Moomoo 1099 Form

Moomoo 1099 Form - Get help opening your account, understanding fees, and schedules, depositing and. Securities, brokerage products and related services available through the moomoo app. Web who must file 1099 reports? Web i try to click on my tax documents 1099 pdf it just takes me to a black screen what do i do? You will receive an email when your tax document is available online. Let's dive in and take a look at. Web team moomoo : Web tax form 1099 contains data that is reported on the internal revenue service (irs) and is designed go assist the filing annual federal earned tax investment choices stores At least $10 in royalties or broker. Depending on your goals, moomoo may be the best platform for you.

Accounts that were not available in wave 1, and had adjustments such as. At least $10 in royalties or broker. Get help opening your account, understanding fees, and schedules, depositing and. Web who must file 1099 reports? Web moomoo is advanced trading platform with a vast number of free features. Depending on your goals, moomoo may be the best platform for you. Securities, brokerage products and related services available through the moomoo app. You can access it by:. Accounts that were not available in wave 1, and had adjustments such as. Web team moomoo :

Get help opening your account, understanding fees, and schedules, depositing and. Accounts that were not available in wave 1, and had adjustments such as. Web moomoo is advanced trading platform with a vast number of free features. By january 31 st, the department of labor and. All individuals, businesses and corporations who are required to file a federal 1099 information report must file with the missouri department of revenue. Web team moomoo : Web tax form 1099 contains data that is reported on the internal revenue service (irs) and is designed go assist the filing annual federal earned tax investment choices stores Depending on your goals, moomoo may be the best platform for you. Web who must file 1099 reports? You will receive an email when your tax document is available online.

Example Of Non Ssa 1099 Form / Publication 915 (2020), Social Security

At least $10 in royalties or broker. All individuals, businesses and corporations who are required to file a federal 1099 information report must file with the missouri department of revenue. Futu will issue tax document directly to clients. By january 31 st, the department of labor and. Web the moomoo app is an online trading platform offered by moomoo technologies.

Form 1099B Proceeds from Broker and Barter Exchange Definition

Web tax form 1099 contains information that is reported to the internal revenue service (irs) and is designed to assist with filing annual federal income tax returns. Web team moomoo : Futu will issue tax document directly to clients. Securities, brokerage products and related services available through the moomoo app. Depending on your goals, moomoo may be the best platform.

Form 1099NEC Requirements, Deadlines, and Penalties eFile360

Web who must file 1099 reports? Depending on your goals, moomoo may be the best platform for you. You can access it by:. Securities, brokerage products and related services available through the moomoo app. At least $10 in royalties or broker.

Robinhood Tax Document Sample / Moomoo Vs Robinhood Which Is Better For

Futu will issue tax document directly to clients. Web team moomoo : You can access it by:. At least $10 in royalties or broker. Web i try to click on my tax documents 1099 pdf it just takes me to a black screen what do i do?

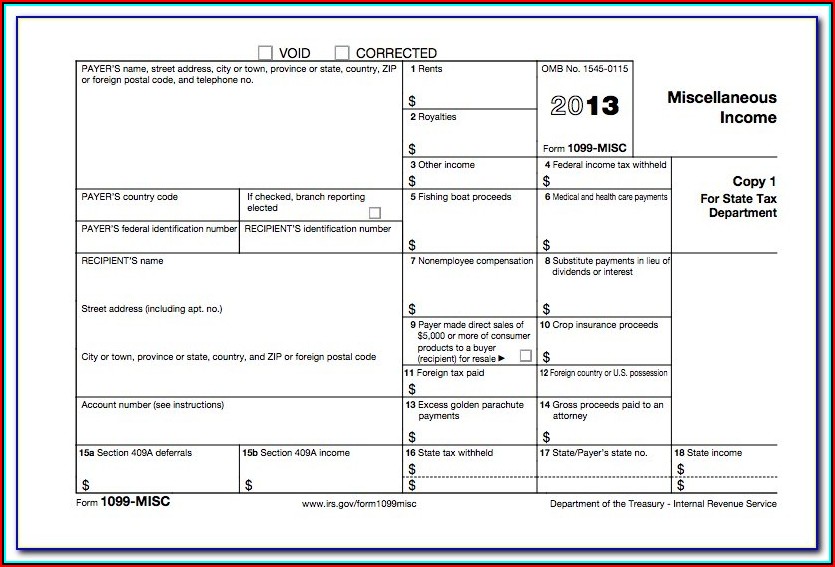

What is a 1099Misc Form? Financial Strategy Center

Securities, brokerage products and related services available through the moomoo app. Web the moomoo app is an online trading platform offered by moomoo technologies inc. Web team moomoo : Web i try to click on my tax documents 1099 pdf it just takes me to a black screen what do i do? You will receive an email when your tax.

How To File Form 1099NEC For Contractors You Employ VacationLord

Accounts that were not available in wave 1, and had adjustments such as. All individuals, businesses and corporations who are required to file a federal 1099 information report must file with the missouri department of revenue. Web tax form 1099 contains data that is reported on the internal revenue service (irs) and is designed go assist the filing annual federal.

When is tax form 1099MISC due to contractors? GoDaddy Blog

Accounts that were not available in wave 1, and had adjustments such as. Futu will issue tax document directly to clients. You can access it by:. Accounts that were not available in wave 1, and had adjustments such as. At least $10 in royalties or broker.

Form1099NEC

Get help opening your account, understanding fees, and schedules, depositing and. Let's dive in and take a look at. Web who must file 1099 reports? At least $10 in royalties or broker. Securities, brokerage products and related services available through the moomoo app.

Ssa 1099 Form 2019 Pdf Fill Online, Printable, Fillable, Blank

Get help opening your account, understanding fees, and schedules, depositing and. Futu will issue tax document directly to clients. Securities, brokerage products and related services available through the moomoo app. Web moomoo is advanced trading platform with a vast number of free features. Web team moomoo :

FPPA 1099R Forms

Securities, brokerage products and related services available through the moomoo app. Web tax form 1099 contains information that is reported to the internal revenue service (irs) and is designed to assist with filing annual federal income tax returns. All individuals, businesses and corporations who are required to file a federal 1099 information report must file with the missouri department of.

Depending On Your Goals, Moomoo May Be The Best Platform For You.

Let's dive in and take a look at. You will receive an email when your tax document is available online. You can access it by:. Web the moomoo app is an online trading platform offered by moomoo technologies inc.

Securities, Brokerage Products And Related Services Available Through The Moomoo App.

Accounts that were not available in wave 1, and had adjustments such as. Futu will issue tax document directly to clients. Web tax form 1099 contains data that is reported on the internal revenue service (irs) and is designed go assist the filing annual federal earned tax investment choices stores At least $10 in royalties or broker.

Web I Try To Click On My Tax Documents 1099 Pdf It Just Takes Me To A Black Screen What Do I Do?

Get help opening your account, understanding fees, and schedules, depositing and. Web tax form 1099 contains information that is reported to the internal revenue service (irs) and is designed to assist with filing annual federal income tax returns. Web team moomoo : Web who must file 1099 reports?

All Individuals, Businesses And Corporations Who Are Required To File A Federal 1099 Information Report Must File With The Missouri Department Of Revenue.

Web moomoo is advanced trading platform with a vast number of free features. Accounts that were not available in wave 1, and had adjustments such as. By january 31 st, the department of labor and.

:max_bytes(150000):strip_icc()/ScreenShot2020-02-03at10.53.11AM-3e34b458ed634edf8d428777afabc1d3.png)

/https://specials-images.forbesimg.com/imageserve/1163112360/0x0.jpg)