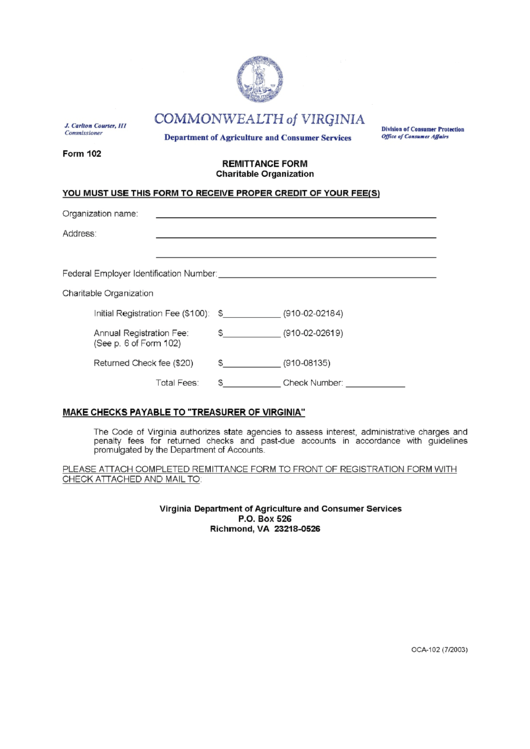

Virginia Form 102

Virginia Form 102 - 9/8/20) quarterly financial report must be filed by any organization realizing any charitable gaming receipts in the quarter. Corporation and pass through entity tax. $ $ % 1) 2) 3) 4) total amount of contributions received directly from the public: This form may be utilized by charitable organizations if. (found on the irs form 990, page 9, part viii, line 1h / 990ez, page 1, part 1, Web of the signed form 102 for your own records. Web use the forms below for periods beginning with 3rd quarter 2022: 04/25/2023) quarterly financial report must be filed by any organization realizing any charitable gaming receipts in the quarter. Web find forms & instructions by category. Web in order to complete vdacs form 102, organizations will need to refer to internal financials to list fundraising and management expenses:

The audit and administration fee percentage for this report is. (found on the irs form 990, page 9, part viii, line 1h / 990ez, page 1, part 1, Web of the signed form 102 for your own records. Web find forms & instructions by category. Web in order to complete vdacs form 102, organizations will need to refer to internal financials to list fundraising and management expenses: $ $ % 1) 2) 3) 4) total amount of contributions received directly from the public: This form may be utilized by charitable organizations if. Web virginia exemption application for charitable or civic organization (form 100) registration statement for a charitable organization (form 102) unified registration statement: 9/8/20) quarterly financial report must be filed by any organization realizing any charitable gaming receipts in the quarter. Web use the forms below for periods beginning with 3rd quarter 2022:

Web in order to complete vdacs form 102, organizations will need to refer to internal financials to list fundraising and management expenses: (found on the irs form 990, page 9, part viii, line 1h / 990ez, page 1, part 1, 04/25/2023) quarterly financial report must be filed by any organization realizing any charitable gaming receipts in the quarter. Web find forms & instructions by category. Web use the forms below for periods beginning with 3rd quarter 2022: This form may be utilized by charitable organizations if. Form & instructions for virginia consumer's use tax return for individuals (use for purchases made on and after july 1, 2023) 762. $ $ % 1) 2) 3) 4) total amount of contributions received directly from the public: Corporation and pass through entity tax. Web of the signed form 102 for your own records.

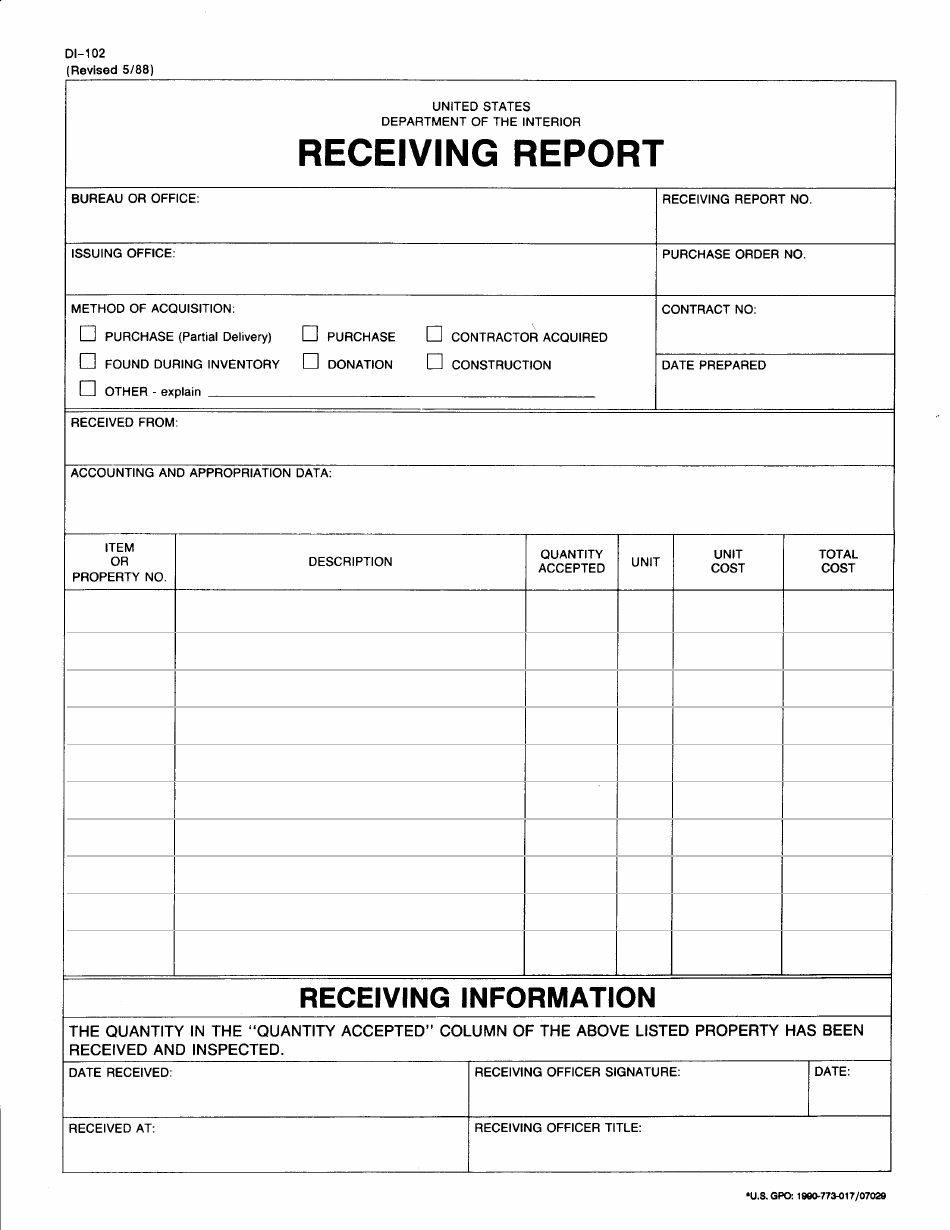

FWS Form DI102 Download Fillable PDF or Fill Online Receiving Report

The audit and administration fee percentage for this report is. $ $ % 1) 2) 3) 4) total amount of contributions received directly from the public: Web find forms & instructions by category. Web in order to complete vdacs form 102, organizations will need to refer to internal financials to list fundraising and management expenses: Web of the signed form.

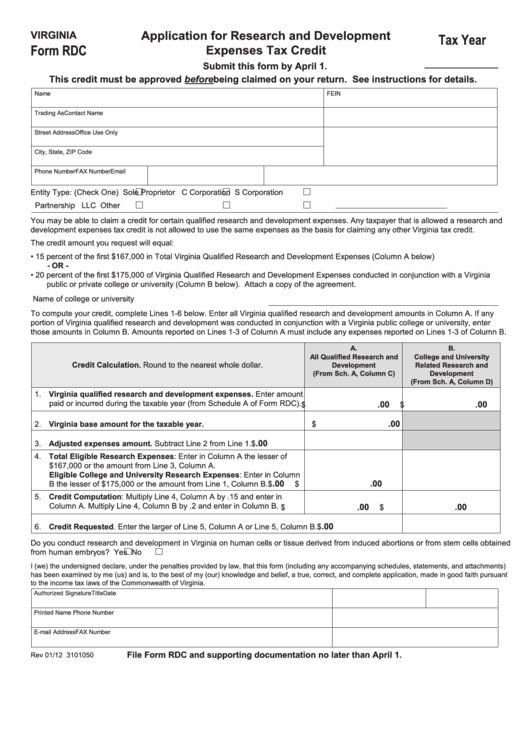

Virginia Form Rdc Application For Research And Development Expenses

Web find forms & instructions by category. Web use the forms below for periods beginning with 3rd quarter 2022: Web in order to complete vdacs form 102, organizations will need to refer to internal financials to list fundraising and management expenses: The audit and administration fee percentage for this report is. Web of the signed form 102 for your own.

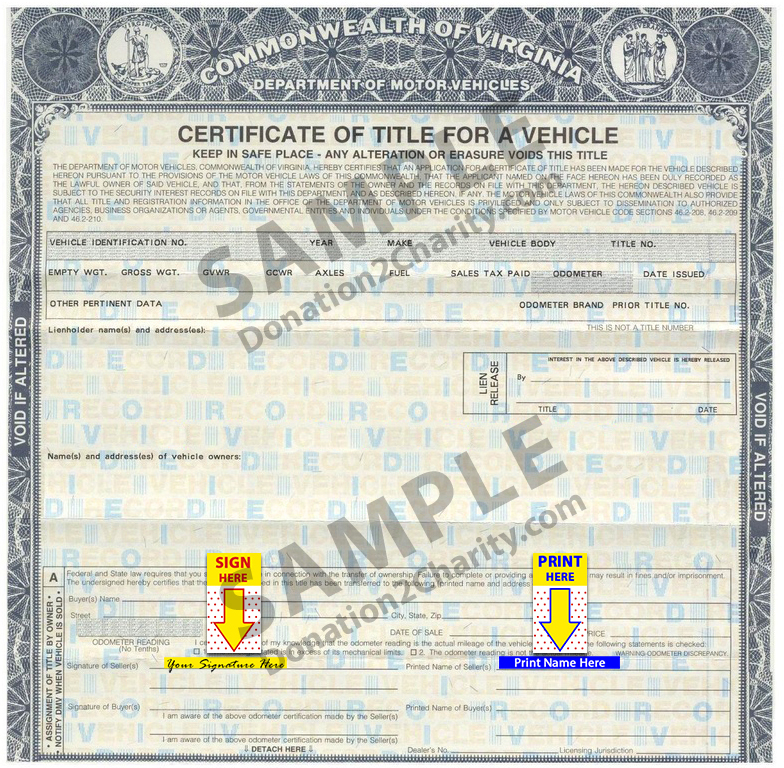

Virginia Donation2Charity

The audit and administration fee percentage for this report is. Web virginia exemption application for charitable or civic organization (form 100) registration statement for a charitable organization (form 102) unified registration statement: Web in order to complete vdacs form 102, organizations will need to refer to internal financials to list fundraising and management expenses: (found on the irs form 990,.

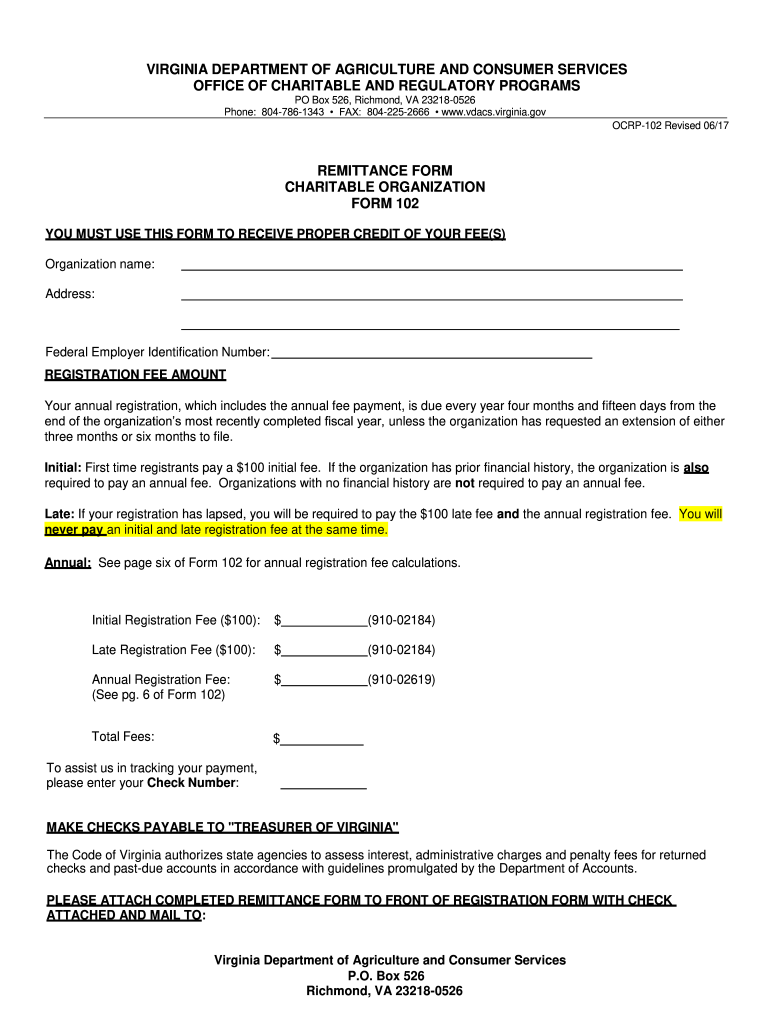

Form 102 Remittance Form Charitable Organization Virginia

Web use the forms below for periods beginning with 3rd quarter 2022: Corporation and pass through entity tax. Web virginia exemption application for charitable or civic organization (form 100) registration statement for a charitable organization (form 102) unified registration statement: Web of the signed form 102 for your own records. (found on the irs form 990, page 9, part viii,.

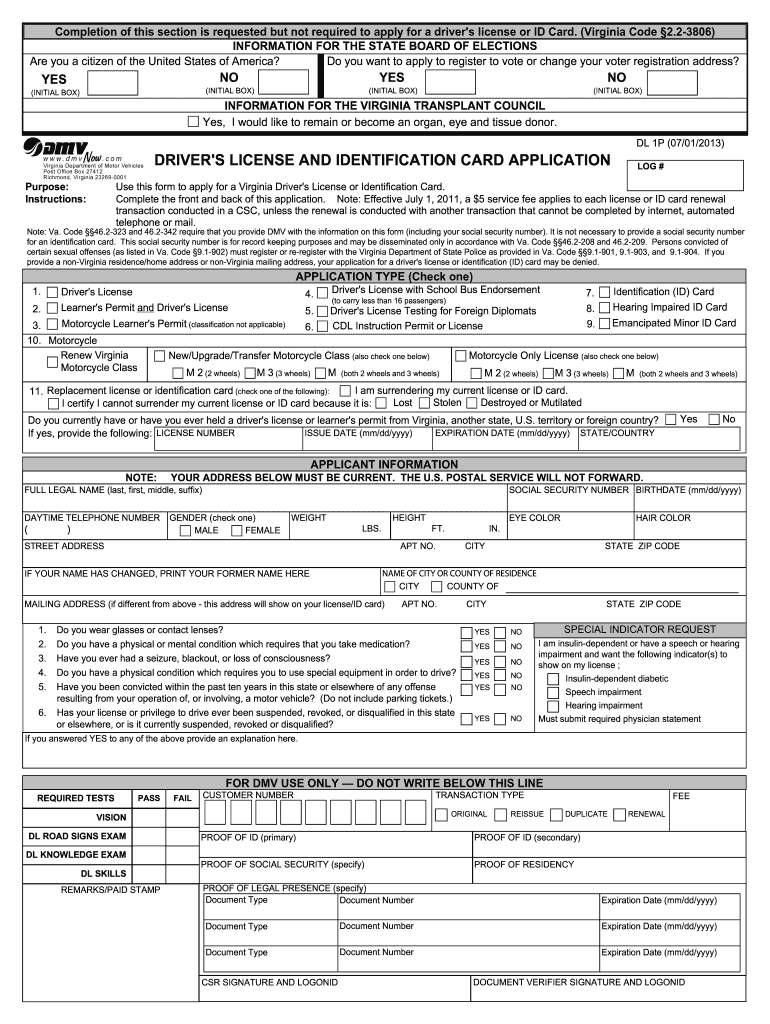

2012 Form VA DL 1P Fill Online, Printable, Fillable, Blank pdfFiller

Form & instructions for virginia consumer's use tax return for individuals (use for purchases made on and after july 1, 2023) 762. Corporation and pass through entity tax. (found on the irs form 990, page 9, part viii, line 1h / 990ez, page 1, part 1, Web in order to complete vdacs form 102, organizations will need to refer to.

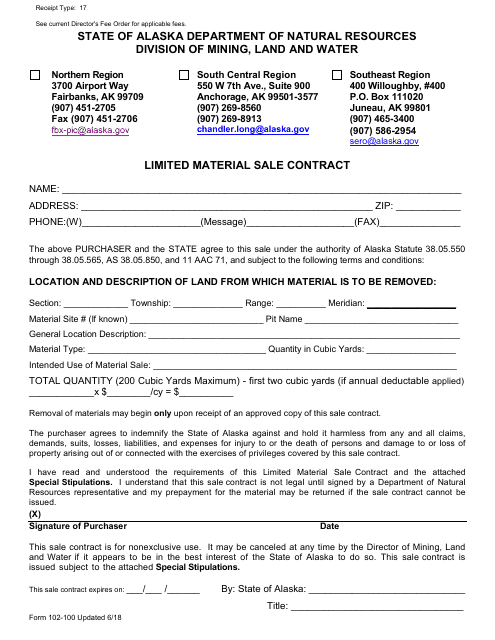

Form 102100 Download Fillable PDF or Fill Online Limited Material Sale

9/8/20) quarterly financial report must be filed by any organization realizing any charitable gaming receipts in the quarter. This form may be utilized by charitable organizations if. Web virginia exemption application for charitable or civic organization (form 100) registration statement for a charitable organization (form 102) unified registration statement: Corporation and pass through entity tax. 04/25/2023) quarterly financial report must.

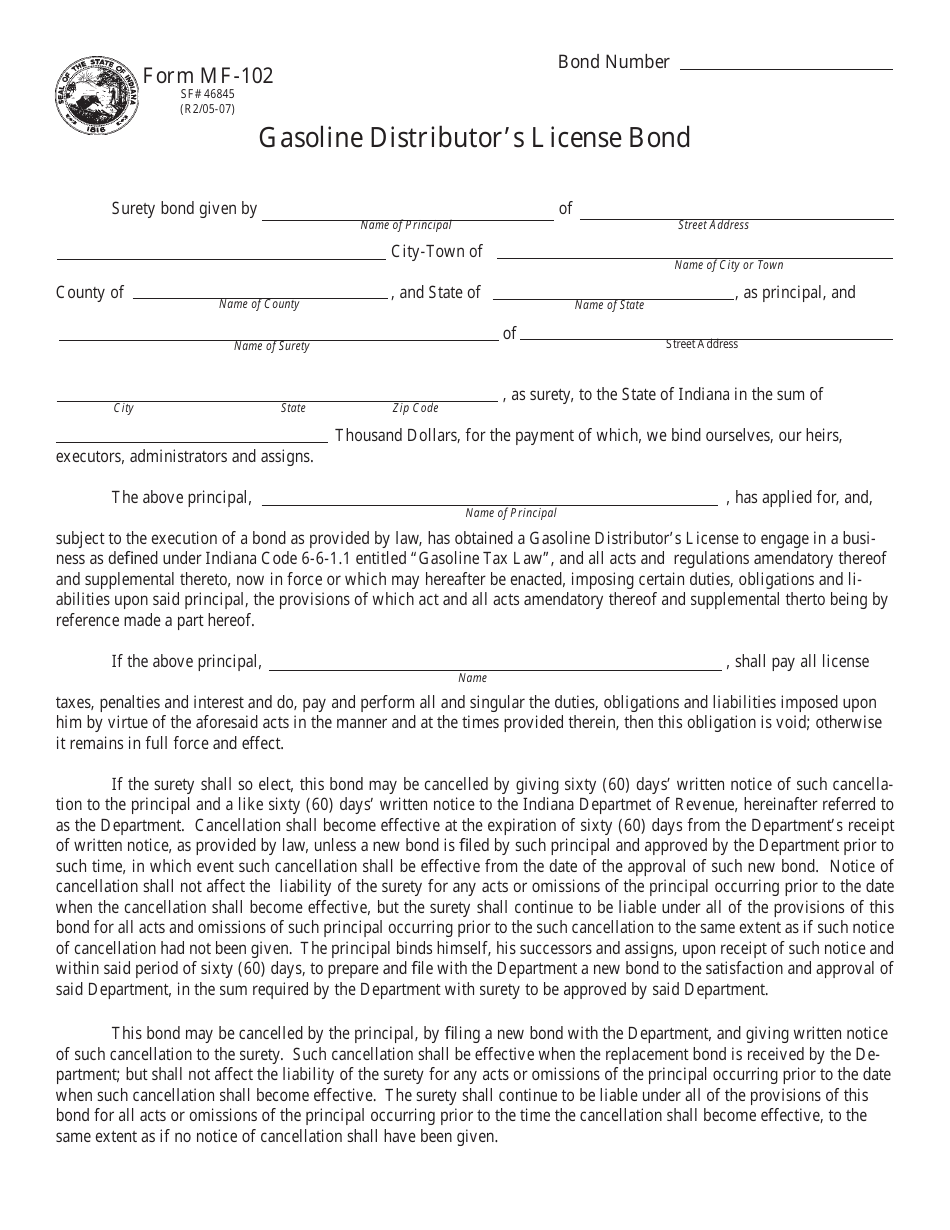

Form MF102 (State Form 46845) Download Fillable PDF or Fill Online

04/25/2023) quarterly financial report must be filed by any organization realizing any charitable gaming receipts in the quarter. Web virginia exemption application for charitable or civic organization (form 100) registration statement for a charitable organization (form 102) unified registration statement: Web find forms & instructions by category. $ $ % 1) 2) 3) 4) total amount of contributions received directly.

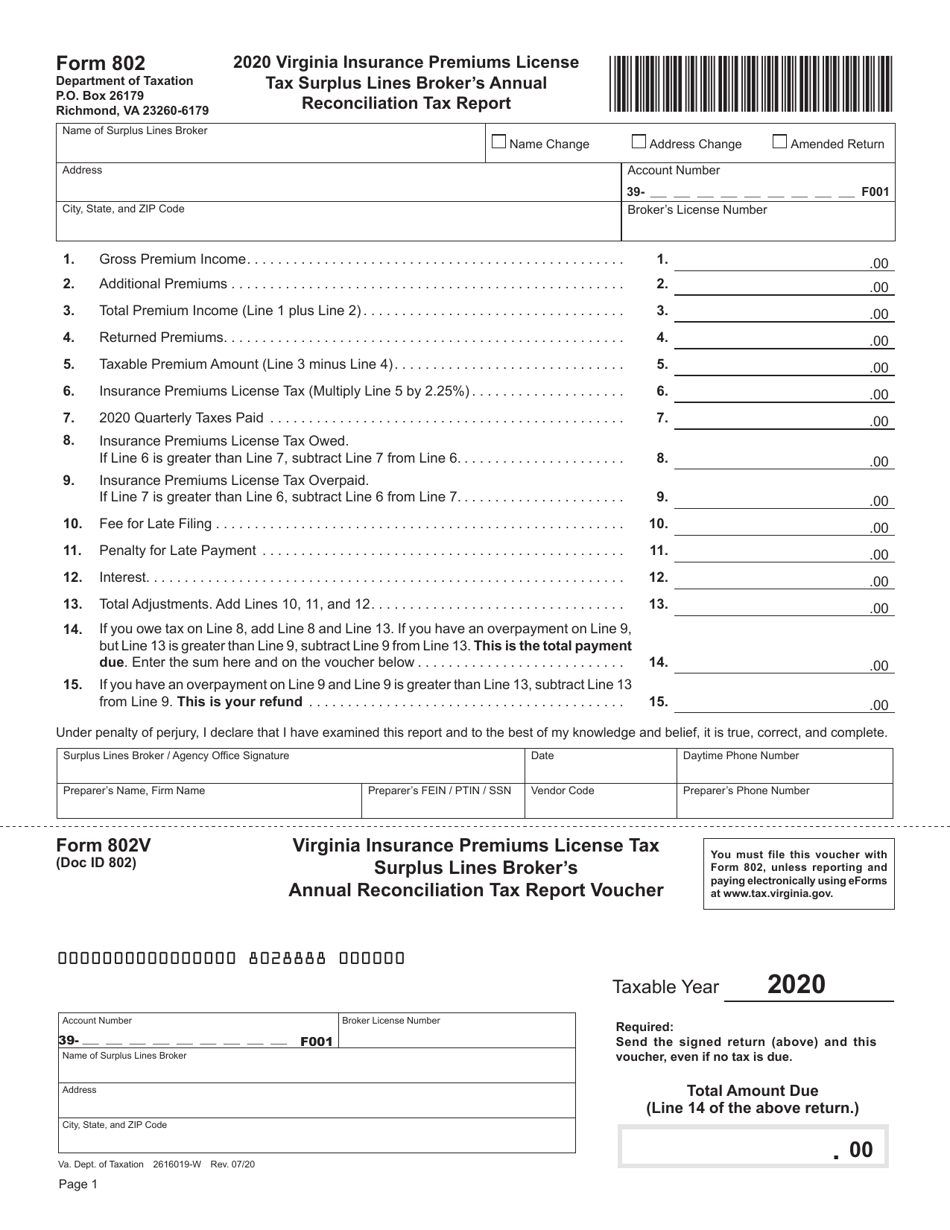

Form 802 Download Fillable PDF or Fill Online Virginia Insurance

04/25/2023) quarterly financial report must be filed by any organization realizing any charitable gaming receipts in the quarter. Web in order to complete vdacs form 102, organizations will need to refer to internal financials to list fundraising and management expenses: Web virginia exemption application for charitable or civic organization (form 100) registration statement for a charitable organization (form 102) unified.

2017 Form VA OCRP102 Fill Online, Printable, Fillable, Blank pdfFiller

Web of the signed form 102 for your own records. 04/25/2023) quarterly financial report must be filed by any organization realizing any charitable gaming receipts in the quarter. $ $ % 1) 2) 3) 4) total amount of contributions received directly from the public: 9/8/20) quarterly financial report must be filed by any organization realizing any charitable gaming receipts in.

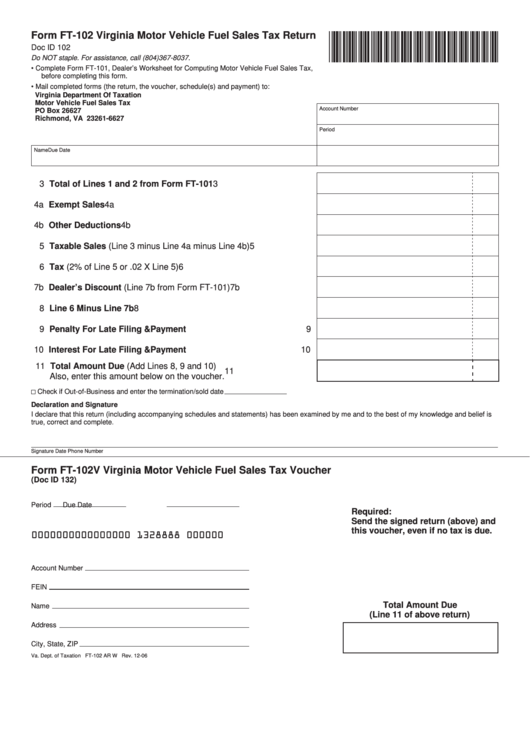

Fillable Form Ft102 Virginia Motor Vehicle Fuel Sales Tax Return

The audit and administration fee percentage for this report is. Form & instructions for virginia consumer's use tax return for individuals (use for purchases made on and after july 1, 2023) 762. (found on the irs form 990, page 9, part viii, line 1h / 990ez, page 1, part 1, Corporation and pass through entity tax. 04/25/2023) quarterly financial report.

Web Use The Forms Below For Periods Beginning With 3Rd Quarter 2022:

Web in order to complete vdacs form 102, organizations will need to refer to internal financials to list fundraising and management expenses: 04/25/2023) quarterly financial report must be filed by any organization realizing any charitable gaming receipts in the quarter. $ $ % 1) 2) 3) 4) total amount of contributions received directly from the public: Web find forms & instructions by category.

This Form May Be Utilized By Charitable Organizations If.

(found on the irs form 990, page 9, part viii, line 1h / 990ez, page 1, part 1, Web virginia exemption application for charitable or civic organization (form 100) registration statement for a charitable organization (form 102) unified registration statement: Web of the signed form 102 for your own records. Corporation and pass through entity tax.

9/8/20) Quarterly Financial Report Must Be Filed By Any Organization Realizing Any Charitable Gaming Receipts In The Quarter.

Form & instructions for virginia consumer's use tax return for individuals (use for purchases made on and after july 1, 2023) 762. The audit and administration fee percentage for this report is.