Form 712 Life Insurance

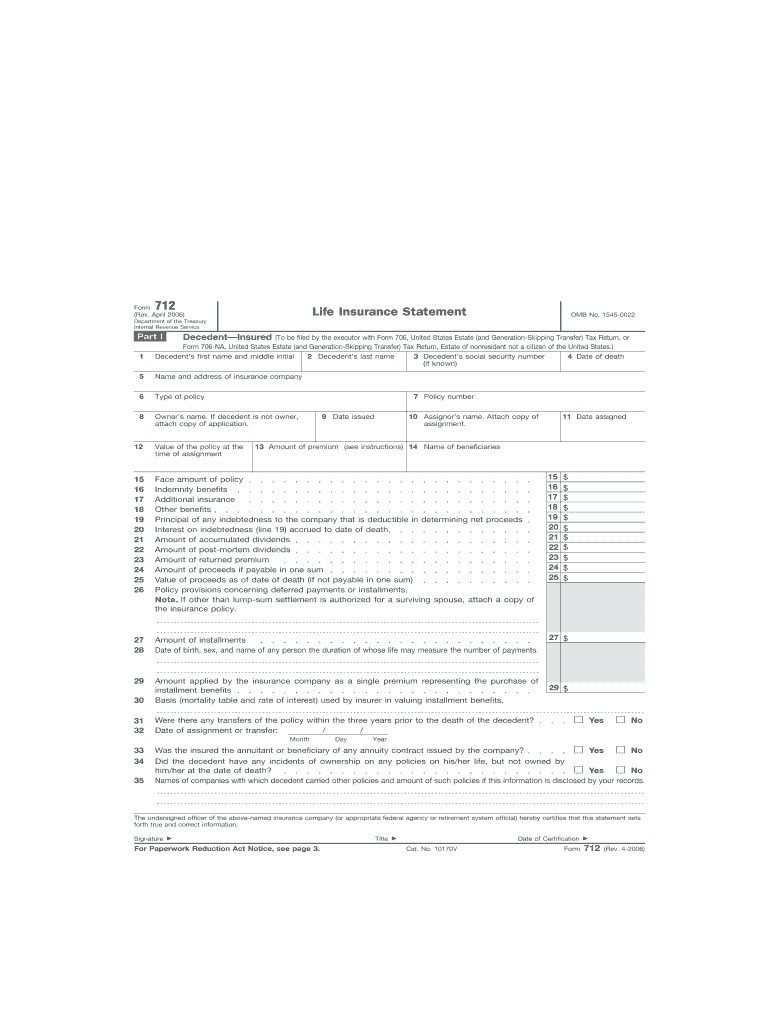

Form 712 Life Insurance - Cause and manner of death are required to rule out the death by homicide. Web irs form 712 is a gift or estate tax form that may need to be filed with the deceased’s final estate tax return. I received form 712 for a $5000 life insurance payout following my husband's death. If the deceased is the policy owner, please include an address for. Call or send your request, including the policy number(s). At the request of the estate’s administrator/executor, we will complete this form to provide the value of the policy as of the date of death. Why does the insurance company need the death certificate that includes manner and cause of death? Web irs form 712 is an informational tax form that is used to report the value of life insurance policies as part of an estate tax return. Web irs form 712 is a statement that provides life insurance policy values as of the date of an insured's or policy owner's death, or at the time a life insurance policy is transferred as a gift. Do i need to report that as income?

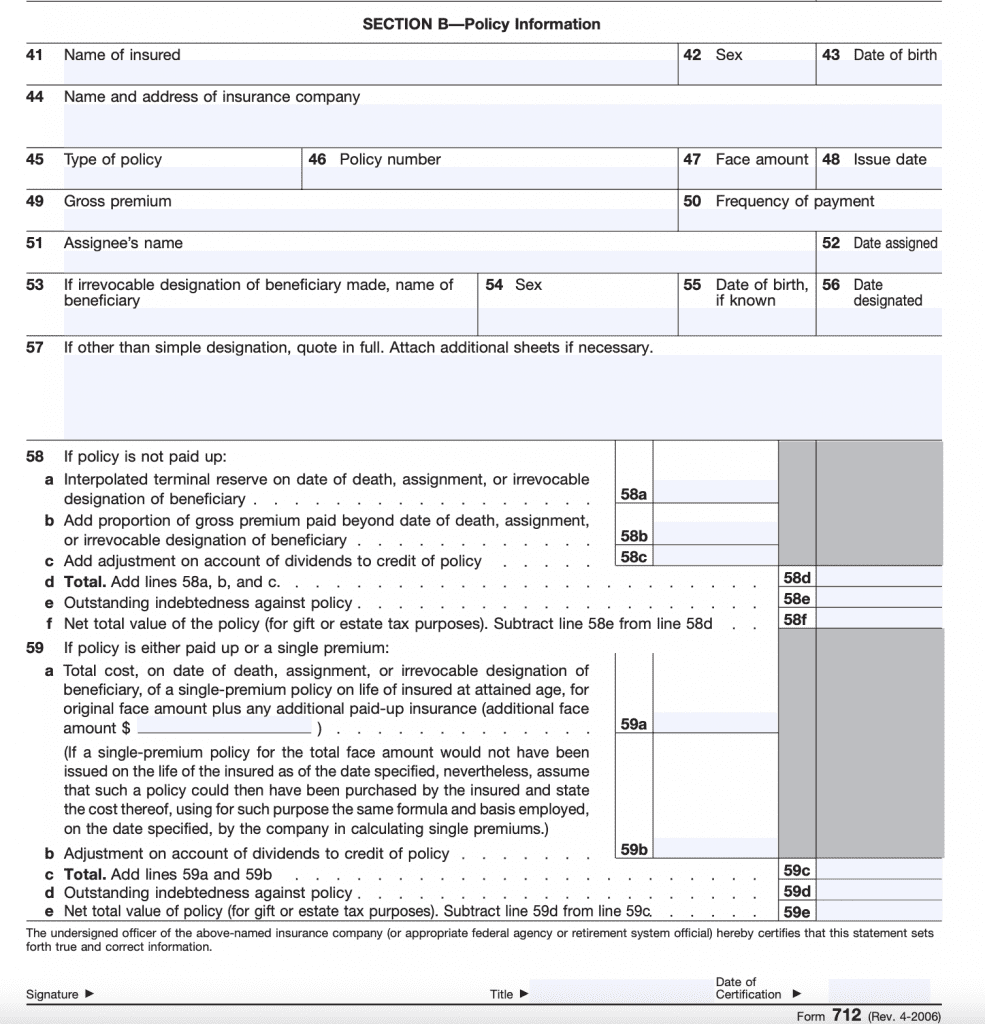

Web form 712 reports the value of life insurance policies for estate tax purposes. Cause and manner of death are required to rule out the death by homicide. Estate tax one of an executor's responsibilities is determining the total value of the estate, as estates larger. I received form 712 for a $5000 life insurance payout following my husband's death. Web irs form 712 is a statement that provides life insurance policy values as of the date of an insured's or policy owner's death, or at the time a life insurance policy is transferred as a gift. Other items you may find useful all revisions for form 712 Why does the insurance company need the death certificate that includes manner and cause of death? Call or send your request, including the policy number(s). If the deceased is the policy owner, please include an address for. Web form 712 should be included with any form 709 gift tax return related to certain policy transfers during the insured’s lifetime to establish the value of the gift as well as with the form 706 estate tax return after death.

This form is not filed by itself, but as an accompaniment to other estate tax forms, most notably irs form 706: Web form 712 reports the value of life insurance policies for estate tax purposes. At the request of the estate’s administrator/executor, we will complete this form to provide the value of the policy as of the date of death. Web irs form 712 is a gift or estate tax form that may need to be filed with the deceased’s final estate tax return. Web irs form 712 is an informational tax form that is used to report the value of life insurance policies as part of an estate tax return. Current revision form 712 pdf recent developments none at this time. Other items you may find useful all revisions for form 712 Cause and manner of death are required to rule out the death by homicide. If the deceased is the policy owner, please include an address for. Web irs form 712 is a statement that provides life insurance policy values as of the date of an insured's or policy owner's death, or at the time a life insurance policy is transferred as a gift.

Form 712 Life Insurance Statement (2006) Free Download

Get an irs form 712? Call or send your request, including the policy number(s). April 2006) life insurance statement omb no. Why does the insurance company need the death certificate that includes manner and cause of death? Web irs form 712 is a gift or estate tax form that may need to be filed with the deceased’s final estate tax.

Life Insurance Form 712 Realtors Can Save Up to 58 on Life Insurance

Do i need to report that as income? April 2006) life insurance statement omb no. Cause and manner of death are required to rule out the death by homicide. Why does the insurance company need the death certificate that includes manner and cause of death? Web irs form 712 is a statement that provides life insurance policy values as of.

IRS Form 712 A Guide to the Life Insurance Statement

Cause and manner of death are required to rule out the death by homicide. If the deceased is the policy owner, please include an address for. April 2006) life insurance statement omb no. Other items you may find useful all revisions for form 712 Do i need to report that as income?

Life Insurance Form 712 Realtors Can Save Up to 58 on Life Insurance

Current revision form 712 pdf recent developments none at this time. Web irs form 712 is a statement that provides life insurance policy values as of the date of an insured's or policy owner's death, or at the time a life insurance policy is transferred as a gift. Web irs form 712 is a gift or estate tax form that.

IRS Form 945 Instructions

If the deceased is the policy owner, please include an address for. Web form 712 should be included with any form 709 gift tax return related to certain policy transfers during the insured’s lifetime to establish the value of the gift as well as with the form 706 estate tax return after death. Estate tax one of an executor's responsibilities.

Form 712 Life Insurance Statement (2006) Free Download

Cause and manner of death are required to rule out the death by homicide. If the deceased is the policy owner, please include an address for. Why does the insurance company need the death certificate that includes manner and cause of death? Other items you may find useful all revisions for form 712 I received form 712 for a $5000.

John Hancock Claim Death Form ≡ Fill Out Printable PDF Forms Online

Current revision form 712 pdf recent developments none at this time. Get an irs form 712? At the request of the estate’s administrator/executor, we will complete this form to provide the value of the policy as of the date of death. I received form 712 for a $5000 life insurance payout following my husband's death. April 2006) life insurance statement.

Fill Free fillable Form 712 Life Insurance Statement 2006 PDF form

At the request of the estate’s administrator/executor, we will complete this form to provide the value of the policy as of the date of death. Other items you may find useful all revisions for form 712 Why does the insurance company need the death certificate that includes manner and cause of death? Call or send your request, including the policy.

Form 712 Life Insurance Statement (2006) Free Download

Web the irs federal form 712 reports the value of a life insurance policy's proceeds after the insured dies for estate tax purposes. Do i need to report that as income? Web form 712 reports the value of life insurance policies for estate tax purposes. Estate tax one of an executor's responsibilities is determining the total value of the estate,.

712 life insurance form Fill out & sign online DocHub

Estate tax one of an executor's responsibilities is determining the total value of the estate, as estates larger. At the request of the estate’s administrator/executor, we will complete this form to provide the value of the policy as of the date of death. If the deceased is the policy owner, please include an address for. Web irs form 712 is.

Get An Irs Form 712?

If the deceased is the policy owner, please include an address for. Cause and manner of death are required to rule out the death by homicide. Why does the insurance company need the death certificate that includes manner and cause of death? Web irs form 712 is an informational tax form that is used to report the value of life insurance policies as part of an estate tax return.

Web The Irs Federal Form 712 Reports The Value Of A Life Insurance Policy's Proceeds After The Insured Dies For Estate Tax Purposes.

Do i need to report that as income? At the request of the estate’s administrator/executor, we will complete this form to provide the value of the policy as of the date of death. Web form 712 should be included with any form 709 gift tax return related to certain policy transfers during the insured’s lifetime to establish the value of the gift as well as with the form 706 estate tax return after death. I received form 712 for a $5000 life insurance payout following my husband's death.

Estate Tax One Of An Executor's Responsibilities Is Determining The Total Value Of The Estate, As Estates Larger.

Web irs form 712 is a gift or estate tax form that may need to be filed with the deceased’s final estate tax return. This form is not filed by itself, but as an accompaniment to other estate tax forms, most notably irs form 706: Web irs form 712 is a statement that provides life insurance policy values as of the date of an insured's or policy owner's death, or at the time a life insurance policy is transferred as a gift. Web form 712 reports the value of life insurance policies for estate tax purposes.

Call Or Send Your Request, Including The Policy Number(S).

April 2006) life insurance statement omb no. Current revision form 712 pdf recent developments none at this time. Other items you may find useful all revisions for form 712