Irs Form 8922

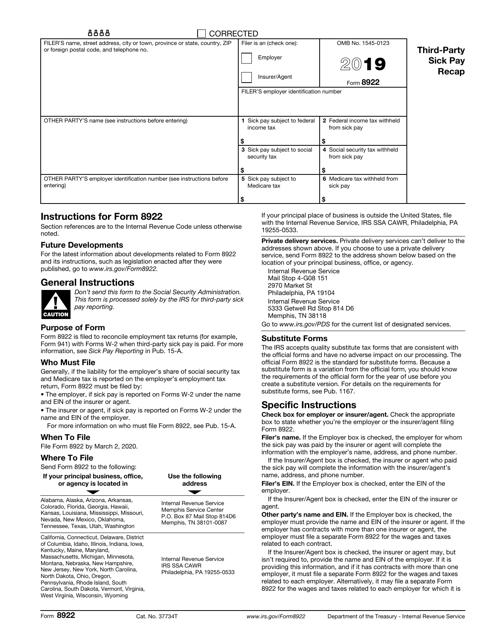

Irs Form 8922 - For more information, see sick pay reporting in. Web generally, if the liability for the employer's share of social security tax and medicare tax is reported on the employer's employment tax return, form 8922 must be filed by: Web form 8922 is fillable only by employers or insurers/agents, which means taxpayers don’t need to fill out this form. Form 8922 is filed to reconcile employment tax returns (for example, form 941) with. For more information, see sick pay reporting in. Web employers and third parties that provide sick pay to employees on behalf of employers now must report benefits to the internal revenue service on form 8922, the. You can download or print current. Download and print the form 8822. Web the procedures for filing the form 8922 recaps may change if the form 8922 becomes eligible for electronic filing, officials say. Enter your name, address, and social security number at the top of the.

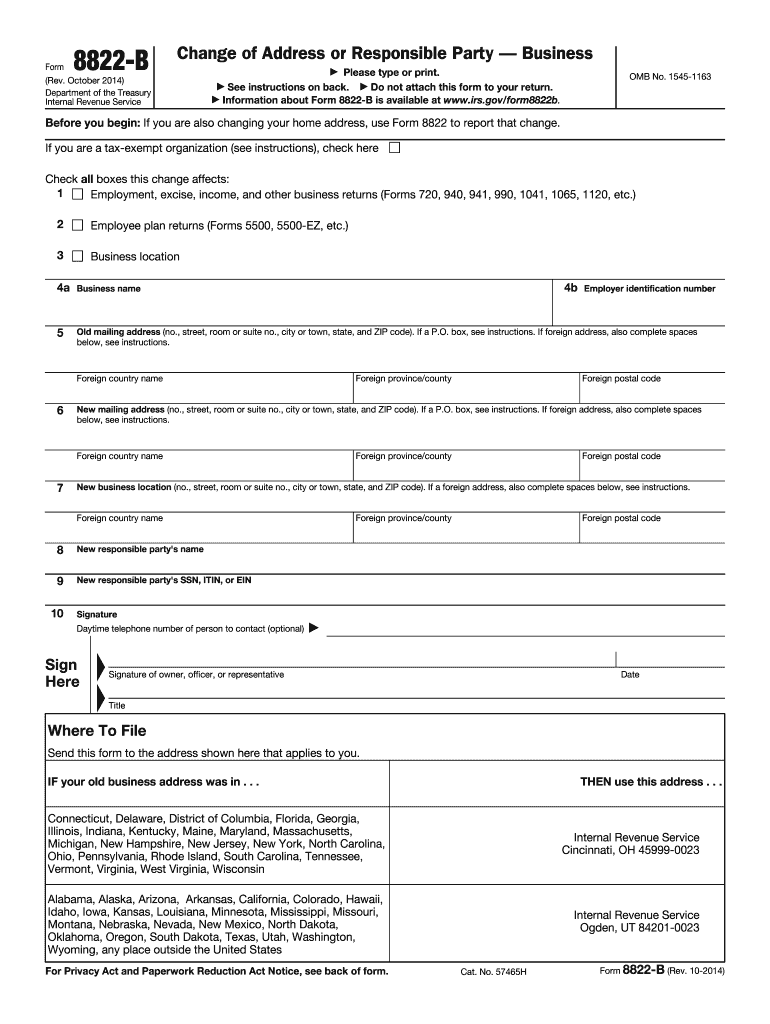

Identity of your responsible party. For more information, see sick pay reporting in. Web generally, if the liability for the employer's share of social security tax and medicare tax is reported on the employer's employment tax return, form 8922 must be filed by: For more information, see sick pay reporting in. Form 8922 is filed to reconcile employment tax returns (for example, form 941) with. Web employers and third parties that provide sick pay to employees on behalf of employers now must report benefits to the internal revenue service on form 8922, the. Download and print the form 8822. Enter your name, address, and social security number at the top of the. Web the procedures for filing the form 8922 recaps may change if the form 8922 becomes eligible for electronic filing, officials say. Web form 8922 is fillable only by employers or insurers/agents, which means taxpayers don’t need to fill out this form.

Form 8922 is filed to reconcile employment tax returns (for example, form 941) with. Web form 8922 is fillable only by employers or insurers/agents, which means taxpayers don’t need to fill out this form. Web the procedures for filing the form 8922 recaps may change if the form 8922 becomes eligible for electronic filing, officials say. Enter your name, address, and social security number at the top of the. Web generally, if the liability for the employer's share of social security tax and medicare tax is reported on the employer's employment tax return, form 8922 must be filed by: You can download or print current. Download and print the form 8822. For more information, see sick pay reporting in. For more information, see sick pay reporting in. Identity of your responsible party.

IRS FORM 12257 PDF

Identity of your responsible party. Enter your name, address, and social security number at the top of the. Web the procedures for filing the form 8922 recaps may change if the form 8922 becomes eligible for electronic filing, officials say. Form 8922 is filed to reconcile employment tax returns (for example, form 941) with. Web form 8922 is fillable only.

understanding irs form 982 Fill Online, Printable, Fillable Blank

Enter your name, address, and social security number at the top of the. Form 8922 is filed to reconcile employment tax returns (for example, form 941) with. Download and print the form 8822. Web generally, if the liability for the employer's share of social security tax and medicare tax is reported on the employer's employment tax return, form 8922 must.

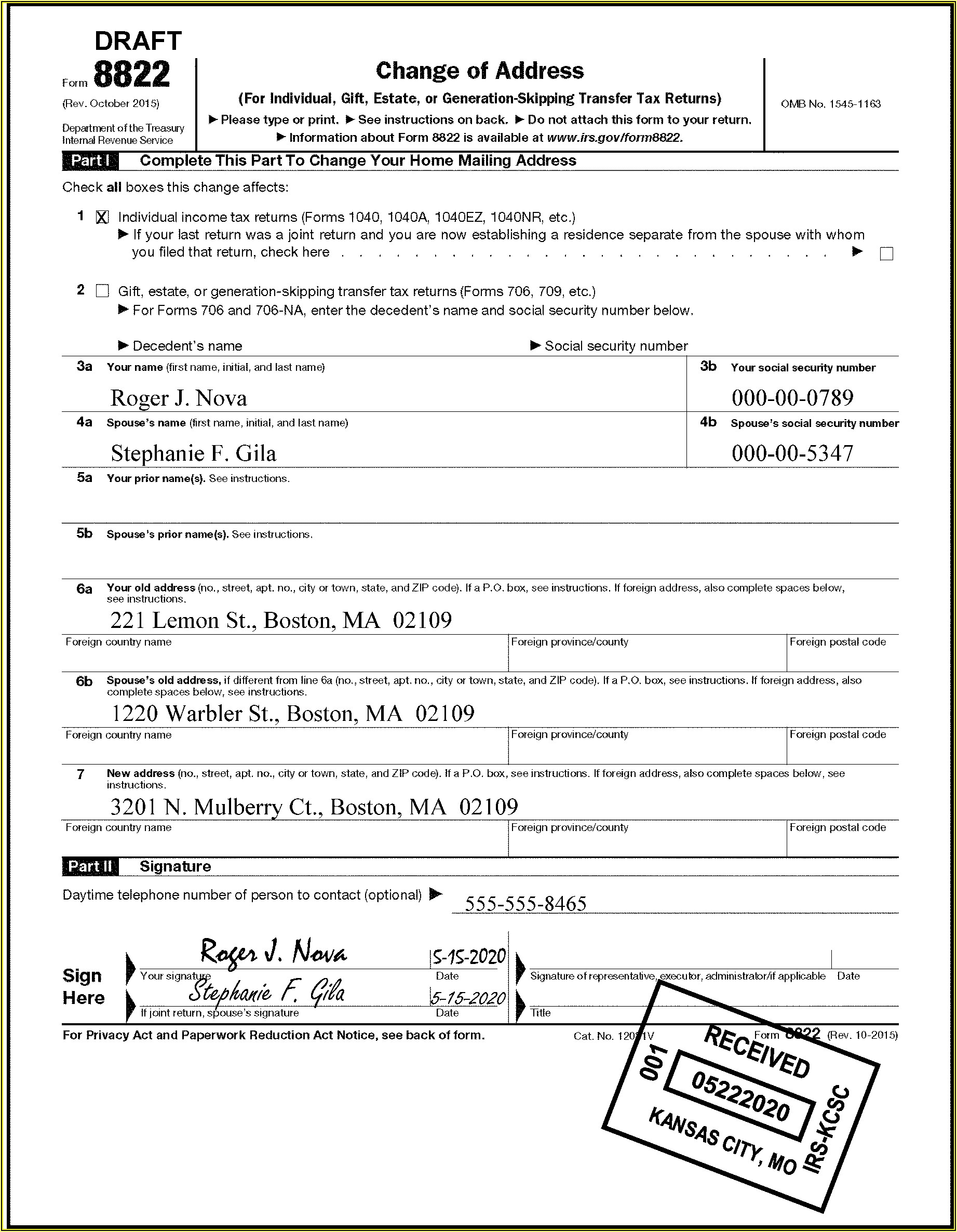

Downloadable Irs Form 8822 Form Resume Examples WjYDkqk9KB

Identity of your responsible party. Download and print the form 8822. Enter your name, address, and social security number at the top of the. Web employers and third parties that provide sick pay to employees on behalf of employers now must report benefits to the internal revenue service on form 8922, the. For more information, see sick pay reporting in.

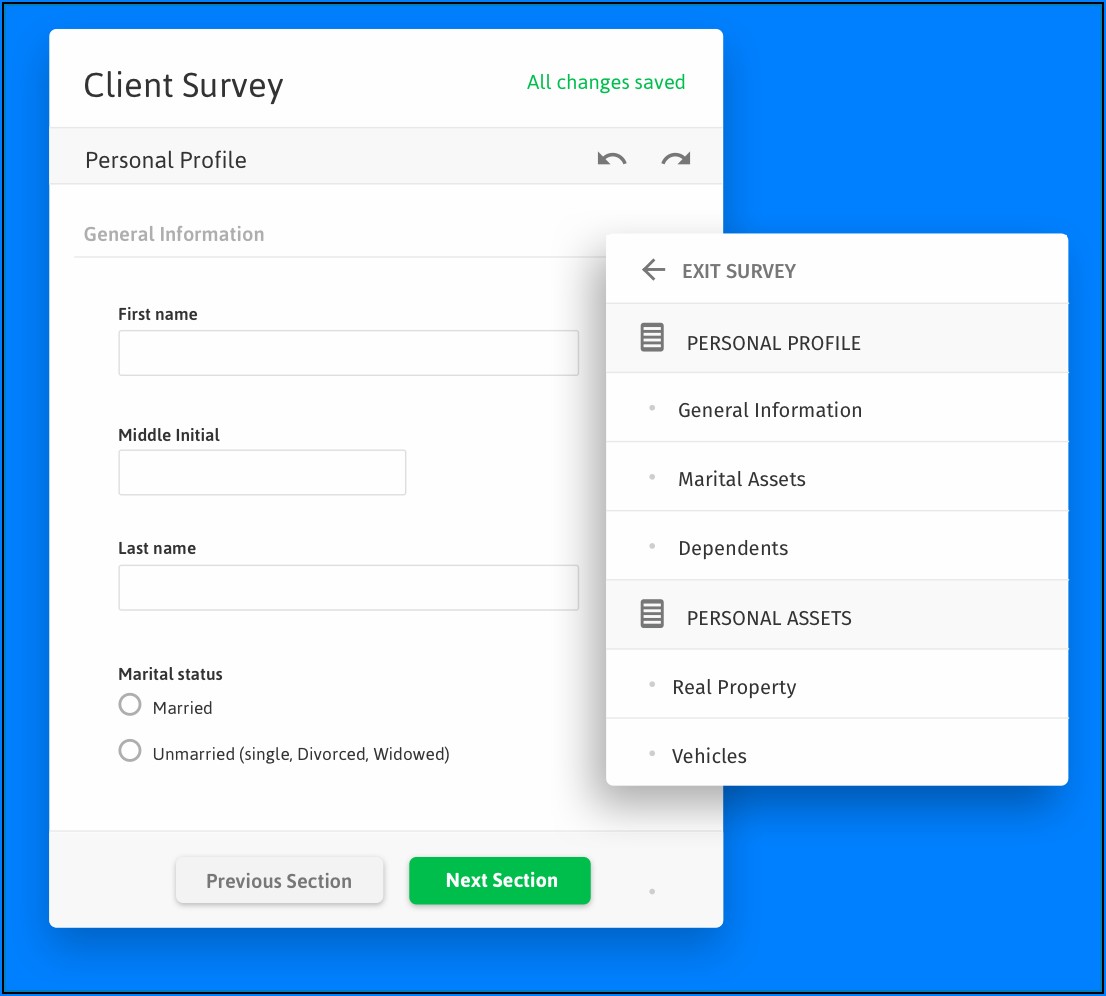

Fill Free fillable IRS PDF forms

Enter your name, address, and social security number at the top of the. For more information, see sick pay reporting in. For more information, see sick pay reporting in. Web generally, if the liability for the employer's share of social security tax and medicare tax is reported on the employer's employment tax return, form 8922 must be filed by: Download.

Fill Free fillable IRS PDF forms

Web employers and third parties that provide sick pay to employees on behalf of employers now must report benefits to the internal revenue service on form 8922, the. Identity of your responsible party. Web the procedures for filing the form 8922 recaps may change if the form 8922 becomes eligible for electronic filing, officials say. Form 8922 is filed to.

The IRS 8822 Form To File or Not to File MissNowMrs

Enter your name, address, and social security number at the top of the. You can download or print current. Identity of your responsible party. For more information, see sick pay reporting in. Download and print the form 8822.

IRS Form 8922 Download Fillable PDF or Fill Online ThirdParty Sick Pay

Web employers and third parties that provide sick pay to employees on behalf of employers now must report benefits to the internal revenue service on form 8922, the. Web form 8922 is fillable only by employers or insurers/agents, which means taxpayers don’t need to fill out this form. For more information, see sick pay reporting in. Enter your name, address,.

Irs Form 8379 Pdf Form Resume Examples 3q9JkkdgYA

Web form 8922 is fillable only by employers or insurers/agents, which means taxpayers don’t need to fill out this form. For more information, see sick pay reporting in. Web generally, if the liability for the employer's share of social security tax and medicare tax is reported on the employer's employment tax return, form 8922 must be filed by: Download and.

File IRS 2290 Form Online for 20222023 Tax Period

For more information, see sick pay reporting in. Form 8922 is filed to reconcile employment tax returns (for example, form 941) with. Identity of your responsible party. Download and print the form 8822. You can download or print current.

IRS 8822B 2014 Fill out Tax Template Online US Legal Forms

For more information, see sick pay reporting in. Form 8922 is filed to reconcile employment tax returns (for example, form 941) with. Web generally, if the liability for the employer's share of social security tax and medicare tax is reported on the employer's employment tax return, form 8922 must be filed by: For more information, see sick pay reporting in..

Download And Print The Form 8822.

For more information, see sick pay reporting in. You can download or print current. Web generally, if the liability for the employer's share of social security tax and medicare tax is reported on the employer's employment tax return, form 8922 must be filed by: Web employers and third parties that provide sick pay to employees on behalf of employers now must report benefits to the internal revenue service on form 8922, the.

Web The Procedures For Filing The Form 8922 Recaps May Change If The Form 8922 Becomes Eligible For Electronic Filing, Officials Say.

Enter your name, address, and social security number at the top of the. Identity of your responsible party. Web form 8922 is fillable only by employers or insurers/agents, which means taxpayers don’t need to fill out this form. Form 8922 is filed to reconcile employment tax returns (for example, form 941) with.

.jpg)