How To Fill Out A Payroll Form

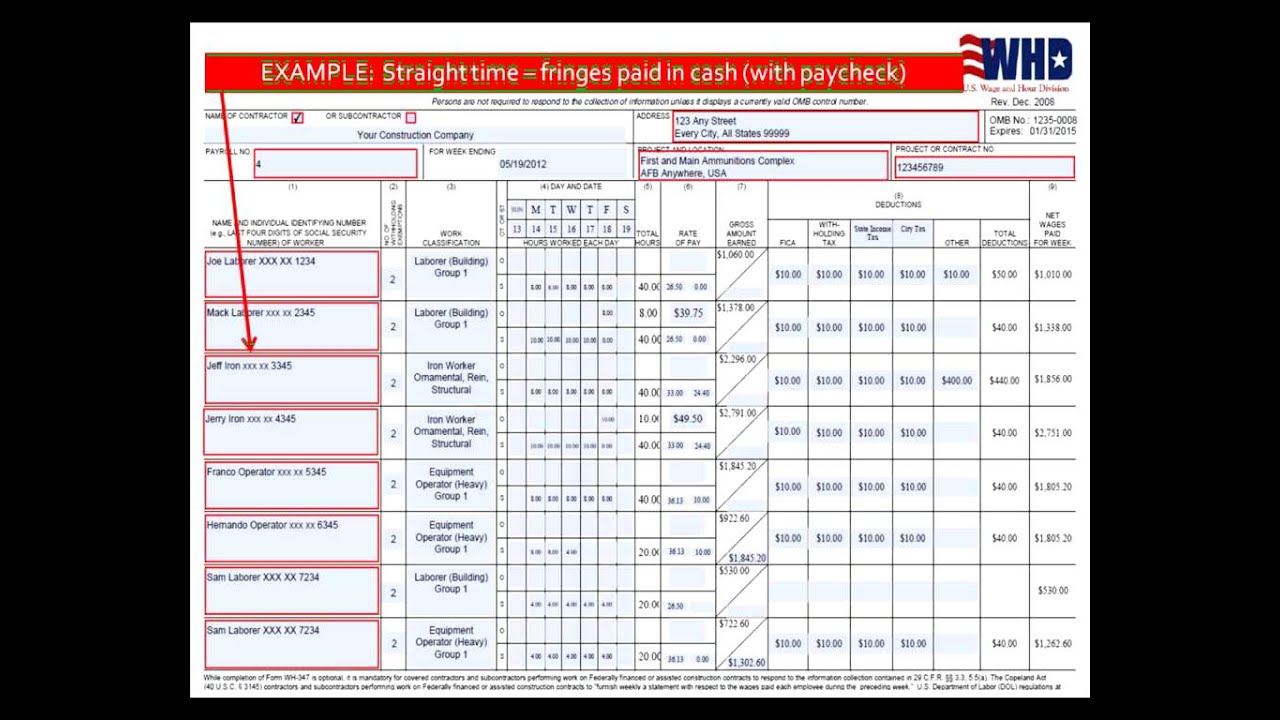

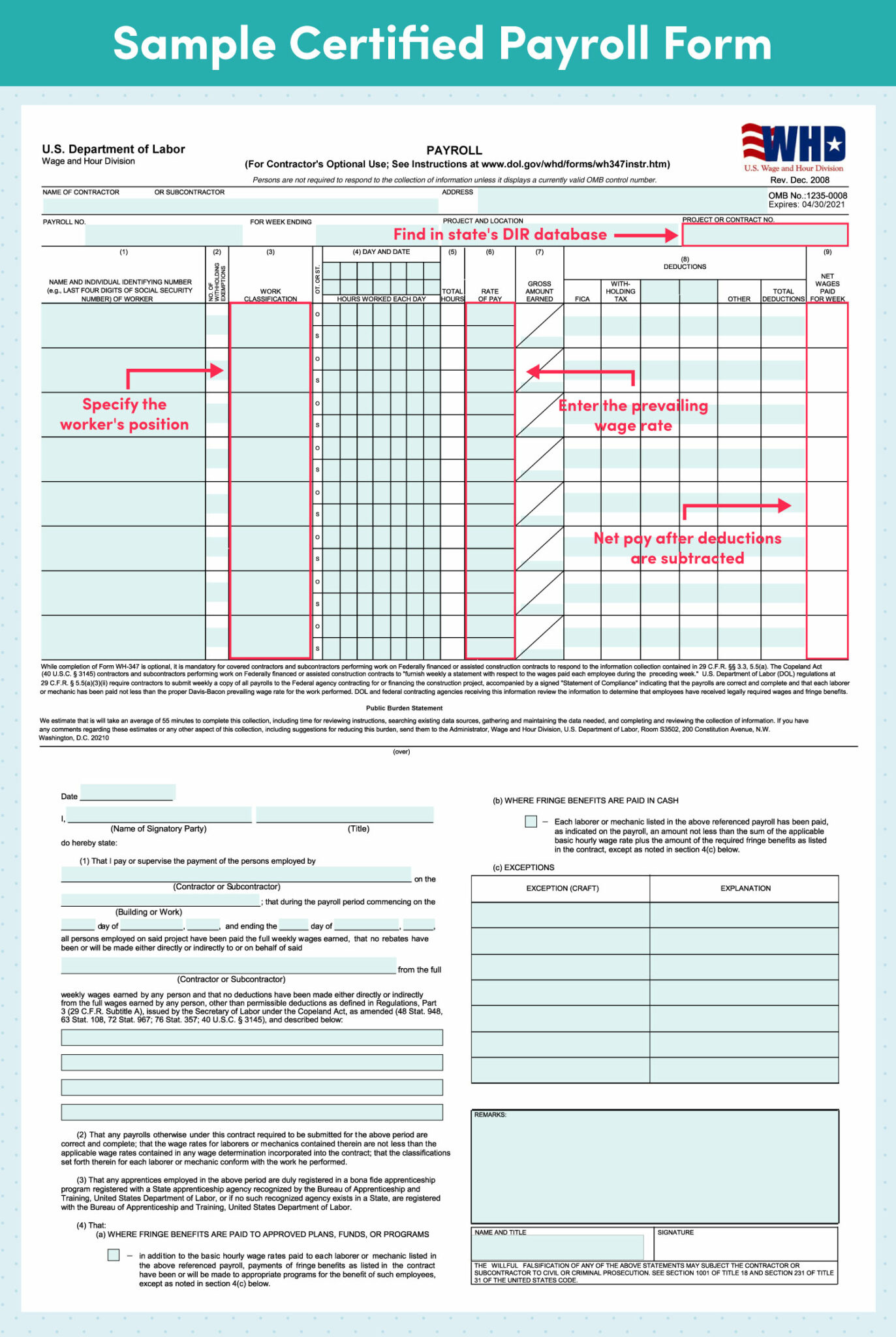

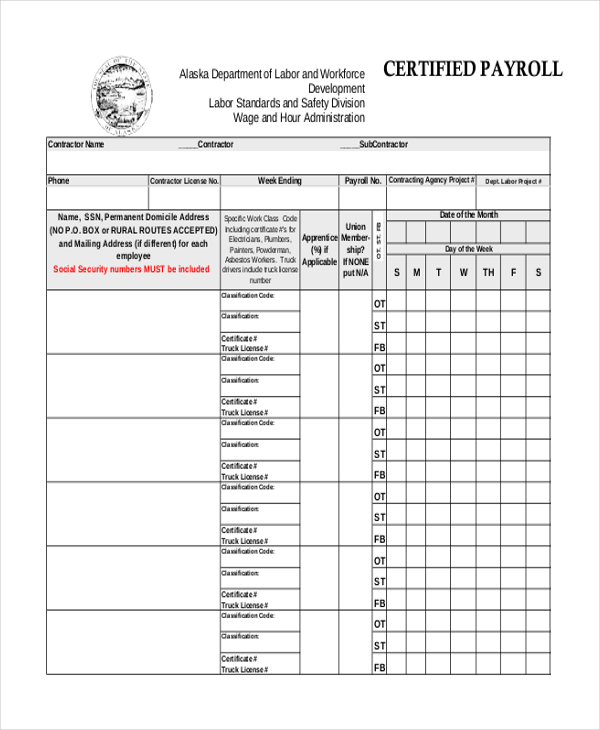

How To Fill Out A Payroll Form - Onlyonly laborerslaborers andand mechanicsmechanics performingperforming constructionconstruction workwork underunder thethe specifyspecify thethe jobjob classificationclassification locatedlocated inin thethe contractcontract wagewage listlist hourlyhourly wagewage raterate andand Single or married filing separately. Web correction to the instructions for form 941 (rev. Select the federal or state form you want to create from the list. Select the filing period from the drop down, and then select ok. Fill in any sections highlighted in green and review any pre. Be sure to submit payroll reports for both federal and state taxes. I want to submit the forms myself. Web how to fill out an employee payroll form. Web if you use a tax preparer to fill out form 941, make sure the preparer shows your business name exactly as it appeared when you applied for your ein.

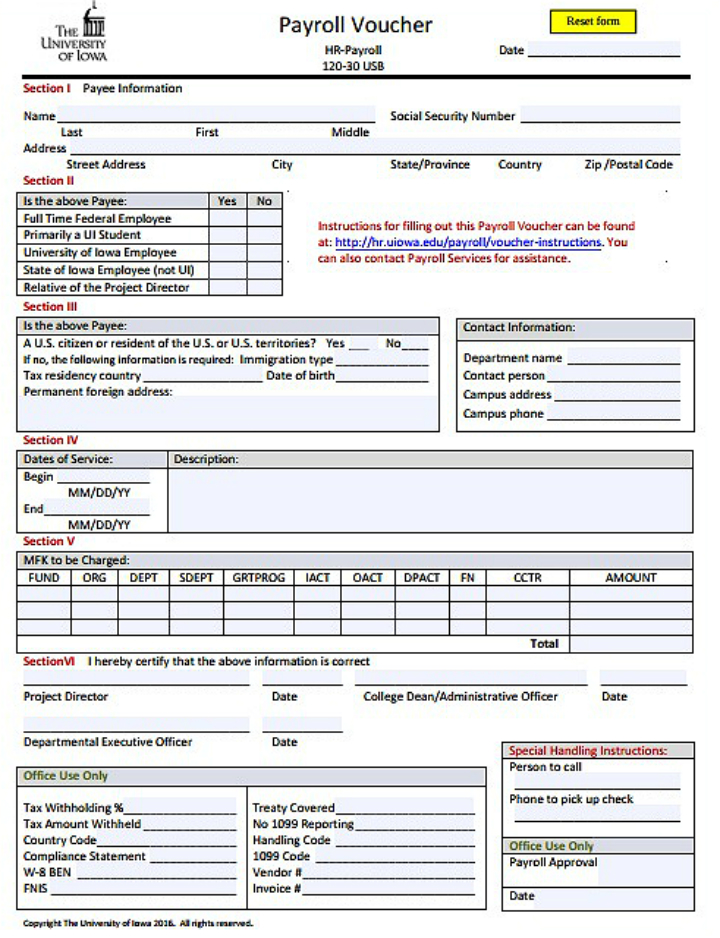

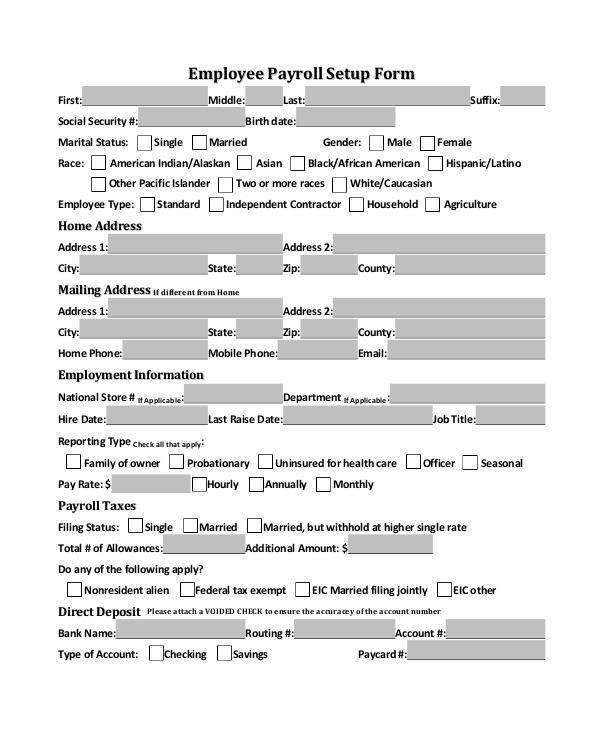

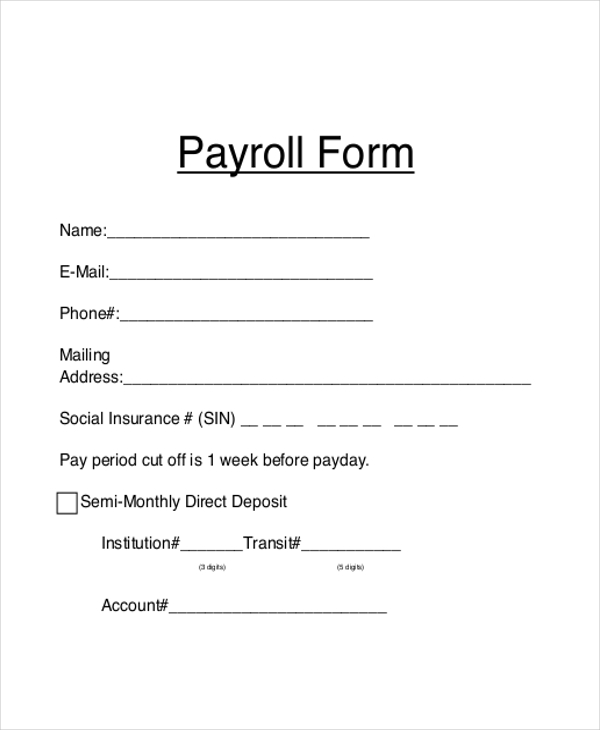

This is where you’ll input your full name, address, and social security number. Be prepared to sign an employment history verification agreement. Web businesses must file payroll forms on time to stay in good standing with the internal revenue service (irs). Complete the interview for your form. After that date, they will be subject to penalties if they use the older form. To make sure businesses comply with federal tax laws, the irs monitors tax filings and payments by using a numerical system to identify taxpayers. The new version will not be. Web beyond the $725 million settlement, the company paid a record $5 billion settlement to the federal trade commission, alongside a further $100 million to the securities and exchange commission. The detailed certified payroll report, which provides all employee information, also includes the necessary information to fill out box 1 of a. This includes their name, address, employer identification number (ein), and other vital information.

The detailed certified payroll report, which provides all employee information, also includes the necessary information to fill out box 1 of a. Employer and employee shares of social. Web how to fill out an employee payroll form. It isn’t always the same as the number on a savings deposit slip. After that date, they will be subject to penalties if they use the older form. Order forms download forms 2023 combined payroll tax reporting instruction booklet 2023 payroll tax reporting instructions for oregon employers. This is where you’ll input your full name, address, and social security number. Web listlist eacheach worker'sworker's name.name. Read the entire form before starting to fill out the questionnaire. Web they must be ordered from the employment department.

10+ Employee Payroll Form Templates

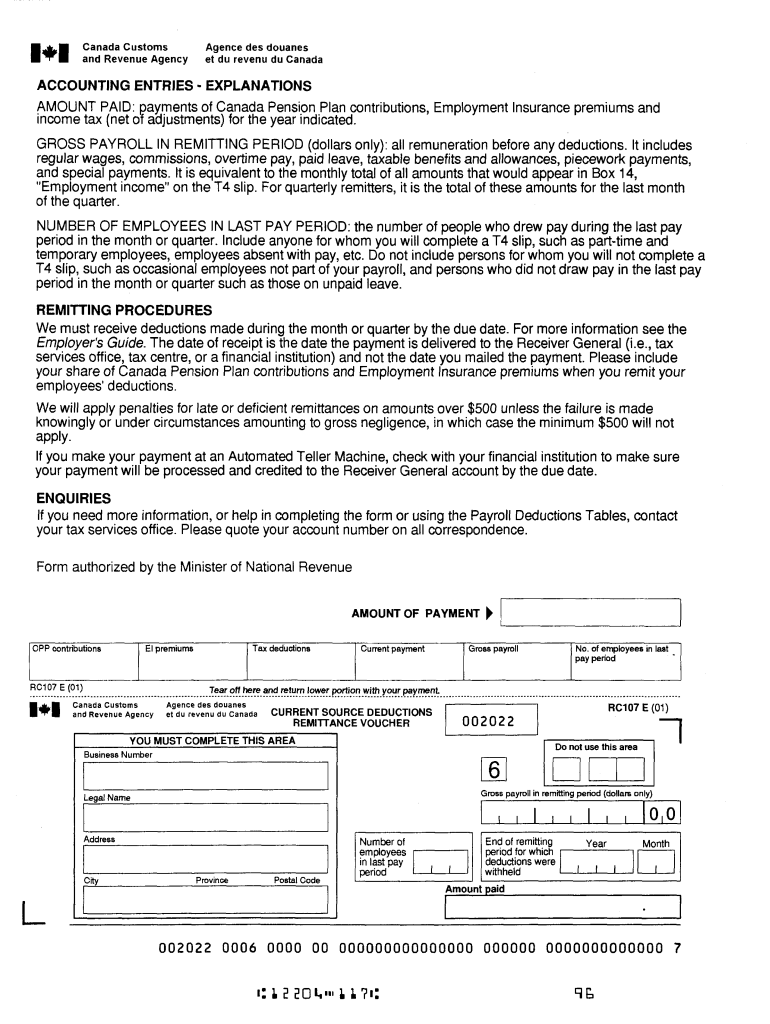

After that date, they will be subject to penalties if they use the older form. Employer and employee shares of social. On this form, document the taxes you withheld from employee wages and the payroll taxes you paid. Complete the interview for your form. List the workweek ending date.

Payroll Remittance Form Pdf 2020 Fill and Sign Printable Template

List the workweek ending date. That’s why we will look at 10 important payroll forms and examine their use cases,. Read the entire form before starting to fill out the questionnaire. Fill in your firm's name and check appropriate box. It isn’t always the same as the number on a savings deposit slip.

Completing a Certified Payroll Report YouTube

Web they must be ordered from the employment department. This includes their name, address, employer identification number (ein), and other vital information. Web to fill out box 1 of the certified payroll form: I want to submit the forms myself. Tax filing options include the following:

10+ Employee Payroll Form Templates

Web listlist eacheach worker'sworker's name.name. Read the entire form before starting to fill out the questionnaire. What is recommended for this form is that your team should fill out a new. Web a payroll report form informs the government of your employment tax liabilities. Select the federal or state form you want to create from the list.

Certified Payroll What It Is & How to Report It FinancePal

This list of providers offers options based on the relevant tax year. Select the filing period from the drop down, and then select ok. On this form, document the taxes you withheld from employee wages and the payroll taxes you paid. The new version will not be. You may have to pay a fee to electronically file the returns.

FREE 21+ Sample Payroll Forms in MS Word PDF Excel

Be prepared to sign an employment history verification agreement. If depositing to a savings account, ask your bank to give you the routing/transit number for your account. Be sure to submit payroll reports for both federal and state taxes. Web a payroll report form informs the government of your employment tax liabilities. That’s why we will look at 10 important.

Massachusetts Weekly Certified Payroll Form Fill Online, Printable

Select the filing period from the drop down, and then select ok. This information is used when filing. Onlyonly laborerslaborers andand mechanicsmechanics performingperforming constructionconstruction workwork underunder thethe specifyspecify thethe jobjob classificationclassification locatedlocated inin thethe contractcontract wagewage listlist hourlyhourly wagewage raterate andand That’s why we will look at 10 important payroll forms and examine their use cases,. If depositing to a.

FREE 21+ Sample Payroll Forms in MS Word PDF Excel

If depositing to a savings account, ask your bank to give you the routing/transit number for your account. Order forms download forms 2023 combined payroll tax reporting instruction booklet 2023 payroll tax reporting instructions for oregon employers. List the workweek ending date. Single or married filing separately. Beginning with the number 1, list the payroll number for the submission.

Quickbooks Payrolls Certified Payroll Forms Excel Free

Web to enroll in full service direct deposit, simply fill out this form and give to your payroll manager. The identifying number can be just the last four digits of their social security number. Web how to fill out an employee payroll form. Web businesses must file payroll forms on time to stay in good standing with the internal revenue.

Quickbooks Payrolls How To Fill Out Certified Payroll Forms

Order forms download forms 2023 combined payroll tax reporting instruction booklet 2023 payroll tax reporting instructions for oregon employers. Be prepared to sign an employment history verification agreement. This includes their name, address, employer identification number (ein), and other vital information. Web how to fill out an employee payroll form. The identifying number can be just the last four digits.

Be Prepared To Sign An Employment History Verification Agreement.

Web forms to obtain information from payees: Web listlist eacheach worker'sworker's name.name. This includes their name, address, employer identification number (ein), and other vital information. The identifying number can be just the last four digits of their social security number.

It Isn’t Always The Same As The Number On A Savings Deposit Slip.

Web choose from spreadsheets and forms for microsoft excel and word, pdf, and google sheets. Tax filing options include the following: Web how to fill out an employee payroll form. I want to submit the forms myself.

That’s Why We Will Look At 10 Important Payroll Forms And Examine Their Use Cases,.

On this form, document the taxes you withheld from employee wages and the payroll taxes you paid. Complete the interview for your form. Web to enroll in full service direct deposit, simply fill out this form and give to your payroll manager. If depositing to a savings account, ask your bank to give you the routing/transit number for your account.

Single Or Married Filing Separately.

Web they must be ordered from the employment department. Federal income tax you withheld from your employees' paychecks. List the workweek ending date. To make sure businesses comply with federal tax laws, the irs monitors tax filings and payments by using a numerical system to identify taxpayers.