Form 990 Schedule C Instructions

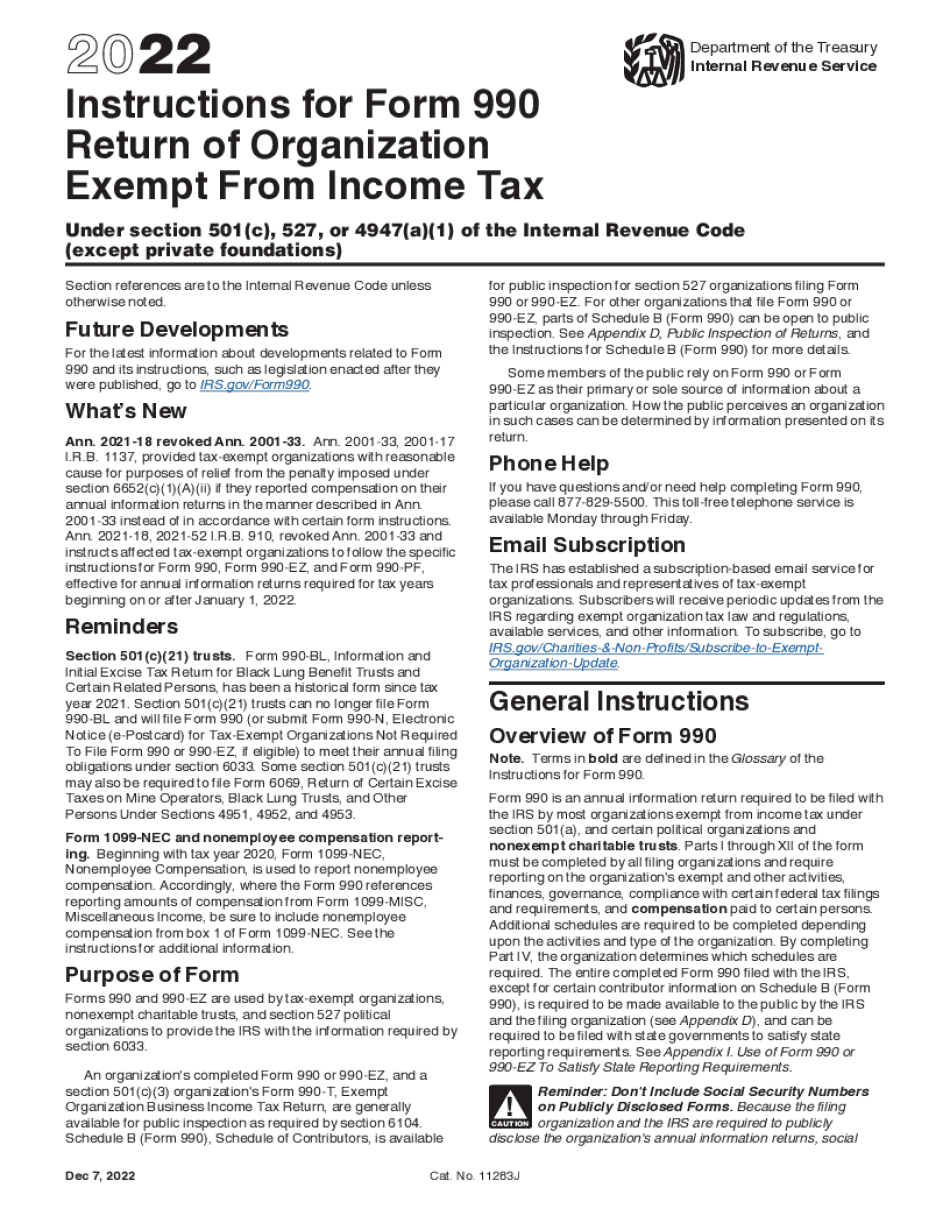

Form 990 Schedule C Instructions - The instructions include a reminder that form. Web schedule c tax form. Profit or loss from business is an internal revenue service (irs) tax form that is used to report income and expenses for a business. Read the irs instructions for 990 forms. Web you will need to file schedule c annually as an attachment to your form 1040. H(c) k lm prior year current year. Web the 2020 form 990, return of organization exempt from income tax, and instructions contain the following notable changes: Return of organization exempt from income tax. Web instructions for form 990. Web schedule c is required to be attached to form 990 when:

Web the 2020 form 990, return of organization exempt from income tax, and instructions contain the following notable changes: Return of organization exempt from income tax. The npo engaged in direct or indirect political campaign activities on behalf of or in opposition to. It is critical for not. Web see instructions lha form (2020) part i summary part ii signature block 990. Web for instructions and the latest information. Web under section 501(c), 527, or 4947(a)(1) of the internal revenue code (except private foundations) | do not enter social security numbers on this form as it may be made. The irs schedule c form is an important form for business owners and sole proprietors. H(c) k lm prior year current year. Web for paperwork reduction act notice, see the instructions for form 990.

It is critical for not. Web for paperwork reduction act notice, see the instructions for form 990. Purpose of schedule schedule c (form 990) is used by: Web schedule c tax form. The irs schedule c form is an important form for business owners and sole proprietors. Read the irs instructions for 990 forms. Form 990 (2020) page check if schedule o contains a response or note to any. • section 501(c) organizations, and • section 527 organizations. Web for instructions and the latest information. Web you will need to file schedule c annually as an attachment to your form 1040.

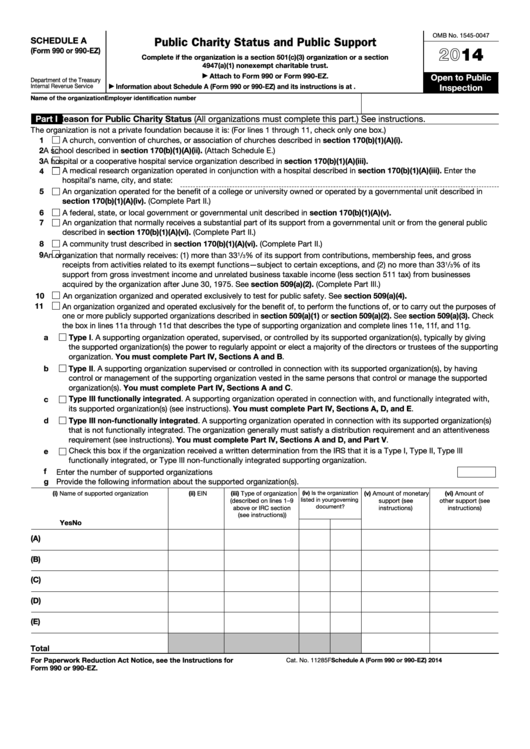

Fillable Schedule A (Form 990 Or 990Ez) Public Charity Status And

Web under section 501(c), 527, or 4947(a)(1) of the internal revenue code (except private foundations) | do not enter social security numbers on this form as it may be made. Web tax filings by year. Web see instructions lha form (2020) part i summary part ii signature block 990. Web schedule c (form 990) 2022 page check if the filing.

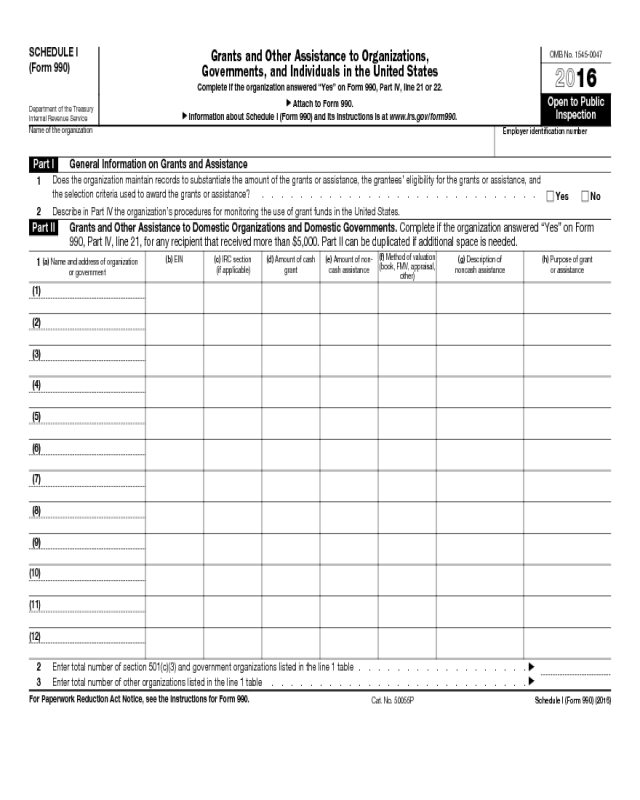

Form 990 Schedule I Edit, Fill, Sign Online Handypdf

Read the irs instructions for 990 forms. Web form 990 schedules with instructions. Web tax filings by year. Web schedule c (form 990) 2022 page check if the filing organization belongs to an affiliated group (and list in part iv each affiliated group member’s name, address, ein,. The irs schedule c form is an important form for business owners and.

2020 form 990 schedule c instructions Fill Online, Printable

Web schedule c is used by section 501 (c) organizations and section 527 organizations to furnish additional information on political campaign activities or. Web form 990 schedules with instructions. The npo engaged in direct or indirect political campaign activities on behalf of or in opposition to. H(c) k lm prior year current year. Web you will need to file schedule.

form 990 schedule o Fill Online, Printable, Fillable Blank form990

Web for paperwork reduction act notice, see the instructions for form 990. The following schedules to form 990, return of organization exempt from income tax, do not have separate instructions. Web for instructions and the latest information. Web see instructions lha form (2020) part i summary part ii signature block 990. After you calculate your income and expenses,.

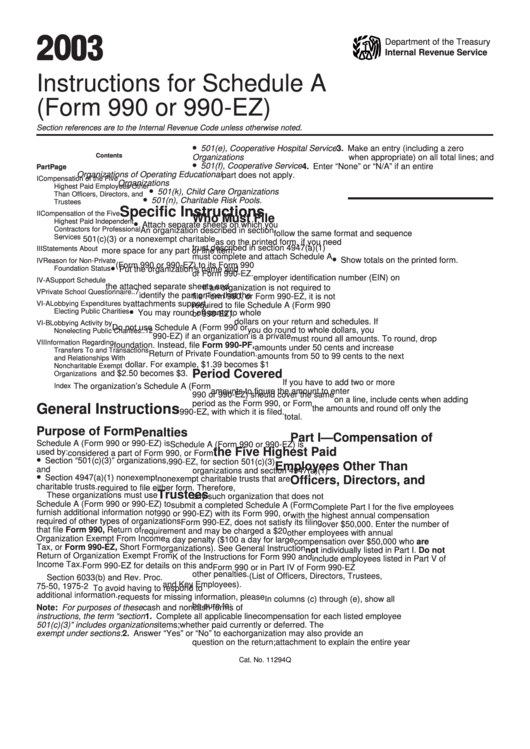

Instructions For Schedule A (Form 990 Or 990Ez) 2003 printable pdf

The npo engaged in direct or indirect political campaign activities on behalf of or in opposition to. Web instructions for form 990. Web under section 501(c), 527, or 4947(a)(1) of the internal revenue code (except private foundations) | do not enter social security numbers on this form as it may be made. Web you will need to file schedule c.

Form Instructions 990 and Form 990 Schedule G Main Differences

H(c) k lm prior year current year. Web schedule c is used by section 501 (c) organizations and section 527 organizations to furnish additional information on political campaign activities or. Schedule f (form 990) 2021 name of the organization complete if the organization answered yes. The irs schedule c form is an important form for business owners and sole proprietors..

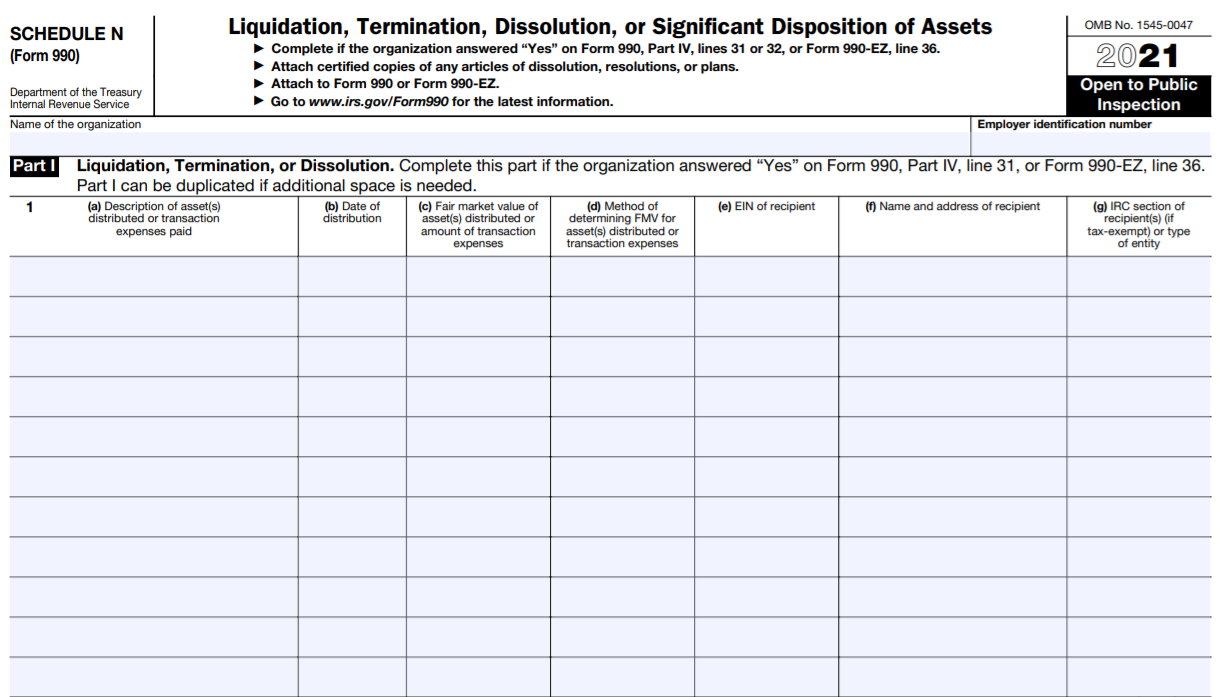

IRS Form 990/990EZ Schedule N Instructions Liquidation, Termination

Web see instructions lha form (2020) part i summary part ii signature block 990. Web for paperwork reduction act notice, see the instructions for form 990. The irs schedule c form is an important form for business owners and sole proprietors. Web tax filings by year. Short form return of organization exempt from income tax.

IRS Instructions 990 2019 Printable & Fillable Sample in PDF

Web for instructions and the latest information. Form 990 (2020) page check if schedule o contains a response or note to any. The following schedules to form 990, return of organization exempt from income tax, do not have separate instructions. The instructions include a reminder that form. H(c) k lm prior year current year.

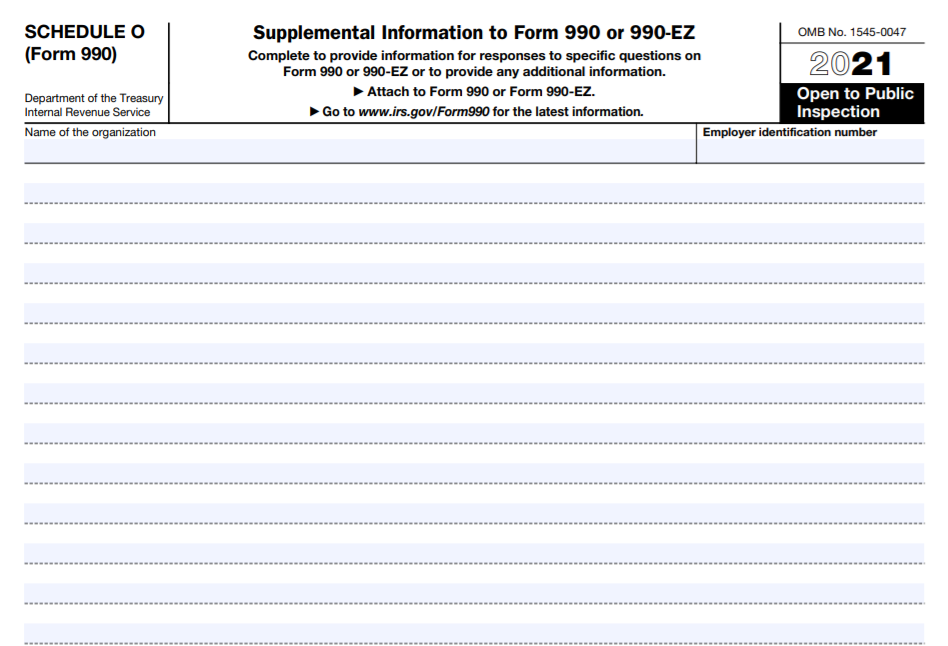

IRS Form 990 Schedule O Instructions Supplemental Information

Web instructions for form 990. Web schedule c is used by section 501 (c) organizations and section 527 organizations to furnish additional information on political campaign activities or. Profit or loss from business is an internal revenue service (irs) tax form that is used to report income and expenses for a business. Web see instructions form 990 (2022) c d.

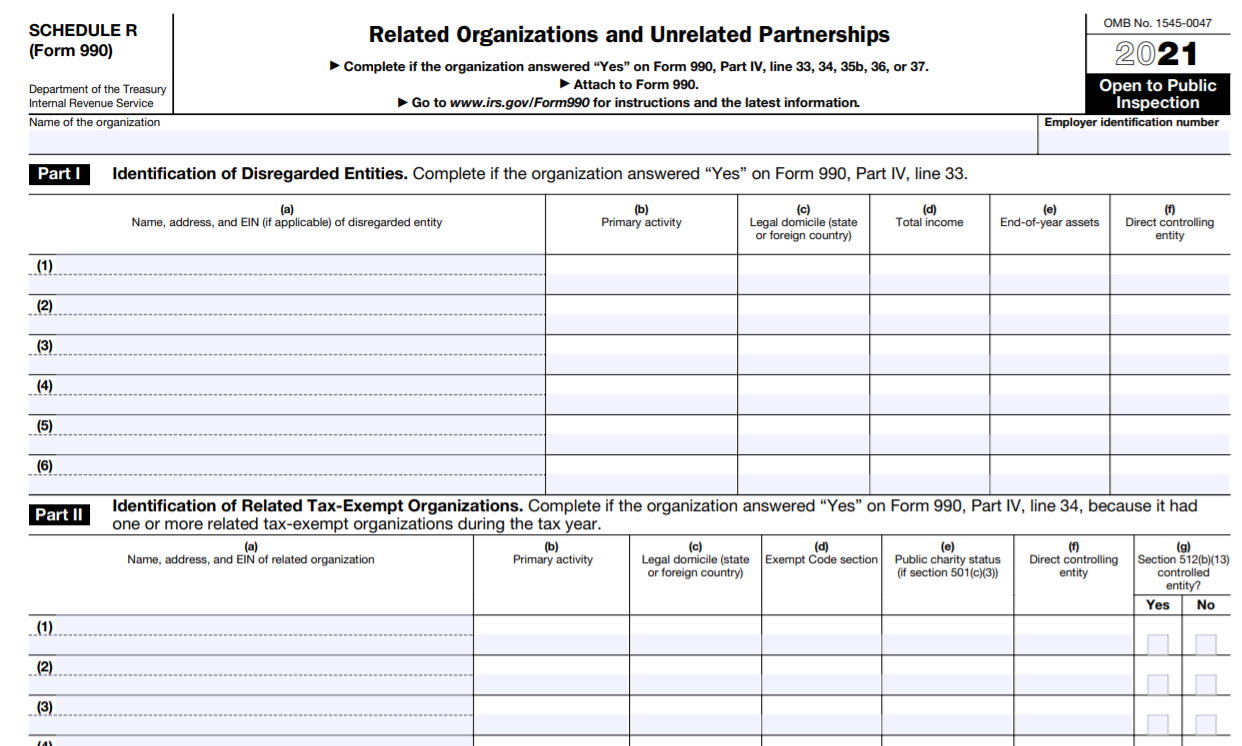

IRS Form 990 Schedule R Instructions Related Organizations and

Web instructions for form 990. Web you will need to file schedule c annually as an attachment to your form 1040. Form 990 (2020) page check if schedule o contains a response or note to any. Web for paperwork reduction act notice, see the instructions for form 990. The npo engaged in direct or indirect political campaign activities on behalf.

Web See Instructions Lha Form (2020) Part I Summary Part Ii Signature Block 990.

Web see instructions form 990 (2022) c d employer identification number e g f h(a) yes no h(b) yes no i j website: Web schedule c tax form. Web schedule c is required to be attached to form 990 when: Schedule f (form 990) 2021 name of the organization complete if the organization answered yes.

Web The 2020 Form 990, Return Of Organization Exempt From Income Tax, And Instructions Contain The Following Notable Changes:

Form 990 (2020) page check if schedule o contains a response or note to any. H(c) k lm prior year current year. It is critical for not. The npo engaged in direct or indirect political campaign activities on behalf of or in opposition to.

The Irs Schedule C Form Is An Important Form For Business Owners And Sole Proprietors.

Web for instructions and the latest information. If the organization answered “yes,” on form 990, part iv, line 3, or form. The following schedules to form 990, return of organization exempt from income tax, do not have separate instructions. Web schedule c (form 990) 2022 page check if the filing organization belongs to an affiliated group (and list in part iv each affiliated group member’s name, address, ein,.

Profit Or Loss From Business Is An Internal Revenue Service (Irs) Tax Form That Is Used To Report Income And Expenses For A Business.

After you calculate your income and expenses,. Web for paperwork reduction act notice, see the instructions for form 990. Read the irs instructions for 990 forms. Web tax filings by year.