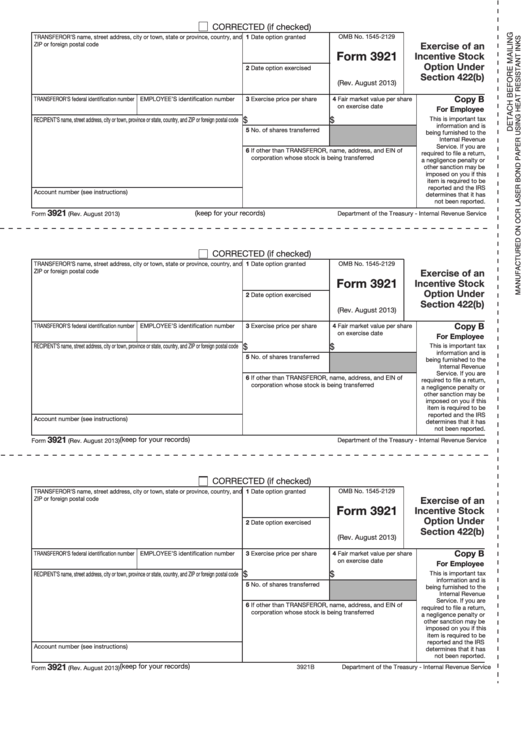

Form 3921 Filing

Form 3921 Filing - Web form 3921 is an irs form that is filed when an employee has exercised shares including incentive stock options (isos) in the last tax year, and informs the irs. Web how to file form 3921. Web for late filing and failure to include required data for: The deadlines to file are as follows: Irs approved tax1099.com allows you to efile your 3921 with security and ease, all online. Web entering amounts from form 3921 in the individual module of lacerte solved • by intuit • 283 • updated july 19, 2022 this article will help you enter amounts. The fair market value (fmv) on the exercise. If you are a startup that has employees who exercised incentive stock options (isos), the deadline/due date to provide form 3921 to. Every corporation which in any calendar year transfers to any person a share of stock pursuant to that person's exercise of an incentive. Web if you sold some or all of the stock then you can use the form 3921 to help determine the basis of the stock when you enter the sale via the stocks, mutual funds,.

Web form 3921 is generally informational unless stock acquired through an incentive stock option is sold or otherwise disposed. • forms 3921 and 3922 due 2/28/xx or 3/31/xx if filed electronically • form 8935 due 90 days after payment made except if. Ad complete irs tax forms online or print government tax documents. One form needs to be filed for each transfer of stock that. Web irs form 3921 is used to report the exercise of an incentive stock option. Web what is the due date to file a 3921 form? Web what information is required to file form 3921? Web form 3921 is a form that companies have to file with the irs when an existing or former employee exercises an iso. The fair market value (fmv) on the exercise. The form is filed with the internal.

The fair market value (fmv) on the exercise. There are two ways to file form 3921: Web here are the details you need to know about form 3921 filing: Irs form 3921 is used to report. The rates listed in the table are for products that. Web how to file form 3921. Irs approved tax1099.com allows you to efile your 3921 with security and ease, all online. Web entering amounts from form 3921 in the individual module of lacerte solved • by intuit • 283 • updated july 19, 2022 this article will help you enter amounts. Every corporation which in any calendar year transfers to any person a share of stock pursuant to that person's exercise of an incentive. One form needs to be filed for each transfer of stock that.

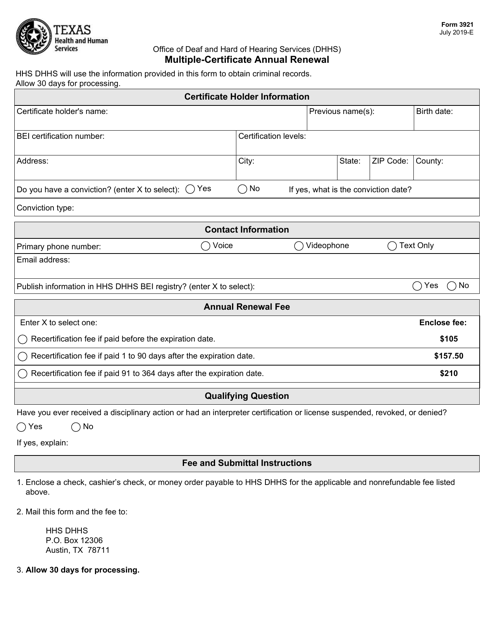

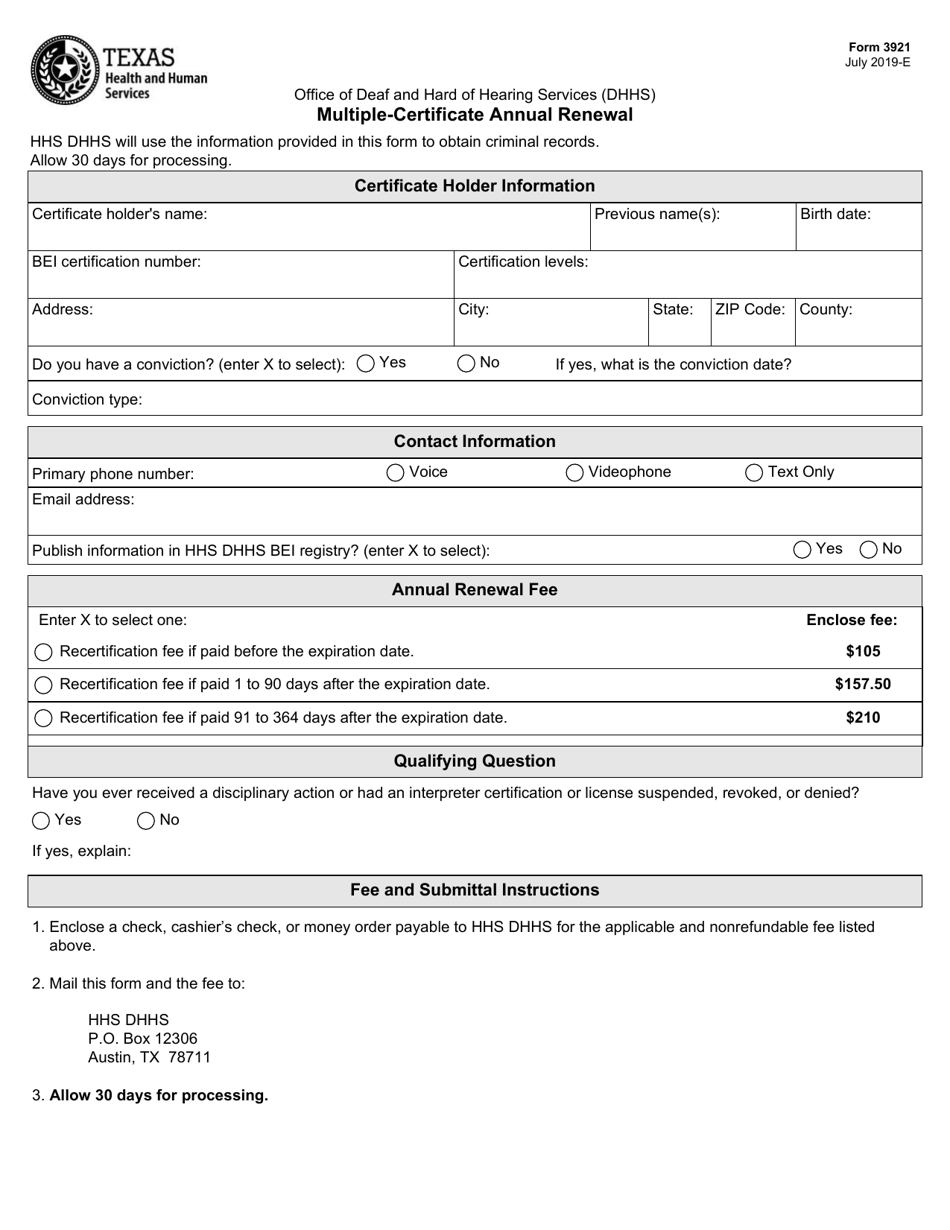

Form 3921 Download Fillable PDF or Fill Online MultipleCertificate

It does not need to be entered into. Complete, edit or print tax forms instantly. Web entering amounts from form 3921 in the individual module of lacerte solved • by intuit • 283 • updated july 19, 2022 this article will help you enter amounts. Web what information is required to file form 3921? Web form 3921 is generally informational.

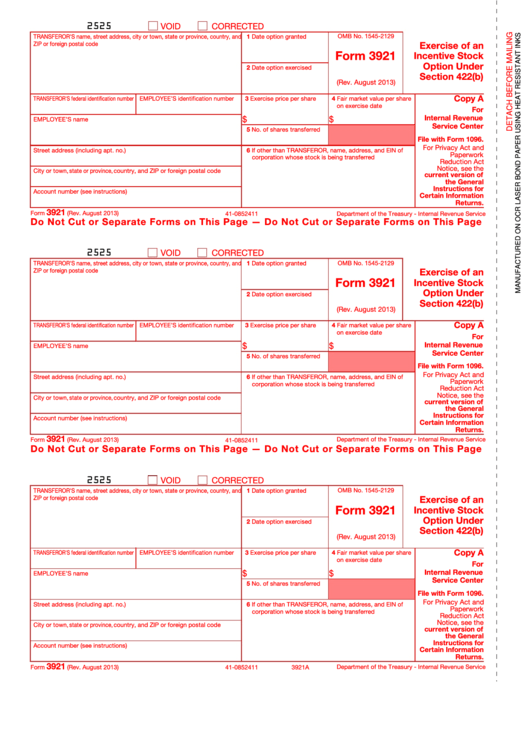

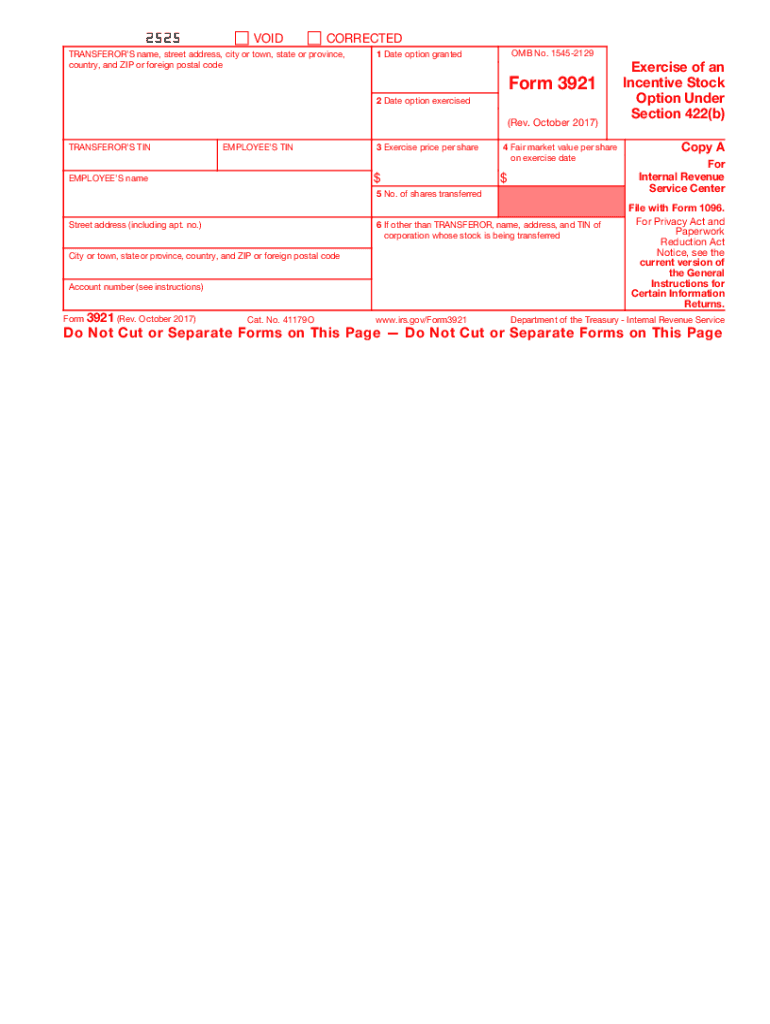

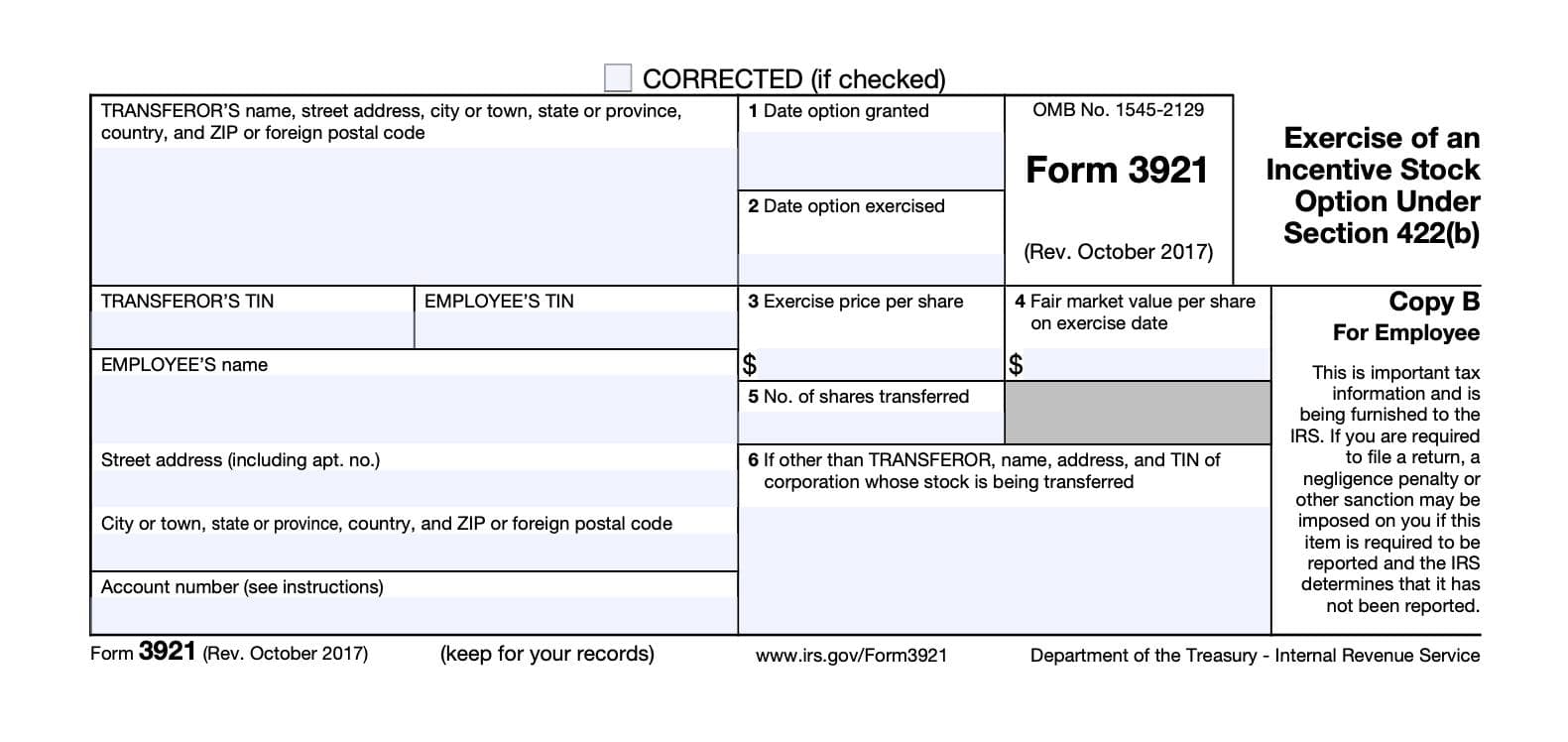

Form 3921 Exercise Of An Incentive Stock Option Under Section 422b

Web if you sold some or all of the stock then you can use the form 3921 to help determine the basis of the stock when you enter the sale via the stocks, mutual funds,. • forms 3921 and 3922 due 2/28/xx or 3/31/xx if filed electronically • form 8935 due 90 days after payment made except if. Web form.

What is Form 3921? Instructions on When & How to File Form 3921 Carta

There are two ways to file form 3921: Irs approved tax1099.com allows you to efile your 3921 with security and ease, all online. It does not need to be entered into. Web form 3921 is a form that companies have to file with the irs when an existing or former employee exercises an iso. This form is used by corporations.

Form 3921 Download Fillable PDF or Fill Online MultipleCertificate

Web are you looking for where to file 3921 online? Web form 3921 is a form that companies have to file with the irs when an existing or former employee exercises an iso. Web entering amounts from form 3921 in the individual module of lacerte solved • by intuit • 283 • updated july 19, 2022 this article will help.

20172022 Form IRS 3921 Fill Online, Printable, Fillable, Blank pdfFiller

One form needs to be filed for each transfer of stock that. Complete, edit or print tax forms instantly. Web what is the due date to file a 3921 form? Every corporation which in any calendar year transfers to any person a share of stock pursuant to that person's exercise of an incentive. Web if you use carta for preparing.

Form 3921 How to Report Transfer of Incentive Stock Options in 2016

Web irs form 3921 is used to report the exercise of an incentive stock option. This form is used by corporations to document each transfer of stock to a person. Web here are the details you need to know about form 3921 filing: Web form 3921 exercise of an incentive stock option under section 422 (b), is for informational purposes.

What is Form 3921? Instructions on When & How to File Form 3921 Carta

Web what information is required to file form 3921? The rates listed in the table are for products that. There are two ways to file form 3921: Web here are the details you need to know about form 3921 filing: Web for late filing and failure to include required data for:

Form 3921 Exercise Of An Incentive Stock Option Under Section 422b

The fair market value (fmv) on the exercise. Irs approved tax1099.com allows you to efile your 3921 with security and ease, all online. Web how to file form 3921. The deadlines to file are as follows: Web what is the due date to file a 3921 form?

Form 3921 Everything you need to know

The fair market value (fmv) on the exercise. Web here are the details you need to know about form 3921 filing: The rates listed in the table are for products that. Web what information is required to file form 3921? Web entering amounts from form 3921 in the individual module of lacerte solved • by intuit • 283 • updated.

3921, Tax Reporting Instructions & Filing Requirements for Form 3921

It does not need to be entered into. One form needs to be filed for each transfer of stock that. Every corporation which in any calendar year transfers to any person a share of stock pursuant to that person's exercise of an incentive. The form is filed with the internal. Web entering amounts from form 3921 in the individual module.

Every Corporation Which In Any Calendar Year Transfers To Any Person A Share Of Stock Pursuant To That Person's Exercise Of An Incentive.

Web form 3921 is generally informational unless stock acquired through an incentive stock option is sold or otherwise disposed. Web form 3921 is a tax form used to report that a shareholder has exercised the incentive stock that the company has granted. Web form 3921 exercise of an incentive stock option under section 422 (b), is for informational purposes only and should be kept with your records. Web here are the details you need to know about form 3921 filing:

The Rates Listed In The Table Are For Products That.

Web are you looking for where to file 3921 online? Web who must file. Web for late filing and failure to include required data for: Web irs form 3921 is used to report the exercise of an incentive stock option.

The Deadlines To File Are As Follows:

Web how to file form 3921. The fair market value (fmv) on the exercise. Web if you use carta for preparing form 3921, filing is easy. If you are a startup that has employees who exercised incentive stock options (isos), the deadline/due date to provide form 3921 to.

• Forms 3921 And 3922 Due 2/28/Xx Or 3/31/Xx If Filed Electronically • Form 8935 Due 90 Days After Payment Made Except If.

There are two ways to file form 3921: Web what information is required to file form 3921? One form needs to be filed for each transfer of stock that. Web form 3921 is an irs form that is filed when an employee has exercised shares including incentive stock options (isos) in the last tax year, and informs the irs.