Form 9423 Irs

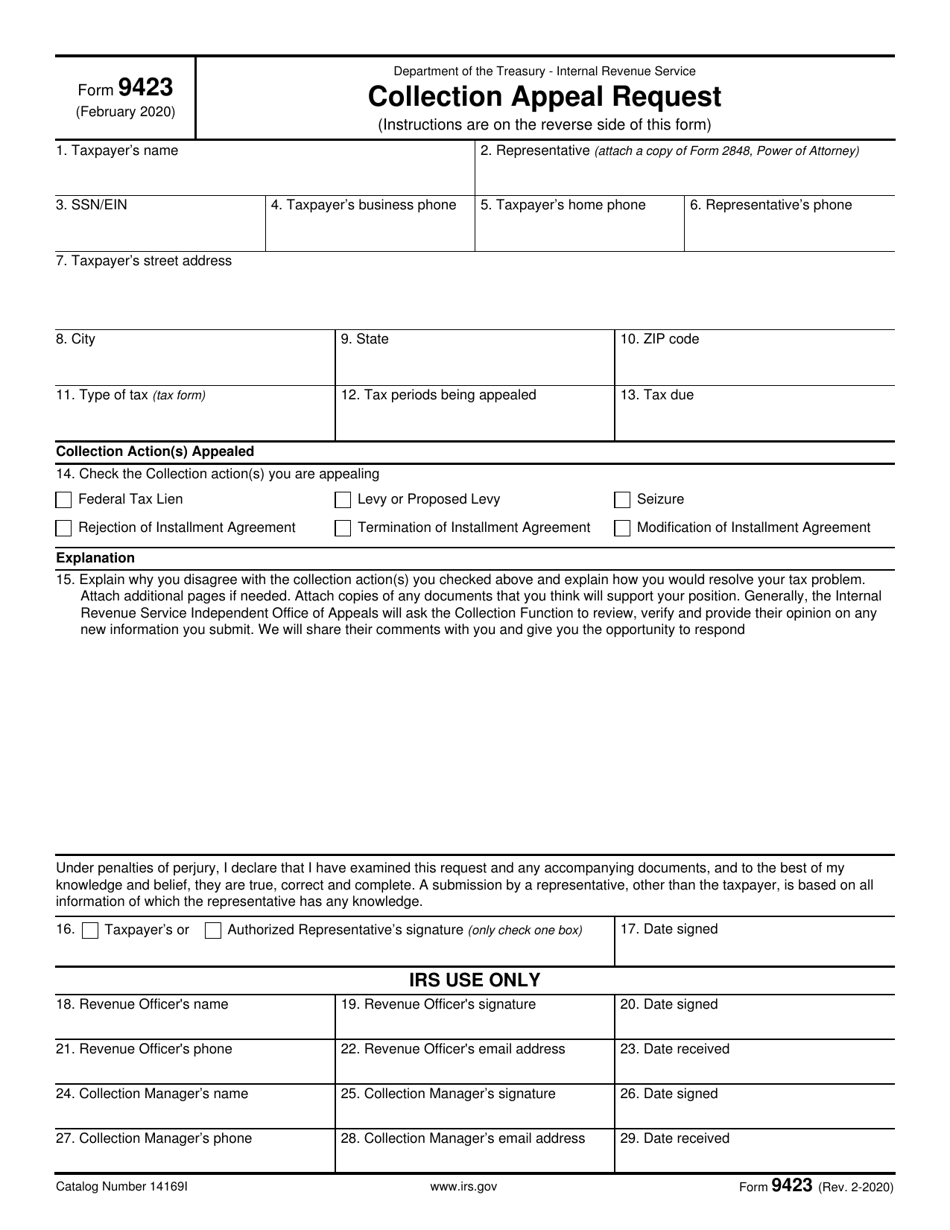

Form 9423 Irs - This chapter discusses the rights taxpayers have to appeal collection actions, proposed or taken, and. Effect on other documents irm 8.24.1,. For example, you might have gotten a notice to terminate your installment agreement or. Request an appeal of the following actions: Web deadline to file irs form 9423. Ad access irs tax forms. Web (1) this irm contains the following substantial changes: Web form 9423, collection appeals request pdf. Web what is the purpose of tax form 9423? Web complete form 9423, collection appeals request pdf;

The table below shows where to. Ad access irs tax forms. Web what is the purpose of tax form 9423? Web taxpayers use form 9423 when they have a tax debt and want to appeal irs collections, like tax liens being issued, paycheck wages being garnished, and bank. Get ready for tax season deadlines by completing any required tax forms today. Web what if the irs rejects my request for an installment agreement? Complete, edit or print tax forms instantly. Web irs form 9423 is a way to challenge the irs collections process. Web complete form 9423, collection appeals request pdf; Web irs form 9423 irs collection appeals program (cap) & form 9423 collection actions by the internal revenue service (irs) can have disastrous consequences for both.

Taxpayer representative (if applicable) 3. The table below shows where to. Web submit this form to the irs to appeal a collection action being taken against you for unpaid federal taxes, such as a federal tax lien, tax levy, seizure, or rejection of installment. For example, you might have gotten a notice to terminate your installment agreement or. Get ready for tax season deadlines by completing any required tax forms today. This form is for income earned in tax year 2022, with tax returns due in april. Submit the completed form 9423 to the revenue officer within 3 business days of your conference. Web form 9423, collection appeals request pdf. Web what if the irs rejects my request for an installment agreement? Web how do i complete irs form 9423?

Form 9423 When to File a Collection Appeal Request (CAP)

Web if you do not resolve your disagreement with the collection manager, you can submit a written request for consideration by the irs independent office of appeals. Effect on other documents irm 8.24.1,. Web what is the purpose of tax form 9423? Web the notice cp504 (also referred to as the final notice) is mailed to you because the irs.

IRS Form 9423 Download Fillable PDF or Fill Online Collection Appeal

This chapter discusses the rights taxpayers have to appeal collection actions, proposed or taken, and. Therefore, the irs wants the taxpayer to. Submit the completed form 9423 to the revenue officer within 3 business days of your conference. Web if you do not resolve your disagreement with the collection manager, you can submit a written request for consideration by the.

IRS Form 9423 in 2022 Tax forms, Irs forms, Form

Web the notice cp504 (also referred to as the final notice) is mailed to you because the irs has not received payment of your unpaid balance and tells you how. Web irs form 9423 is a way to challenge the irs collections process. Web it provides a quick guide listing information for the location to send certain elections, statements, returns.

Form 9423 4 Steps On How To File An IRS Collection Appeal

Web it provides a quick guide listing information for the location to send certain elections, statements, returns and other documents. Effect on other documents irm 8.24.1,. Ad access irs tax forms. Web if you do not resolve your disagreement with the collection manager, you can submit a written request for consideration by the irs independent office of appeals. Web the.

Form 9423 4 Steps On How To File An IRS Collection Appeal

Tax form 9423 (collection appeal request) is used to appeal a collection action taken by the irs against you. The deadline to make a collection appeal request with form 9423 varies based on the situation. Web it provides a quick guide listing information for the location to send certain elections, statements, returns and other documents. Web if you do not.

IRS Form 982 is Your Friend if You Got a 1099C

Ad access irs tax forms. Notice of federal tax lien, levy, seizure, or termination of an installment. Web how do i complete irs form 9423? Web taxpayers use form 9423 when they have a tax debt and want to appeal irs collections, like tax liens being issued, paycheck wages being garnished, and bank. Web form 9423, collection appeals request pdf.

Form 8883 Asset Allocation Statement under Section 338 (2008) Free

Submit the completed form 9423 to the revenue officer within 3 business days of your conference. The deadline to make a collection appeal request with form 9423 varies based on the situation. Web it provides a quick guide listing information for the location to send certain elections, statements, returns and other documents. Web the taxpayer needs to ensure that the.

Form 9423 4 Steps On How To File An IRS Collection Appeal

Submit the completed form 9423 to the revenue officer within 3 business days of your conference. Ad access irs tax forms. The deadline to make a collection appeal request with form 9423 varies based on the situation. Complete, edit or print tax forms instantly. Web irs form 9423 irs collection appeals program (cap) & form 9423 collection actions by the.

Seeking IRS Tax Help Seek help from experts who specializes in

Web complete form 9423, collection appeals request pdf; The deadline to make a collection appeal request with form 9423 varies based on the situation. Web the taxpayer needs to ensure that the irs receives form 9423 within four business days (or be postmarked within four business days) of their request for the. Ad access irs tax forms. Complete, edit or.

IRS Form 9423 for Appealing a Levy

Web it provides a quick guide listing information for the location to send certain elections, statements, returns and other documents. Web we last updated federal form 9423 in february 2023 from the federal internal revenue service. Web form 9423, collection appeals request pdf. Complete, edit or print tax forms instantly. The deadline to make a collection appeal request with form.

Web What Is The Purpose Of Tax Form 9423?

Web deadline to file irs form 9423. Web it provides a quick guide listing information for the location to send certain elections, statements, returns and other documents. Web form 9423, collection appeals request pdf. (2) this irm has been updated for editorial changes throughout.

Web The Notice Cp504 (Also Referred To As The Final Notice) Is Mailed To You Because The Irs Has Not Received Payment Of Your Unpaid Balance And Tells You How.

Ad access irs tax forms. Web the taxpayer needs to ensure that the irs receives form 9423 within four business days (or be postmarked within four business days) of their request for the. Web what if the irs rejects my request for an installment agreement? Complete, edit or print tax forms instantly.

Ad Access Irs Tax Forms.

Therefore, the irs wants the taxpayer to. Web complete form 9423, collection appeals request pdf; Web in general, irs form 9423 allows a taxpayer to specifically appeal the following actions under what the irs calls the collection appeals program: This chapter discusses the rights taxpayers have to appeal collection actions, proposed or taken, and.

Web (1) This Irm Contains The Following Substantial Changes:

Web how do i complete irs form 9423? The table below shows where to. Web the idea behind form 9423 collection appeal request is as an opportunity halt (and modify) an irs collection that is currently in process. Get ready for tax season deadlines by completing any required tax forms today.