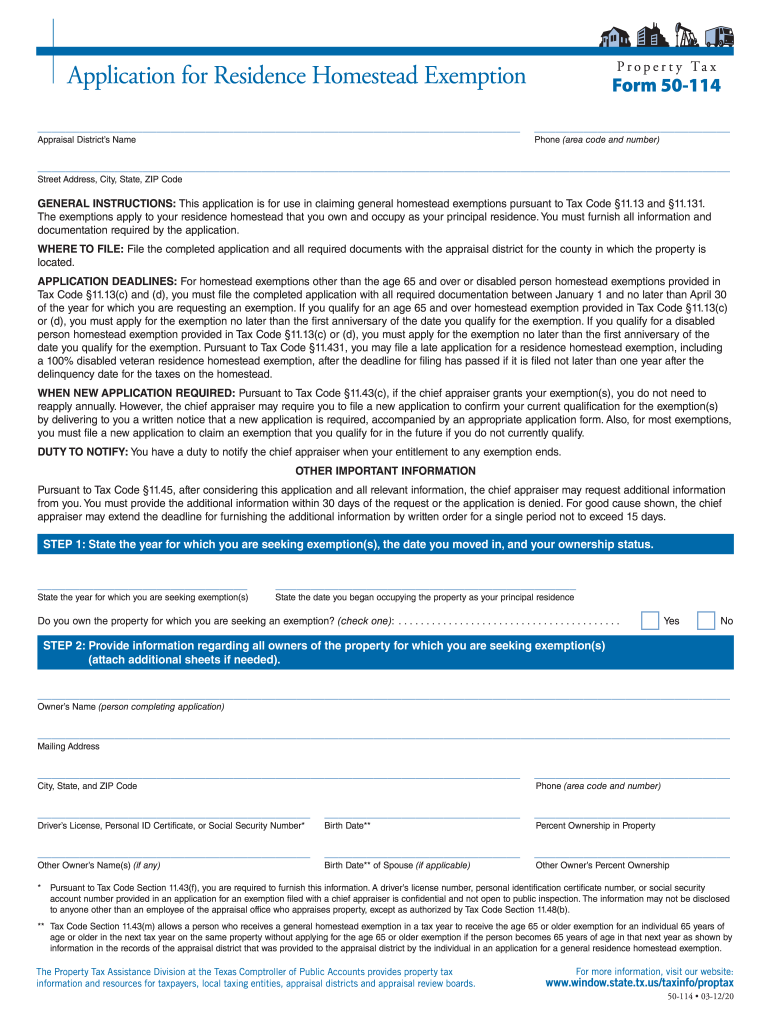

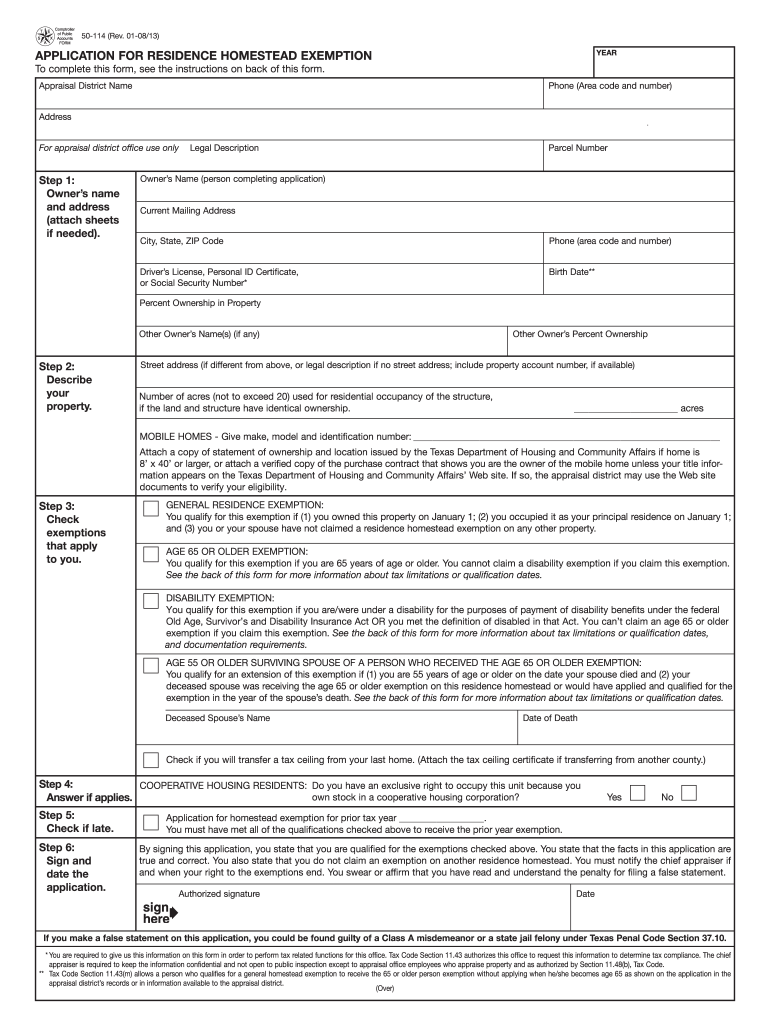

Texas Form 50 114

Texas Form 50 114 - Residence homestead exemption application form. Web pursuant to tax code section 11.431, you may file a late application for a residence homestead exemption, including an exemption under tax code sections 11.131, 11.132. Ad answer simple questions to make legal forms on any device in minutes. The application can be found on your. Web you must apply with your county appraisal district to apply for a homestead exemption. Applying is free and only needs to be filed once. This document must be filed with the appraisal district office in the county in which your property is located. Do not file this document with the office of the texas. This document must be filed with the. Use fill to complete blank online others pdf forms for.

This document must be filed with the appraisal district office in the county in which your property is located. Use fill to complete blank online others pdf forms for. Applying is free and only needs to be filed once. Web you must apply with your county appraisal district to apply for a homestead exemption. Complete, edit or print tax forms instantly. Do you live in the property for which you are seeking this residence homestead exemption? Web pursuant to tax code section 11.431, you may file a late application for a residence homestead exemption, including an exemption under tax code sections 11.131, 11.132. Complete, edit or print tax forms instantly. Residence homestead exemption application form. This document must be filed with the.

Web to qualify for a homestead exemption, an heir property owner must designate on the homestead application form that they are an heir property owner. Use fill to complete blank online others pdf forms for. Complete, edit or print tax forms instantly. Web pursuant to tax code section 11.431, you may file a late application for a residence homestead exemption, including an exemption under tax code sections 11.131 and. Complete, edit or print tax forms instantly. The application can be found on your. Web pursuant to tax code section 11.431, you may file a late application for a residence homestead exemption, including an exemption under tax code sections 11.131, 11.132. Web you must apply with your county appraisal district to apply for a homestead exemption. Residence homestead exemption application form. Applying is free and only needs to be filed once.

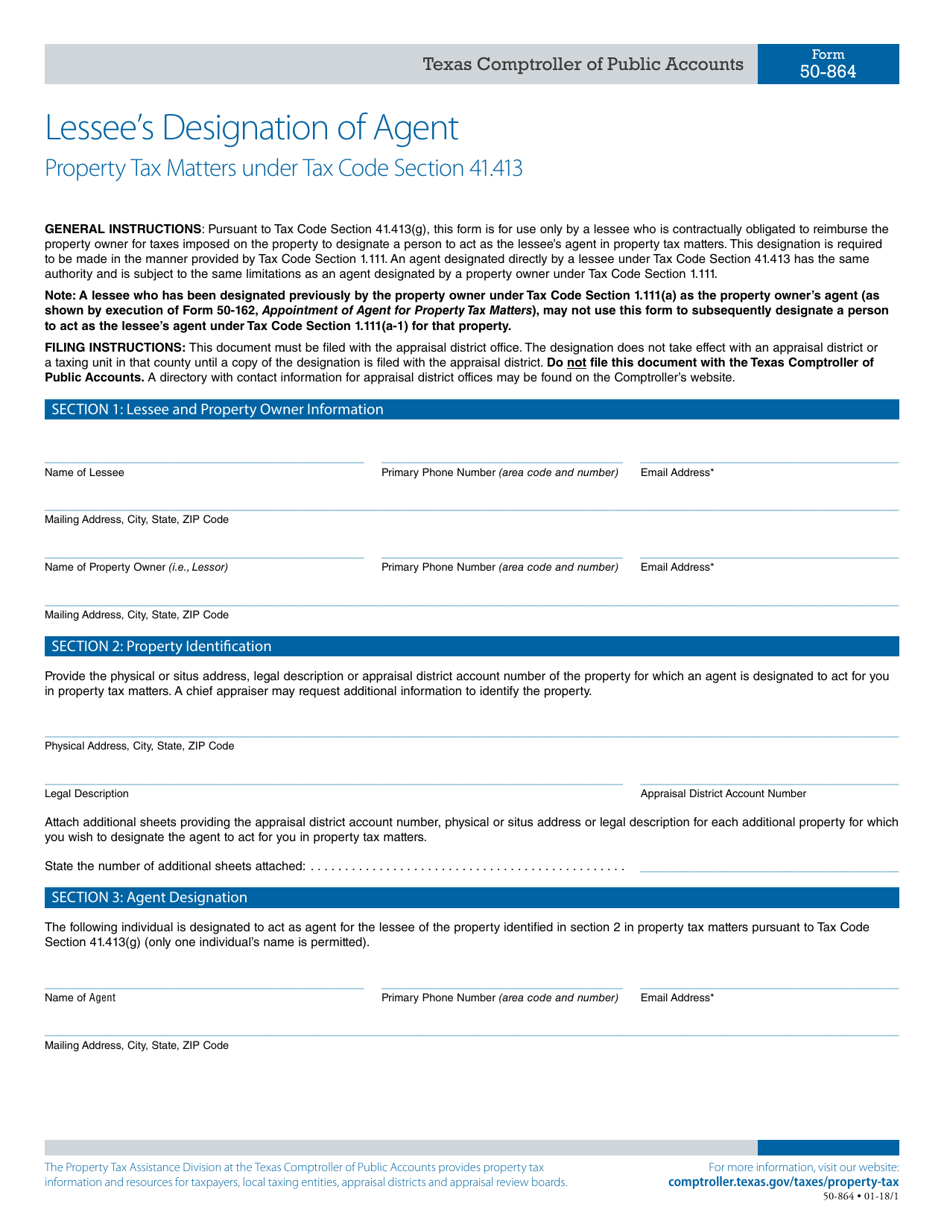

Form 50864 Download Fillable PDF or Fill Online Lessee's Designation

Web to qualify for a homestead exemption, an heir property owner must designate on the homestead application form that they are an heir property owner. Web pursuant to tax code section 11.431, you may file a late application for a residence homestead exemption, including an exemption under tax code sections 11.131, 11.132. Do not file this document with the office.

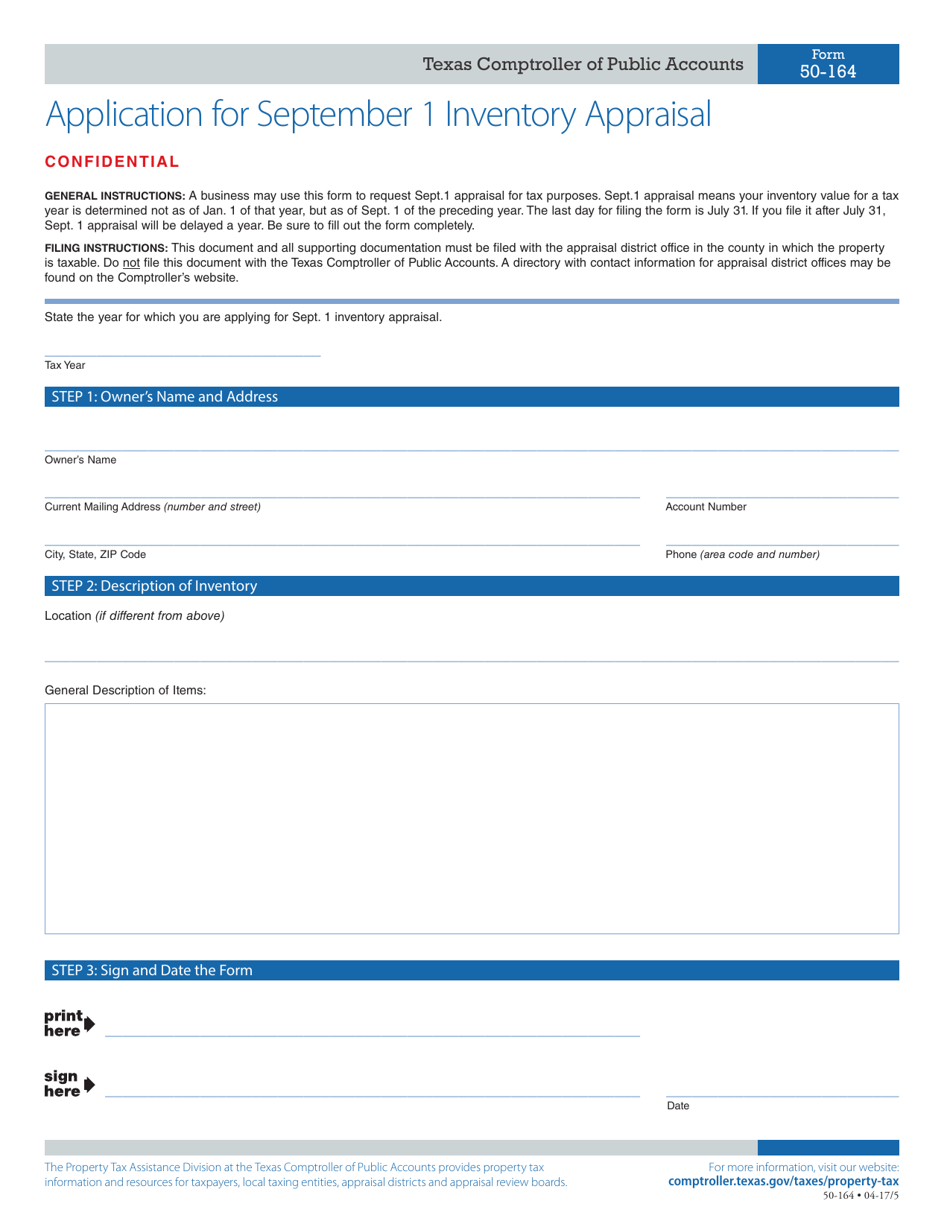

Form 50164 Download Fillable PDF or Fill Online Application for

Web to qualify for a homestead exemption, an heir property owner must designate on the homestead application form that they are an heir property owner. Use fill to complete blank online others pdf forms for. This document must be filed with the appraisal district office in the county in which your property is located. Web pursuant to tax code section.

2015 Form TX Comptroller 50144 Fill Online, Printable, Fillable, Blank

This document must be filed with the appraisal district office in the county in which your property is located. Easily customize your legal forms. Use fill to complete blank online others pdf forms for. Do you live in the property for which you are seeking this residence homestead exemption? The application can be found on your.

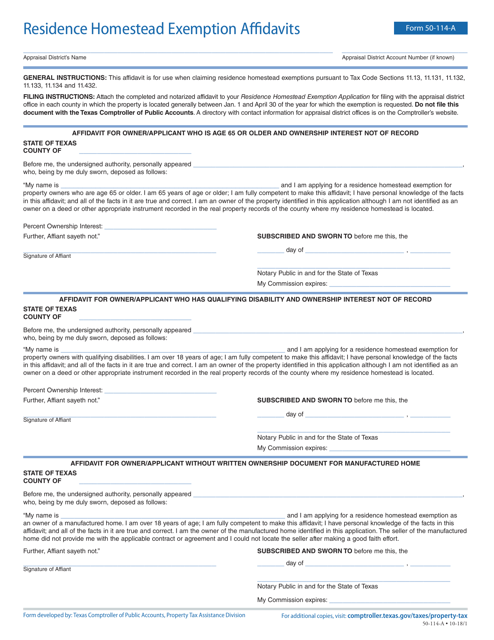

Form 50114A Download Fillable PDF or Fill Online Residence Homestead

Applying is free and only needs to be filed once. Residence homestead exemption application form. Do you live in the property for which you are seeking this residence homestead exemption? Use the tips about how to fill out the tx. Do not file this document with the office of the texas.

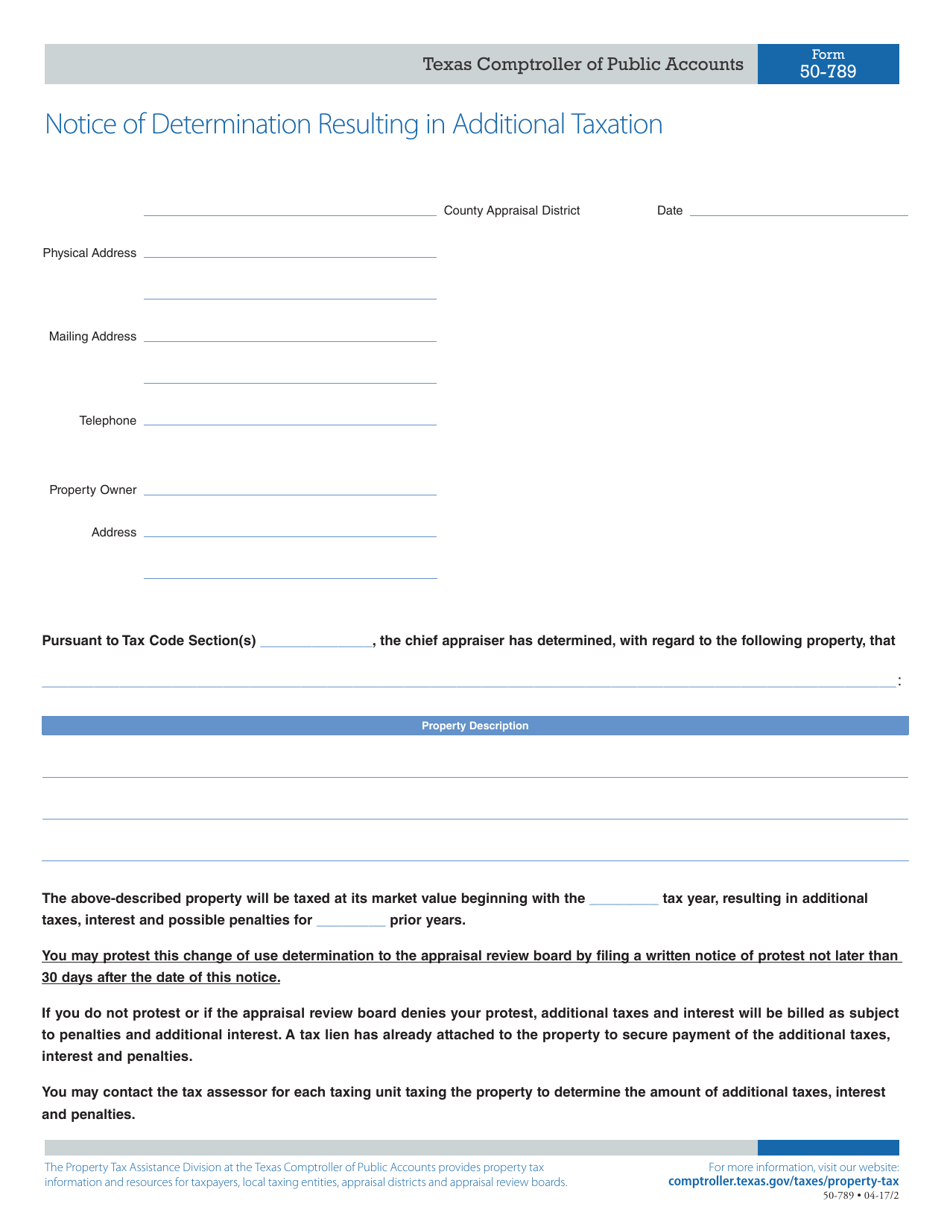

Form 50789 Download Fillable PDF or Fill Online Notice of

Do not file this document with the office of the texas. Residence homestead exemption application form. Instructions for filling out the form are provided in the form itself. Web you must apply with your county appraisal district to apply for a homestead exemption. The application can be found on your.

2012 Form TX Comptroller 50114 Fill Online, Printable, Fillable, Blank

Web pursuant to tax code section 11.431, you may file a late application for a residence homestead exemption, including an exemption under tax code sections 11.131 and. Web pursuant to tax code section 11.431, you may file a late application for a residence homestead exemption, including an exemption under tax code sections 11.131, 11.132. This document must be filed with.

Form 50 Fill Out and Sign Printable PDF Template signNow

Use the tips about how to fill out the tx. Ad answer simple questions to make legal forms on any device in minutes. Residence homestead exemption application form. The application can be found on your. Web applying is free and only needs to be filed once.

2011 Form TX Comptroller 50144 Fill Online, Printable, Fillable, Blank

Web pursuant to tax code section 11.431, you may file a late application for a residence homestead exemption, including an exemption under tax code sections 11.131 and. Applying is free and only needs to be filed once. This document must be filed with the. Web pursuant to tax code section 11.431, you may file a late application for a residence.

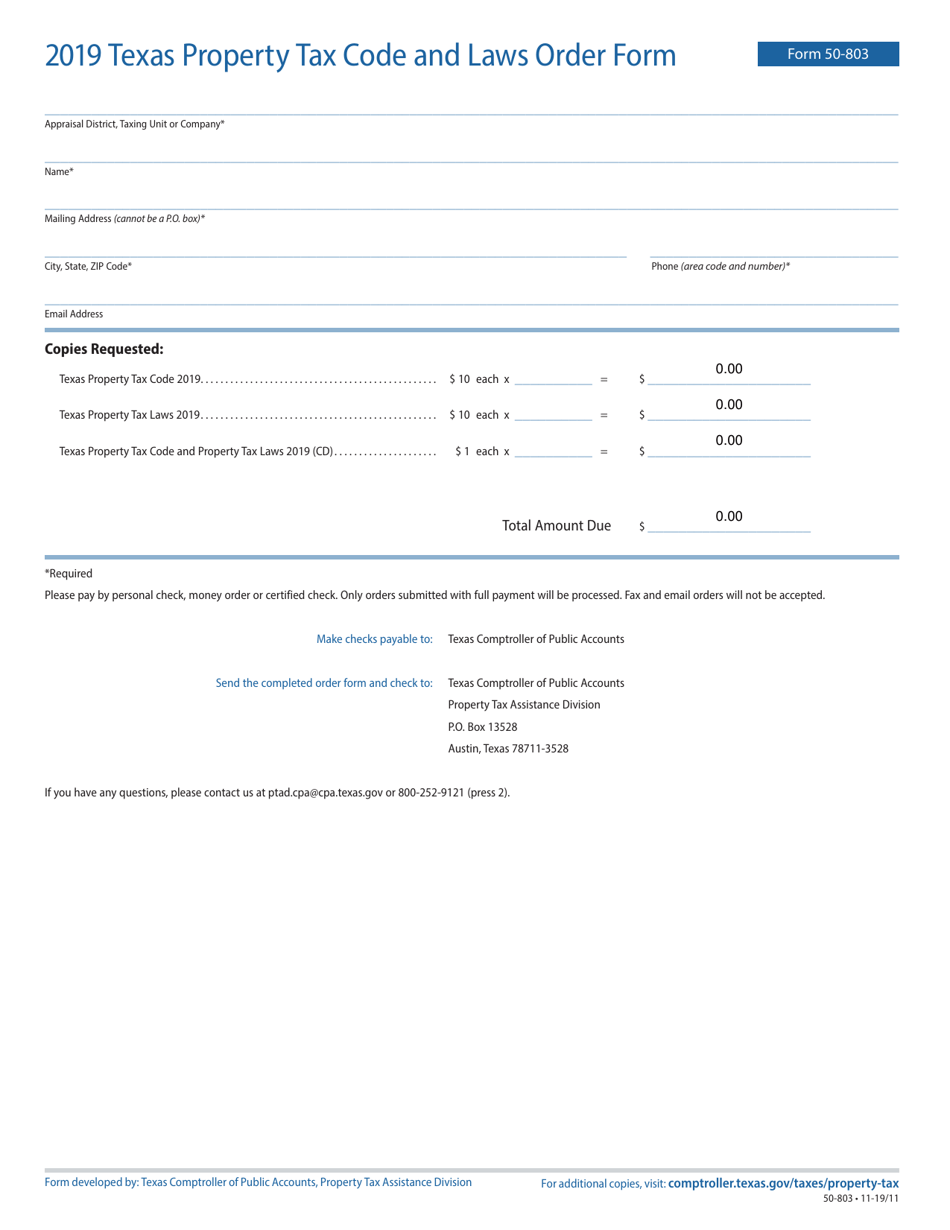

Form 50803 Download Fillable PDF or Fill Online Texas Property Tax

Web pursuant to tax code section 11.431, you may file a late application for a residence homestead exemption, including an exemption under tax code sections 11.131 and. Complete, edit or print tax forms instantly. Complete, edit or print tax forms instantly. Do you live in the property for which you are seeking this residence homestead exemption? Use fill to complete.

2011 Form TX Comptroller 50114 Fill Online, Printable, Fillable, Blank

Easily customize your legal forms. This document must be filed with the. This document must be filed with the appraisal district office in the county in which your property is located. Complete, edit or print tax forms instantly. Instructions for filling out the form are provided in the form itself.

This Document Must Be Filed With The Appraisal District Office In The County In Which Your Property Is Located.

This document must be filed with the. Applying is free and only needs to be filed once. Do not file this document with the office of the texas. Residence homestead exemption application form.

Complete, Edit Or Print Tax Forms Instantly.

Complete, edit or print tax forms instantly. Easily customize your legal forms. Web to qualify for a homestead exemption, an heir property owner must designate on the homestead application form that they are an heir property owner. Web applying is free and only needs to be filed once.

Use The Tips About How To Fill Out The Tx.

Web you must apply with your county appraisal district to apply for a homestead exemption. Use fill to complete blank online others pdf forms for. Instructions for filling out the form are provided in the form itself. The application can be found on your.

Web Pursuant To Tax Code Section 11.431, You May File A Late Application For A Residence Homestead Exemption, Including An Exemption Under Tax Code Sections 11.131 And.

Web pursuant to tax code section 11.431, you may file a late application for a residence homestead exemption, including an exemption under tax code sections 11.131, 11.132. Ad answer simple questions to make legal forms on any device in minutes. Do you live in the property for which you are seeking this residence homestead exemption?