How To Form A 501C3 In Georgia

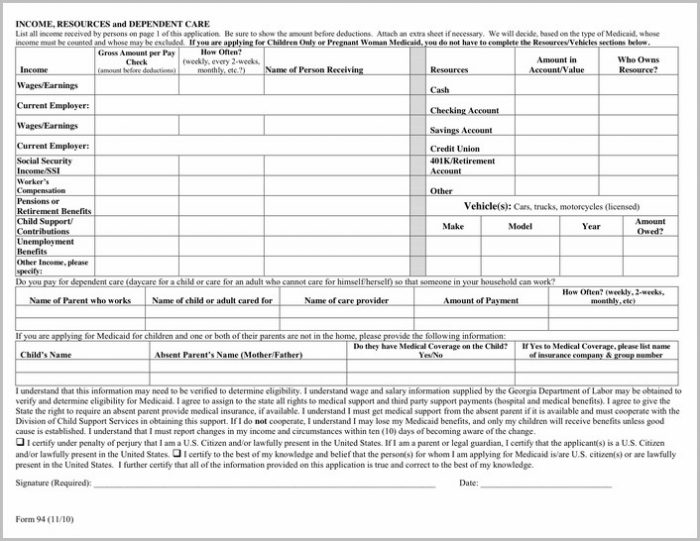

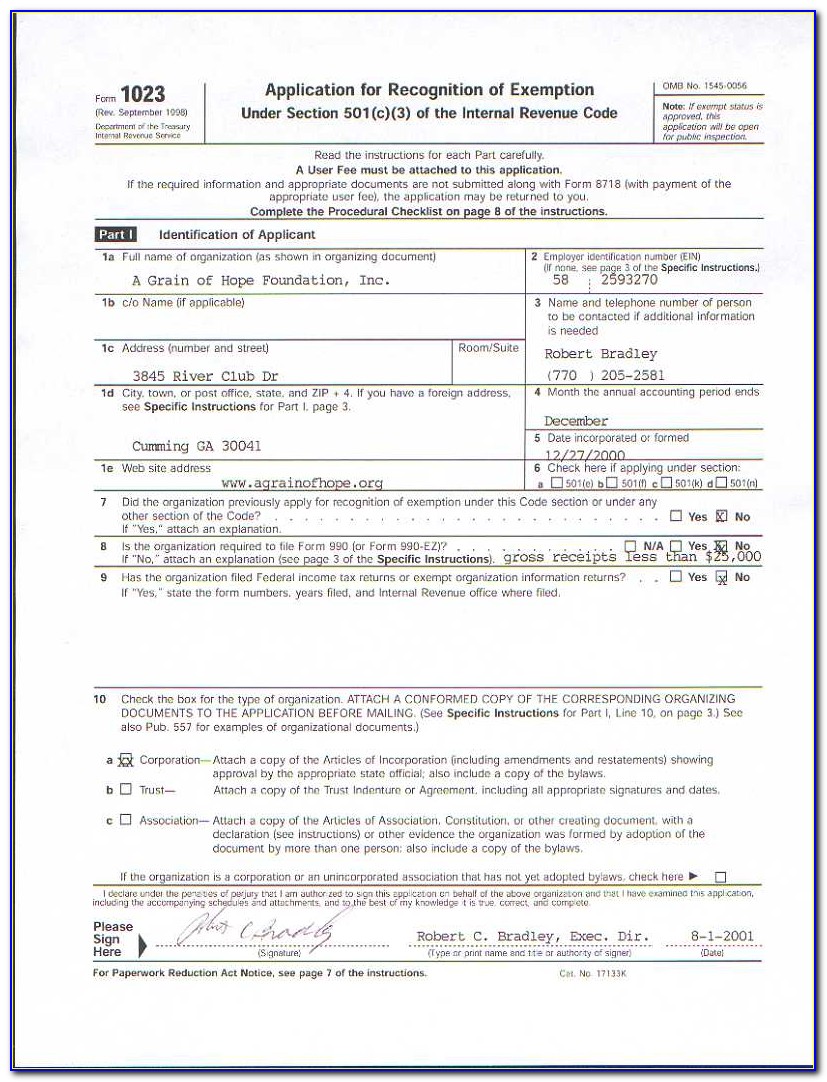

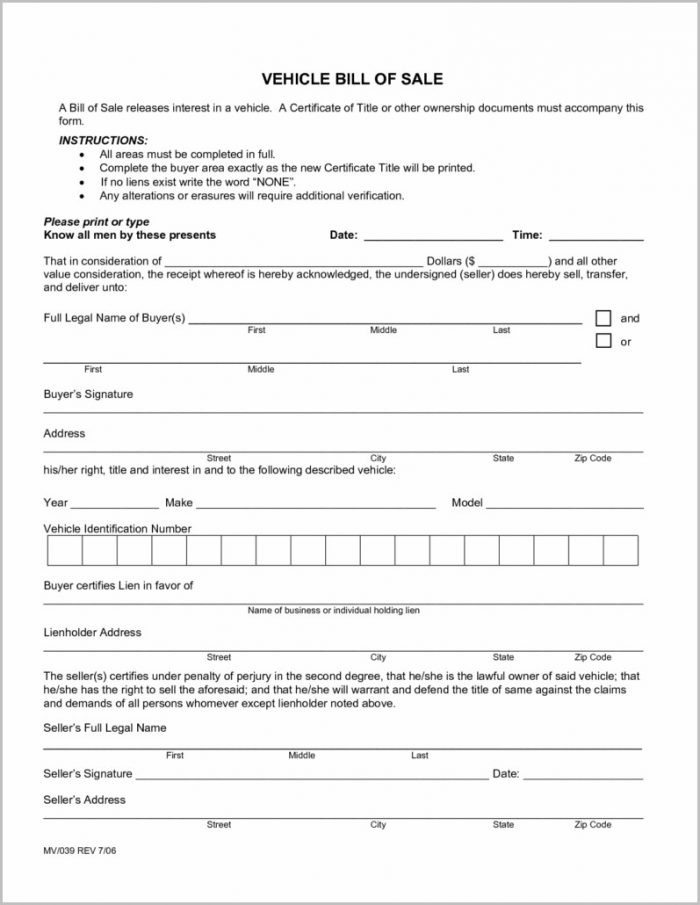

How To Form A 501C3 In Georgia - Web thinking to start a nonprofit in georgia? Web choosing a registered agent for your 501 (c) (3) nonprofit is the second step in our complete guide, how to start a nonprofit in georgia. Web application for recognition of exemption. State income tax exemption once your organization receives your 501 (c) determination letter from the irs, you can then. These organizations are required to. Disclose your nonprofit statement step 3: Protect your business from liabilities. 100% of past 501c3s approved. Choose a registered agent step 4: Web to start a georgia 501 (c) (3) nonprofit organization, you'll need to first register a nonprofit corporation with the state of georgia, and then apply for tax exempt.

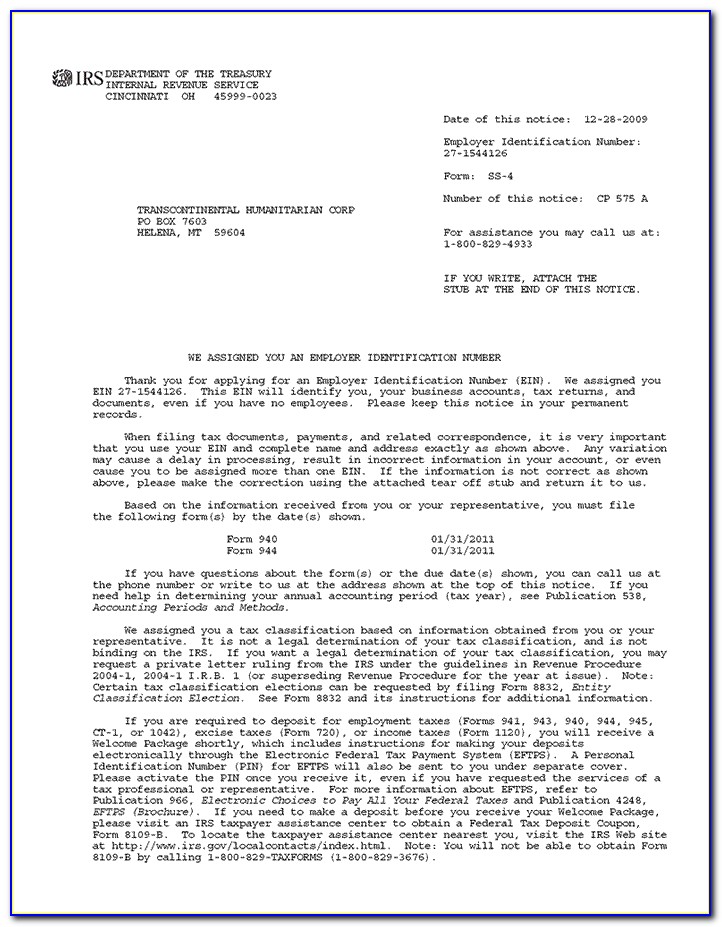

State income tax exemption once your organization receives your 501 (c) determination letter from the irs, you can then. Ederal tax law provides tax benefits to nonprofit organizations recognized as. Protect your business from liabilities. Here are some things you must know about this process: Web application for recognition of exemption. Web forms for exempt organizations. Ad start your georgia incorporation today. Web state charities regulation: Web to form a corporation in georgia that exists for charitable, educational, religious, humanitarian, or other nonprofit purposes, there are certain steps to follow. 100% of past 501c3s approved.

Web in general, georgia statute grants no sales or use tax exemption to churches, religious, charitable, civic and other nonprofit organizations. List your nonprofit’s name step 2: In georgia, charities regulation responsibilities are shared by the attorney general and the secretary of state. State income tax exemption once your organization receives your 501 (c) determination letter from the irs, you can then. Web to start a georgia 501 (c) (3) nonprofit organization, you'll need to first register a nonprofit corporation with the state of georgia, and then apply for tax exempt. Confirm any members step 5:. Web state charities regulation: Ad formalize your nonprofit with an industry leader in online formation. Charitable allies makes it easy. Kickstart your nonprofit in minutes.

What Is A 501c3 Form Forms NzA0OQ Resume Examples

List your nonprofit’s name step 2: Web apply for exemption from state taxes a. Prepare and file articles of incorporation with the secretary of state. Protect your business from liabilities. The formation of non profit organizations within the state of georgia will require choosing a name for the charitable organization.

How To Form A 501c3 In Form Resume Examples

Web application for recognition of exemption. Web form non profit organizations in georgia. Web to start a georgia 501 (c) (3) nonprofit organization, you'll need to first register a nonprofit corporation with the state of georgia, and then apply for tax exempt. State income tax exemption once your organization receives your 501 (c) determination letter from the irs, you can.

501c3 Non Profit Organization Form Form Resume Examples YL5zwjROzV

Here are some things you must know about this process: Choose a registered agent step 4: Confirm any members step 5:. State income tax exemption once your organization receives your 501 (c) determination letter from the irs, you can then. The formation of non profit organizations within the state of georgia will require choosing a name for the charitable organization.

How To Form A 501c3 In Missouri Form Resume Examples A4knyeGOjG

Web how to start a 501c3 for your nonprofit organization in georgia. Ad start your georgia incorporation today. Web state charities regulation: Web form non profit organizations in georgia. 100% of past 501c3s approved.

Do Not Resuscitate (dnr) Form Universal Network

List your nonprofit’s name step 2: Ederal tax law provides tax benefits to nonprofit organizations recognized as. Disclose your nonprofit statement step 3: Over 1,000,0000 filings since 2004, a+ bbb. Select a name for your organization one of the fundamental steps in starting a nonprofit organization in georgia is choosing a name for your corporation.

Irs 501c3 Form 1023 Form Resume Examples EvkBMrPO2d

Select a name for your organization one of the fundamental steps in starting a nonprofit organization in georgia is choosing a name for your corporation. Web apply for exemption from state taxes a. Protect your business from liabilities. Web thinking to start a nonprofit in georgia? Web how to start a 501c3 for your nonprofit organization in georgia.

How To Form A 501c3 In Form Resume Examples Gambaran

Web apply for exemption from state taxes a. These organizations are required to. 100% of past 501c3s approved. Disclose your nonprofit statement step 3: Prepare and file articles of incorporation with the secretary of state.

Free 501c3 Form Download Form Resume Examples gzOe4lM5Wq

Ad start your georgia incorporation today. Check out our other guides. Confirm any members step 5:. The formation of non profit organizations within the state of georgia will require choosing a name for the charitable organization. Web thinking to start a nonprofit in georgia?

How To Form A 501c3 In Form Resume Examples

State income tax exemption once your organization receives your 501 (c) determination letter from the irs, you can then. Here are some things you must know about this process: Over 1,000,0000 filings since 2004, a+ bbb. Web application for recognition of exemption. Ad forming a nonprofit is complex.

Forming A 501c3 In Illinois Form Resume Examples o7Y3z039BN

Select a name for your organization one of the fundamental steps in starting a nonprofit organization in georgia is choosing a name for your corporation. These organizations are required to. Web to form a corporation in georgia that exists for charitable, educational, religious, humanitarian, or other nonprofit purposes, there are certain steps to follow. Ederal tax law provides tax benefits.

Web Thinking To Start A Nonprofit In Georgia?

Web apply for exemption from state taxes a. Ederal tax law provides tax benefits to nonprofit organizations recognized as. 100% of past 501c3s approved. Ad start your georgia incorporation today.

State Income Tax Exemption Once Your Organization Receives Your 501 (C) Determination Letter From The Irs, You Can Then.

List your nonprofit’s name step 2: Protect your business from liabilities. Ad forming a nonprofit is complex. Web choosing a registered agent for your 501 (c) (3) nonprofit is the second step in our complete guide, how to start a nonprofit in georgia.

Web To Form A Corporation In Georgia That Exists For Charitable, Educational, Religious, Humanitarian, Or Other Nonprofit Purposes, There Are Certain Steps To Follow.

Web state charities regulation: Here are some things you must know about this process: Home of the $0 llc. In georgia, charities regulation responsibilities are shared by the attorney general and the secretary of state.

Prepare And File Articles Of Incorporation With The Secretary Of State.

Disclose your nonprofit statement step 3: Web forms for exempt organizations. To form a nonprofit, you'll need to learn how to name, appoint a registered agent, select board members, and ultimately. Over 1,000,0000 filings since 2004, a+ bbb.