Vermont State Tax Form

Vermont State Tax Form - Teacher application to purchase service credit; Web the state also collects revenue through vermont sales tax (6.0%) which is imposed on the transaction of certain goods and services, but many cities in vt also charge an additional. Find forms for your industry in minutes. Locate a vital record search and. Streamlined document workflows for any industry. Voter services register to vote and find other useful information. The 2023 property tax credit is based on 2022 household income and. Web instructions vermont income tax forms for current and previous tax years. Waiver of direct deposit form; Voter services register to vote and find other useful information.

Web instructions vermont income tax forms for current and previous tax years. Streamlined document workflows for any industry. Web vermont has a state income tax that ranges between 3.35% and 8.75%, which is administered by the vermont department of taxes. Waiver of direct deposit form; The 2023 property tax credit is based on 2022 household income and. Teacher application to purchase service credit; Web the credit is applied to your property tax and the town issues a bill for any balance due. Web tax forms and instructions april 12, 2023 april 18 vermont personal income tax and homestead declaration due date january 18, 2023 2023 tax filing season opens. Locate a vital record search and. Tax credits earned, applied, expired, and carried forward (if applicable) please note:

Locate a vital record search and. As with the federal deadline extension, vermont. Locate a vital record search and. Voter services register to vote and find other useful information. Tax credits earned, applied, expired, and carried forward (if applicable) please note: Web vermont residents now have until july 15, 2020, to file their state returns and pay any state tax they owe for 2019. Web vermont has a state income tax that ranges between 3.35% and 8.75%, which is administered by the vermont department of taxes. Web the state also collects revenue through vermont sales tax (6.0%) which is imposed on the transaction of certain goods and services, but many cities in vt also charge an additional. Web taxes for individuals file and pay taxes online and find required forms. Voter services register to vote and find other useful information.

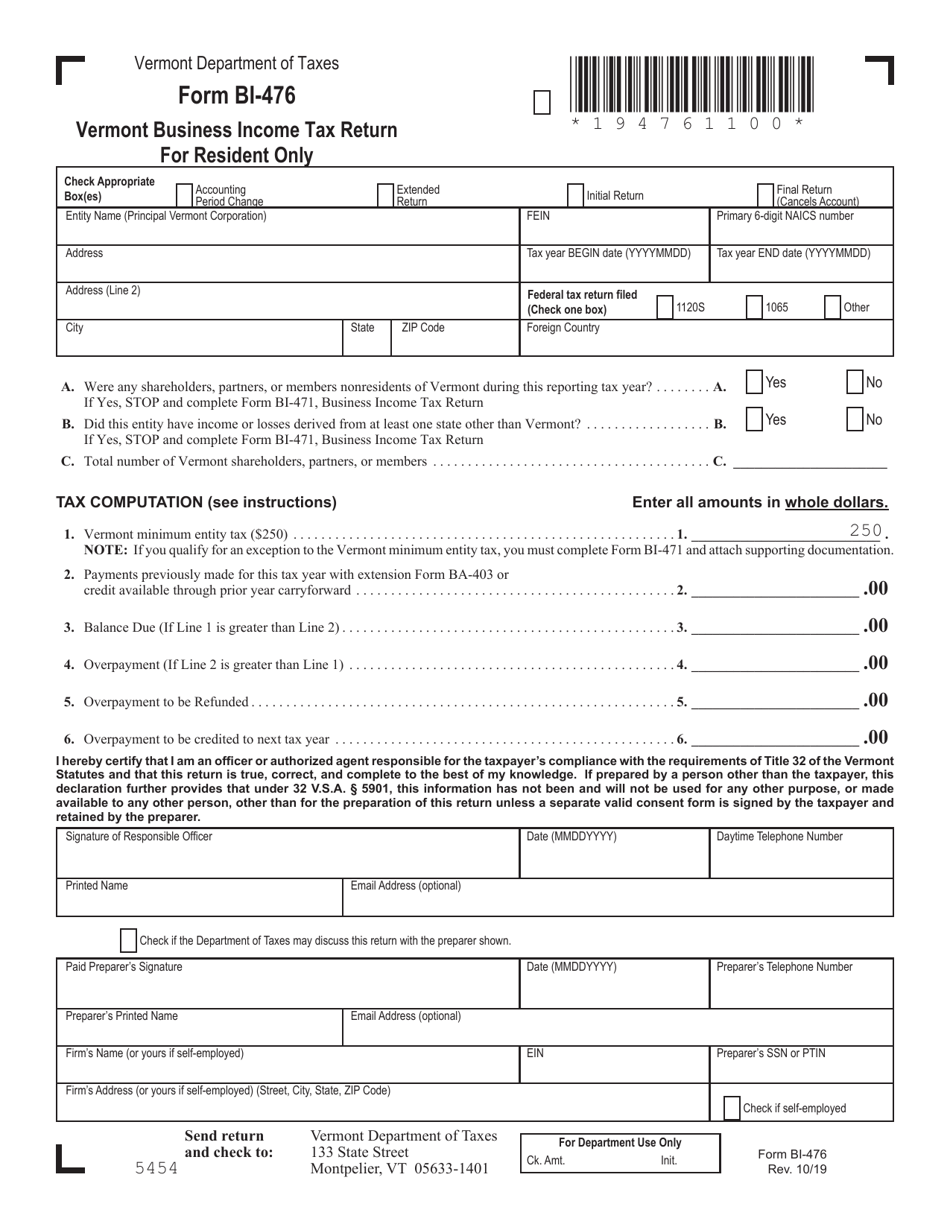

Form BI476 Download Printable PDF or Fill Online Vermont Business

Complete, edit or print tax forms instantly. Find forms for your industry in minutes. Web the credit is applied to your property tax and the town issues a bill for any balance due. Web taxes for individuals file and pay taxes online and find required forms. Web taxes for individuals file and pay taxes online and find required forms.

301 Moved Permanently

As with the federal deadline extension, vermont. Web taxes for individuals file and pay taxes online and find required forms. Tax credits earned, applied, expired, and carried forward (if applicable) please note: Web the state also collects revenue through vermont sales tax (6.0%) which is imposed on the transaction of certain goods and services, but many cities in vt also.

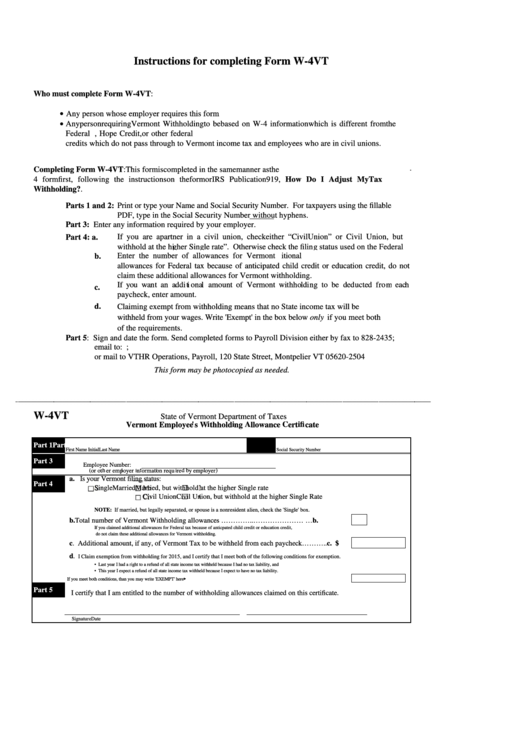

Fillable Form W4vt Vermont Employee'S Withholding Allowance

Web the credit is applied to your property tax and the town issues a bill for any balance due. Web vermont has a state income tax that ranges between 3.35% and 8.75%. Web vermont has a state income tax that ranges between 3.35% and 8.75%, which is administered by the vermont department of taxes. Web the state also collects revenue.

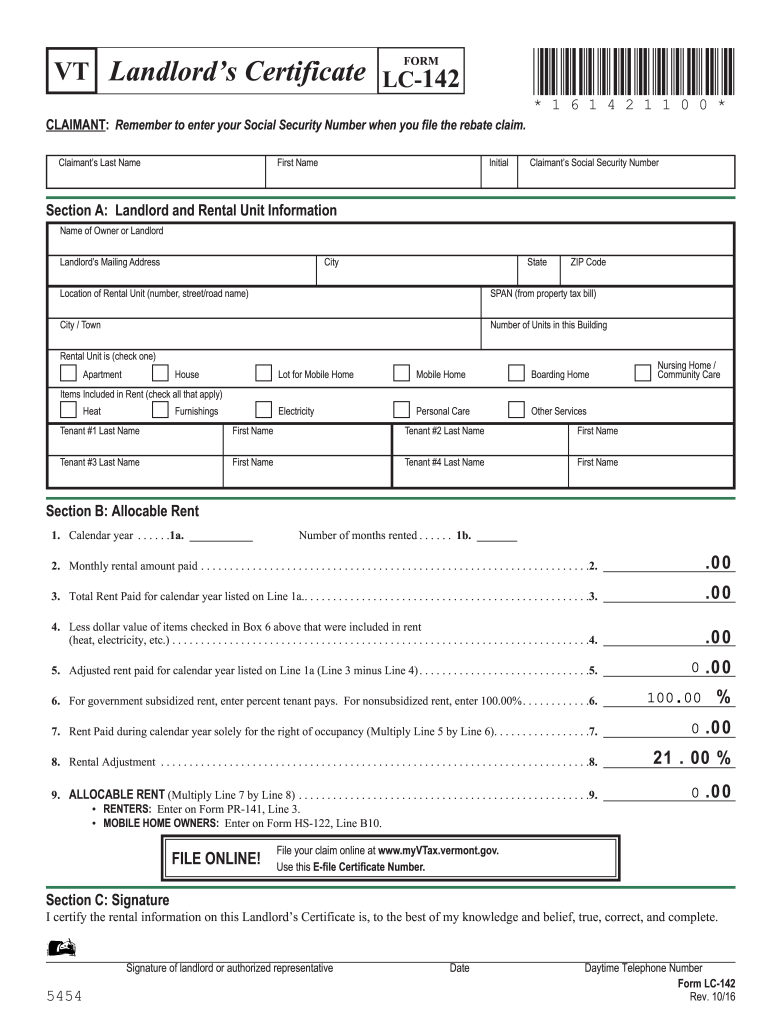

Vermont Landlord Complaint Form Fill Online, Printable, Fillable

Web the state also collects revenue through vermont sales tax (6.0%) which is imposed on the transaction of certain goods and services, but many cities in vt also charge an additional. Locate a vital record search and. Web instructions vermont income tax forms for current and previous tax years. Voter services register to vote and find other useful information. Locate.

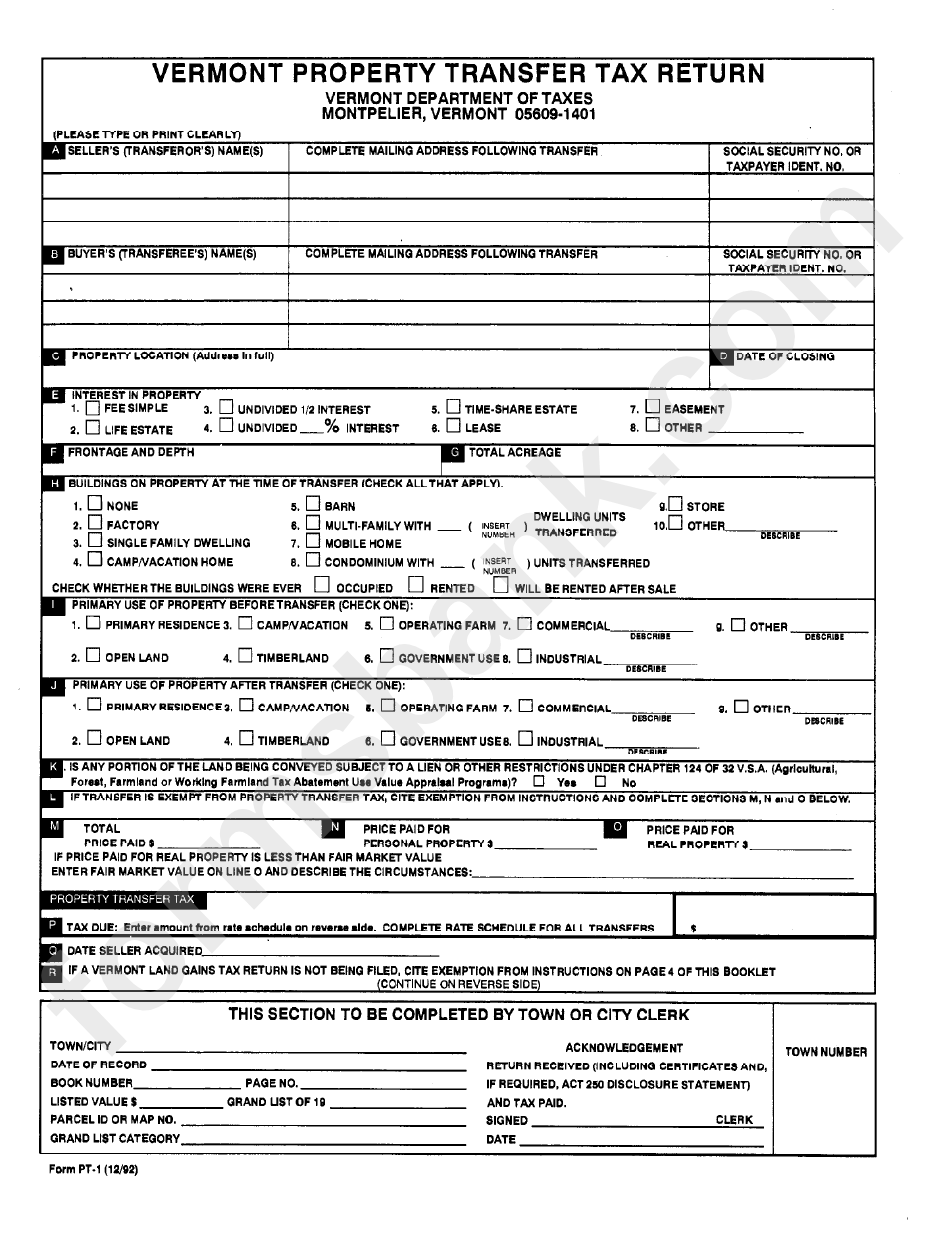

Form Pt1 Vermont Property Transfer Tax Return Department Of Taxes

Find forms for your industry in minutes. Voter services register to vote and find other useful information. Locate a vital record search and. Web instructions vermont income tax forms for current and previous tax years. Locate a vital record search and.

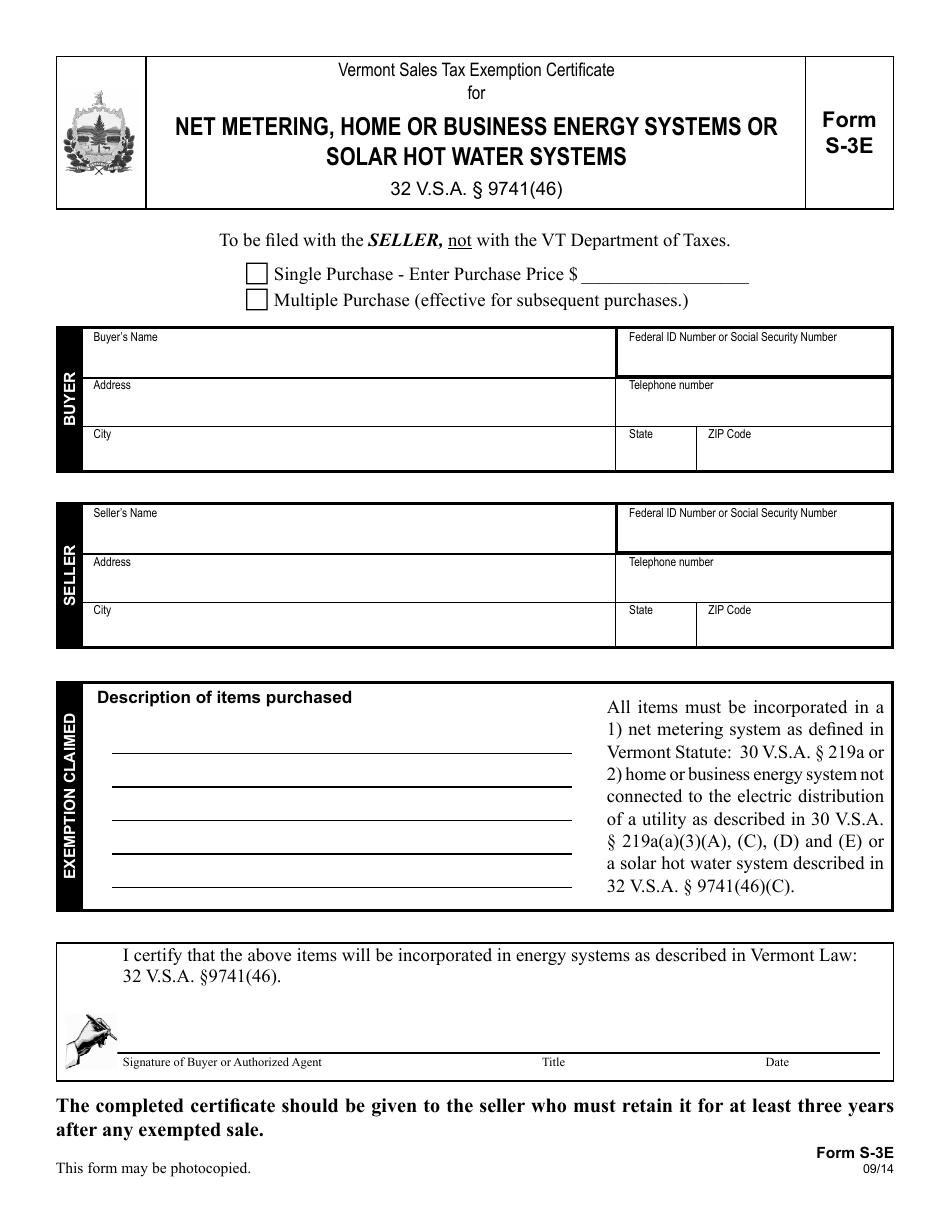

vermont state tax exempt form Trudie Cote

Web taxes for individuals file and pay taxes online and find required forms. Web vermont has a state income tax that ranges between 3.35% and 8.75%. Streamlined document workflows for any industry. Waiver of direct deposit form; Locate a vital record search and.

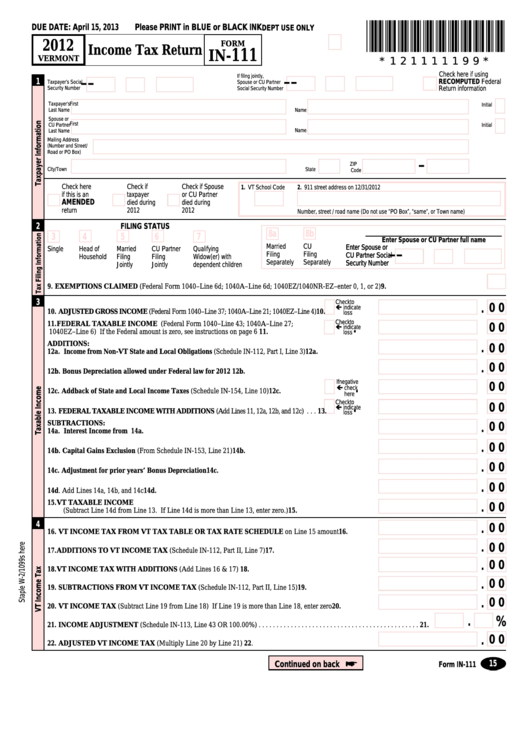

Form In111 Vermont Tax Return 2012 printable pdf download

Find forms for your industry in minutes. Teacher application to purchase service credit; Voter services register to vote and find other useful information. As with the federal deadline extension, vermont. Web taxes for individuals file and pay taxes online and find required forms.

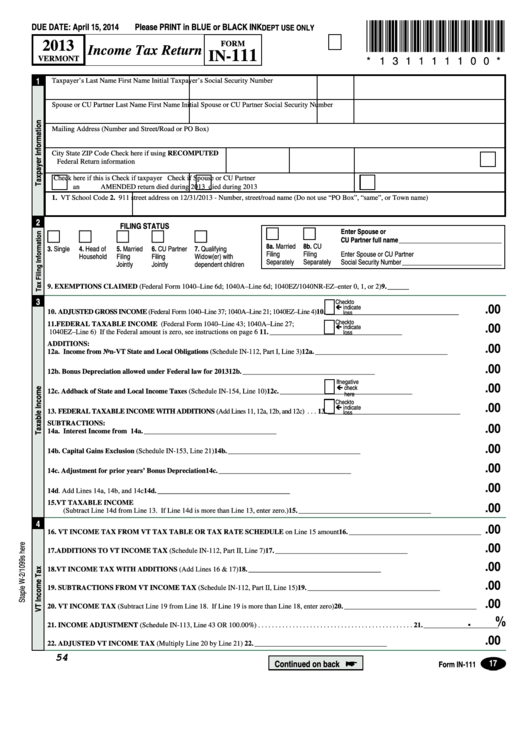

Fillable Form In111 Vermont Tax Return 2013 printable pdf

Web the state also collects revenue through vermont sales tax (6.0%) which is imposed on the transaction of certain goods and services, but many cities in vt also charge an additional. Web vermont has a state income tax that ranges between 3.35% and 8.75%, which is administered by the vermont department of taxes. Teacher application to purchase service credit; Locate.

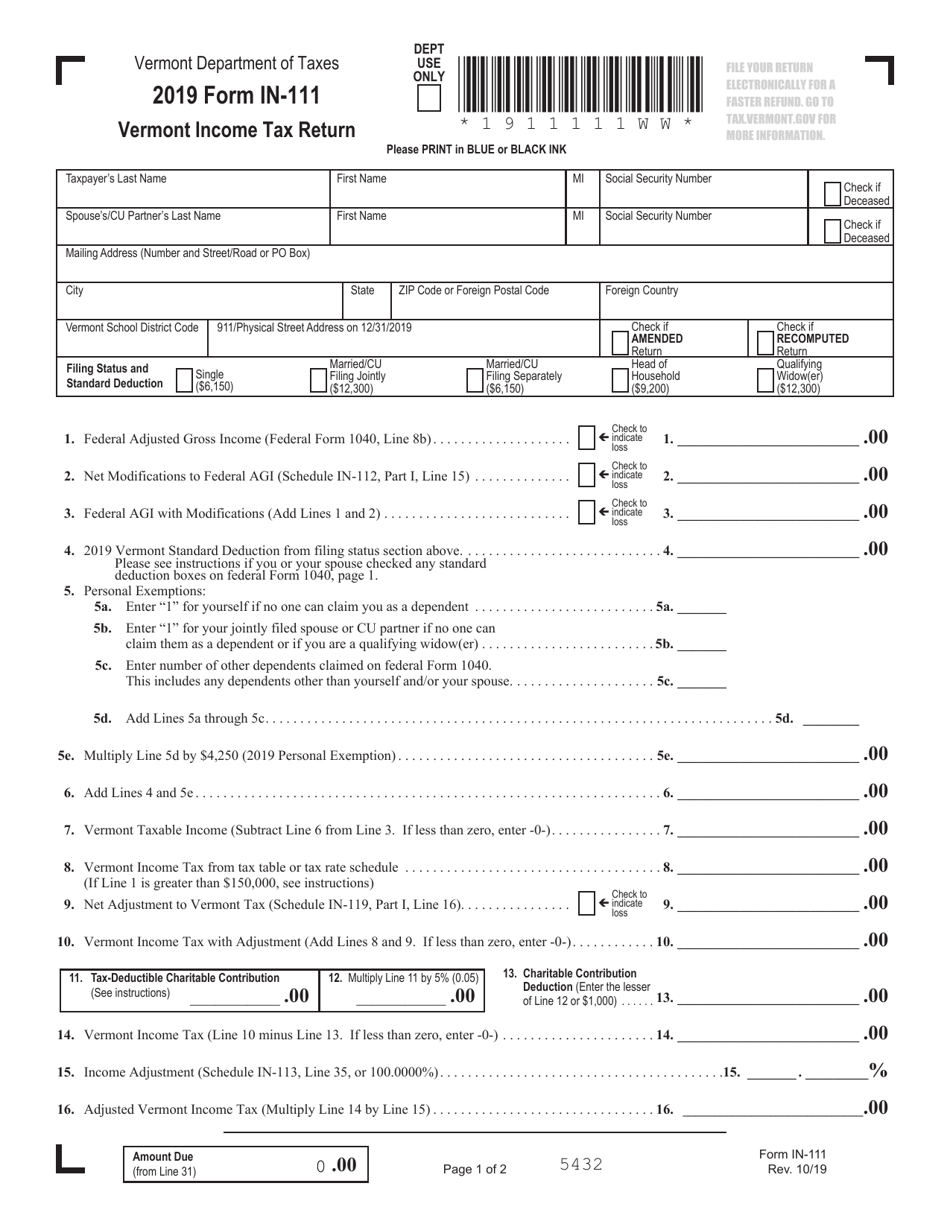

Form IN111 Download Fillable PDF or Fill Online Vermont Tax

Web instructions vermont income tax forms for current and previous tax years. Find forms for your industry in minutes. Web the state also collects revenue through vermont sales tax (6.0%) which is imposed on the transaction of certain goods and services, but many cities in vt also charge an additional. Streamlined document workflows for any industry. As with the federal.

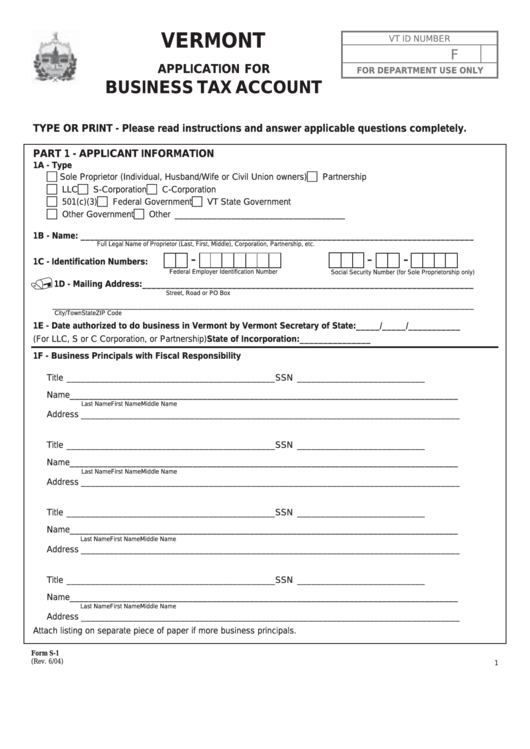

Form S1 Vermont Application For Business Tax Account printable pdf

Waiver of direct deposit form; Tax credits earned, applied, expired, and carried forward (if applicable) please note: Web the credit is applied to your property tax and the town issues a bill for any balance due. Locate a vital record search and. As with the federal deadline extension, vermont.

Locate A Vital Record Search And.

Voter services register to vote and find other useful information. The 2023 property tax credit is based on 2022 household income and. Voter services register to vote and find other useful information. Locate a vital record search and.

Web Taxes For Individuals File And Pay Taxes Online And Find Required Forms.

Web the state also collects revenue through vermont sales tax (6.0%) which is imposed on the transaction of certain goods and services, but many cities in vt also charge an additional. Find forms for your industry in minutes. Teacher application to purchase service credit; Complete, edit or print tax forms instantly.

As With The Federal Deadline Extension, Vermont.

Web taxes for individuals file and pay taxes online and find required forms. Web instructions vermont income tax forms for current and previous tax years. Web tax forms and instructions april 12, 2023 april 18 vermont personal income tax and homestead declaration due date january 18, 2023 2023 tax filing season opens. Web the credit is applied to your property tax and the town issues a bill for any balance due.

Web Vermont Has A State Income Tax That Ranges Between 3.35% And 8.75%, Which Is Administered By The Vermont Department Of Taxes.

Web taxes for individuals file and pay taxes online and find required forms. Web vermont has a state income tax that ranges between 3.35% and 8.75%. Voter services register to vote and find other useful information. Locate a vital record search and.