Form Ez 2555

Form Ez 2555 - Web the exact limit changes each year. In screen 31, foreign income exclusion (2555), locate the employer subsection. Ad access irs tax forms. For filing irs form 2555 to take the foreign earned income exclusion in 2022 (tax year 2021), the limit is $108,700. Get ready for tax season deadlines by completing any required tax forms today. Web youmay use this form if you: It is used to claim the foreign earned income exclusion and/or the. Web 5 employer is (check a a foreign entity b a u.s. Web what is form 2555? Company e other (specify) 6 a if you previously filed form 2555 or.

If you qualify, you can use form 2555 to figure your foreign. Web youmay use this form if you: Company c self any that apply): Web form 2555 (foreign earned income exclusion) calculates the amount of foreign earned income and/or foreign housing you can exclude from taxation. Web 235 rows purpose of form. It is used to claim the foreign earned income exclusion and/or the. Web the exact limit changes each year. In screen 31, foreign income exclusion (2555), locate the employer subsection. Web 5 employer is (check a a foreign entity b a u.s. Get ready for tax season deadlines by completing any required tax forms today.

In screen 31, foreign income exclusion (2555), locate the employer subsection. If you qualify, you can use form. Earned wages/salaries in a foreign country. D a foreign affiliate of a u.s. Since tax year 2019, the form is no longer used to claim the feie. Citizen or a resident alien. Ad access irs tax forms. In order to use the foreign earned. Web form 2555 department of the treasury internal revenue service foreign earned income. Web form 2555 (foreign earned income exclusion) calculates the amount of foreign earned income and/or foreign housing you can exclude from taxation.

Ssurvivor Form 2555 Ez Instructions 2019

If you qualify, you can use form 2555 to figure your foreign. Get ready for this year's tax season quickly and safely with pdffiller! Company e other (specify) 6 a if you previously filed form 2555 or. Web form 2555 department of the treasury internal revenue service foreign earned income. Web form 2555 is a tax form that must be.

Form 2555EZ U.S Expat Taxes Community Tax

Since tax year 2019, the form is no longer used to claim the feie. If you qualify, you can use form 2555 to figure your foreign. Earned wages/salaries in a foreign country. Web form 2555 is a tax form that must be filed by nonresident aliens who have earned income from the united states. Company e other (specify) 6 a.

Breanna Form 2555 Ez Instructions 2019

Web 5 employer is (check a a foreign entity b a u.s. Ad complete irs tax forms online or print government tax documents. In order to use the foreign earned. Web what is form 2555? Web form 2555 (foreign earned income exclusion) calculates the amount of foreign earned income and/or foreign housing you can exclude from taxation.

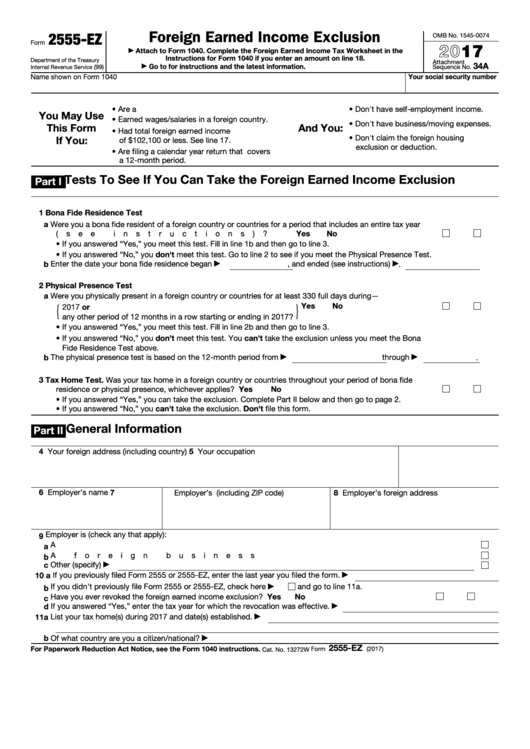

Fillable Form 2555Ez Foreign Earned Exclusion 2017 printable

Ad access irs tax forms. Since tax year 2019, the form is no longer used to claim the feie. If you qualify, you can use form 2555 to figure your foreign. Get ready for this year's tax season quickly and safely with pdffiller! Web 5 employer is (check a a foreign entity b a u.s.

Irs Form Ez 2555 Universal Network

Web form 2555 is a tax form that must be filed by nonresident aliens who have earned income from the united states. Get ready for tax season deadlines by completing any required tax forms today. In screen 31, foreign income exclusion (2555), locate the employer subsection. Earned wages/salaries in a foreign country. Get ready for tax season deadlines by completing.

Form 2555, Foreign Earned Exclusion YouTube

Web youmay use this form if you: If you qualify, you can use form 2555 to figure your foreign. Web if you qualify, you can use form 2555 to figure your foreign earned income exclusion and your housing exclusion or deduction. Company e other (specify) 6 a if you previously filed form 2555 or. Get ready for this year's tax.

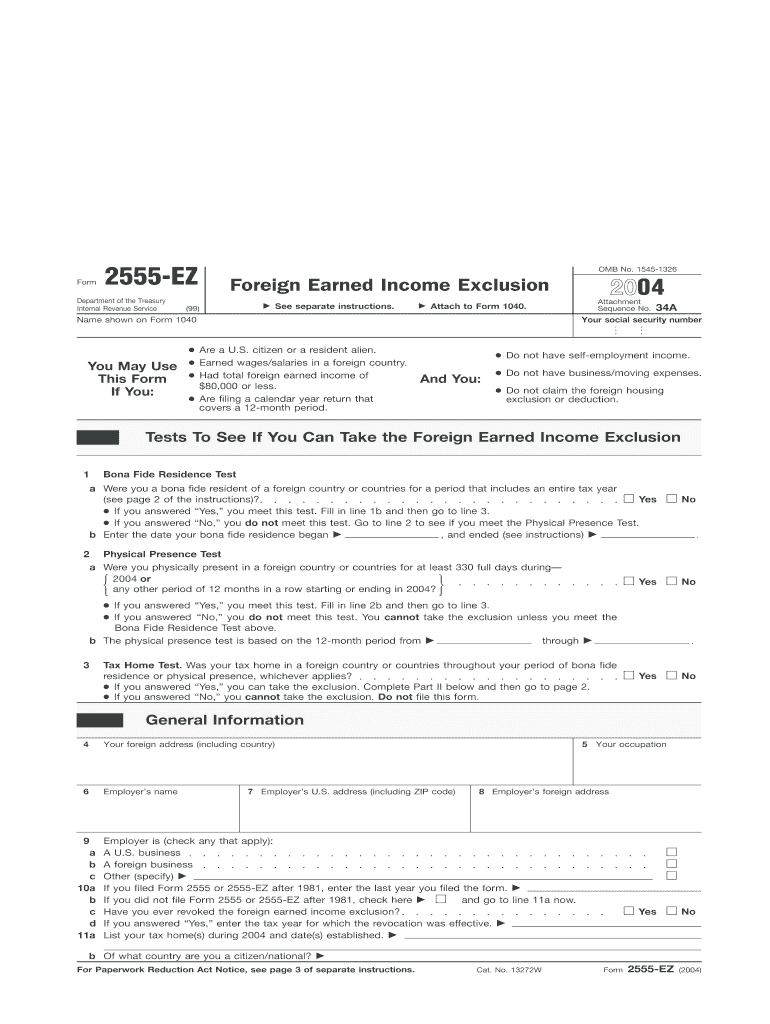

Instructions For Form 2555Ez Foreign Earned Exclusion

Web the exact limit changes each year. Web youmay use this form if you: Web the foreign earned income exclusion allows taxpayers to exclude their foreign earned income up to $100,800 in 2015 and $99,200 in 2014. You cannot exclude or deduct more than the. Web information about form 2555, foreign earned income, including recent updates, related forms, and instructions.

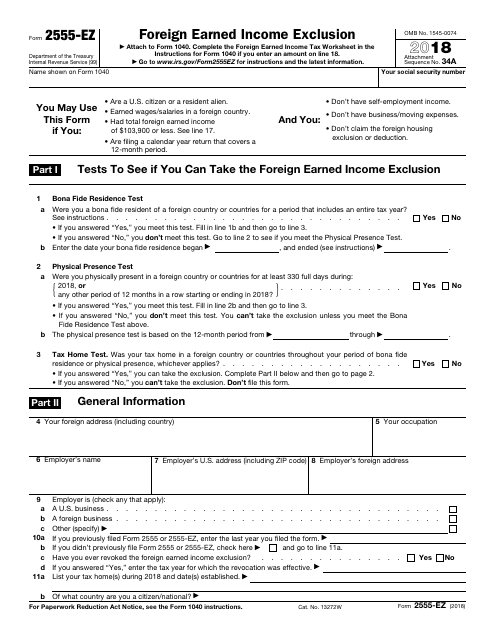

IRS Form 2555EZ Download Fillable PDF or Fill Online Foreign Earned

Ad access irs tax forms. Web form 2555 is a tax form that must be filed by nonresident aliens who have earned income from the united states. You cannot exclude or deduct more than the. In order to use the foreign earned. Citizen or a resident alien.

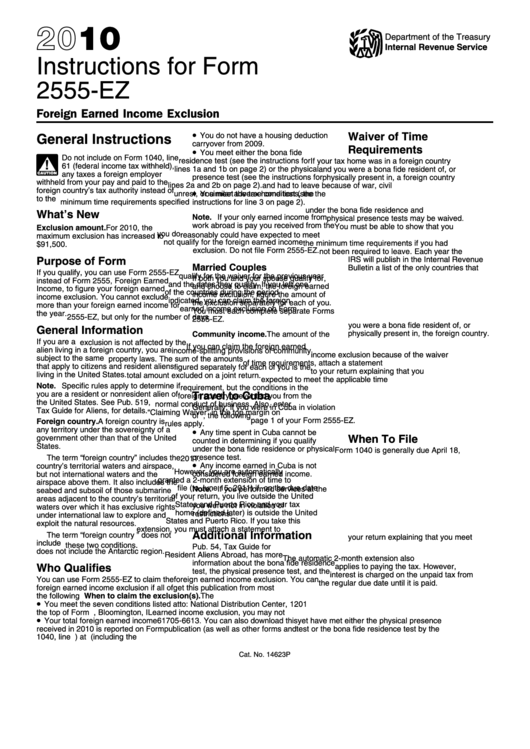

Irs 2555 ez instructions 2014

Web form 2555 is a tax form that must be filed by nonresident aliens who have earned income from the united states. Web 235 rows purpose of form. In order to use the foreign earned. In screen 31, foreign income exclusion (2555), locate the employer subsection. D a foreign affiliate of a u.s.

Form 2555 Ez Fill Out and Sign Printable PDF Template signNow

Company c self any that apply): Get ready for this year's tax season quickly and safely with pdffiller! Web what is form 2555? Ad complete irs tax forms online or print government tax documents. If you qualify, you can use form 2555 to figure your foreign.

Citizen Or A Resident Alien.

Get ready for this year's tax season quickly and safely with pdffiller! In screen 31, foreign income exclusion (2555), locate the employer subsection. If you qualify, you can use form 2555 to figure your foreign. Since tax year 2019, the form is no longer used to claim the feie.

Complete, Edit Or Print Tax Forms Instantly.

In order to use the foreign earned. Web what is form 2555? Web 235 rows purpose of form. Web youmay use this form if you:

It Is Used To Claim The Foreign Earned Income Exclusion And/Or The.

For filing irs form 2555 to take the foreign earned income exclusion in 2022 (tax year 2021), the limit is $108,700. Web form 2555 department of the treasury internal revenue service foreign earned income. Get ready for tax season deadlines by completing any required tax forms today. Ad access irs tax forms.

Web If You Qualify, You Can Use Form 2555 To Figure Your Foreign Earned Income Exclusion And Your Housing Exclusion Or Deduction.

Company e other (specify) 6 a if you previously filed form 2555 or. Web form 2555 (foreign earned income exclusion) calculates the amount of foreign earned income and/or foreign housing you can exclude from taxation. Company c self any that apply): Get ready for tax season deadlines by completing any required tax forms today.