Irs Audit Reconsideration Form 12661

Irs Audit Reconsideration Form 12661 - How to request irs audit reconsideration review audit report and gather documents. Web form 12661 is the irs form for you to explain why you disagree with the audit’s changes and adjustments. Web an audit reconsideration is a process the irs offers to help you if you disagree with the results of an audit of your tax return, or if you disagree with a tax return the irs. Web form 12661 is a form that taxpayers can use to request an audit reconsideration for a return or claim that has already been audited. In any of the four situations below, you can request an audit reconsideration. Web other documents to include are form 12661, disputed issue verification, which explains the issues you are outlining, and form 4549, which is your original. Introduction 4.13.1 introduction manual transmittal december 16, 2015 purpose (1) this transmits revised 4.13.1 audit. Web request an audit reconsideration: Web form 12661 is the official irs audit letter for reconsideration that gives taxpayers the opportunity to explain which decisions they disagree with upon receiving. Web send letter 3338c with pub 3598, and form 12661 to the taxpayer and advise them to follow procedures in the publication on how to file an audit.

Web audit reconsideration section 1. A process that reopens your irs audit. The irs will review the taxpayer’s claim. Web you can file for an audit reconsideration under certain circumstances authorized by the internal revenue code 6020 (b). If available, attach a copy of your examination report, form 4549, along with the. Web send letter 3338c with pub 3598, and form 12661 to the taxpayer and advise them to follow procedures in the publication on how to file an audit. To request an audit reconsideration, you must complete and submit form 12661 to the irs. Web responding with irs form 12661. Web form 12661 is a form that taxpayers can use to request an audit reconsideration for a return or claim that has already been audited. Web the audit reconsideration process:

Web other documents to include are form 12661, disputed issue verification, which explains the issues you are outlining, and form 4549, which is your original. In any of the four situations below, you can request an audit reconsideration. To request an audit reconsideration, you must complete and submit form 12661 to the irs. Web in that case, you can request a reconsideration by attaching irs form 12661 (disputed issue verification) and irs form 4549 (your audit report) to your request. Web advise the taxpayer to fully explain the reason for disagreement with the audit adjustment on form 12661. You can also write an irs audit reconsideration letter. A process that reopens your irs audit. Web the audit reconsideration process: Web form 12661, disputed issue verification, is recommended to explain the issues you disagree with. Introduction 4.13.1 introduction manual transmittal december 16, 2015 purpose (1) this transmits revised 4.13.1 audit.

IRS Publication 936 2010 Fill and Sign Printable Template Online US

Web form 12661 is the official irs audit letter for reconsideration that gives taxpayers the opportunity to explain which decisions they disagree with upon receiving. Get your online template and fill it in using progressive. Web form 12661 is the irs form for you to explain why you disagree with the audit’s changes and adjustments. Web audit reconsideration section 1..

IRS Audit Letter 4364C Sample 1

Web form 12661 is a form that taxpayers can use to request an audit reconsideration for a return or claim that has already been audited. Web you may request an audit reconsideration when you disagree with the tax the irs says you owe and any of the three situations below apply: Web request an audit reconsideration: Introduction 4.13.1 introduction manual.

IRS Appeals Page 2 Tax Debt Advisors

Form 12661 must be submitted within 30 days of the. Get your online template and fill it in using progressive. A process that reopens your irs audit. Web form 12661 is the official irs audit letter for reconsideration that gives taxpayers the opportunity to explain which decisions they disagree with upon receiving. Web form 12661, disputed issue verification, is recommended.

IRS Audit Penalties Everything to Know About IRS Audit Tax Penalties

In any of the four situations below, you can request an audit reconsideration. Web you can file for an audit reconsideration under certain circumstances authorized by the internal revenue code 6020 (b). Web in that case, you can request a reconsideration by attaching irs form 12661 (disputed issue verification) and irs form 4549 (your audit report) to your request. Web.

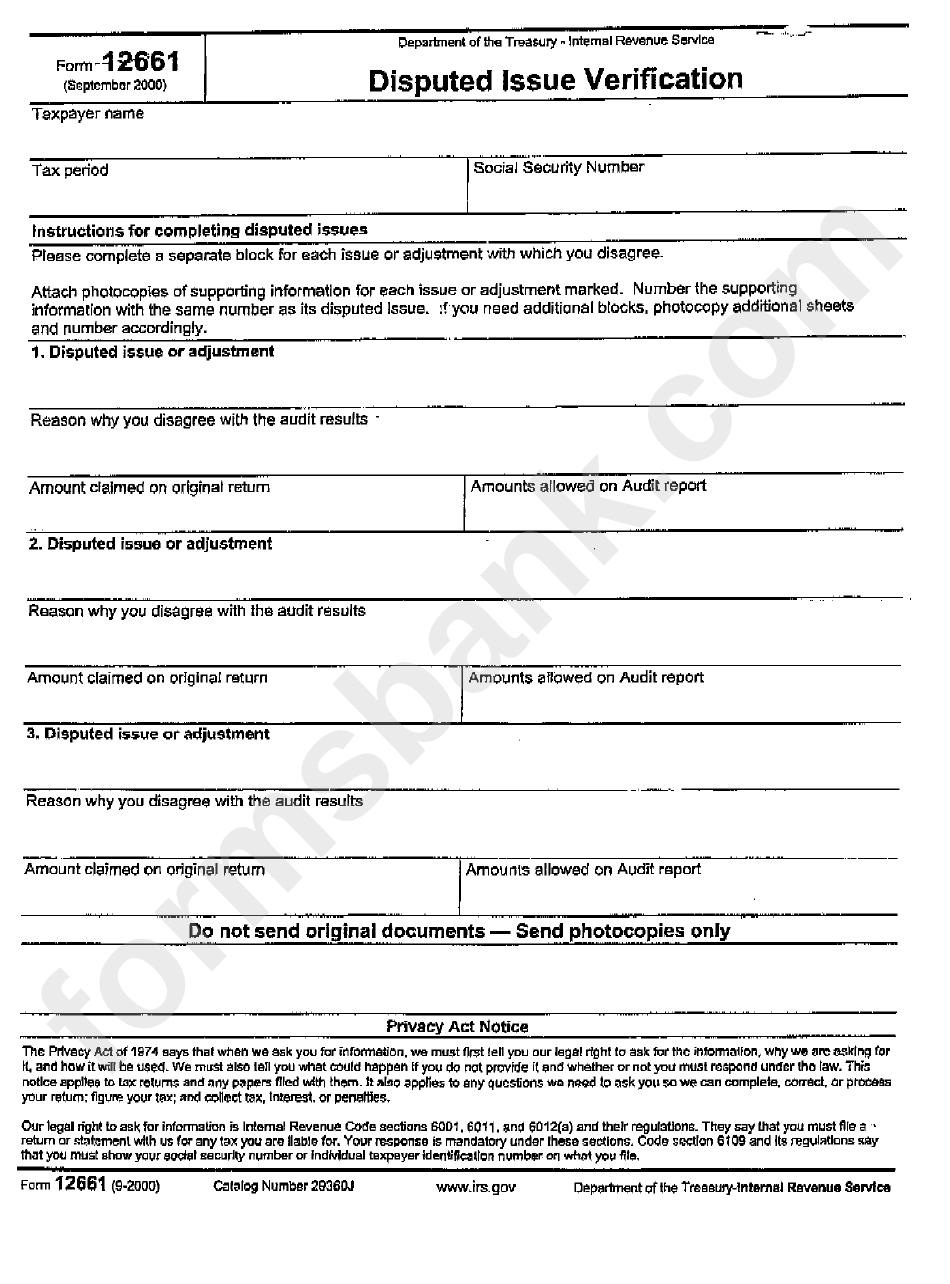

Form 12661 Disputed Issue Verification 2000 printable pdf download

Web you may request an audit reconsideration when you disagree with the tax the irs says you owe and any of the three situations below apply: Web other documents to include are form 12661, disputed issue verification, which explains the issues you are outlining, and form 4549, which is your original. If available, attach a copy of your examination report,.

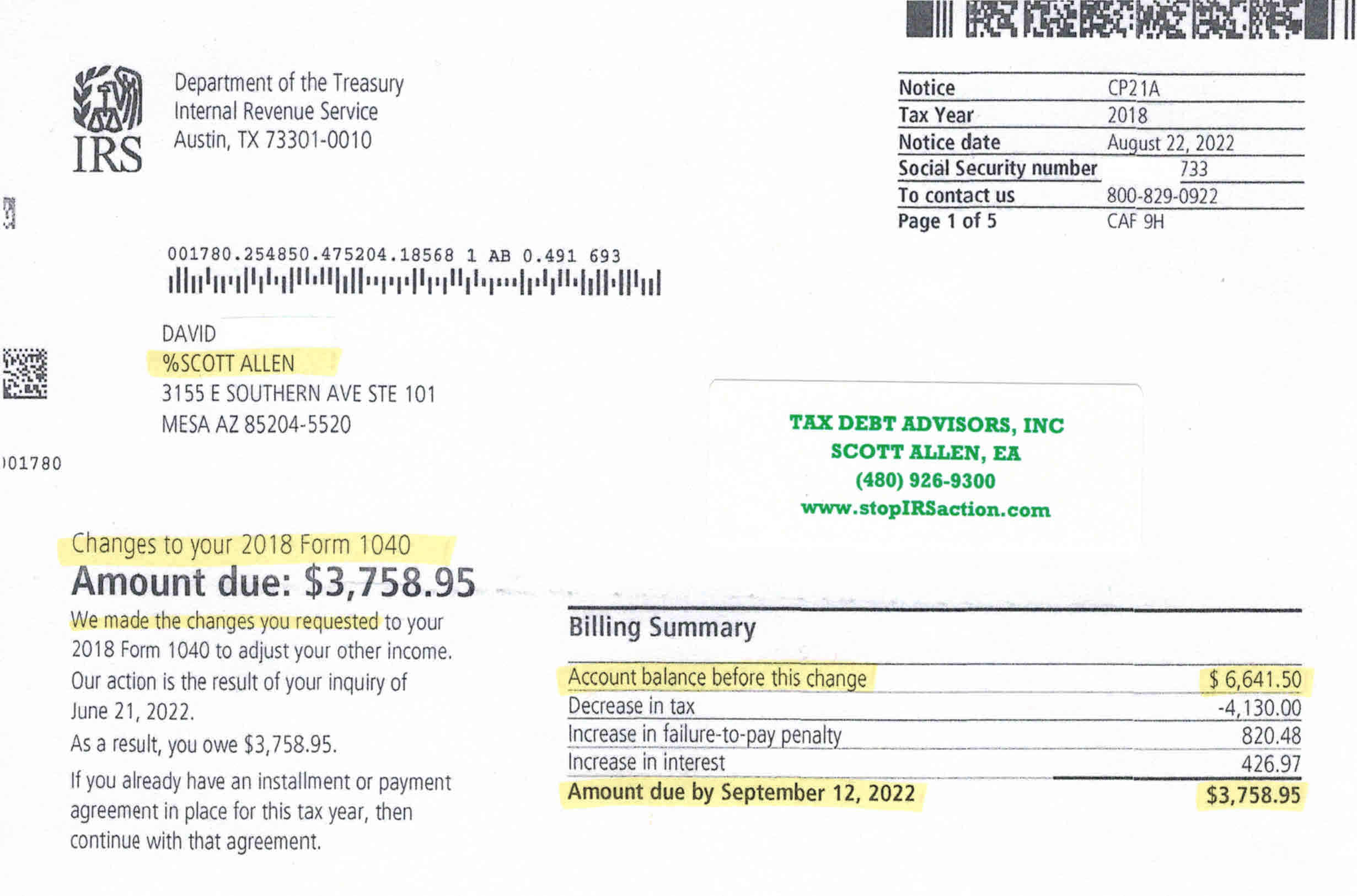

David’s IRS Audit reconsideration in Scottsdale Arizona Tax Debt Advisors

Web form 12661, disputed issue verification, is recommended to explain the issues you disagree with. Web the audit reconsideration process: Web form 12661 is the official irs audit letter for reconsideration that gives taxpayers the opportunity to explain which decisions they disagree with upon receiving. A process that reopens your irs audit. Web audit reconsideration section 1.

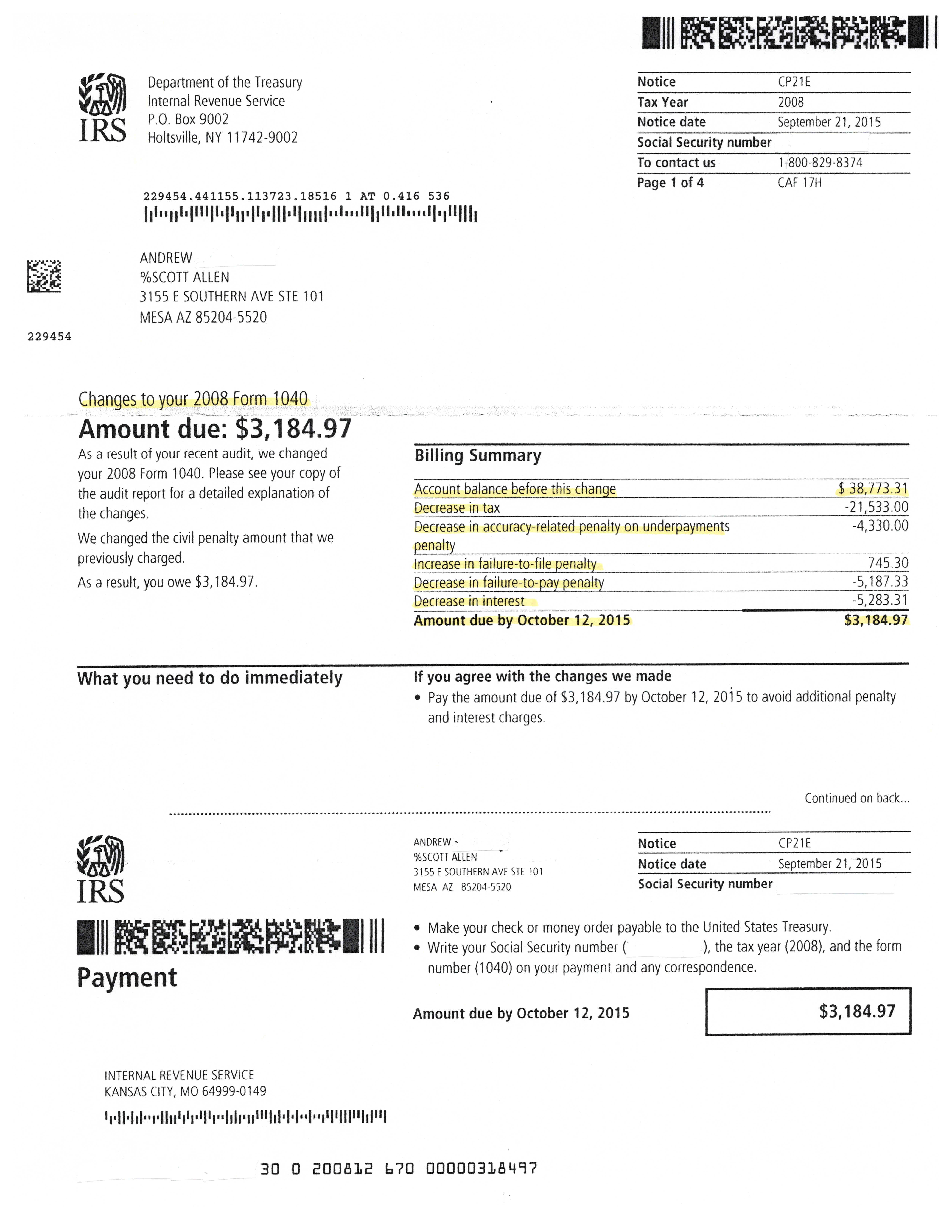

Successful IRS Audit Reconsideration in Phoenix Arizona Tax Debt

Web form 12661, disputed issue verification, is recommended to explain the issues you disagree with. To request an audit reconsideration, you must complete and submit form 12661 to the irs. The irs will review the taxpayer’s claim. In any of the four situations below, you can request an audit reconsideration. Web an audit reconsideration is a process the irs offers.

See? 45+ List Of Irs Audit Reconsideration Sample Letter Your Friends

Web advise the taxpayer to fully explain the reason for disagreement with the audit adjustment on form 12661. Introduction 4.13.1 introduction manual transmittal december 16, 2015 purpose (1) this transmits revised 4.13.1 audit. Web form 12661, disputed issue verification, is recommended to explain the issues you disagree with. To request an audit reconsideration, you must complete and submit form 12661.

irs audit reconsideration form 12661 Fill Online, Printable, Fillable

In any of the four situations below, you can request an audit reconsideration. Web audit reconsideration section 1. You can also write an irs audit reconsideration letter. Web form 12661 is the official irs audit letter for reconsideration that gives taxpayers the opportunity to explain which decisions they disagree with upon receiving. Web you may request an audit reconsideration when.

IRS Form W2G IRS Form for Gambling Winnings

• form 12661 is now obsolete and no longer relevant. Web you can file for an audit reconsideration under certain circumstances authorized by the internal revenue code 6020 (b). Get your online template and fill it in using progressive. Introduction 4.13.1 introduction manual transmittal december 16, 2015 purpose (1) this transmits revised 4.13.1 audit. Web send letter 3338c with pub.

You Can Also Write An Irs Audit Reconsideration Letter.

Web request an audit reconsideration: Web you can file for an audit reconsideration under certain circumstances authorized by the internal revenue code 6020 (b). Web you may request an audit reconsideration when you disagree with the tax the irs says you owe and any of the three situations below apply: Web form 12661 is the official irs audit letter for reconsideration that gives taxpayers the opportunity to explain which decisions they disagree with upon receiving.

The Irs Will Review The Taxpayer’s Claim.

Web form 12661 is a form that taxpayers can use to request an audit reconsideration for a return or claim that has already been audited. Web audit reconsideration section 1. Web advise the taxpayer to fully explain the reason for disagreement with the audit adjustment on form 12661. Web o copy of audit report (form 4549) o reconsideration request is sent to the campus shown on audit report.

Web Send Letter 3338C With Pub 3598, And Form 12661 To The Taxpayer And Advise Them To Follow Procedures In The Publication On How To File An Audit.

If available, attach a copy of your examination report, form 4549, along with the. Web the audit reconsideration process: Web other documents to include are form 12661, disputed issue verification, which explains the issues you are outlining, and form 4549, which is your original. In any of the four situations below, you can request an audit reconsideration.

How To Request Irs Audit Reconsideration Review Audit Report And Gather Documents.

Web in that case, you can request a reconsideration by attaching irs form 12661 (disputed issue verification) and irs form 4549 (your audit report) to your request. Get your online template and fill it in using progressive. A process that reopens your irs audit. Web form 12661 is the irs form for you to explain why you disagree with the audit’s changes and adjustments.