Form 8621 Pdf

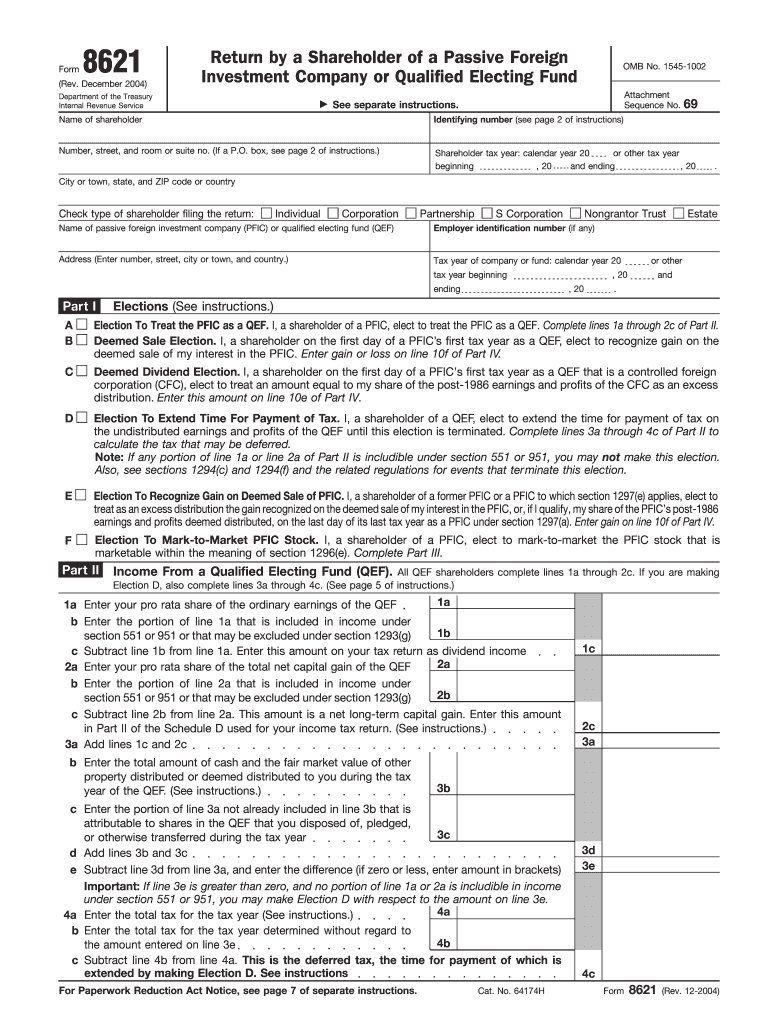

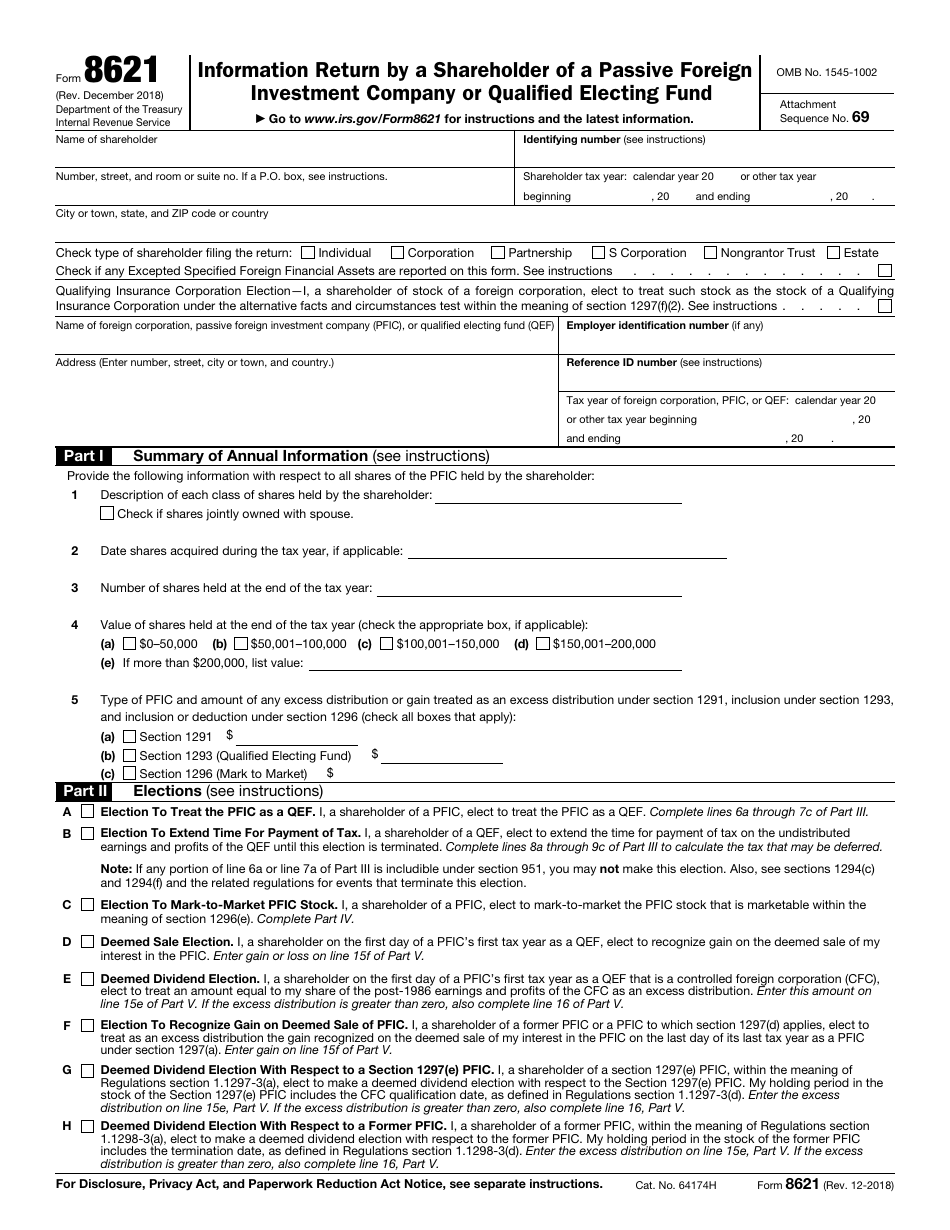

Form 8621 Pdf - Owners of a pfic to report ownership of their passive foreign investment companies on form 8621. Form 8621 calculator makes reporting all of the elements of passive foreign investment company income (pfics) easier. Return by a shareholder making certain late elections to end treatment as a passive foreign investment company. Information return by a shareholder of a passive foreign investment company or qualified electing fund. Shareholders file form 8621 if they receive certain pfic direct/indirect distributions. Web shareholder must file a form 8621 for each pfic in the chain. Such form should be attached to the shareholder’s us income tax return, and may need to be filed even if the shareholder is not required to file a us income tax return or other return for the tax year. According to the irs, it can take an experienced tax professional more than 24 hours to complete form 8621. For instructions and the latest information. In recent years, the irs has aggressively increased enforcement of offshore reporting.

Information return by a shareholder of a passive foreign investment company or qualified electing fund. Web the form, if applicable (that is, if required by line 4 or line 8 of the form). According to the irs, it can take an experienced tax professional more than 24 hours to complete form 8621. • keep a copy of the form for your records. Owners of a pfic to report ownership of their passive foreign investment companies on form 8621. Such form should be attached to the shareholder’s us income tax return, and may need to be filed even if the shareholder is not required to file a us income tax return or other return for the tax year. In recent years, the irs has aggressively increased enforcement of offshore reporting. Web shareholder must file a form 8621 for each pfic in the chain. For instructions and the latest information. December 2018) department of the treasury internal revenue service.

December 2018) department of the treasury internal revenue service. Common examples include foreign mutual funds and holding companies. Web shareholder must file a form 8621 for each pfic in the chain. Web the form, if applicable (that is, if required by line 4 or line 8 of the form). Save yourself the time and frustration. Web tax form 8621, information return by a shareholder of a passive foreign investment company or qualified electing fund, is used to report income from foreign mutual funds, also referred to as passive foreign investment companies (pfics). Information return by a shareholder of a passive foreign investment company or qualified electing fund. Shareholders file form 8621 if they receive certain pfic direct/indirect distributions. In recent years, the irs has aggressively increased enforcement of offshore reporting. Return by a shareholder making certain late elections to end treatment as a passive foreign investment company.

Form 8621 PDF Fill Out and Sign Printable PDF Template signNow

Owners of a pfic to report ownership of their passive foreign investment companies on form 8621. Web the form, if applicable (that is, if required by line 4 or line 8 of the form). In recent years, the irs has aggressively increased enforcement of offshore reporting. • keep a copy of the form for your records. December 2018) department of.

form8621calculatorupdatetwitter Expat Tax Tools

Web information about form 8621, information return by a shareholder of a passive foreign investment company or qualified electing fund, including recent updates, related forms, and instructions on how to file. December 2018) department of the treasury internal revenue service. In recent years, the irs has aggressively increased enforcement of offshore reporting. Web that annual report is form 8621 (information.

Form 8621 Instructions 2020 2021 IRS Forms

Web information about form 8621, information return by a shareholder of a passive foreign investment company or qualified electing fund, including recent updates, related forms, and instructions on how to file. Common examples include foreign mutual funds and holding companies. Owners of a pfic to report ownership of their passive foreign investment companies on form 8621. Web shareholder must file.

Fill Free fillable Form 8621A 2013 Return by a Shareholder PDF form

Return by a shareholder making certain late elections to end treatment as a passive foreign investment company. A single form 8621 may be filed with respect to a pfic to report the information required by section 1298(f) (that is, part i), as well as to report information in parts iii through vi of the form and to make elections in.

Form 8621A Return by a Shareholder Making Certain Late Elections to

• keep a copy of the form for your records. Web information about form 8621, information return by a shareholder of a passive foreign investment company or qualified electing fund, including recent updates, related forms, and instructions on how to file. Web shareholder must file a form 8621 for each pfic in the chain. Save yourself the time and frustration..

The Only Business U.S. Expat Tax blog you need to read

A single form 8621 may be filed with respect to a pfic to report the information required by section 1298(f) (that is, part i), as well as to report information in parts iii through vi of the form and to make elections in part ii of the form. December 2018) department of the treasury internal revenue service. Web the form,.

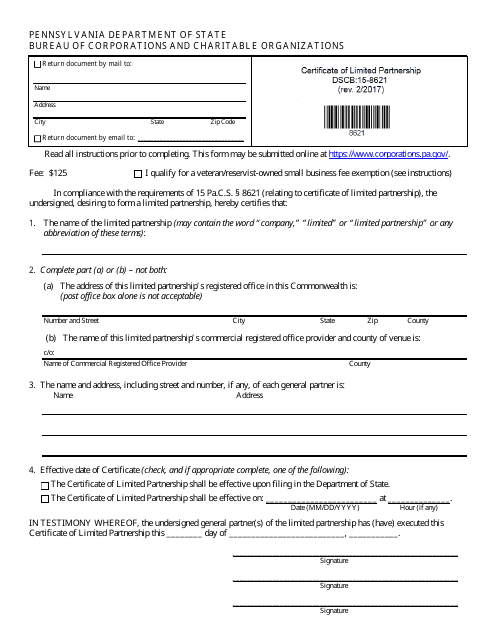

Form DSCB158621 Download Fillable PDF or Fill Online Certificate of

Common examples include foreign mutual funds and holding companies. Web information about form 8621, information return by a shareholder of a passive foreign investment company or qualified electing fund, including recent updates, related forms, and instructions on how to file. Such form should be attached to the shareholder’s us income tax return, and may need to be filed even if.

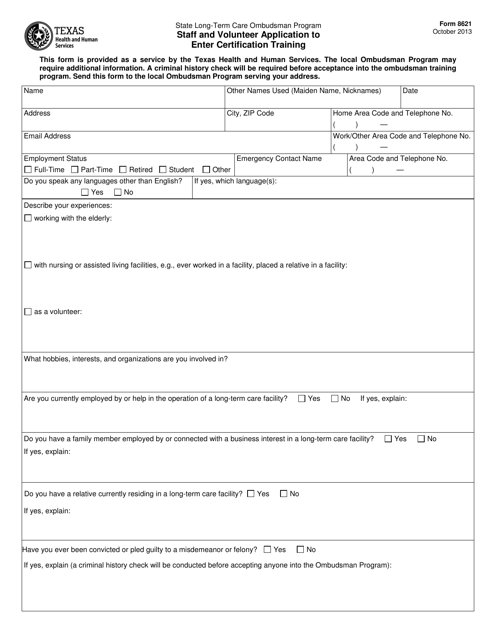

Form 8621 Download Printable PDF or Fill Online Staff and Volunteer

• keep a copy of the form for your records. Web shareholder must file a form 8621 for each pfic in the chain. Web information about form 8621, information return by a shareholder of a passive foreign investment company or qualified electing fund, including recent updates, related forms, and instructions on how to file. For instructions and the latest information..

IRS Form 8621 Download Fillable PDF or Fill Online Information Return

Common examples include foreign mutual funds and holding companies. Web that annual report is form 8621 (information return by a shareholder of a passive foreign investment company or qualified electing fund). Web the form, if applicable (that is, if required by line 4 or line 8 of the form). Shareholders file form 8621 if they receive certain pfic direct/indirect distributions..

Form 8621 Instructions 2020 2021 IRS Forms

Information return by a shareholder of a passive foreign investment company or qualified electing fund. Form 8621 calculator makes reporting all of the elements of passive foreign investment company income (pfics) easier. A single form 8621 may be filed with respect to a pfic to report the information required by section 1298(f) (that is, part i), as well as to.

Shareholders File Form 8621 If They Receive Certain Pfic Direct/Indirect Distributions.

In recent years, the irs has aggressively increased enforcement of offshore reporting. Web tax form 8621, information return by a shareholder of a passive foreign investment company or qualified electing fund, is used to report income from foreign mutual funds, also referred to as passive foreign investment companies (pfics). Web the form, if applicable (that is, if required by line 4 or line 8 of the form). Web shareholder must file a form 8621 for each pfic in the chain.

For Instructions And The Latest Information.

Information return by a shareholder of a passive foreign investment company or qualified electing fund. Common examples include foreign mutual funds and holding companies. According to the irs, it can take an experienced tax professional more than 24 hours to complete form 8621. Web information about form 8621, information return by a shareholder of a passive foreign investment company or qualified electing fund, including recent updates, related forms, and instructions on how to file.

• Keep A Copy Of The Form For Your Records.

Such form should be attached to the shareholder’s us income tax return, and may need to be filed even if the shareholder is not required to file a us income tax return or other return for the tax year. Owners of a pfic to report ownership of their passive foreign investment companies on form 8621. Form 8621 calculator makes reporting all of the elements of passive foreign investment company income (pfics) easier. Web that annual report is form 8621 (information return by a shareholder of a passive foreign investment company or qualified electing fund).

December 2018) Department Of The Treasury Internal Revenue Service.

Return by a shareholder making certain late elections to end treatment as a passive foreign investment company. A single form 8621 may be filed with respect to a pfic to report the information required by section 1298(f) (that is, part i), as well as to report information in parts iii through vi of the form and to make elections in part ii of the form. Save yourself the time and frustration.