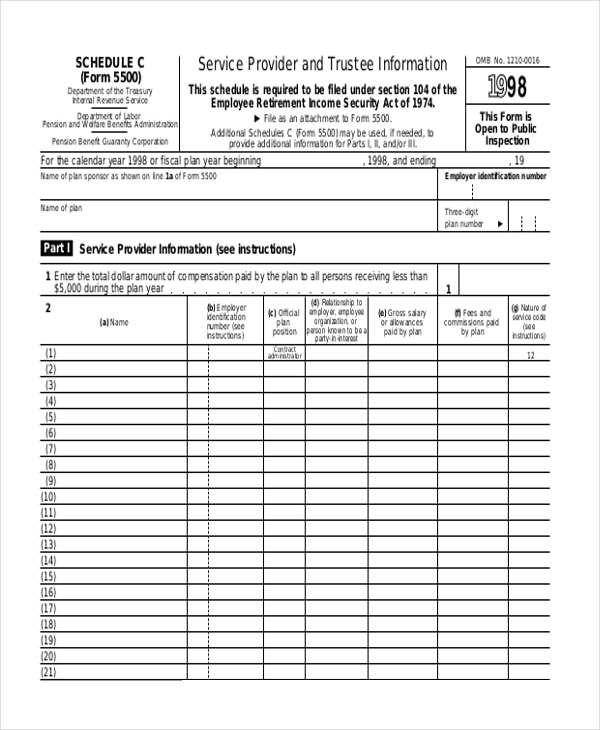

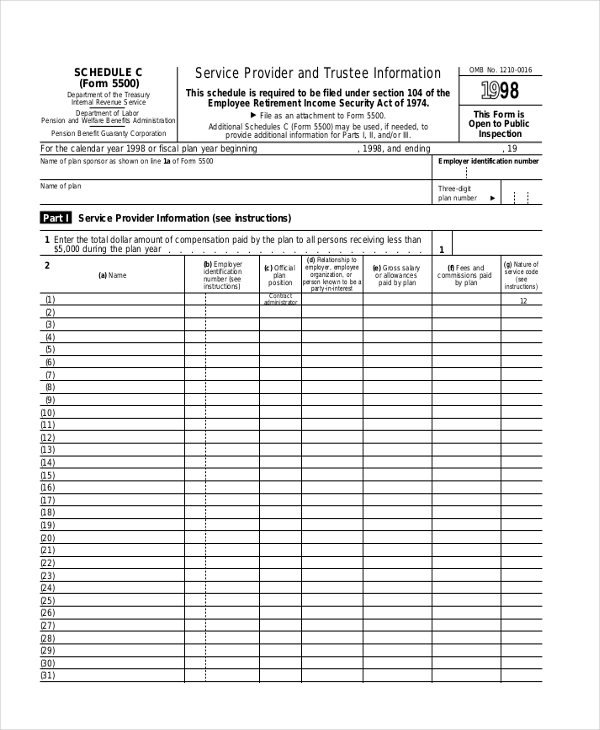

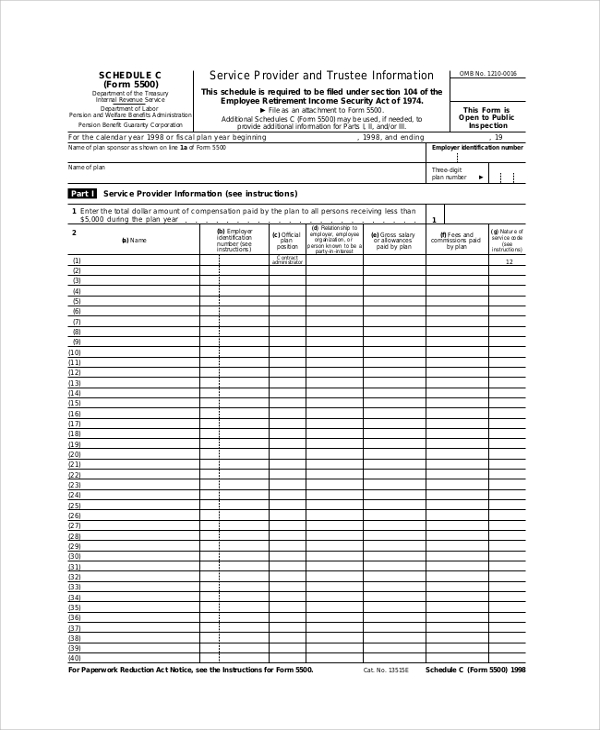

Schedule C Form 5500

Schedule C Form 5500 - Web file as an attachment to form 5500. Web the schedule c of form 5500 disclosure rules provide that each retirement plan required to file a schedule c of form 5500, review and potentially report, any “direct” and. Web schedule c provides details on the fees associated with the plan and is typically only provided in the event the reportable fees exceed $5,000. Web schedules a & c are attached to form 5500 and used to report insurance and service provider information, respectively. It contains information regarding eligible indirect compensation received by vanguard and others from. Eligible indirect compensation disclosure guide. Web schedule c (form 5500) 1997 page 2 enter the name and address of all trustees who served during the plan year. Web schedule c (form 5500), page 3 of 4 (page 4 is blank) margins: Is this reported in the form 5500? Web schedule c (form 5500) 2019 v.

Eligible indirect compensation disclosure guide. Web form 5500 schedule c: Web file as an attachment to form 5500. The department of labor (dol) has implemented new reporting requirements on form 5500 schedule c relating to plan fees/compensation. Web what is form 5500 schedule c? It contains information regarding eligible indirect compensation received by vanguard and others from. For calendar plan year 2022 or fiscal plan year beginning and ending. In this issue brief, we will briefly discuss. Web completing form 5500 schedule c (service provider information). For large plans form 5500 schedule c must be filed which outlines service providers utilized by the plan to whom more than $5,000.

No, neither the aetna administrative fees nor commissions to brokers are reported since the. Web aetna sends a schedule c. Web what is form 5500 schedule c? The department of labor (dol) has implemented new reporting requirements on form 5500 schedule c relating to plan fees/compensation. Web form 5500 schedule c: Web schedule c (form 5500) 1997 page 2 enter the name and address of all trustees who served during the plan year. It contains information regarding eligible indirect compensation received by vanguard and others from. Top 1⁄ 2, center sides. Web schedule c provides details on the fees associated with the plan and is typically only provided in the event the reportable fees exceed $5,000. For large plans form 5500 schedule c must be filed which outlines service providers utilized by the plan to whom more than $5,000.

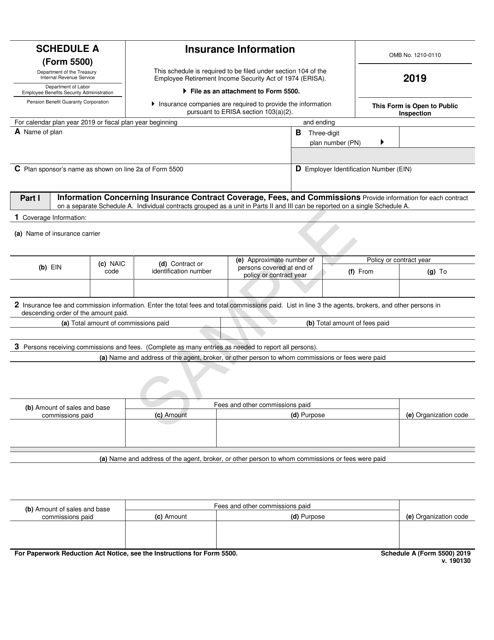

IRS Form 5500 Schedule A Download Fillable PDF or Fill Online Insurance

Web the schedule c instructions state that “eligible indirect compensation” includes fees or expense reimbursement payments charged to “investment funds” and reflected in the. Eligible indirect compensation disclosure guide. For calendar plan year 2022 or fiscal plan year beginning and ending. Web aetna sends a schedule c. If more trustee informationspace is required to supply this.

5500 and Schedule C

Web schedules a & c are attached to form 5500 and used to report insurance and service provider information, respectively. Web the schedule c of form 5500 disclosure rules provide that each retirement plan required to file a schedule c of form 5500, review and potentially report, any “direct” and. The department of labor (dol) has implemented new reporting requirements.

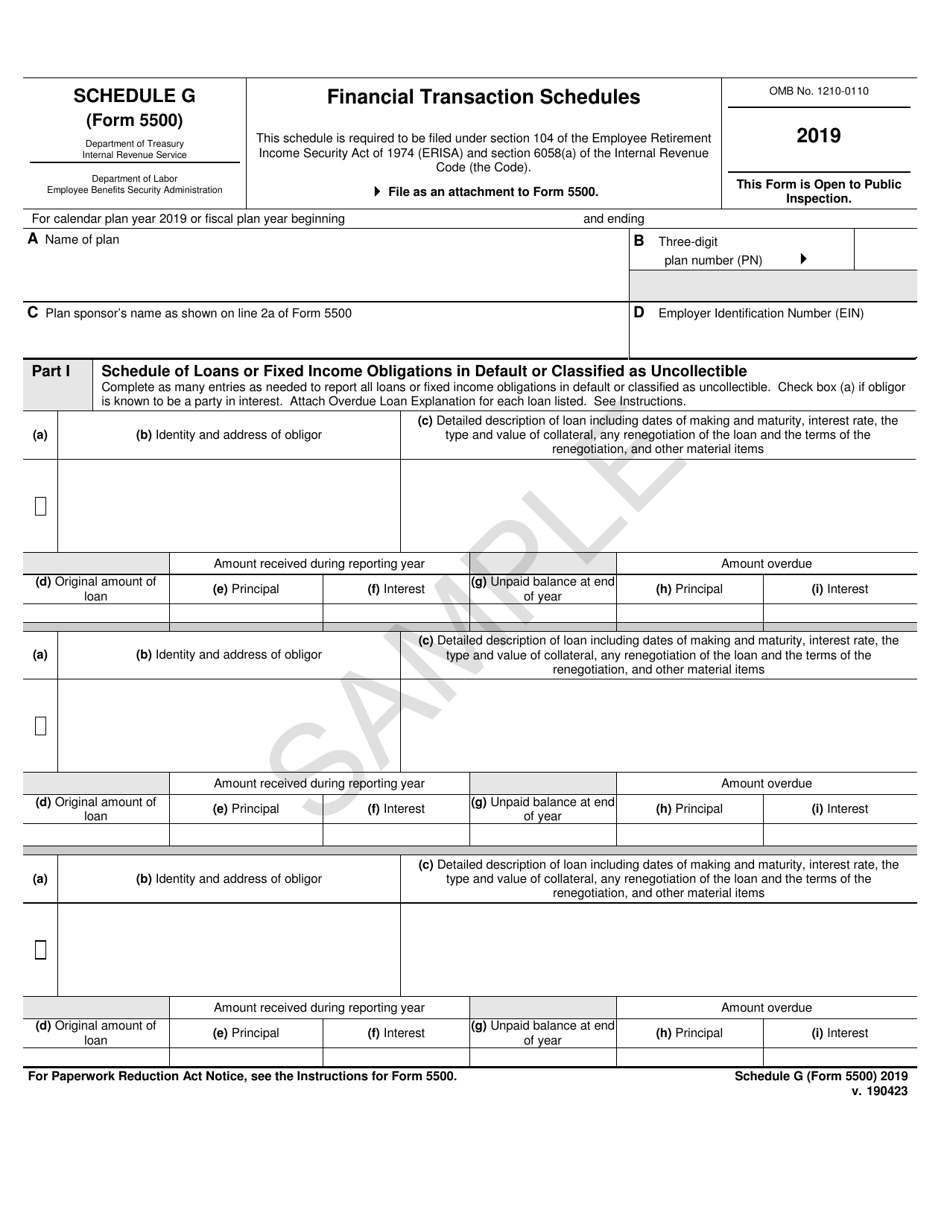

IRS Form 5500 Schedule G Download Fillable PDF or Fill Online Financial

Web the schedule c instructions state that “eligible indirect compensation” includes fees or expense reimbursement payments charged to “investment funds” and reflected in the. Web form 5500 schedule c: Web completing form 5500 schedule c (service provider information). No, neither the aetna administrative fees nor commissions to brokers are reported since the. It contains information regarding eligible indirect compensation received.

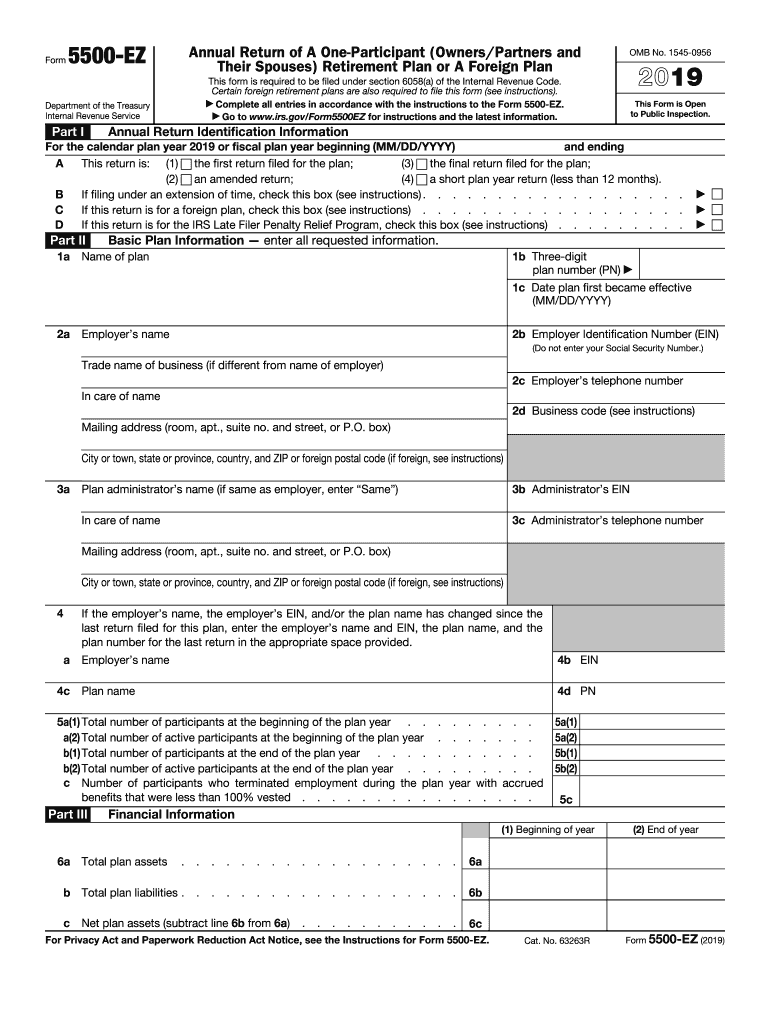

2019 Form IRS 5500EZ Fill Online, Printable, Fillable, Blank pdfFiller

The department of labor (dol) has implemented new reporting requirements on form 5500 schedule c relating to plan fees/compensation. This guide is designed to help plan sponsors complete form 5500 schedule c (service. Web schedule c (form 5500) 1995 page 2 enter the name and address of all trustees who served during the plan year. Web schedule c (form 5500).

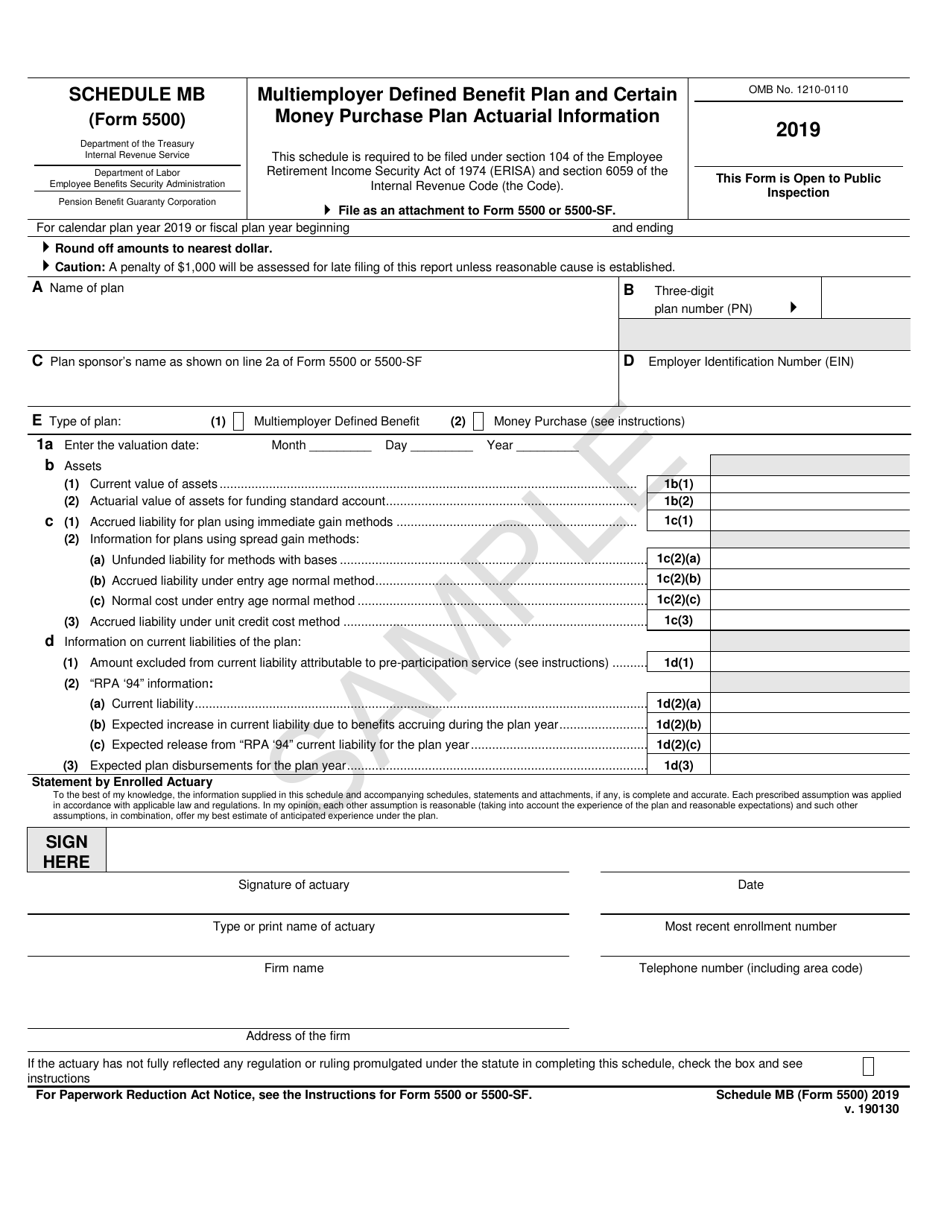

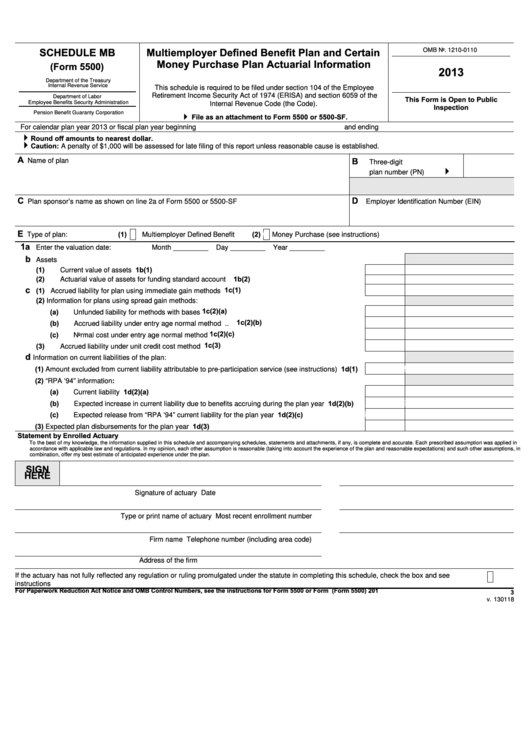

IRS Form 5500 Schedule MB Download Fillable PDF or Fill Online

This guide is designed to help plan sponsors complete form 5500 schedule c (service. Top 1⁄ 2, center sides. Is this reported in the form 5500? This form is open to public inspection. Eligible indirect compensation disclosure guide.

FREE 9+ Sample Schedule C Forms in PDF MS Word

Web file as an attachment to form 5500. Web form 5500 schedule c eligible indirect compensation disclosure guide this guide is being provided to assist plan administrators (usually the plan sponsor) in completing form. In this issue brief, we will briefly discuss. Web schedules a & c are attached to form 5500 and used to report insurance and service provider.

Schedule Mb (Form 5500) Multiemployer Defined Benefit Plan And

This form is open to public inspection. Web schedule c (form 5500), page 3 of 4 (page 4 is blank) margins: Web form 5500 schedule c: Web file as an attachment to form 5500. Is this reported in the form 5500?

FREE 17+ Sample Schedule Forms in PDF MS Word Excel

Web schedule c (form 5500) service provider and trustee information omb no. Web schedules a & c are attached to form 5500 and used to report insurance and service provider information, respectively. The department of labor (dol) has implemented new reporting requirements on form 5500 schedule c relating to plan fees/compensation. Web schedule c provides details on the fees associated.

FREE 9+ Sample Schedule C Forms in PDF MS Word

Web schedule c (form 5500) 1995 page 2 enter the name and address of all trustees who served during the plan year. Web schedule c (form 5500) 2019 v. Information on other service providers receiving direct or indirect compensation. Web what is form 5500 schedule c? Web file as an attachment to form 5500.

PPT Form 5500 Schedule C Why is it not the correct way to compare

Web schedules a & c are attached to form 5500 and used to report insurance and service provider information, respectively. Is this reported in the form 5500? For large plans form 5500 schedule c must be filed which outlines service providers utilized by the plan to whom more than $5,000. No, neither the aetna administrative fees nor commissions to brokers.

It Contains Information Regarding Eligible Indirect Compensation Received By Vanguard And Others From.

Web schedule c (form 5500) 1997 page 2 enter the name and address of all trustees who served during the plan year. Web schedule c (form 5500) 2019 v. Except for those persons for whom you. Web aetna sends a schedule c.

Information On Other Service Providers Receiving Direct Or Indirect Compensation.

Web schedule c (form 5500) service provider and trustee information omb no. Web file as an attachment to form 5500. Is this reported in the form 5500? This guide is designed to help plan sponsors complete form 5500 schedule c (service.

For Large Plans Form 5500 Schedule C Must Be Filed Which Outlines Service Providers Utilized By The Plan To Whom More Than $5,000.

Web schedule c (form 5500), page 3 of 4 (page 4 is blank) margins: Web what is form 5500 schedule c? Eligible indirect compensation disclosure guide. If more trustee informationspace is required to supply this.

Web Schedule C Provides Details On The Fees Associated With The Plan And Is Typically Only Provided In The Event The Reportable Fees Exceed $5,000.

Web the schedule c instructions state that “eligible indirect compensation” includes fees or expense reimbursement payments charged to “investment funds” and reflected in the. For calendar plan year 2022 or fiscal plan year beginning and ending. This is effective for plan. If more trustee informationspace is required to supply this.