Qcd Tax Form

Qcd Tax Form - Two 3 year contracts and are on our third contract. Web qcd is listed in the world's largest and most authoritative dictionary database of abbreviations and acronyms. Web a qualified charitable distribution (qcd) is a distribution from your individual retirement account (ira) to a qualified charity. Ira application & instructions ira application information kit identify beneficiary. Bexar county “we have had qcd for over 7 years; Web to enter a qcd in taxslayer pro, from the main menu of the tax return (form 1040) select: Web qcd on form 1040, u.s. If you have a tax dispute with the irs, there are ways you can resolve it. Web ira qualified charitable distribution (qcd) form ira qcds or ira charitable rollovers, as they are sometimes called, are an increasingly popular way for donors 70. Web donor advised funds and private foundations do not qualify for qcd treatment.

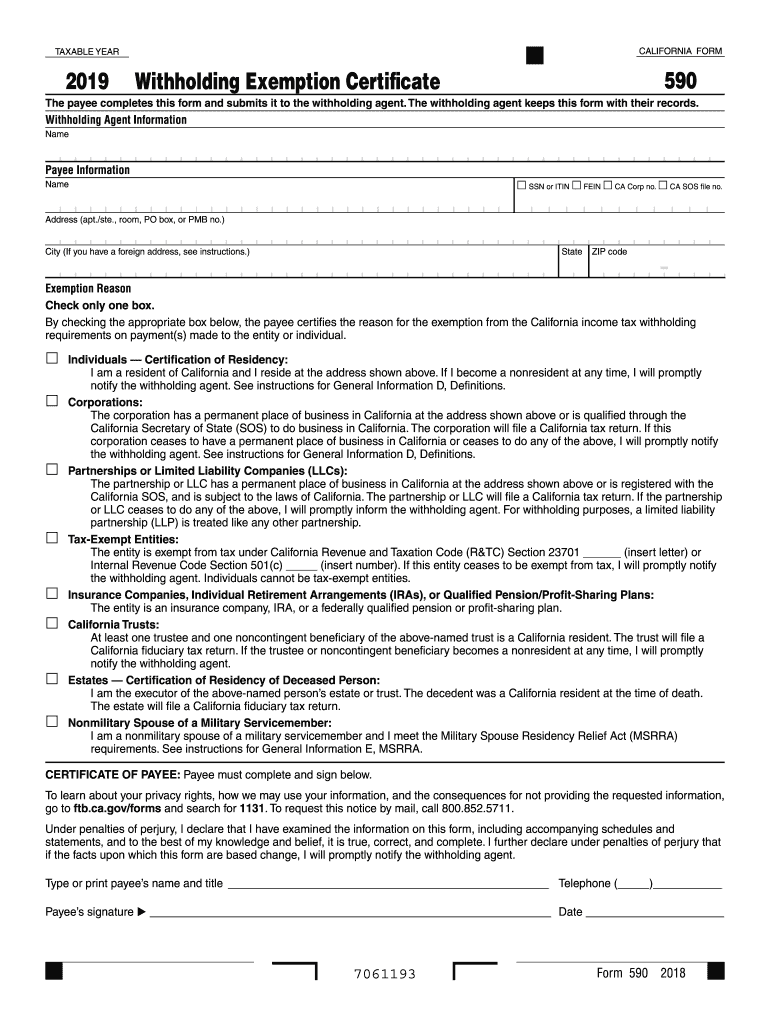

For inherited iras or inherited roth iras, the qcd will be reported as a. Web ruth rideout, office manager, qcd client since 2007; Maximum state/local tax benefits indicated above are based on the treatment of qualified charitable contributions and tax rates in effect as of. The miscellaneous tax credits offered by the state of missouri, are administered by several government agencies including the missouri department of. To report a qcd on your form 1040 tax return, you generally. Web a qualified charitable distribution (qcd) is a distribution of funds from your ira (other than a sep or simple ira) directly by the trustee to a qualified charitable. Ira application & instructions ira application information kit identify beneficiary. Web to report a qualified charitable distribution on your form 1040 tax return, you generally report the full amount of the charitable distribution on the line for ira distributions. Web qcd is listed in the world's largest and most authoritative dictionary database of abbreviations and acronyms. If you have a tax dispute with the irs, there are ways you can resolve it.

Web qcd is listed in the world's largest and most authoritative dictionary database of abbreviations and acronyms. The miscellaneous tax credits offered by the state of missouri, are administered by several government agencies including the missouri department of. ɕ per irs code, you must be. Web the 100% carryover limit available in 2021 for certain qualified cash contributions made in 2020 no longer applies for carryovers of those contributions to 2022 or later years. Maximum state/local tax benefits indicated above are based on the treatment of qualified charitable contributions and tax rates in effect as of. Web ira qualified charitable distribution (qcd) form ira qcds or ira charitable rollovers, as they are sometimes called, are an increasingly popular way for donors 70. To report a qcd on your form 1040 tax return, you generally. Web a qualified charitable distribution (qcd) is a distribution of funds from your ira (other than a sep or simple ira) directly by the trustee to a qualified charitable. Web a qualified charitable distribution (qcd) is a distribution from your individual retirement account (ira) to a qualified charity. Web ruth rideout, office manager, qcd client since 2007;

QCD Form S MTE Enerji Sistemleri

Web donor advised funds and private foundations do not qualify for qcd treatment. Web a qualified charitable distribution (qcd) is a distribution from your individual retirement account (ira) to a qualified charity. Learn what resources are available and how they can help. Two 3 year contracts and are on our third contract. Web a qualified charitable distribution (qcd) is a.

QCD [PDF Document]

Web a qualified charitable distribution (qcd) is a distribution of funds from your ira (other than a sep or simple ira) directly by the trustee to a qualified charitable. Under section 408(d)(8) of the internal revenue code (code), a taxpayer can exclude from gross. Web home » tax credits. Web see below for additional information. Ira application & instructions ira.

QCD MTE Enerji Sistemleri

Web see below for additional information. To report a qcd on your form 1040 tax return, you generally. Ira application & instructions ira application information kit identify beneficiary. Web ruth rideout, office manager, qcd client since 2007; Web home » tax credits.

1099R Software EFile TIN Matching Print and Mail 1099R Forms

Web qcd is listed in the world's largest and most authoritative dictionary database of abbreviations and acronyms. Web resolve tax disputes. Web a qualified charitable distribution (qcd) is a distribution from your individual retirement account (ira) to a qualified charity. Web home » tax credits. Web see below for additional information.

Ca590 Fill Out and Sign Printable PDF Template signNow

Web donor advised funds and private foundations do not qualify for qcd treatment. Web a qualified charitable distribution (qcd) is a distribution of funds from your ira (other than a sep or simple ira) directly by the trustee to a qualified charitable. Two 3 year contracts and are on our third contract. Bexar county “we have had qcd for over.

Tax Benefits of Making a QCD Fisher

Ira application & instructions ira application information kit identify beneficiary. Web to enter a qcd in taxslayer pro, from the main menu of the tax return (form 1040) select: Web qcd on form 1040, u.s. Web a qualified charitable distribution (qcd) is a distribution from your individual retirement account (ira) to a qualified charity. Web ira qualified charitable distribution (qcd).

Tax Benefits of making a QCD Ryan Financial, Inc.

For inherited iras or inherited roth iras, the qcd will be reported as a. The miscellaneous tax credits offered by the state of missouri, are administered by several government agencies including the missouri department of. Web to enter a qcd in taxslayer pro, from the main menu of the tax return (form 1040) select: Web a qualified charitable distribution (qcd).

QCD Sample Comments

Web qcd on form 1040, u.s. You must be age 70½ or older to make a. Web home » tax credits. Web resolve tax disputes. Web the 100% carryover limit available in 2021 for certain qualified cash contributions made in 2020 no longer applies for carryovers of those contributions to 2022 or later years.

Tax Tip From Our Tax Planners How To Report A QCD On Your Tax Form

Learn what resources are available and how they can help. The miscellaneous tax credits offered by the state of missouri, are administered by several government agencies including the missouri department of. Web ira qualified charitable distribution (qcd) form ira qcds or ira charitable rollovers, as they are sometimes called, are an increasingly popular way for donors 70. Web see below.

Turbotax won't calculate tax. Received deferred co...

If you have a tax dispute with the irs, there are ways you can resolve it. The miscellaneous tax credits offered by the state of missouri, are administered by several government agencies including the missouri department of. Maximum state/local tax benefits indicated above are based on the treatment of qualified charitable contributions and tax rates in effect as of. Web.

Web Home » Tax Credits.

Web the 100% carryover limit available in 2021 for certain qualified cash contributions made in 2020 no longer applies for carryovers of those contributions to 2022 or later years. ɕ per irs code, you must be. Web ruth rideout, office manager, qcd client since 2007; Web a qualified charitable distribution (qcd) is a distribution from your individual retirement account (ira) to a qualified charity.

If You Have A Tax Dispute With The Irs, There Are Ways You Can Resolve It.

Web to enter a qcd in taxslayer pro, from the main menu of the tax return (form 1040) select: Web see below for additional information. Under section 408(d)(8) of the internal revenue code (code), a taxpayer can exclude from gross. Bexar county “we have had qcd for over 7 years;

Web To Report A Qualified Charitable Distribution On Your Form 1040 Tax Return, You Generally Report The Full Amount Of The Charitable Distribution On The Line For Ira Distributions.

Web qcd on form 1040, u.s. Web resolve tax disputes. Web ira qualified charitable distribution (qcd) form ira qcds or ira charitable rollovers, as they are sometimes called, are an increasingly popular way for donors 70. Learn what resources are available and how they can help.

The Miscellaneous Tax Credits Offered By The State Of Missouri, Are Administered By Several Government Agencies Including The Missouri Department Of.

You must be age 70½ or older to make a. Maximum state/local tax benefits indicated above are based on the treatment of qualified charitable contributions and tax rates in effect as of. Ira application & instructions ira application information kit identify beneficiary. To report a qcd on your form 1040 tax return, you generally.

![QCD [PDF Document]](https://cdn.vdocuments.net/img/1200x630/reader020/image/20190926/5531f927550346dd568b4bde.png?t=1614207426)