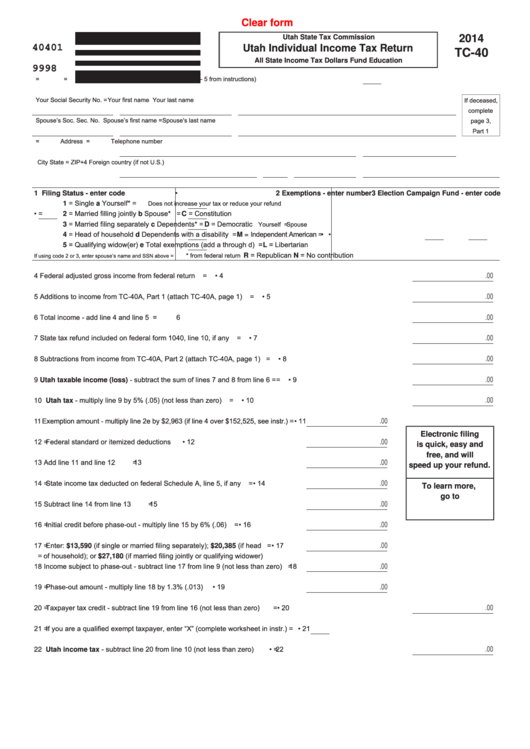

Utah Form Tc 40

Utah Form Tc 40 - Keep a copy with your records. Taxpayer tax credit line 21. Try it for free now! Web attach send the following with your utah return (also keep a copy with your tax records): Who must file a utah return; Do not attach a copy of your federal return. Web most taxpayers are required to file a yearly income tax return in april to both the internal revenue service and their state's revenue department, which will result in either a tax. For more information about the utah income tax, see. Web utah tax line 11. Utah personal exemption line 12.

Column a is for utah income and. Try it for free now! Do not attach a copy of your federal return. Web most taxpayers are required to file a yearly income tax return in april to both the internal revenue service and their state's revenue department, which will result in either a tax. Web utah tax line 11. Taxpayer tax credit line 21. Utah personal exemption line 12. Best tool to create, edit & share pdfs. Who must file a utah return; Keep a copy with your records.

Upload, modify or create forms. Taxpayer tax credit line 21. Who must file a utah return; Do not attach a copy of your federal return. Web attach send the following with your utah return (also keep a copy with your tax records): This form is for income earned in tax year 2022, with tax returns due in april 2023. Web utah tax line 11. For more information about the utah income tax, see. Best tool to create, edit & share pdfs. Column a is for utah income and.

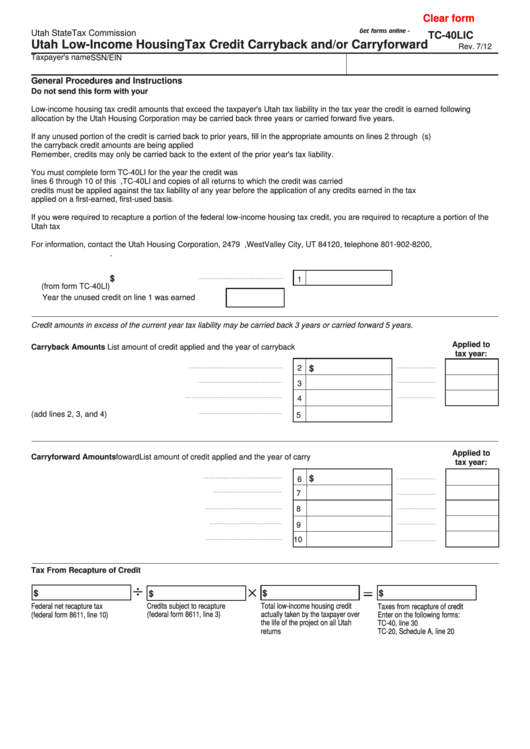

Fillable Form Tc40lic Utah Housing Tax Credit Carryback

Web most taxpayers are required to file a yearly income tax return in april to both the internal revenue service and their state's revenue department, which will result in either a tax. For more information about the utah income tax, see. Upload, modify or create forms. Best tool to create, edit & share pdfs. Taxpayer tax credit line 21.

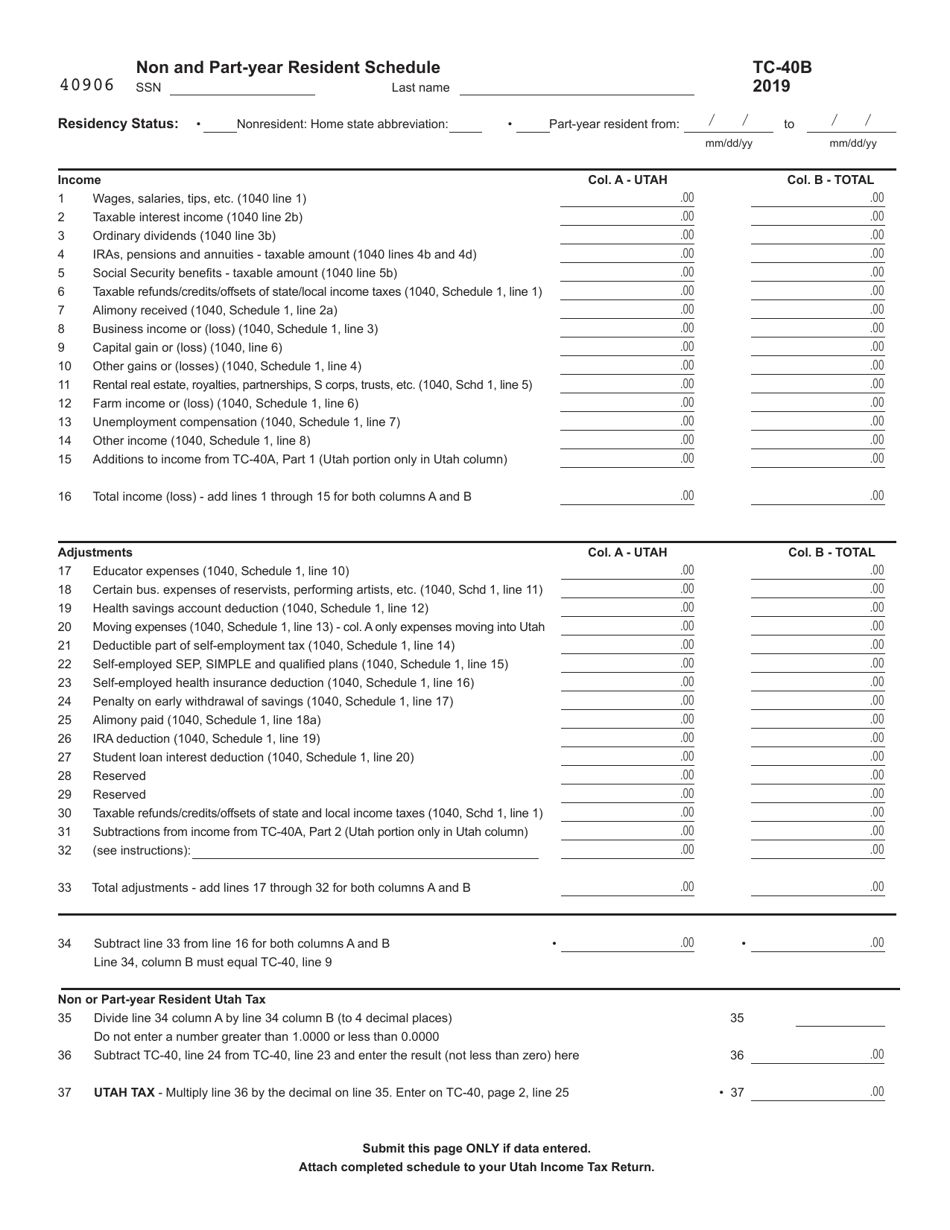

Form TC40B Schedule B Download Fillable PDF or Fill Online Non and

Who must file a utah return; Taxpayer tax credit line 21. Do not attach a copy of your federal return. Best tool to create, edit & share pdfs. This form is for income earned in tax year 2022, with tax returns due in april 2023.

20172022 Form UT USTC TC738 Fill Online, Printable, Fillable, Blank

Web most taxpayers are required to file a yearly income tax return in april to both the internal revenue service and their state's revenue department, which will result in either a tax. Do not attach a copy of your federal return. Web attach send the following with your utah return (also keep a copy with your tax records): Taxpayer tax.

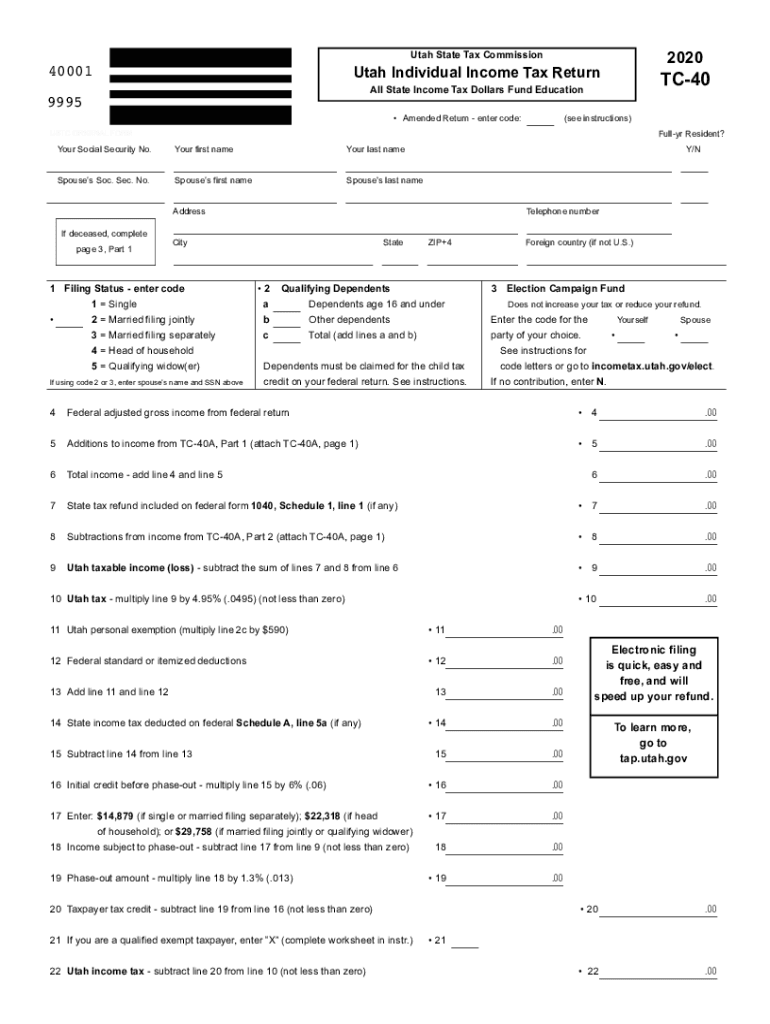

2020 Form UT TC40 Fill Online, Printable, Fillable, Blank pdfFiller

Web attach send the following with your utah return (also keep a copy with your tax records): This form is for income earned in tax year 2022, with tax returns due in april 2023. Keep a copy with your records. Try it for free now! Upload, modify or create forms.

tax.utah.gov forms current tc tc40hd

Web attach send the following with your utah return (also keep a copy with your tax records): This form is for income earned in tax year 2022, with tax returns due in april 2023. Upload, modify or create forms. Do not attach a copy of your federal return. Web utah tax line 11.

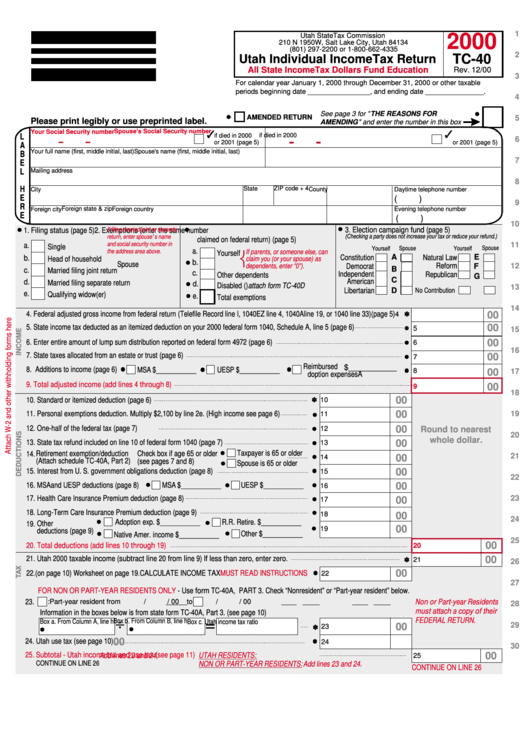

Form Tc40 Utah Individual Tax Return 2000 printable pdf

Upload, modify or create forms. Web utah tax line 11. Try it for free now! This form is for income earned in tax year 2022, with tax returns due in april 2023. Column a is for utah income and.

Fillable Form Tc40 Utah Individual Tax Return printable pdf

Column a is for utah income and. Utah personal exemption line 12. Do not attach a copy of your federal return. Web utah tax line 11. Web attach send the following with your utah return (also keep a copy with your tax records):

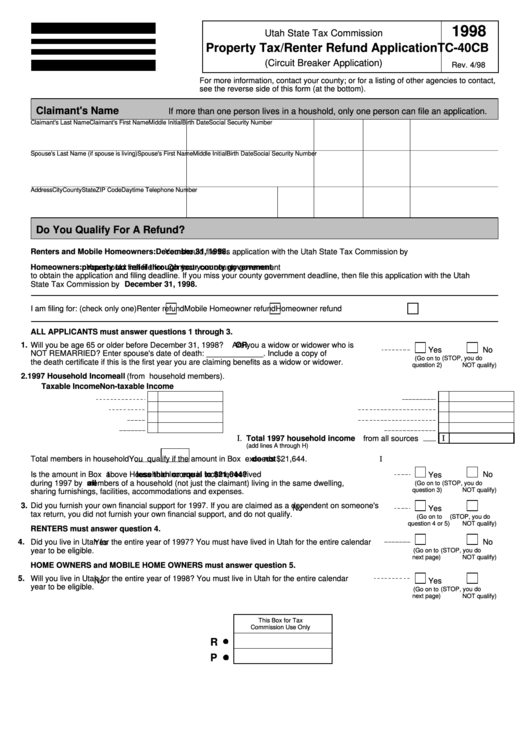

Fillable Form Tc40cb Property Tax/renter Refund Application Utah

This form is for income earned in tax year 2022, with tax returns due in april 2023. Upload, modify or create forms. For more information about the utah income tax, see. Try it for free now! Utah personal exemption line 12.

tax.utah.gov forms current tc tc941r

Web attach send the following with your utah return (also keep a copy with your tax records): This form is for income earned in tax year 2022, with tax returns due in april 2023. Web most taxpayers are required to file a yearly income tax return in april to both the internal revenue service and their state's revenue department, which.

Utah Personal Exemption Line 12.

Do not attach a copy of your federal return. For more information about the utah income tax, see. Web most taxpayers are required to file a yearly income tax return in april to both the internal revenue service and their state's revenue department, which will result in either a tax. Keep a copy with your records.

Best Tool To Create, Edit & Share Pdfs.

Web utah tax line 11. Web attach send the following with your utah return (also keep a copy with your tax records): Who must file a utah return; Upload, modify or create forms.

Ad Vast Library Of Fillable Legal Documents.

Column a is for utah income and. Taxpayer tax credit line 21. Try it for free now! This form is for income earned in tax year 2022, with tax returns due in april 2023.