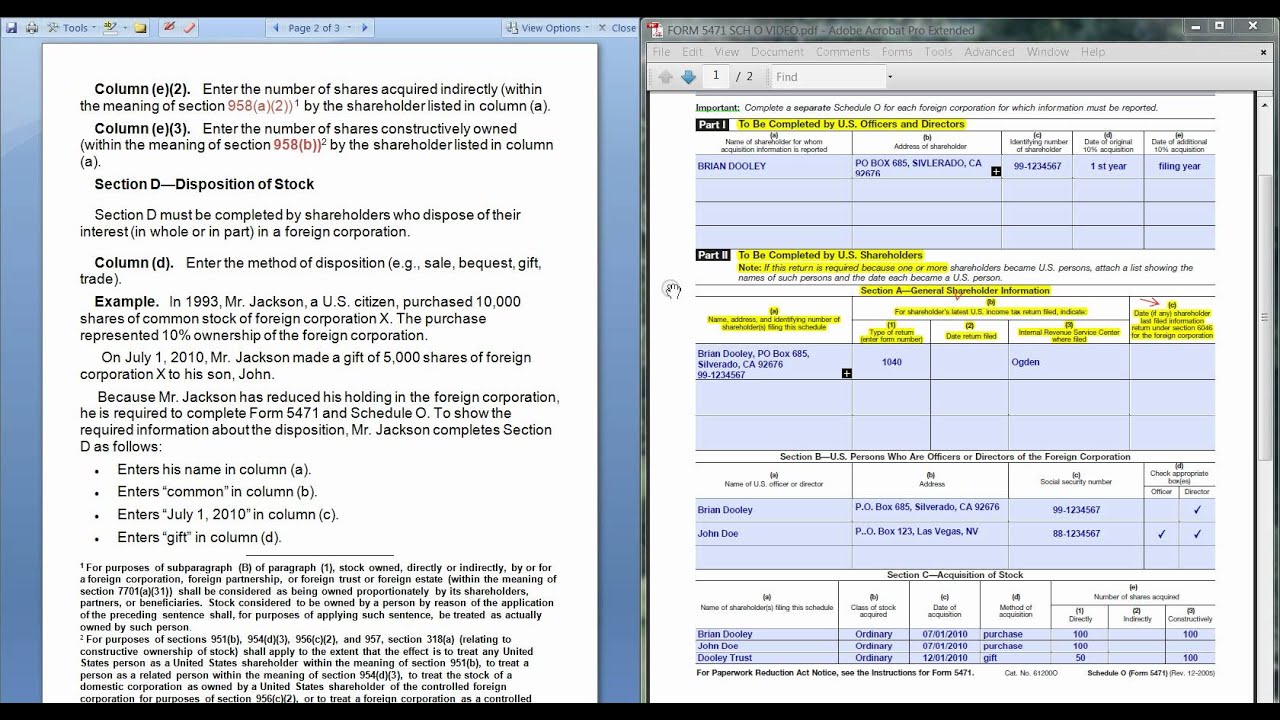

Form 5471 Schedule O

Form 5471 Schedule O - Web failure to file information required by section 6046 and the related regulations (form 5471 and schedule o). Web changes to separate schedule e (form 5471). No changes have been made to schedule m (form 5471). Changes to separate schedule p (form 5471). Web 5471 (schedule o) is a federal corporate income tax form. Web instructions for schedule o (form 5471) schedule p (form 5471), previously taxed earnings and profits of u.s. Some common tax credits apply to many taxpayers, while others only apply to extremely specific situations. Person described in category 3 must complete part ii. Form 5471 (schedule p) previously taxed earnings and profits of u.s. Use the december 2012 revision.

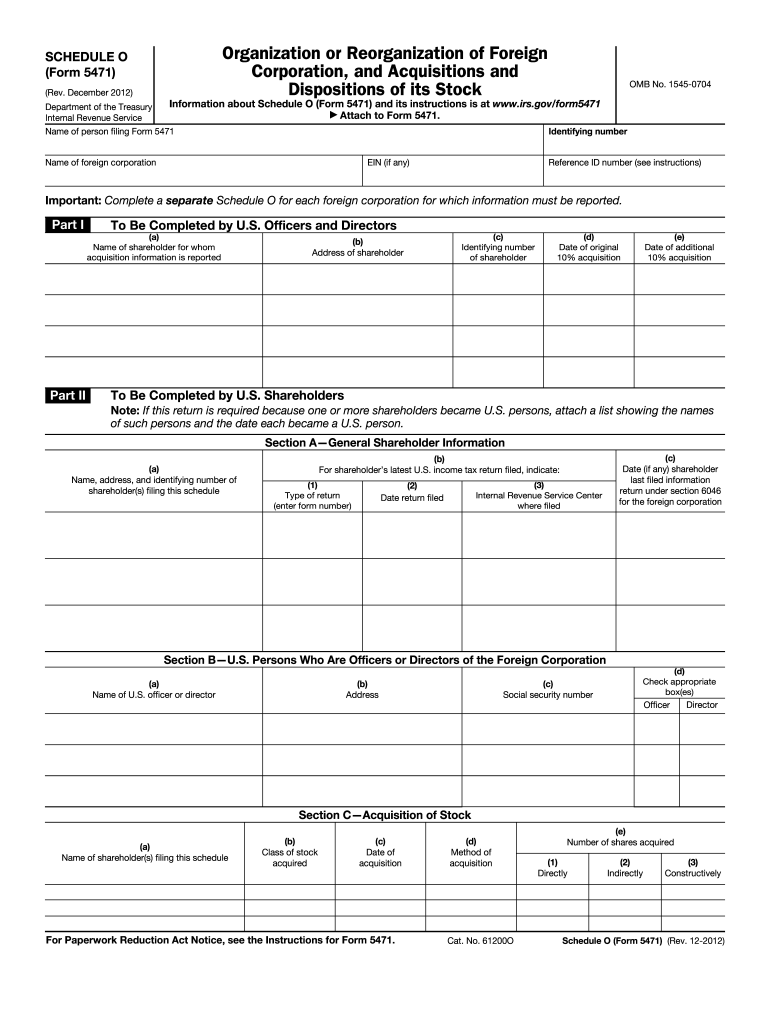

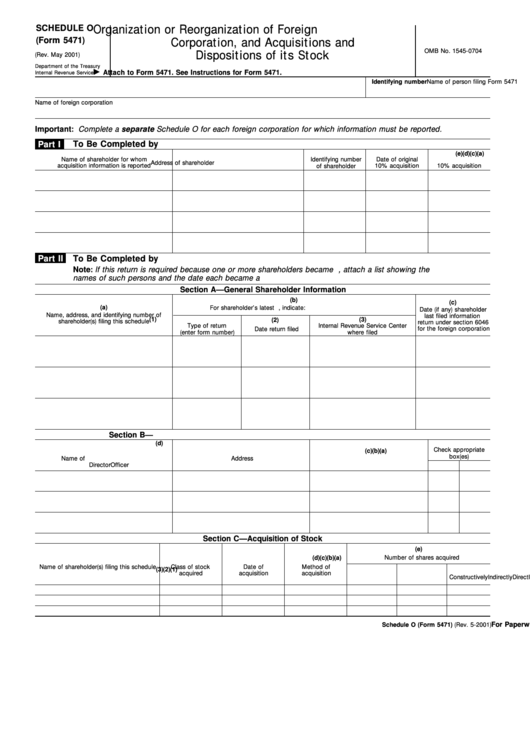

Form 5471 (schedule q) cfc income by cfc income groups. Web schedule o of form 5471 is used to report the organization or reorganization of a foreign corporation and the acquisition or disposition of its stock. Schedule o for each foreign corporation for which information must be reported. Form 5471 filers generally use the same category of filer codes used on form 1118. Form 5471 (schedule p) previously taxed earnings and profits of u.s. Any person who fails to file or report all of the information requested by section 6046 is subject to a $10,000 penalty for each. No changes have been made to schedule m (form 5471). Web attach to form 5471. Use the december 2018 revision. Name of person filing form 5471.

Web form 5471 (schedule o) organization or reorganization of foreign corporation, and acquisitions and dispositions of its stock. Form 5471 filers generally use the same category of filer codes used on form 1118. No changes have been made to schedule m (form 5471). Part i to be completed by u.s. Any person who fails to file or report all of the information requested by section 6046 is subject to a $10,000 penalty for each. Schedule o for each foreign corporation for which information must be reported. Some common tax credits apply to many taxpayers, while others only apply to extremely specific situations. Name of person filing form 5471. Web 5471 (schedule o) is a federal corporate income tax form. Schedule o is used to report the organization or reorganization of a foreign corporation and the acquisition or disposition of its stock.

Demystifying the Form 5471 Part 6. Schedule O SF Tax Counsel

No changes have been made to schedule o (form 5471). Form 5471 (schedule q) cfc income by cfc income groups. Citizen or resident described in category 2 must complete part i. Form 5471 (schedule p) previously taxed earnings and profits of u.s. Web failure to file information required by section 6046 and the related regulations (form 5471 and schedule o).

5471 Worksheet A

Person described in category 3 must complete part ii. Some common tax credits apply to many taxpayers, while others only apply to extremely specific situations. Use the december 2012 revision. Web 5471 (schedule o) is a federal corporate income tax form. Citizen or resident described in category 2 must complete part i.

FORM 5471 SCHEDULE O CONTROLLED FOREIGN CORPORATION.avi YouTube

Web changes to separate schedule e (form 5471). Use the december 2018 revision. Web form 5471 (schedule o) organization or reorganization of foreign corporation, and acquisitions and dispositions of its stock. Form 5471 filers generally use the same category of filer codes used on form 1118. Shareholder of certain foreign corporations.

IRS Issues Updated New Form 5471 What's New?

Any person who fails to file or report all of the information requested by section 6046 is subject to a $10,000 penalty for each. Form 5471 (schedule p) previously taxed earnings and profits of u.s. Web changes to separate schedule m (form 5471). This article will take a deep dive into each column and line of 2021 schedule j of.

Form 5471 Schedule O Example

Any person who fails to file or report all of the information requested by section 6046 is subject to a $10,000 penalty for each. Person described in category 3 must complete part ii. Shareholder of certain foreign corporations foreign corporation’s that file form 5471 use this schedule to report the ptep in the u.s. Web instructions for schedule o (form.

20122021 Form IRS 5471 Schedule O Fill Online, Printable, Fillable

No changes have been made to schedule m (form 5471). Use the december 2018 revision. Web changes to separate schedule e (form 5471). Web the form 5471 schedules are: Form 5471 (schedule q) cfc income by cfc income groups.

Fillable Form 5471 (Schedule O), (Rev. May 2001) Organization Or

Web the form 5471 schedules are: Part i to be completed by u.s. No changes have been made to schedule m (form 5471). Web attach to form 5471. Web 5471 (schedule o) is a federal corporate income tax form.

A Dive into the New Form 5471 Categories of Filers and the Schedule R

Use the december 2012 revision. Web changes to separate schedule e (form 5471). Web instructions for schedule o (form 5471) schedule p (form 5471), previously taxed earnings and profits of u.s. Changes to separate schedule p (form 5471). Form 5471 (schedule q) cfc income by cfc income groups.

Form 5471 (Schedule O) Foreign Corporation, and Acquisitions and

Schedule o is used to report the organization or reorganization of a foreign corporation and the acquisition or disposition of its stock. Person described in category 3 must complete part ii. Form 5471 filers generally use the same category of filer codes used on form 1118. Web attach to form 5471. Any person who fails to file or report all.

Web Schedule O Of Form 5471 Is Used To Report The Organization Or Reorganization Of A Foreign Corporation And The Acquisition Or Disposition Of Its Stock.

Web failure to file information required by section 6046 and the related regulations (form 5471 and schedule o). Some common tax credits apply to many taxpayers, while others only apply to extremely specific situations. Shareholder of certain foreign corporations foreign corporation’s that file form 5471 use this schedule to report the ptep in the u.s. This article will take a deep dive into each column and line of 2021 schedule j of the form 5471.

Name Of Foreign Corporation Ein (If Any) Reference Id Number (See Instructions) Important:

Schedule o for each foreign corporation for which information must be reported. Use the december 2012 revision. Citizen or resident described in category 2 must complete part i. Shareholder of certain foreign corporations.

No Changes Have Been Made To Schedule O (Form 5471).

Changes to separate schedule o (form 5471). Web attach to form 5471. Form 5471 (schedule p) previously taxed earnings and profits of u.s. Changes to separate schedule p (form 5471).

Person Described In Category 3 Must Complete Part Ii.

Web 5471 (schedule o) is a federal corporate income tax form. Web the form 5471 schedules are: Name of person filing form 5471. Web instructions for schedule o (form 5471) schedule p (form 5471), previously taxed earnings and profits of u.s.