Form It-204 Instructions

Form It-204 Instructions - You as a partner are liable for tax on your share of the partnership income, whether or not distributed. Returns for calendar year 2022 are due march 15, 2023. Prepare tax documents themselves, without the assistance of a tax professional; Enter identifying information on the federal idauth screen in the electronic filing folder, if applicable. Verify the file this return electronically box is checked on the federal elf screen in the electronic filing folder. Every llc that is a disregarded entity for federal income tax purposes that has income, gain, loss, or deduction from new york state sources; Used to report income, deductions, gains, losses and credits from the operation of a partnership.

Every llc that is a disregarded entity for federal income tax purposes that has income, gain, loss, or deduction from new york state sources; Returns for calendar year 2022 are due march 15, 2023. You as a partner are liable for tax on your share of the partnership income, whether or not distributed. Used to report income, deductions, gains, losses and credits from the operation of a partnership. Verify the file this return electronically box is checked on the federal elf screen in the electronic filing folder. Prepare tax documents themselves, without the assistance of a tax professional; Enter identifying information on the federal idauth screen in the electronic filing folder, if applicable.

Prepare tax documents themselves, without the assistance of a tax professional; You as a partner are liable for tax on your share of the partnership income, whether or not distributed. Enter identifying information on the federal idauth screen in the electronic filing folder, if applicable. Every llc that is a disregarded entity for federal income tax purposes that has income, gain, loss, or deduction from new york state sources; Returns for calendar year 2022 are due march 15, 2023. Verify the file this return electronically box is checked on the federal elf screen in the electronic filing folder. Used to report income, deductions, gains, losses and credits from the operation of a partnership.

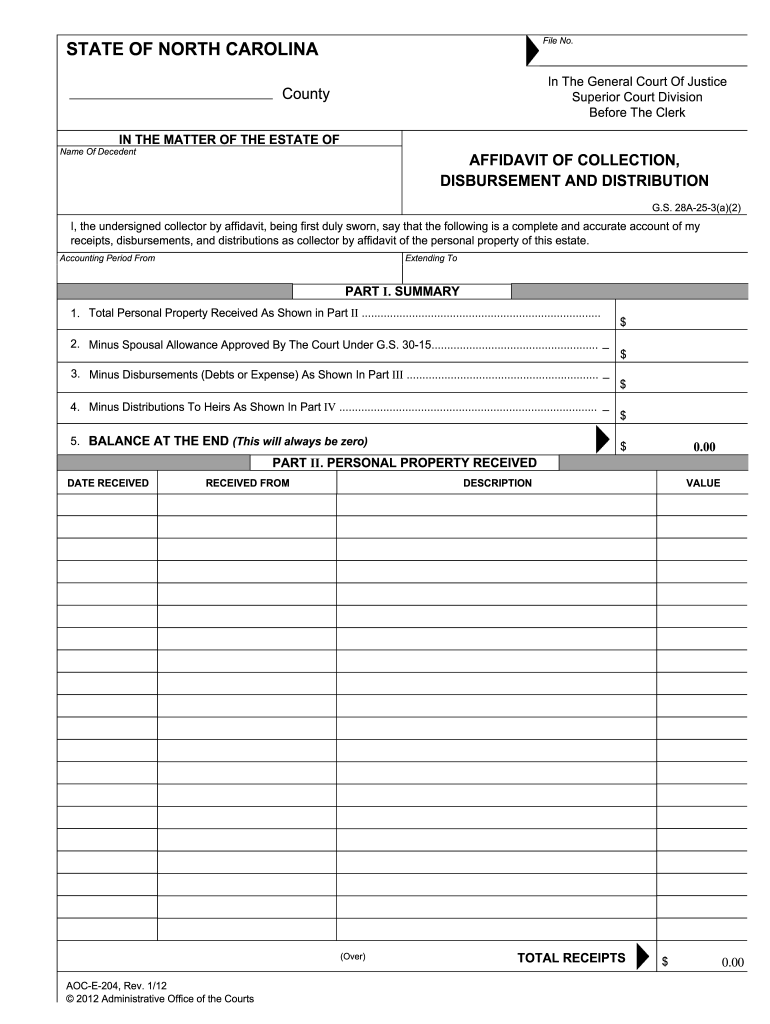

Nc Form Aoc E 204 Instructions Fill Out and Sign Printable PDF

Verify the file this return electronically box is checked on the federal elf screen in the electronic filing folder. Every llc that is a disregarded entity for federal income tax purposes that has income, gain, loss, or deduction from new york state sources; Used to report income, deductions, gains, losses and credits from the operation of a partnership. Returns for.

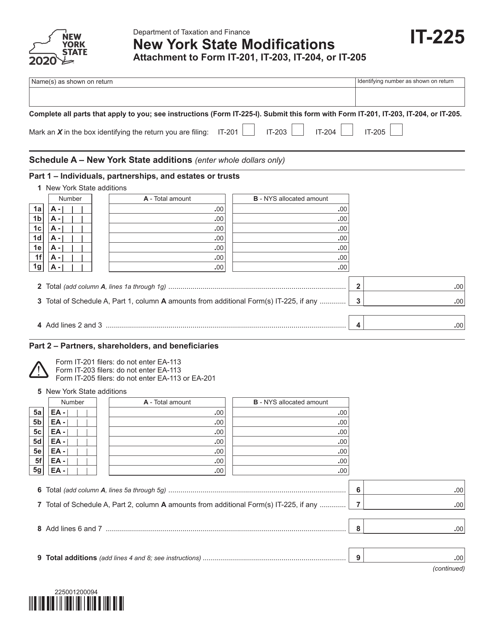

Form IT225 Download Fillable PDF or Fill Online New York State

Enter identifying information on the federal idauth screen in the electronic filing folder, if applicable. Prepare tax documents themselves, without the assistance of a tax professional; Every llc that is a disregarded entity for federal income tax purposes that has income, gain, loss, or deduction from new york state sources; Verify the file this return electronically box is checked on.

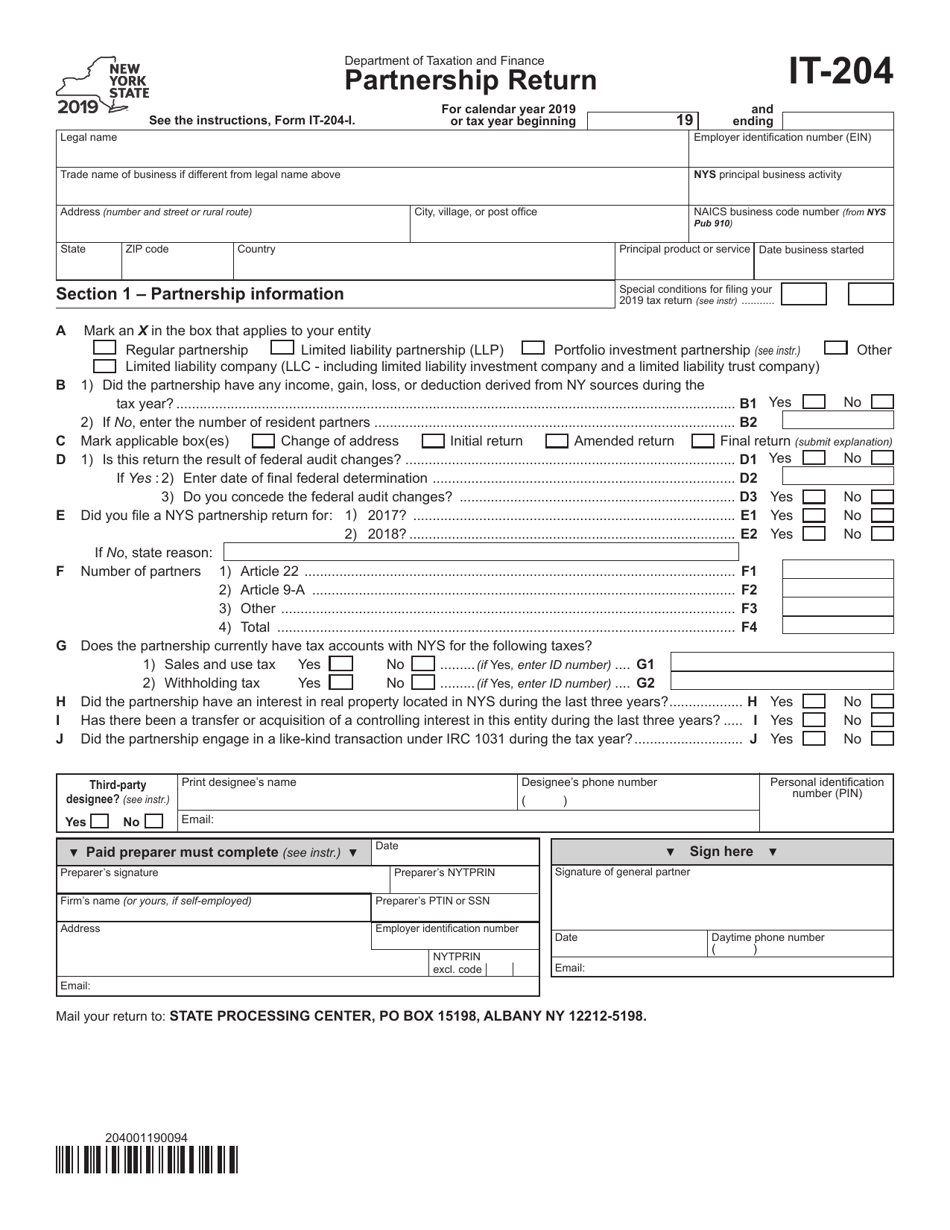

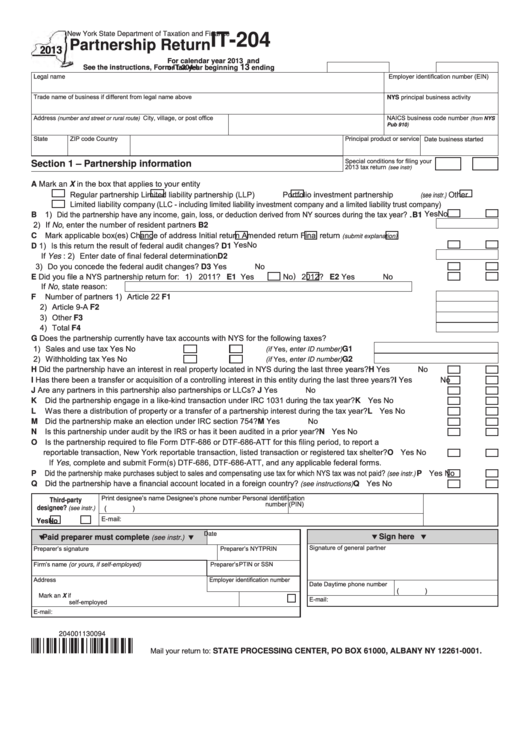

Form IT204 Download Fillable PDF or Fill Online Partnership Return

Returns for calendar year 2022 are due march 15, 2023. Verify the file this return electronically box is checked on the federal elf screen in the electronic filing folder. Used to report income, deductions, gains, losses and credits from the operation of a partnership. Every llc that is a disregarded entity for federal income tax purposes that has income, gain,.

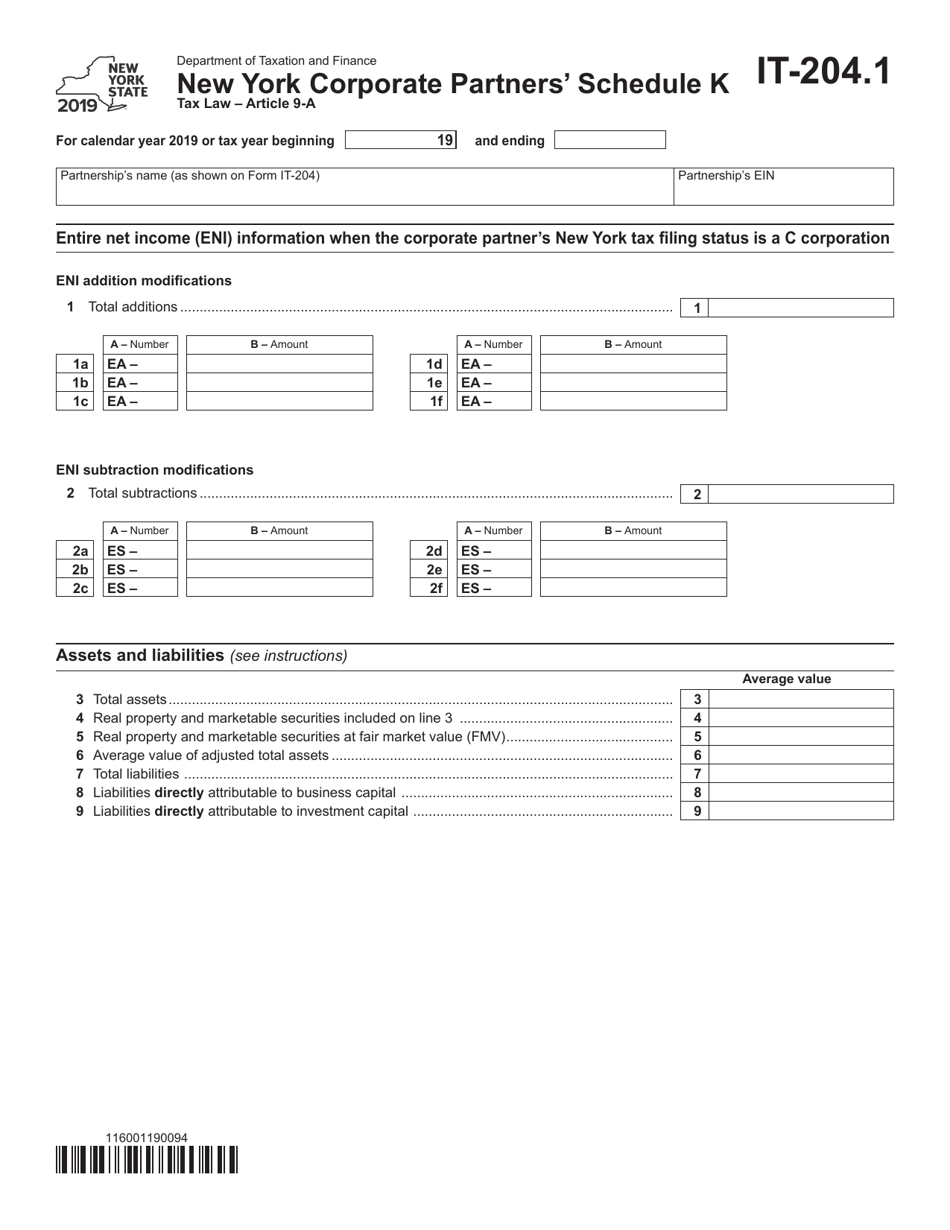

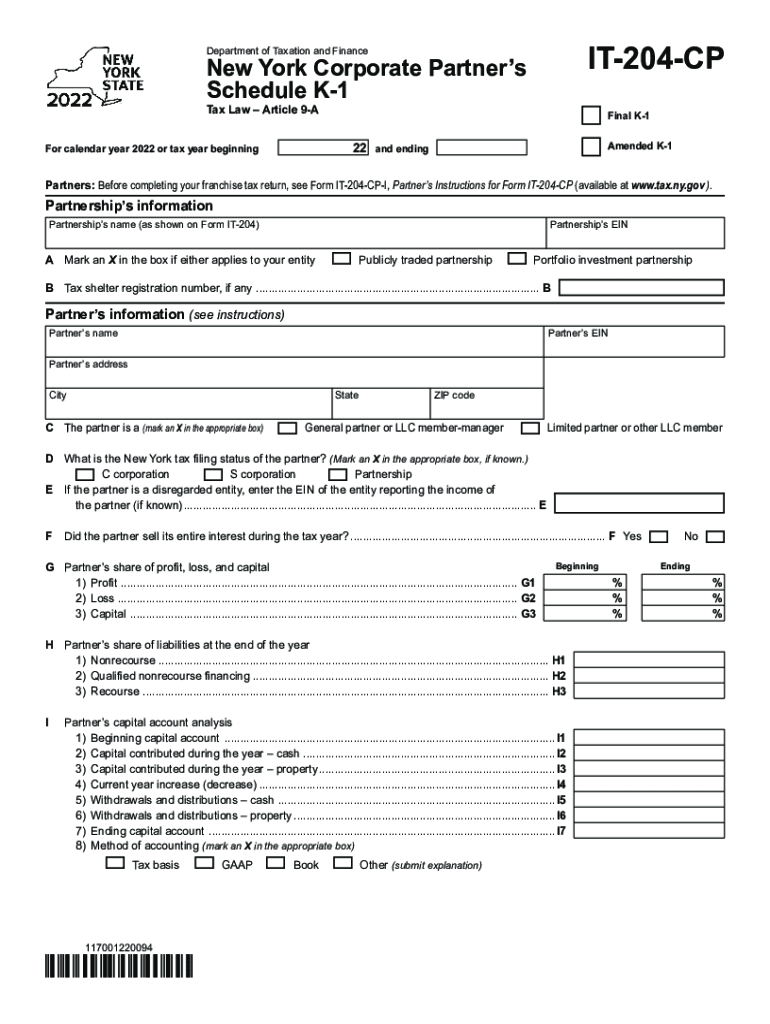

Download Instructions for Form IT204CP New York Corporate Partner's

Verify the file this return electronically box is checked on the federal elf screen in the electronic filing folder. Enter identifying information on the federal idauth screen in the electronic filing folder, if applicable. You as a partner are liable for tax on your share of the partnership income, whether or not distributed. Every llc that is a disregarded entity.

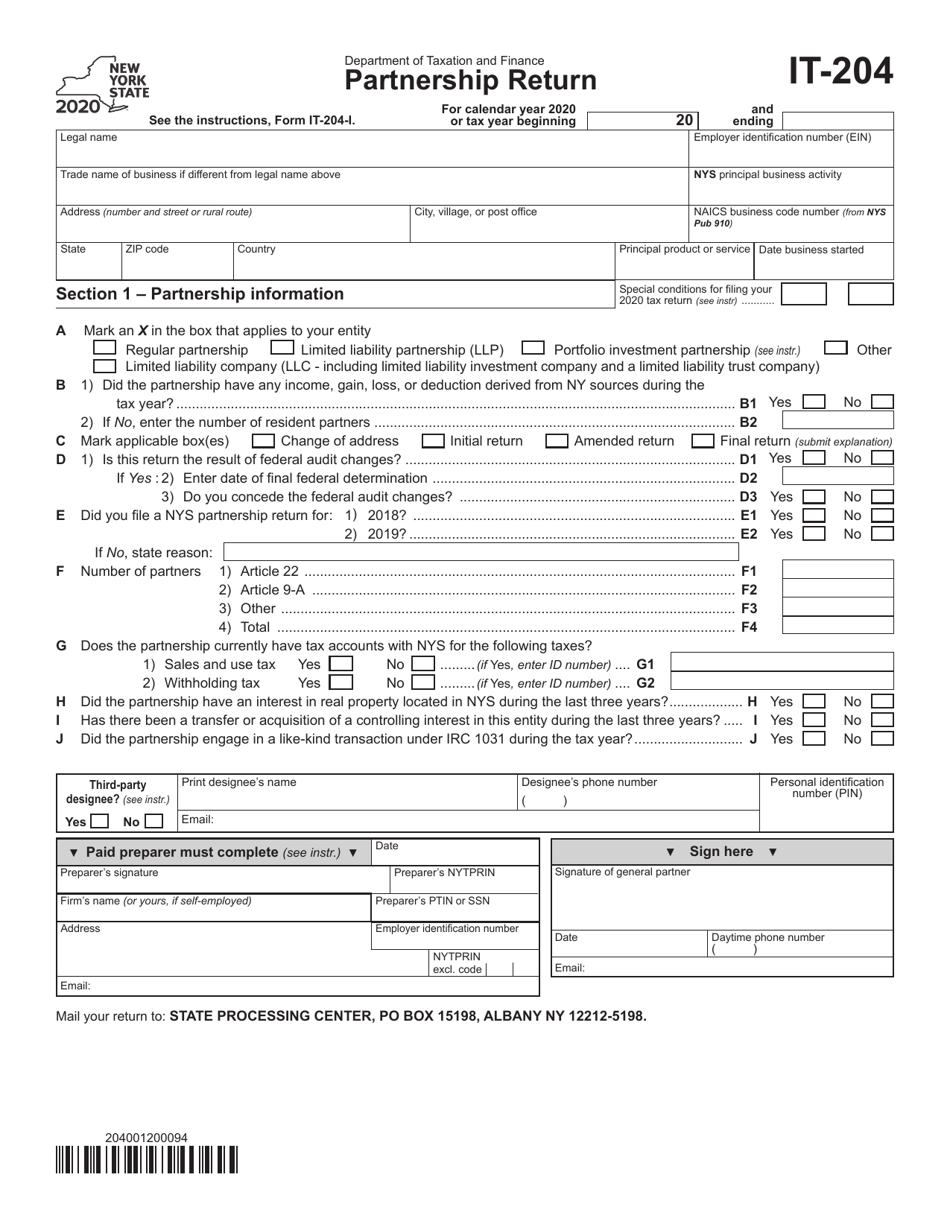

Form IT204 Download Fillable PDF or Fill Online Partnership Return

Prepare tax documents themselves, without the assistance of a tax professional; Verify the file this return electronically box is checked on the federal elf screen in the electronic filing folder. Every llc that is a disregarded entity for federal income tax purposes that has income, gain, loss, or deduction from new york state sources; Used to report income, deductions, gains,.

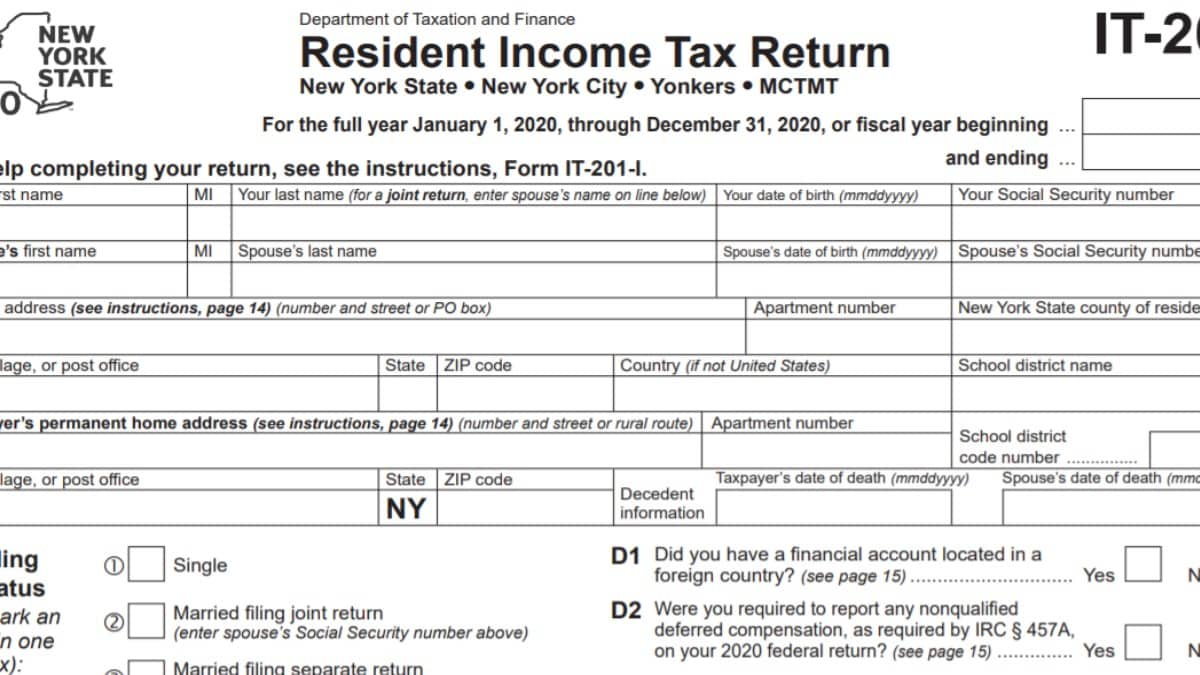

IT201 Instructions 2022 2023 State Taxes TaxUni

Prepare tax documents themselves, without the assistance of a tax professional; Returns for calendar year 2022 are due march 15, 2023. Enter identifying information on the federal idauth screen in the electronic filing folder, if applicable. Used to report income, deductions, gains, losses and credits from the operation of a partnership. You as a partner are liable for tax on.

Fillable Form It204 Partnership Return 2013 printable pdf download

Enter identifying information on the federal idauth screen in the electronic filing folder, if applicable. Returns for calendar year 2022 are due march 15, 2023. Prepare tax documents themselves, without the assistance of a tax professional; You as a partner are liable for tax on your share of the partnership income, whether or not distributed. Verify the file this return.

Form IT204.1 Schedule K Download Fillable PDF or Fill Online New York

Returns for calendar year 2022 are due march 15, 2023. You as a partner are liable for tax on your share of the partnership income, whether or not distributed. Every llc that is a disregarded entity for federal income tax purposes that has income, gain, loss, or deduction from new york state sources; Prepare tax documents themselves, without the assistance.

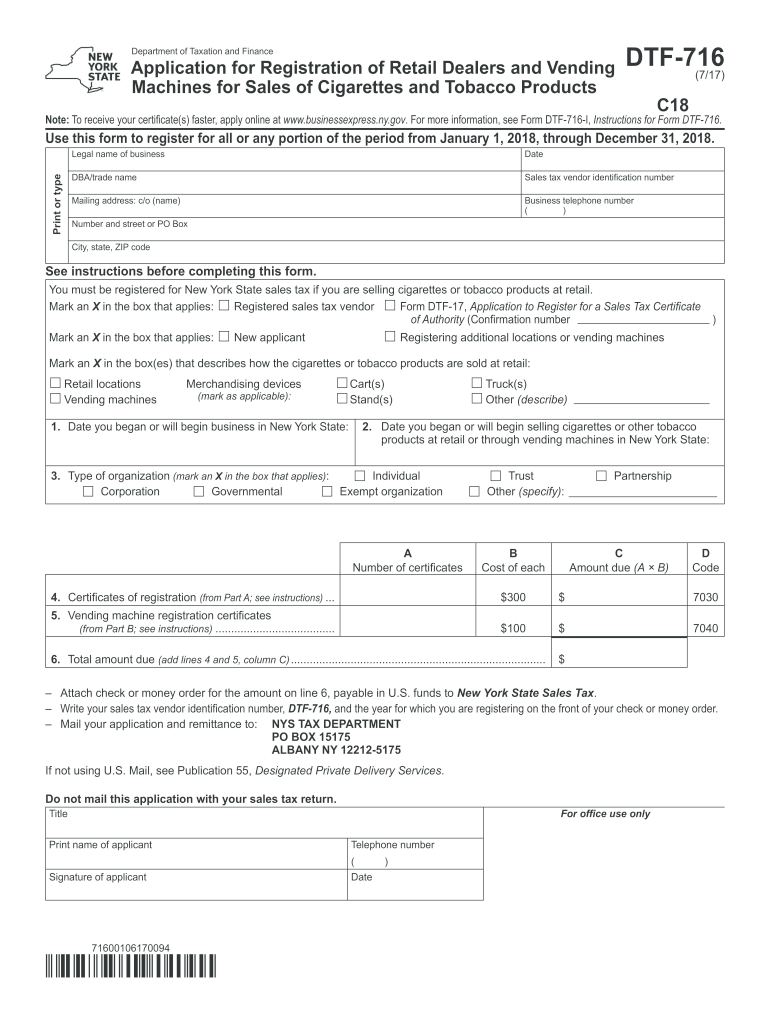

Dtf 716 20202022 Fill and Sign Printable Template Online US Legal

Used to report income, deductions, gains, losses and credits from the operation of a partnership. Prepare tax documents themselves, without the assistance of a tax professional; Verify the file this return electronically box is checked on the federal elf screen in the electronic filing folder. Enter identifying information on the federal idauth screen in the electronic filing folder, if applicable..

Ny Taxation Cp Fill Out and Sign Printable PDF Template signNow

Used to report income, deductions, gains, losses and credits from the operation of a partnership. Returns for calendar year 2022 are due march 15, 2023. Prepare tax documents themselves, without the assistance of a tax professional; Enter identifying information on the federal idauth screen in the electronic filing folder, if applicable. Verify the file this return electronically box is checked.

Verify The File This Return Electronically Box Is Checked On The Federal Elf Screen In The Electronic Filing Folder.

Used to report income, deductions, gains, losses and credits from the operation of a partnership. Prepare tax documents themselves, without the assistance of a tax professional; Every llc that is a disregarded entity for federal income tax purposes that has income, gain, loss, or deduction from new york state sources; Returns for calendar year 2022 are due march 15, 2023.

You As A Partner Are Liable For Tax On Your Share Of The Partnership Income, Whether Or Not Distributed.

Enter identifying information on the federal idauth screen in the electronic filing folder, if applicable.