Form 8829 Simplified Method Worksheet

Form 8829 Simplified Method Worksheet - The calculated amount will flow to the applicable schedule instead. Use get form or simply click on the template preview to open it in the editor. Web form 8829 problem simplified method smart worksheet line a (gross income limitation) imports schedule c line 28 (total expenses), when it should import line 29. File only with schedule c (form 1040). Its lowest terms, find gcd (greatest common divisor) for 429 & 8. Web there are two ways to claim the deduction: Ad access irs tax forms. Department of the treasury internal revenue service (99) expenses for business use of your home. Web the simplified method, discussed in more detail below, doesn’t require you to file form 8829 and instead goes directly on schedule c, the sole proprietor profit or loss. Web electing the simplified method for form 8829 what is the difference between direct and indirect expenses on the 8829?

The calculated amount will flow up to applicable schedule instead. Enter a 2 in the field 1=use actual expenses (default),. Start completing the fillable fields and. Web the simplified method, discussed in more detail below, doesn’t require you to file form 8829 and instead goes directly on schedule c, the sole proprietor profit or loss. Web this article will assist you with using the simplified method for form 8829 home office deduction in intuit proconnect. Department of the treasury internal revenue service (99) expenses for business use of your home. Ad access irs tax forms. Web an easy alternative to form 8829 by jean murray updated on september 19, 2022 fact checked by taylor tompkins in this article home office deduction. Here's how to find gcd of 429 and 8? Web simplified method used for 2021.

Web original home office deduction: Web form 8829 problem simplified method smart worksheet line a (gross income limitation) imports schedule c line 28 (total expenses), when it should import line 29. File only with schedule c (form 1040). The calculated amount will flow up to applicable schedule instead. Taxpayers may use a simplified method when. Web there are two ways to claim the deduction: Complete, edit or print tax forms instantly. Web irs form 8829 is used by small business owners to calculate the allowable expenses for business use of their home or apartment and total the amount of allowable. Enter a 2 in the field 1=use actual expenses (default),. Web when the taxpayer elects to getting the simplified method, form 8829 exists not produced;

Simplified Method Worksheet Schedule C

Web this article will assist you with using the simplified method for form 8829 home office deduction in intuit proconnect. Use get form or simply click on the template preview to open it in the editor. Web the simplified method, discussed in more detail below, doesn’t require you to file form 8829 and instead goes directly on schedule c, the.

The New York Times > Business > Image > Form 8829

Web the simplified method, discussed in more detail below, doesn’t require you to file form 8829 and instead goes directly on schedule c, the sole proprietor profit or loss. The calculated amount will flow up to applicable schedule instead. Start completing the fillable fields and. Web original home office deduction: Gcd is 1, divided that gcd value with both numerator.

Solved Trying to fix incorrect entry Form 8829

Complete, edit or print tax forms instantly. Get ready for tax season deadlines by completing any required tax forms today. Web 10 rows beginning in tax year 2013 (returns filed in 2014), taxpayers may. Web electing the simplified method for form 8829 what is the difference between direct and indirect expenses on the 8829? The calculated amount will flow up.

Simplified method worksheet 2023 Fill online, Printable, Fillable Blank

Web 10 rows beginning in tax year 2013 (returns filed in 2014), taxpayers may. Web when the taxpayer elects to use the simplified method, form 8829 is not produced; Gcd is 1, divided that gcd value with both numerator &. Enter a 2 in the field 1=use actual expenses (default),. Web use form 8829 to figure the allowable expenses for.

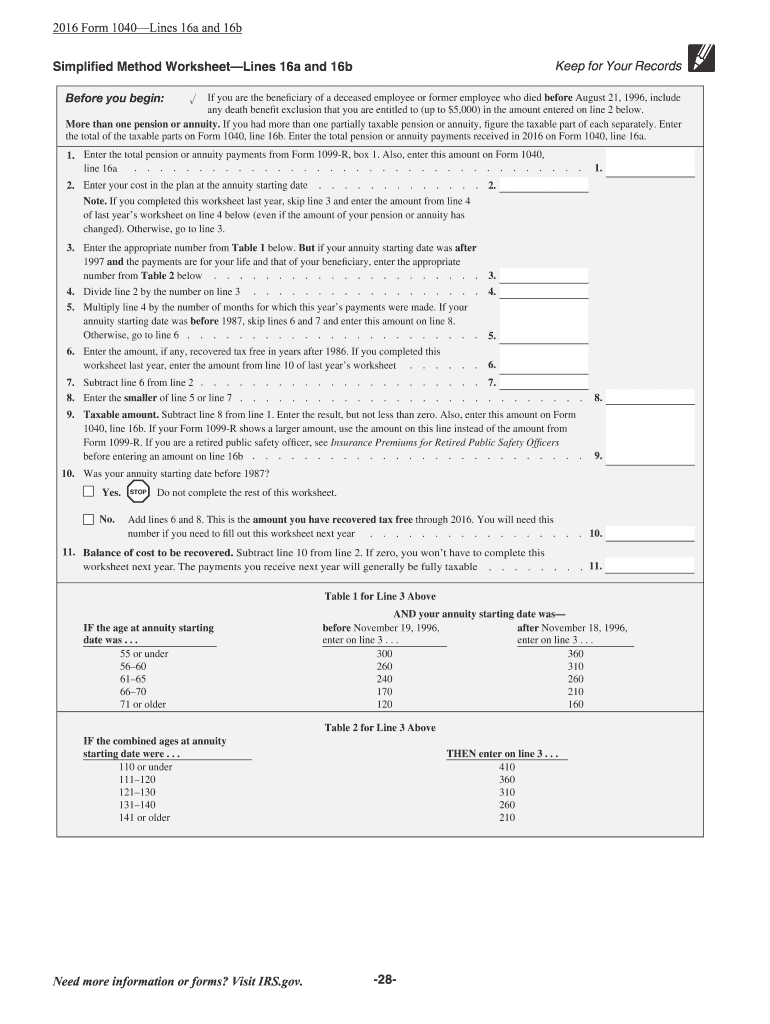

2015 Form IRS 1040 Lines 16a and 16b Fill Online, Printable, Fillable

Web 10 rows beginning in tax year 2013 (returns filed in 2014), taxpayers may. Web irs form 8829 is used by small business owners to calculate the allowable expenses for business use of their home or apartment and total the amount of allowable. Web use form 8829 to figure the allowable expenses for business use of your home on schedule.

Publication 939 (12/2018), General Rule for Pensions and Annuities

Start completing the fillable fields and. If you used the simplified method for 2021 but are not using it for 2022, you may have unallowed expenses from a prior year form 8829 that you can. Taxpayers may use a simplified method when. Department of the treasury internal revenue service (99) expenses for business use of your home. Web use form.

Simplified Method Worksheet Free Square Root Worksheets Pdf And Html

How can i enter multiple 8829's? Department of the treasury internal revenue service (99) expenses for business use of your home. Web there are two ways to claim the deduction: Web electing the simplified method for form 8829 what is the difference between direct and indirect expenses on the 8829? Get ready for tax season deadlines by completing any required.

8829 Simplified Method (ScheduleC, ScheduleF)

Enter a 2 in the field 1=use actual expenses (default),. Web the simplified method, discussed in more detail below, doesn’t require you to file form 8829 and instead goes directly on schedule c, the sole proprietor profit or loss. Web follow these steps to select the simplified method: Go to screen 29, business use of home (8829). Complete, edit or.

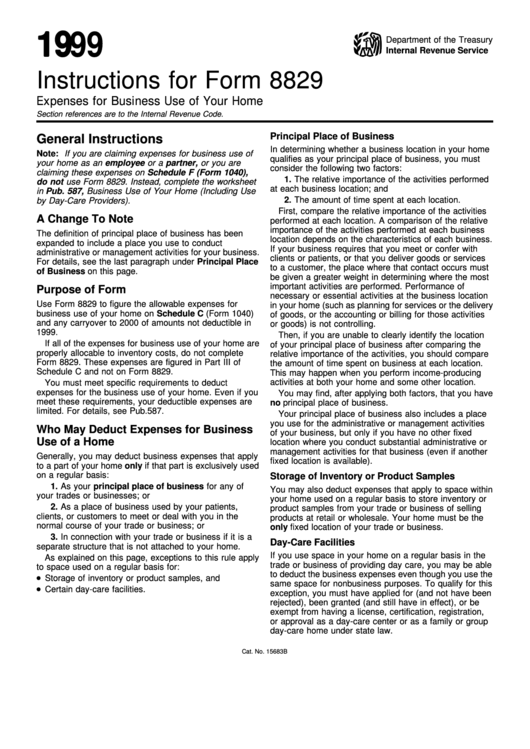

Instructions For Form 8829 Expenses For Business Use Of Your Home

Its lowest terms, find gcd (greatest common divisor) for 429 & 8. Ad access irs tax forms. Department of the treasury internal revenue service (99) expenses for business use of your home. Web simplified method used for 2021. Department of the treasury internal revenue service (99) expenses for business use of your home.

Publication 939 (12/2018), General Rule for Pensions and Annuities

Web use form 8829 to figure the allowable expenses for business use of your home on schedule c (form 1040) and any carryover to next year of amounts not. The calculated amount will flow to the applicable schedule instead. Start completing the fillable fields and. Taxpayers may use a simplified method when. Web follow these steps to select the simplified.

Gcd Is 1, Divided That Gcd Value With Both Numerator &.

Web original home office deduction: Web an easy alternative to form 8829 by jean murray updated on september 19, 2022 fact checked by taylor tompkins in this article home office deduction. Web use form 8829 to figure the allowable expenses for business use of your home on schedule c (form 1040) and any carryover to next year of amounts not. Web when the taxpayer elects to getting the simplified method, form 8829 exists not produced;

File Only With Schedule C (Form 1040).

Complete, edit or print tax forms instantly. Complete, edit or print tax forms instantly. Web when the taxpayer elects to use the simplified method, form 8829 is not produced; Web irs form 8829 is used by small business owners to calculate the allowable expenses for business use of their home or apartment and total the amount of allowable.

Department Of The Treasury Internal Revenue Service (99) Expenses For Business Use Of Your Home.

Here's how to find gcd of 429 and 8? Web follow these steps to select the simplified method: Get ready for tax season deadlines by completing any required tax forms today. Go to screen 29, business use of home (8829).

The Calculated Amount Will Flow To The Applicable Schedule Instead.

Enter a 2 in the field 1=use actual expenses (default),. The calculated amount will flow up to applicable schedule instead. How can i enter multiple 8829's? Its lowest terms, find gcd (greatest common divisor) for 429 & 8.