Form 945 Instructions 2022

Form 945 Instructions 2022 - This form is used to report withheld federal income tax. Complete, edit or print tax forms instantly. Web we last updated the annual return of withheld federal income tax in december 2022, so this is the latest version of form 945, fully updated for tax year 2022. Form 945 is an irs tax form that is required to be filed by business. Use this form to report your federal tax liability (based on the dates payments were made or wages were. These instructions give you some background information about form 945. Easily add and highlight text, insert pictures, checkmarks, and signs, drop new fillable fields, and rearrange or remove pages from. Web if you withheld federal income tax from nonpayroll payments, you must file form 945. Web form 945 pertains only to what the irs calls nonpayroll payments. this form is commonly used for payments to certain independent contractors, as well as for. Web form 945 is somewhat uncommon, so your payroll and tax software might not be able to file it for you.

• enclose your check or money order made payable to “united states treasury.” be sure to enter your ein, “form 945,” and “2021” on your. Web if you withheld federal income tax from nonpayroll payments, you must file form 945. Web address as shown on form 945. As a major exception, if you withheld these taxes from the income of a foreign. Web when is form 945 due date for 2022 tax year? Annual record of federal tax liability 1220. Web form 945 pertains only to what the irs calls nonpayroll payments. this form is commonly used for payments to certain independent contractors, as well as for. This checklist applies to the 2022 form 945. After entering the basic business information such as the. Fill out your company information.

What is irs form 945 and who should file them? Web if you withheld federal income tax from nonpayroll payments, you must file form 945. Web form 945 is somewhat uncommon, so your payroll and tax software might not be able to file it for you. The checklist for the 2023 form 945 will be posted on the thomson reuters tax & accounting customer help center website at. Easily add and highlight text, insert pictures, checkmarks, and signs, drop new fillable fields, and rearrange or remove pages from. As a major exception, if you withheld these taxes from the income of a foreign. This checklist applies to the 2022 form 945. Web address as shown on form 945. Web the irs has made available a draft 2022 form 945 annual return of withheld federal income tax. Web when is form 945 due date for 2022 tax year?

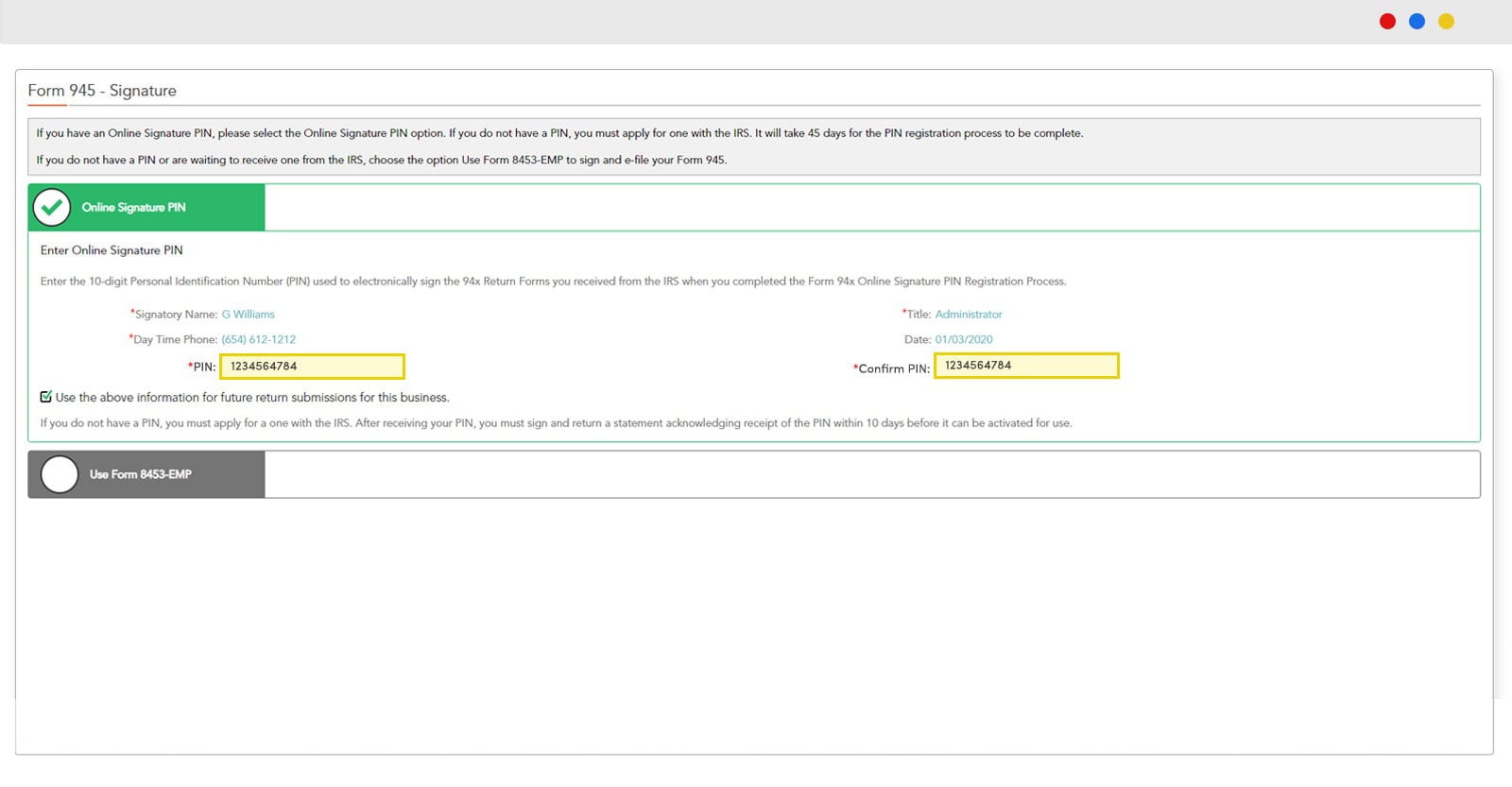

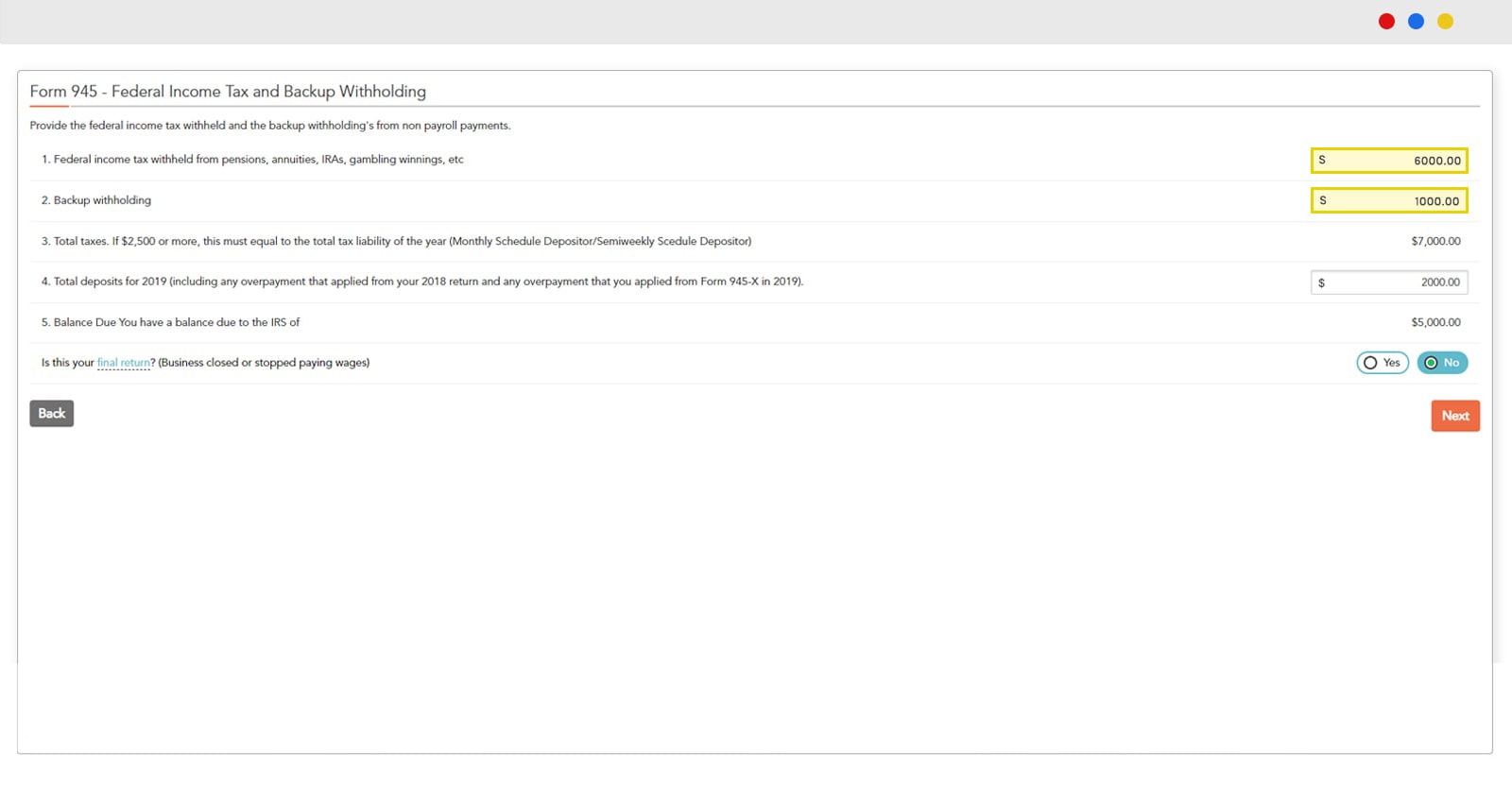

File Form 945 Online Efile 945 Form 945 2020 945 Schedule A

Fill out your company information. After entering the basic business information such as the. Web address as shown on form 945. Web form 945 pertains only to what the irs calls nonpayroll payments. this form is commonly used for payments to certain independent contractors, as well as for. Web 2022 12/07/2022 inst 945:

File Form 945 Online Efile 945 Form 945 2020 945 Schedule A

Easily add and highlight text, insert pictures, checkmarks, and signs, drop new fillable fields, and rearrange or remove pages from. Ad access irs tax forms. Web address as shown on form 945. If you made deposits on time, in full. Web any credit for qualified sick and family leave wages paid in 2022 for leave taken after march 31, 2020,.

Form 945 Reporting Withholding for Defined Benefit Plans Saber Pension

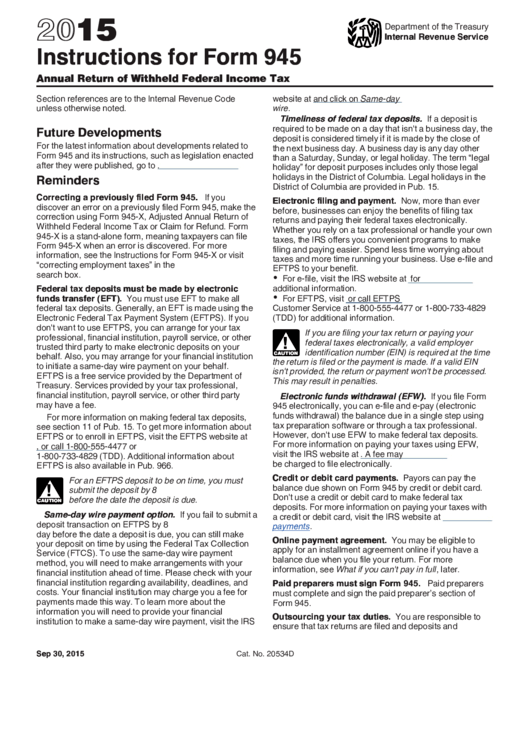

Web any credit for qualified sick and family leave wages paid in 2022 for leave taken after march 31, 2020, and before april 1, 2021, that is remaining at the end of the year because it. They tell you who must file form 945, how to. Annual record of federal tax liability 1220. Use this form to report your federal.

Instructions For Form 945 Annual Return Of Withheld Federal

Web if you withheld federal income tax from nonpayroll payments, you must file form 945. These instructions give you some background information about form 945. Easily add and highlight text, insert pictures, checkmarks, and signs, drop new fillable fields, and rearrange or remove pages from. This checklist applies to the 2022 form 945. After entering the basic business information such.

Form 945 Annual Return of Withheld Federal Tax Form (2015

• enclose your check or money order made payable to “united states treasury.” be sure to enter your ein, “form 945,” and “2021” on your. Ad access irs tax forms. This checklist applies to the 2022 form 945. Web any credit for qualified sick and family leave wages paid in 2022 for leave taken after march 31, 2020, and before.

FORM 945 Instructions On How To File Form 945

Web 2022 12/07/2022 inst 945: Web form 945 instructions for 2022 1. Web if you withheld federal income tax from nonpayroll payments, you must file form 945. The due date to file form 945 for the tax year 2022 is january 31, 2023. Web the irs has made available a draft 2022 form 945 annual return of withheld federal income.

Form 945 Edit, Fill, Sign Online Handypdf

The checklist for the 2023 form 945 will be posted on the thomson reuters tax & accounting customer help center website at. Complete, edit or print tax forms instantly. Web what are the requirements and instructions for filing 945 form? Web address as shown on form 945. As a major exception, if you withheld these taxes from the income of.

Form 945X Adjusted Annual Return of Withheld Federal Tax or

Ad access irs tax forms. Annual record of federal tax liability 1220. Easily add and highlight text, insert pictures, checkmarks, and signs, drop new fillable fields, and rearrange or remove pages from. These instructions give you some background information about form 945. Try it for free now!

Form 945 Instructions Fill online, Printable, Fillable Blank

After entering the basic business information such as the. The due date to file form 945 for the tax year 2022 is january 31, 2023. They tell you who must file form 945, how to. The checklist for the 2023 form 945 will be posted on the thomson reuters tax & accounting customer help center website at. If you made.

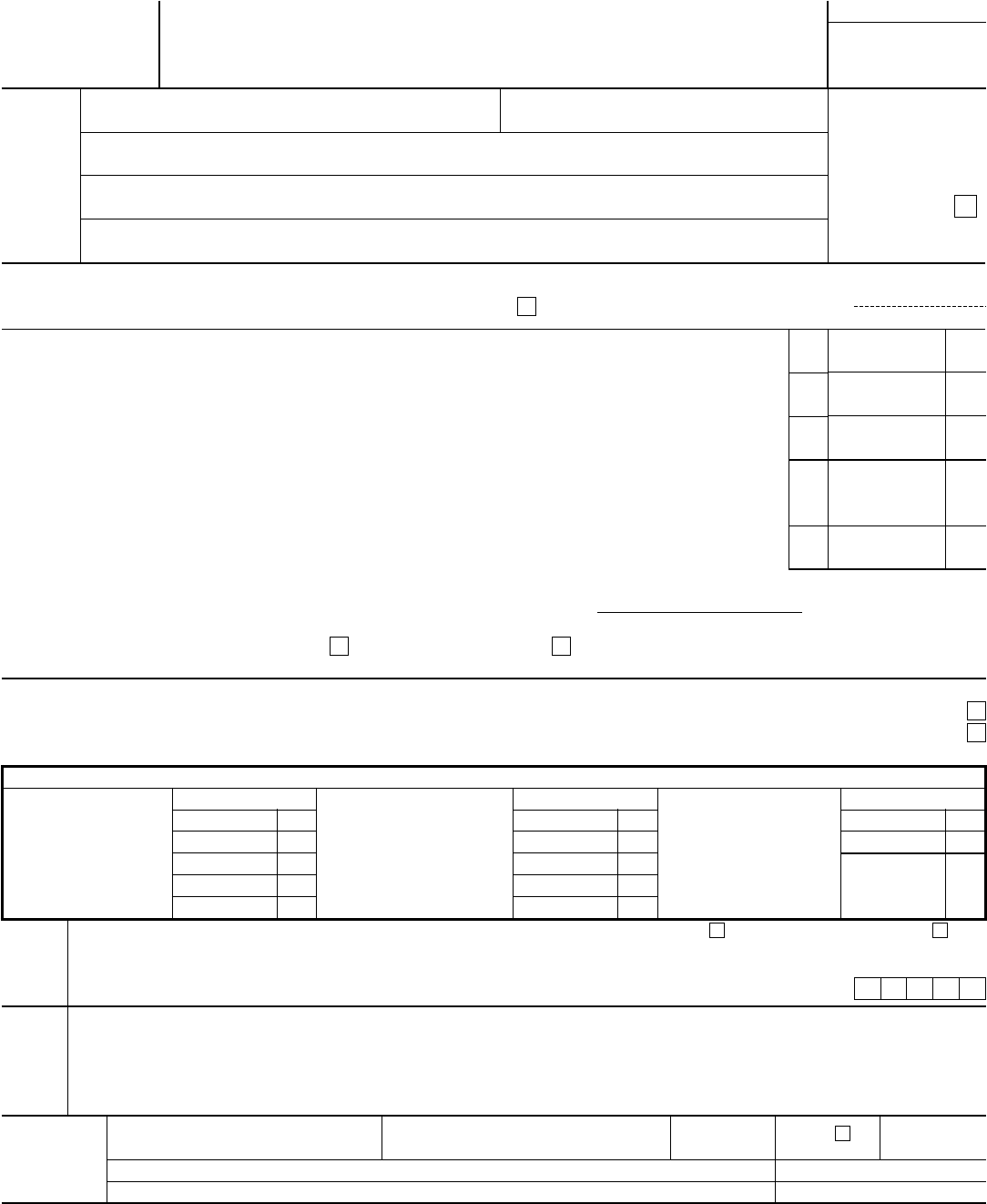

Form 945 Annual Return of Withheld Federal Tax Form (2015

Web any credit for qualified sick and family leave wages paid in 2022 for leave taken after march 31, 2020, and before april 1, 2021, that is remaining at the end of the year because it. Form 945 has a total of seven lines. Web when is form 945 due date for 2022 tax year? If you made deposits on.

• Enclose Your Check Or Money Order Made Payable To “United States Treasury.” Be Sure To Enter Your Ein, “Form 945,” And “2021” On Your.

Complete, edit or print tax forms instantly. These instructions give you some background information about form 945. Web if you withheld federal income tax from nonpayroll payments, you must file form 945. This checklist applies to the 2022 form 945.

As A Major Exception, If You Withheld These Taxes From The Income Of A Foreign.

They tell you who must file form 945, how to. If you made deposits on time, in full. What is irs form 945 and who should file them? Fill out your company information.

This Form Is Used To Report Withheld Federal Income Tax.

Web we last updated the annual return of withheld federal income tax in december 2022, so this is the latest version of form 945, fully updated for tax year 2022. Annual record of federal tax liability 1220. Form 945 is an irs tax form that is required to be filed by business. Use this form to report your federal tax liability (based on the dates payments were made or wages were.

The Due Date To File Form 945 For The Tax Year 2022 Is January 31, 2023.

Upload, modify or create forms. Web any credit for qualified sick and family leave wages paid in 2022 for leave taken after march 31, 2020, and before april 1, 2021, that is remaining at the end of the year because it. Web form 945 pertains only to what the irs calls nonpayroll payments. this form is commonly used for payments to certain independent contractors, as well as for. • enclose your check or money order made payable to “united states treasury.” be sure to enter your ein, “form 945,” and “2021” on your.