Form Llc For Rental Property

Form Llc For Rental Property - We make it simple to register your new llc. Rental businesses must be registered and. We’ll do the legwork so you can set aside more time & money for your real estate business. The main benefit of forming an lcc for rental property ownership is, as we repeatedly said, to protect your. Web who should form an llc for their rental property? Web tax guide for rental businesses. Web a real estate llc is a type of business entity that allows you to sell, buy and rent out real estate separate from yourself as an individual. Web if you decide to form an llc for your rental company, your first step is to file articles of organization and begin the process of forming your new company. If you own a large rental company and want to limit your liability, consider forming an llc. Web rental income tax forms for property owner, partnership or llc if this is your first time filing rental income taxes or if there has been a recent change in the ownership structure.

Web a limited liability company is formed by filing articles of organization with the corporations division. Ad protect your personal assets with a free llc—just pay state filing fees. Web as of july 19, the average credit card interest rate is 20.44%, down slightly from the 20.58% recorded the week before, according to bankrate.com. We’ll do the legwork so you can set aside more time & money for your real estate business. File your llc paperwork in just 3 easy steps! Web long time horizon extra income in search of a rental business structure that blends the advantages of a partnership with the limited liability of a corporation? Ad protect your personal assets with a free llc—just pay state filing fees. Web a real estate llc is a type of business entity that allows you to sell, buy and rent out real estate separate from yourself as an individual. Web whether your real estate investment business is growing or you’re just reconsidering your finances, you might be thinking about creating an llc for your. If you own a large rental company and want to limit your liability, consider forming an llc.

Web acquiring and managing rental property is stressful enough without having to keep a contact list of the different people holding the tools and resources you need to succeed. If you own a large rental company and want to limit your liability, consider forming an llc. Web tax guide for rental businesses. File your llc paperwork in just 3 easy steps! Web your rental property is a business, so you should take the proper precautions to protect yourself and your assets. Web as of july 19, the average credit card interest rate is 20.44%, down slightly from the 20.58% recorded the week before, according to bankrate.com. Ad protect your personal assets with a free llc—just pay state filing fees. Web a limited liability company is formed by filing articles of organization with the corporations division. Also known as a limited liability company, an llc is a business structure that real estate investors often form to hold. We make it simple to register your new llc.

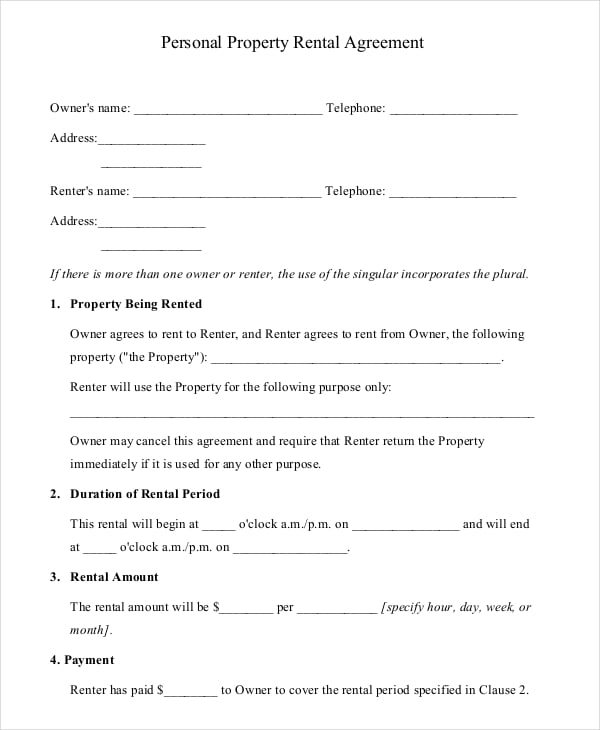

10+ Property Rental Agreement DOC, PDF

Web how to form an llc for rental properties how to transfer property to an llc using series llcs for multiple properties forming an llc vs. Ad protect your personal assets with a free llc—just pay state filing fees. Web acquiring and managing rental property is stressful enough without having to keep a contact list of the different people holding.

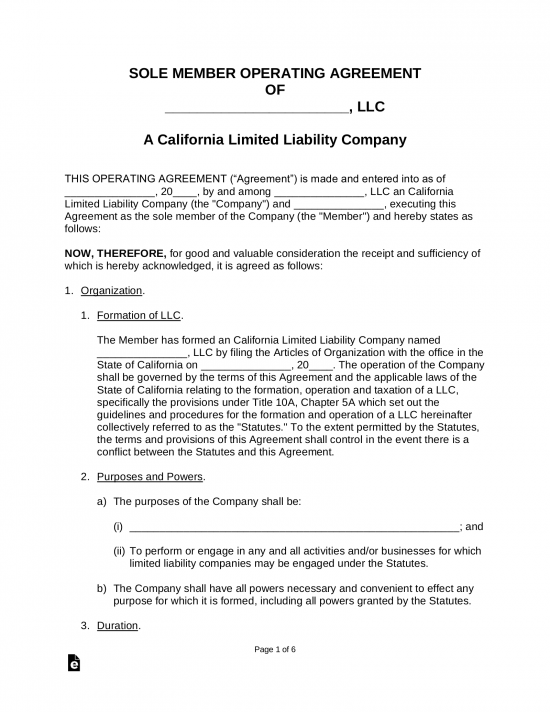

Free California SingleMember LLC Operating Agreement Form PDF Word

We’ll do the legwork so you can set aside more time & money for your real estate business. Ad protect your personal assets with a free llc—just pay state filing fees. Web a limited liability company is formed by filing articles of organization with the corporations division. Web how to form an llc for rental properties how to transfer property.

Rental Property Tax FormsWhat is Required?

Ad launch your llc in 10 min online. Web a real estate llc is a type of business entity that allows you to sell, buy and rent out real estate separate from yourself as an individual. Also known as a limited liability company, an llc is a business structure that real estate investors often form to hold. Ad protect your.

How to Form a LLC (Stepbystep Guide) Community Tax

Anyone looking to rent out property for income should consider forming an llc, no matter what state they live in or how small. The main benefit of forming an lcc for rental property ownership is, as we repeatedly said, to protect your. Web your rental property is a business, so you should take the proper precautions to protect yourself and.

Pin on Tellus Blog

Web acquiring and managing rental property is stressful enough without having to keep a contact list of the different people holding the tools and resources you need to succeed. Web a real estate llc is a type of business entity that allows you to sell, buy and rent out real estate separate from yourself as an individual. This guide is.

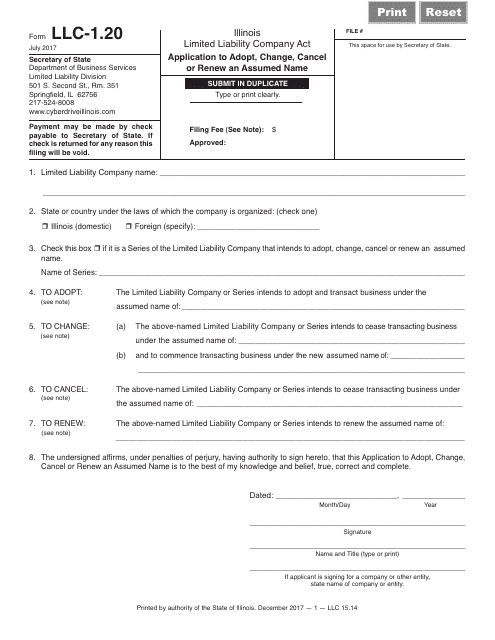

Form LLC1.20 Download Fillable PDF or Fill Online Application to Adopt

If you own a large rental company and want to limit your liability, consider forming an llc. Web rental income tax forms for property owner, partnership or llc if this is your first time filing rental income taxes or if there has been a recent change in the ownership structure. Ad protect your personal assets with a free llc—just pay.

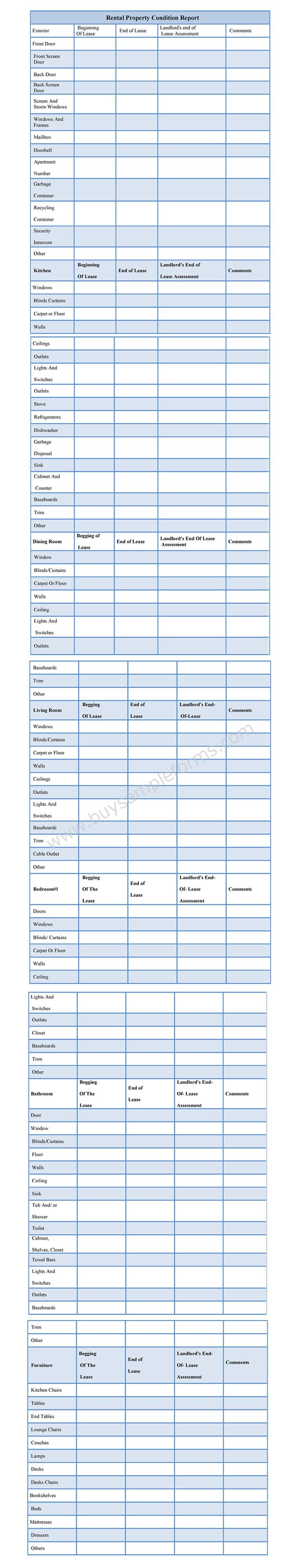

Rental Property Condition Report Form Sample Forms

Rental businesses must be registered and. File your llc paperwork in just 3 easy steps! If you own a large rental company and want to limit your liability, consider forming an llc. Web acquiring and managing rental property is stressful enough without having to keep a contact list of the different people holding the tools and resources you need to.

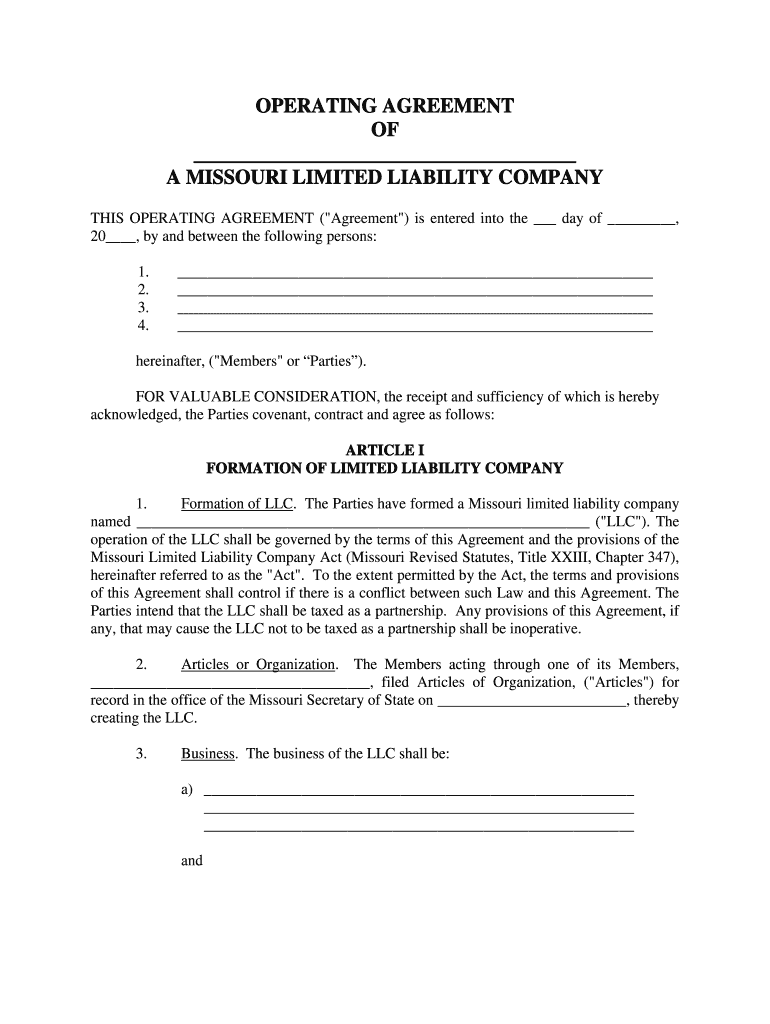

Operating Agreement Llc Missouri Fill Out and Sign Printable PDF

This means that if something. Web if you decide to form an llc for your rental company, your first step is to file articles of organization and begin the process of forming your new company. File your llc paperwork in just 3 easy steps! Web what is an llc for a rental property? Web acquiring and managing rental property is.

Michigan Llc Operating Agreement Template Free Printable Form

Ad protect your personal assets with a free llc—just pay state filing fees. Anyone looking to rent out property for income should consider forming an llc, no matter what state they live in or how small. Web whether your real estate investment business is growing or you’re just reconsidering your finances, you might be thinking about creating an llc for.

Should You Form an LLC for Your Rental Property? Tellus Talk

File your llc paperwork in just 3 easy steps! Sets forth the information that must be provided in the. What is an llc for a rental property? Ad protect your personal assets with a free llc—just pay state filing fees. We’ll do the legwork so you can set aside more time & money for your real estate business.

2023'S Best Llc Formation Services.

Web if you decide to form an llc for your rental company, your first step is to file articles of organization and begin the process of forming your new company. Rental businesses must be registered and. Anyone looking to rent out property for income should consider forming an llc, no matter what state they live in or how small. Web how to form an llc for rental properties how to transfer property to an llc using series llcs for multiple properties forming an llc vs.

Sets Forth The Information That Must Be Provided In The.

Web as of july 19, the average credit card interest rate is 20.44%, down slightly from the 20.58% recorded the week before, according to bankrate.com. Web up to 25% cash back should you form an llc for your rental property? Web tax guide for rental businesses. Web using an llc for rental property ownership can provide significant benefits, such as personal liability protection, tax advantages, and increased credibility.

If You Own A Large Rental Company And Want To Limit Your Liability, Consider Forming An Llc.

Ad launch your llc in 10 min online. Web a limited liability company is formed by filing articles of organization with the corporations division. We’ll do the legwork so you can set aside more time & money for your real estate business. Ad protect your personal assets with a free llc—just pay state filing fees.

Web Who Should Form An Llc For Their Rental Property?

Web a real estate llc is a type of business entity that allows you to sell, buy and rent out real estate separate from yourself as an individual. We’ll do the legwork so you can set aside more time & money for your real estate business. What is an llc for a rental property? Ad protect your personal assets with a free llc—just pay state filing fees.