees who exercised incentive stock options (isos), the deadline/due date to provide form 3921 to those employees, and file with the irs, by. Although this information is not taxable unless. What is 3921 tax form? Web 1099 pro products range from i) client server / asp applications capable of filing over 100 million records utilizing a ms sql back end with a multi year presentation of forms via. Web form 3921 deadlines. Web form 3921 is generally informational unless stock acquired through an incentive stock option is sold or otherwise disposed. The deadlines to file are as follows: You must be aware of the steps.

On the other hand, under copy a, 28th february. Web in addition to notifying employees, the corporation must file the forms 3921 with the irs. Deadline to provide copy b to all employees who exercised isos in the previous. The deadline for filing the forms is march 1, 2021, or march 31, 2021, if. Web january 31 provide copy b of the form to all applicable employees (or former employees) february 28 deadline to file paper versions of copy a with the irs march 31 deadline. Web 1099 pro products range from i) client server / asp applications capable of filing over 100 million records utilizing a ms sql back end with a multi year presentation of forms via. Web the irs instructions to form 3921 and 3922 may be obtained here. You must be aware of the steps. Web due dates and deadlines for form 3921. Web when is the deadline for filing form 3921?

Web january 31 provide copy b of the form to all applicable employees (or former employees) february 28 deadline to file paper versions of copy a with the irs march 31 deadline. The deadlines to file are as follows: Web when is the deadline to file form 3921 for the 2022 tax year? Irs form 3921 is used to report. Deadline to provide copy b to all employees who exercised isos in the previous. Web the irs instructions to form 3921 and 3922 may be obtained here. Web form 3921 is generally informational unless stock acquired through an incentive stock option is sold or otherwise disposed. Web due dates and deadlines for form 3921. The corporation must send or. For iso exercises and applicable espp stock transfers which occurred in calendar year 2020, corporations must file completed forms.

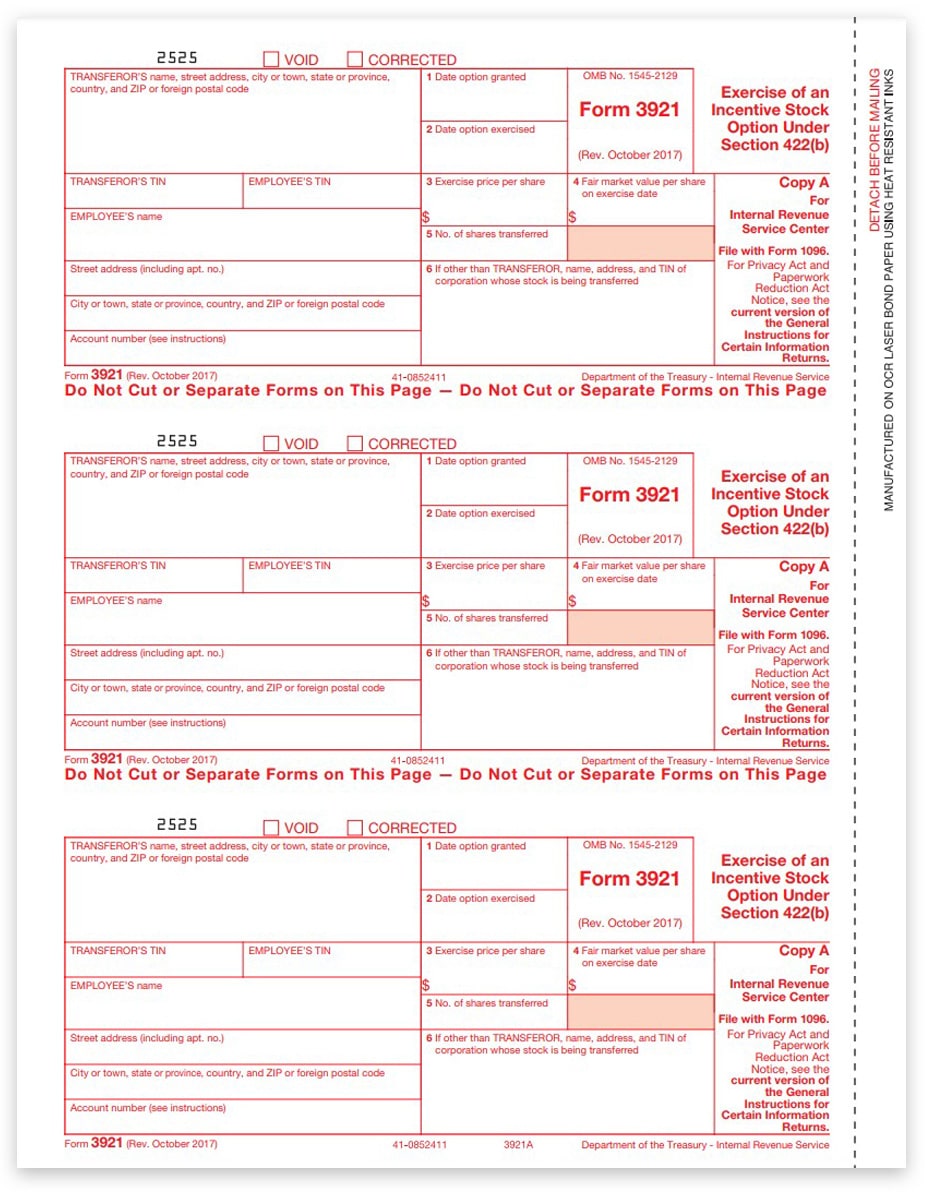

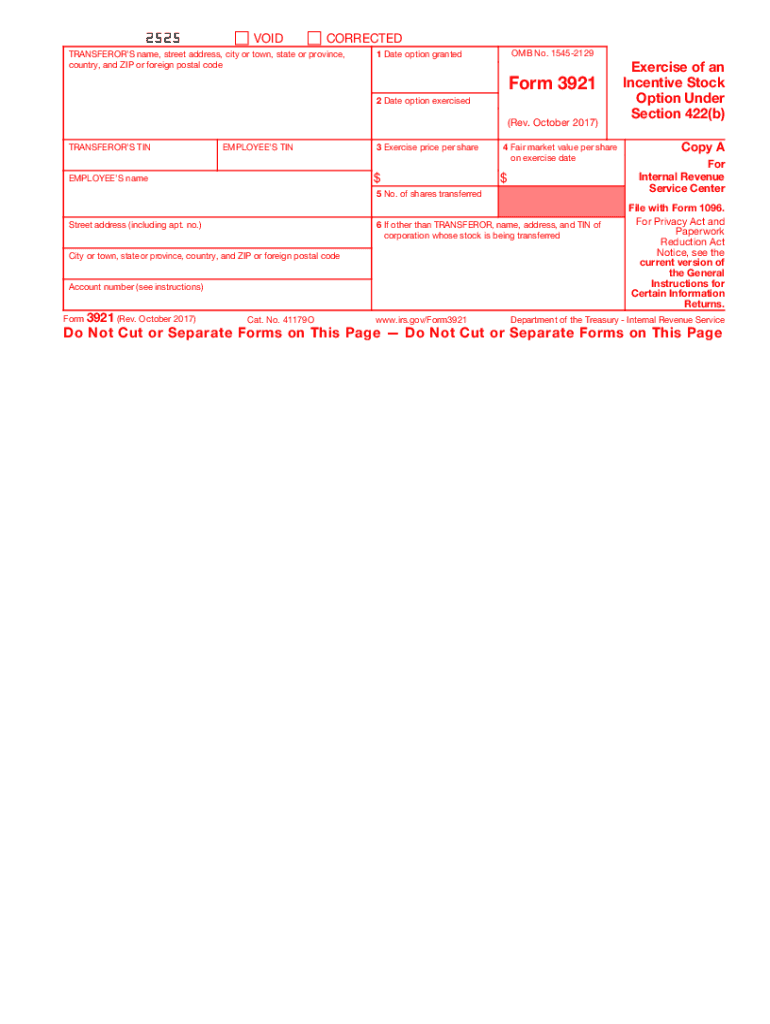

3921 Tax Forms for Incentive Stock Option, IRS Copy A DiscountTaxForms

The deadline for filing the forms is march 1, 2021, or march 31, 2021, if. Web january 31 provide copy b of the form to all applicable employees (or former employees) february 28 deadline to file paper versions of copy a with the irs march 31 deadline. Web every corporation which in any calendar year transfers to any person a.

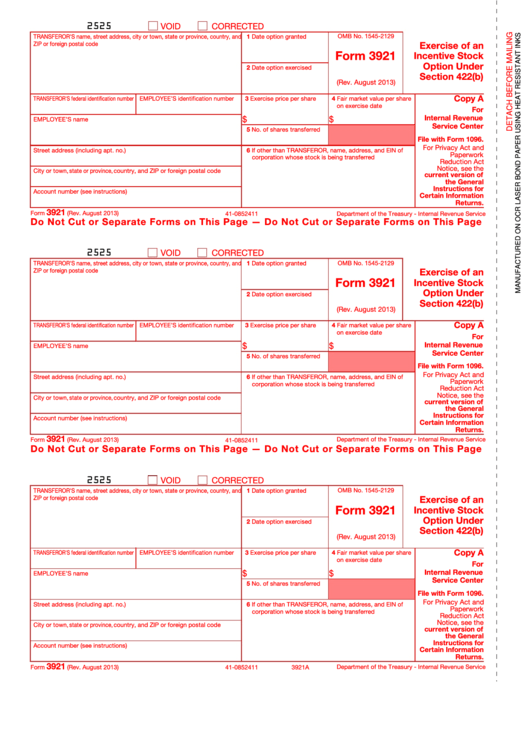

IRS Form 3921

The corporation must send or. Web form 3921 is generally informational unless stock acquired through an incentive stock option is sold or otherwise disposed. Web a form 3921 is not required for the exercise of an incentive stock option by an employee who is a nonresident alien (as defined in section 7701 (b)) and to whom the. On the other.

· IRS Form 3921 Toolbx

On the other hand, under copy a, 28th february. Web the irs instructions to form 3921 and 3922 may be obtained here. Deadline to provide copy b to all employees who exercised isos in the previous. Web a form 3921 is not required for the exercise of an incentive stock option by an employee who is a nonresident alien (as.

What Are a Company's Tax Reporting Obligations for Incentive Stock

Your company needs to provide copy b of the form to all applicable shareholder by the 1st of february. It is a requirement by law for corporations to fill out form 3921 by specific dates. For iso exercises and applicable espp stock transfers which occurred in calendar year 2020, corporations must file completed forms. Web a form 3921 is not.

Form 3921 Exercise Of An Incentive Stock Option Under Section 422b

Irs form 3921 is used to report. Web the deadline for filing the forms is february 28, 2023, or march 31, 2023, if filed electronically. Although this information is not taxable unless. Web the irs instructions to form 3921 and 3922 may be obtained here. Web due dates and deadlines for form 3921.

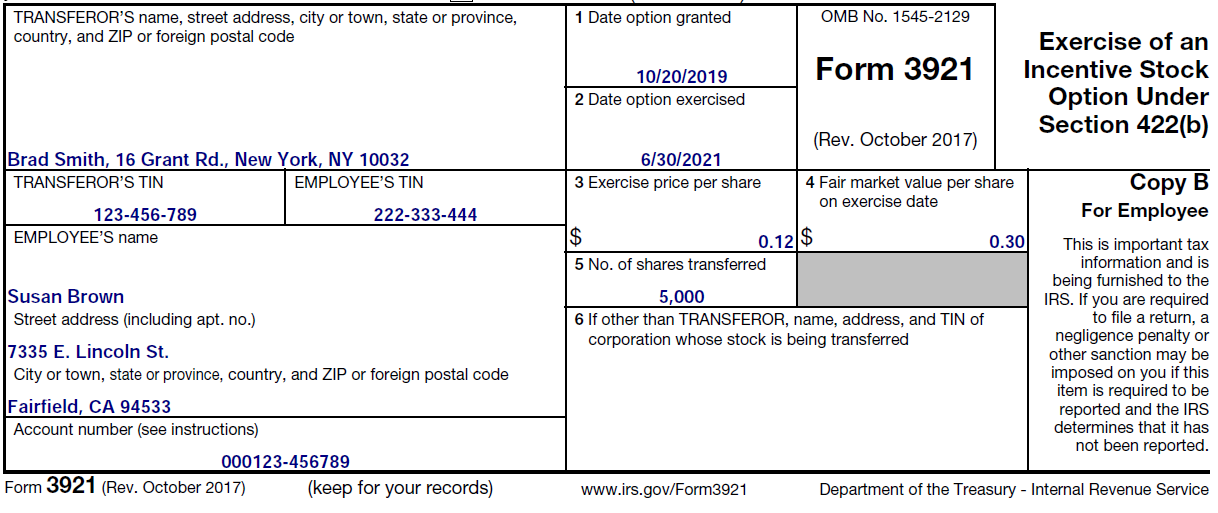

Form 3921 How to Report Transfer of Incentive Stock Options in 2016

You must be aware of the steps. Web 1099 pro products range from i) client server / asp applications capable of filing over 100 million records utilizing a ms sql back end with a multi year presentation of forms via. Web when is the deadline to file form 3921 for the 2022 tax year? Web if you are a startup.

File Form 3921 Eqvista

Web in the case of copy b, isos or espps exercised in 2022, will be required to file form 3921 and form 3922 by 31st january 2023. Web when is the deadline to file form 3921 for the 2022 tax year? How to file form 3921 with taxbandits 1. Web in addition to notifying employees, the corporation must file the.

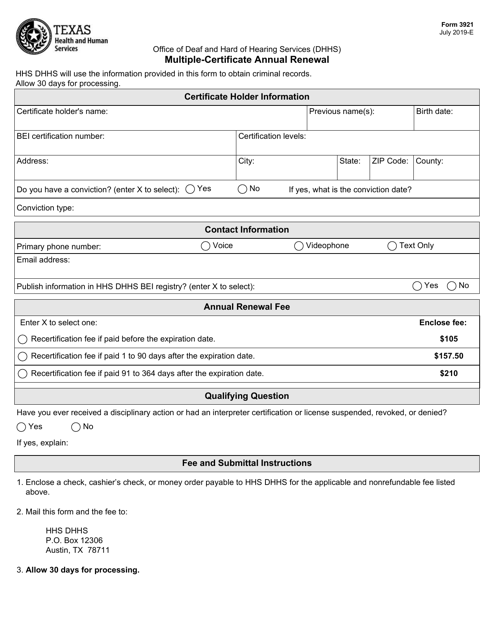

Form 3921 Download Fillable PDF or Fill Online MultipleCertificate

Web when is the deadline for filing form 3921? You must be aware of the steps. Web form 3921 deadlines. Your company needs to provide copy b of the form to all applicable shareholder by the 1st of february. Web in addition to notifying employees, the corporation must file the forms 3921 with the irs.

Purpose of form 3921 Fill out & sign online DocHub

Web the irs instructions to form 3921 and 3922 may be obtained here. The deadline for filing the forms is march 1, 2021, or march 31, 2021, if. Web a form 3921 is not required for the exercise of an incentive stock option by an employee who is a nonresident alien (as defined in section 7701 (b)) and to whom.

What do I do with Form 3921? (Exercise of ISO) r/tax

Electronic filing is required if 250 or more forms must be filed. Web if you are a startup that has employees who exercised incentive stock options (isos), the deadline/due date to provide form 3921 to those employees, and file with the irs, by. Web due dates and deadlines for form 3921. Web 1099 pro products range from i) client server.

Web January 31 Provide Copy B Of The Form To All Applicable Employees (Or Former Employees) February 28 Deadline To File Paper Versions Of Copy A With The Irs March 31 Deadline.

Irs form 3921 is used to report. On the other hand, under copy a, 28th february. What is 3921 tax form? Web if you are a startup that has employees who exercised incentive stock options (isos), the deadline/due date to provide form 3921 to those employees, and file with the irs, by.

Web Form 3921 Deadlines.

Although this information is not taxable unless. You must be aware of the steps. Web 1099 pro products range from i) client server / asp applications capable of filing over 100 million records utilizing a ms sql back end with a multi year presentation of forms via. Web when is the deadline for filing form 3921?

Deadline To Provide Copy B To All Employees Who Exercised Isos In The Previous.

Web due dates and deadlines for form 3921. Web form 3921 is generally informational unless stock acquired through an incentive stock option is sold or otherwise disposed. Web tip if you exercise an iso during 2020, you should receive form 3921, or a statement, from the corporation for each transfer made during 2020. Web when is the deadline to file form 3921 for the 2022 tax year?

Web The Irs Instructions To Form 3921 And 3922 May Be Obtained Here.

How to file form 3921 with taxbandits 1. Web deadline for startups to file form 3921 as of 2022, form 3921 must be filed on paper by february 28 or electronically by march 31 of the year following the tax year in. The corporation must send or. The deadline for filing the forms is march 1, 2021, or march 31, 2021, if.