Nyc 210 Form 2022

Nyc 210 Form 2022 - Sign it in a few clicks draw your signature, type it, upload its image, or use your mobile device as a signature pad. Enjoy smart fillable fields and interactivity. Employer compensation expense program wage credit: You must file your 2022 claim no later than april 15, 2026. You may be eligible for free file using one of the software providers below, if: Follow the simple instructions below: Edit your nyc210 online type text, add images, blackout confidential details, add comments, highlights and more. Web nyc property and business tax forms documents on this page are provided in pdf format. New york state department of taxation and finance Online learn more about tax credits.

New york state department of taxation and finance Employer compensation expense program wage credit: Enjoy smart fillable fields and interactivity. Web nyc 210 form 2022 rating ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ 4.8 satisfied 51 votes how to fill out and sign na 1 32 210 2022 online? You must file your 2022 claim no later than april 15, 2026. Kings county (brooklyn), bronx, new You lived in new york city if you lived in any of the following counties during 2022: Follow the simple instructions below: You may be eligible for free file using one of the software providers below, if: We will compute the amount of your credit.

You must file your 2022 claim no later than april 15, 2026. You lived in new york city if you lived in any of the following counties during 2022: Web nyc property and business tax forms documents on this page are provided in pdf format. Online learn more about tax credits. You must file your 2022 claim no later than april 15, 2026. You must file your 2022 claim no later than april 15, 2026. Web good news for 2022! You can get more information and check refund status online and by phone. Web credit for new york city unincorporated business tax: Edit your nyc210 online type text, add images, blackout confidential details, add comments, highlights and more.

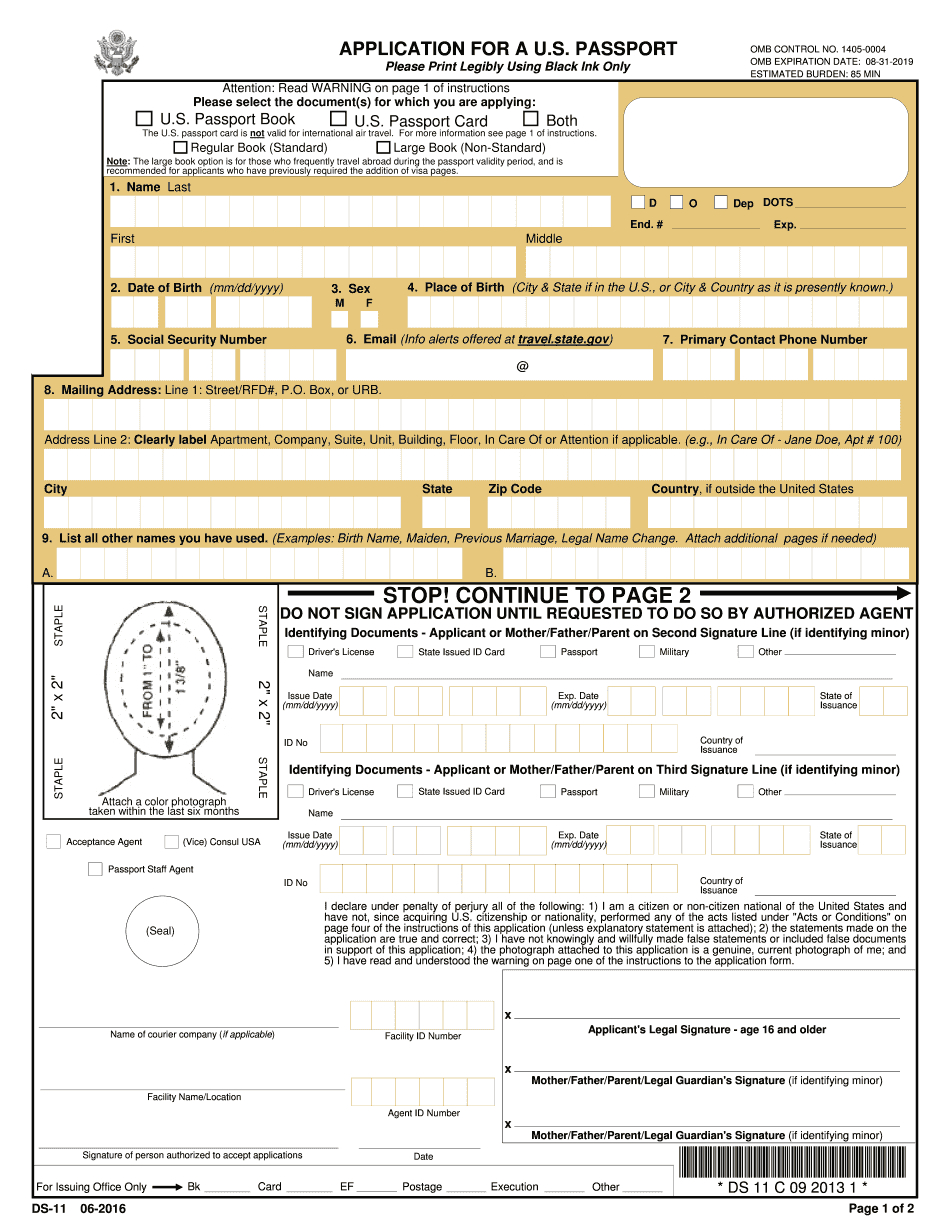

Nyc210 Form 2021 Printable Printable Word Searches

Web credit for new york city unincorporated business tax: We will compute the amount of your credit. Employer compensation expense program wage credit: You may be eligible for free file using one of the software providers below, if: Web good news for 2022!

Nyc210 Form 2021 Printable Printable Word Searches

We will compute the amount of your credit. Get your online template and fill it in using progressive features. Share your form with others send school tax credit form via email, link, or fax. Online learn more about tax credits. You may be eligible for free file using one of the software providers below, if:

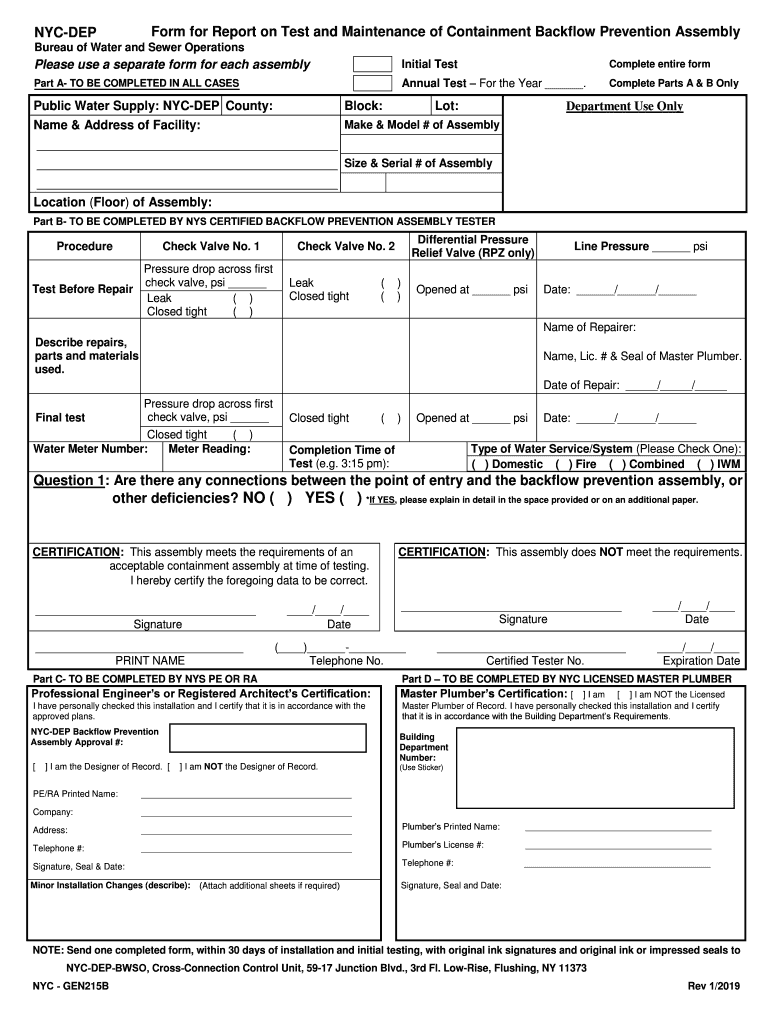

Gc 310 Fill Out and Sign Printable PDF Template signNow

You may be eligible for free file using one of the software providers below, if: Web good news for 2022! Edit your nyc210 online type text, add images, blackout confidential details, add comments, highlights and more. Enjoy smart fillable fields and interactivity. Follow the simple instructions below:

Nyc210 Form 2021 Printable Printable Word Searches

Sign it in a few clicks draw your signature, type it, upload its image, or use your mobile device as a signature pad. Online learn more about tax credits. You must file your 2022 claim no later than april 15, 2026. We will compute the amount of your credit. Follow the simple instructions below:

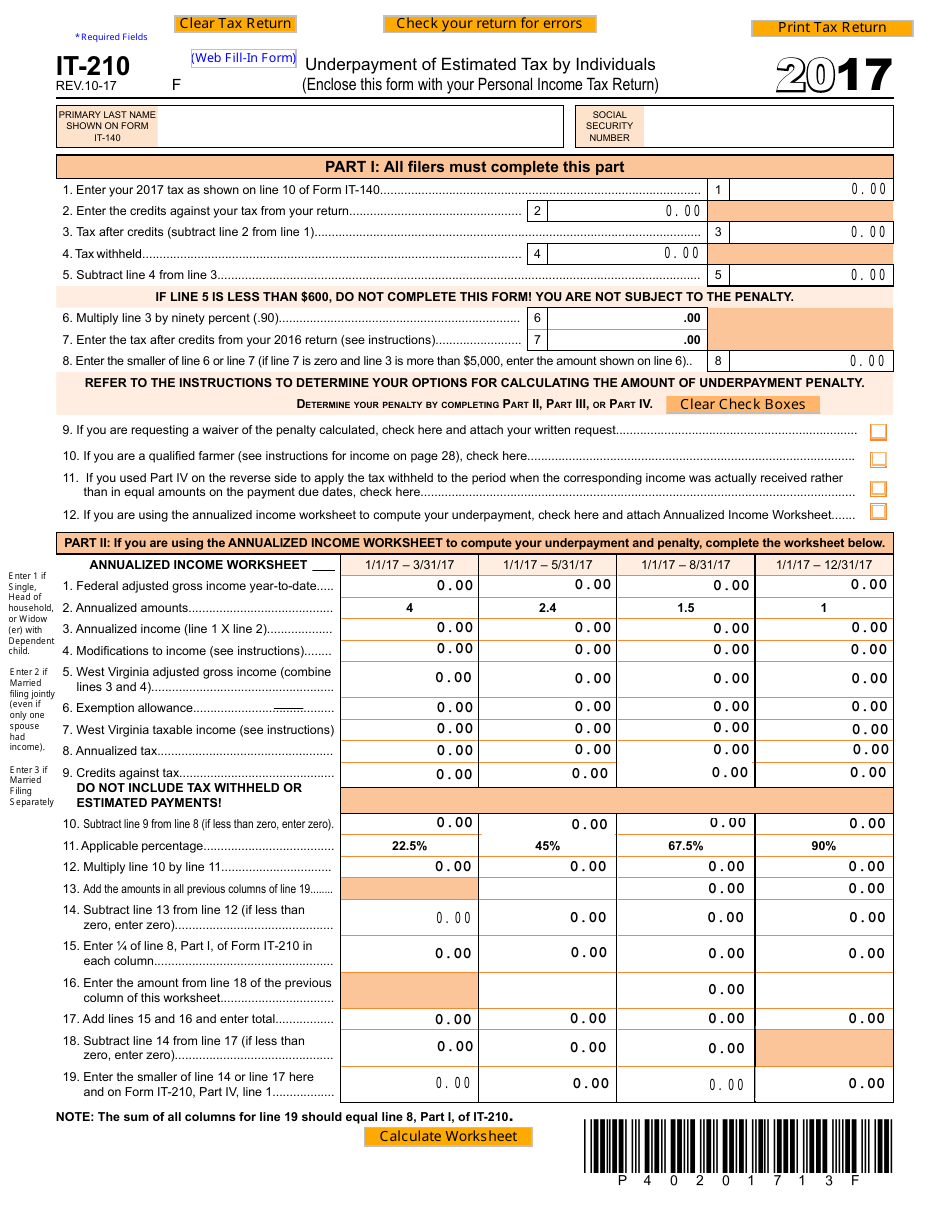

Form IT210 Download Fillable PDF or Fill Online Underpayment of

New york state department of taxation and finance You must file your 2022 claim no later than april 15, 2026. You can get more information and check refund status online and by phone. Your federal adjusted gross income (agi) is $41,000 or less regardless of age, or Am i eligible to free file?

Nyc210 Form 2020 Printable Printable Word Searches

Am i eligible to free file? Enjoy smart fillable fields and interactivity. We will compute the amount of your credit. Online learn more about tax credits. Web credit for new york city unincorporated business tax:

Nyc210 Form 2020 Printable Printable Word Searches

Online learn more about tax credits. Get your online template and fill it in using progressive features. Your federal adjusted gross income (agi) is $41,000 or less regardless of age, or Enjoy smart fillable fields and interactivity. You can get more information and check refund status online and by phone.

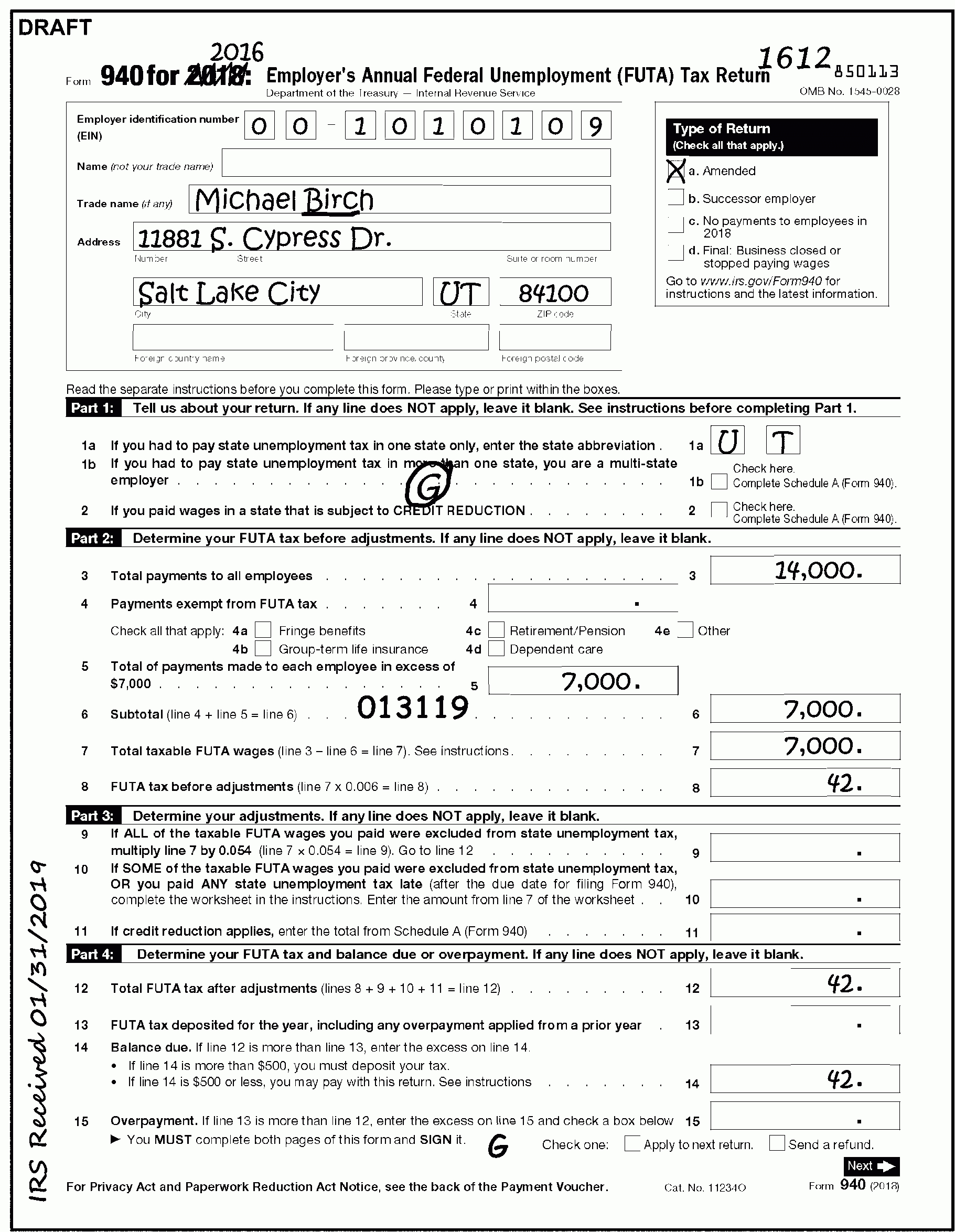

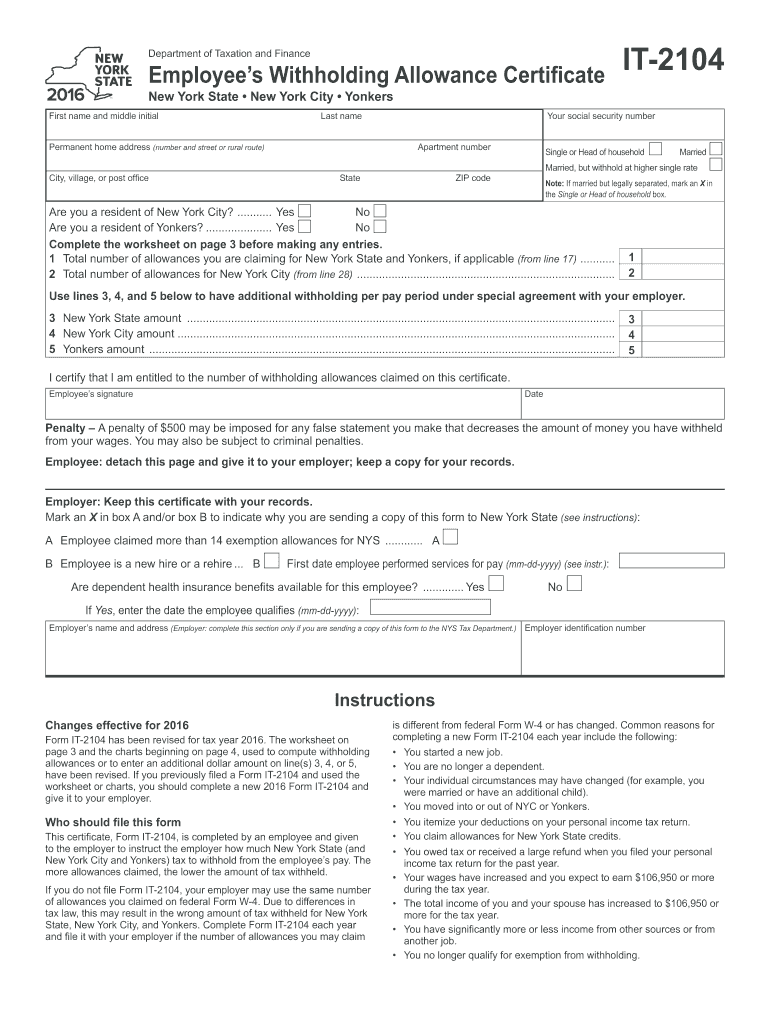

Filling Out It 2104 Fill Out and Sign Printable PDF Template signNow

You must file your 2022 claim no later than april 15, 2026. New york state department of taxation and finance You lived in new york city if you lived in any of the following counties during 2022: Share your form with others send school tax credit form via email, link, or fax. Web nyc property and business tax forms documents.

nyc 210 form 2015

Sign it in a few clicks draw your signature, type it, upload its image, or use your mobile device as a signature pad. You must file your 2022 claim no later than april 15, 2026. Online learn more about tax credits. You may be eligible for free file using one of the software providers below, if: We will compute the.

Kings County (Brooklyn), Bronx, New

Your federal adjusted gross income (agi) is $41,000 or less regardless of age, or Employer compensation expense program wage credit: Share your form with others send school tax credit form via email, link, or fax. You lived in new york city if you lived in any of the following counties during 2022:

Follow The Simple Instructions Below:

Web good news for 2022! Online learn more about tax credits. You must file your 2022 claim no later than april 15, 2026. You may be eligible for free file using one of the software providers below, if:

You Must File Your 2022 Claim No Later Than April 15, 2026.

Am i eligible to free file? Sign it in a few clicks draw your signature, type it, upload its image, or use your mobile device as a signature pad. Web nyc 210 form 2022 rating ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ 4.8 satisfied 51 votes how to fill out and sign na 1 32 210 2022 online? Web nyc property and business tax forms documents on this page are provided in pdf format.

Web Credit For New York City Unincorporated Business Tax:

We will compute the amount of your credit. Enjoy smart fillable fields and interactivity. You can get more information and check refund status online and by phone. You must file your 2022 claim no later than april 15, 2026.