What Is A 1310 Form

What Is A 1310 Form - Web use form 1310 to claim a refund on behalf of a deceased taxpayer. Web this information includes name, address, and the social security number of the person who is filing the tax return. Web form 1310 is a tax form used by the internal revenue service (irs) in the united states. Complete, edit or print tax forms instantly. Complete, edit or print tax forms instantly. Only certain people related to the decedent are eligible to make this claim. Web if a refund is due on the individual income tax return of the deceased, claim the refund by submitting form 1310, statement of a person claiming refund due a. Complete, edit or print tax forms instantly. Web if you are claiming a refund on behalf of a deceased taxpayer, you must file form 1310 unless either of the following applies: Web what is the form used for?

Use form 1310 to claim a refund on behalf of a deceased taxpayer. Web we last updated the statement of person claiming refund due a deceased taxpayer in january 2023, so this is the latest version of form 1310, fully updated for tax year 2022. Only certain people related to the decedent are eligible to make this claim. Then you have to provide all other required information in the. Web irs form 1310, statement of person claiming refund due a deceased taxpayer, is used to inform the irs that a taxpayer has passed away and a trust or beneficiary will be. This form is filled out by an individual acting as a decedent’s executor or a surviving. If you are claiming a refund on behalf of a deceased taxpayer, you must file. In today’s post, i’ll answer some common questions about requesting a tax refund. You are a surviving spouse filing an original or. Web usually, there is one decedent’s name.

Complete, edit or print tax forms instantly. Web what is the form used for? Web form 1310 is a tax form used by the internal revenue service (irs) in the united states. Then you have to provide all other required information in the. Web in order to claim a federal tax refund for a deceased person, you may need to file form 1310. Web form 1310 to the internal revenue service center designated for the address shown on form 1310 above. This form is filled out by an individual acting as a decedent’s executor or a surviving. See the instructions for the original return for the address. In the case that the refund is for a joint return, and both taxpayers are deceased, then you would: Is the form supported in our program?

Irs Form 1310 Printable Master of Documents

In today’s post, i’ll answer some common questions about requesting a tax refund. Get ready for tax season deadlines by completing any required tax forms today. Web irs form 1310 allows you to claim a refund due on behalf of a deceased taxpayer. Web yes, you can file irs form 1310 in turbotax to claim the tax refund for a.

Irs Form 1310 Printable Master of Documents

If you are claiming a refund on behalf of a deceased taxpayer, you must file. Web what is the form used for? Web form 1310 to the internal revenue service center designated for the address shown on form 1310 above. In the case that the refund is for a joint return, and both taxpayers are deceased, then you would: Is.

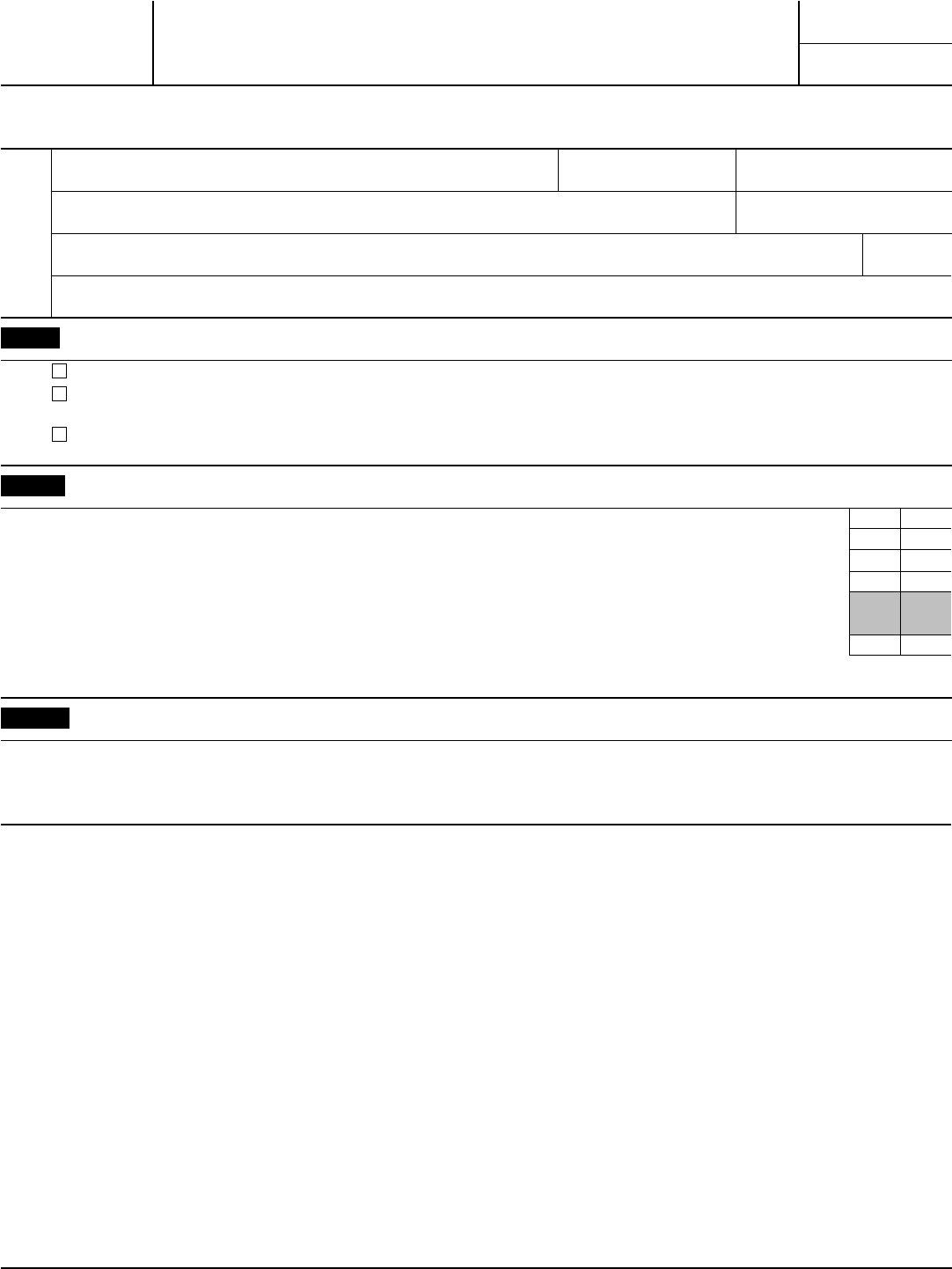

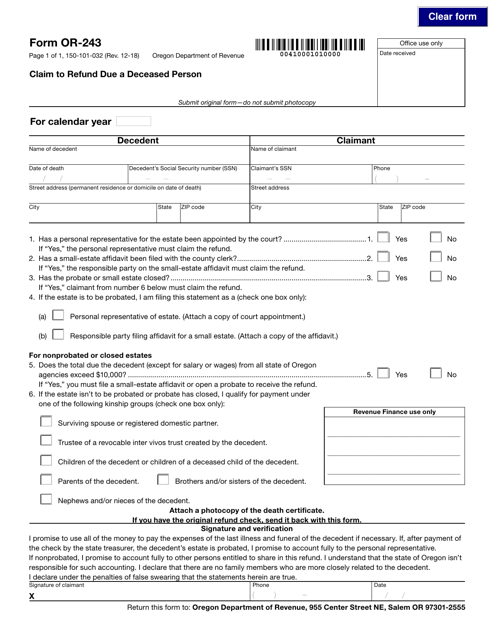

Fillable Form Mi1310 Claim For Refund Due A Deceased Taxpayer

Only certain people related to the decedent are eligible to make this claim. Complete, edit or print tax forms instantly. Web in order to claim a federal tax refund for a deceased person, you may need to file form 1310. Web overview you must file a tax return for an individual who died during the tax year if: Use form.

Scpa 1310 Affidavit Form

Use form 1310 to claim a refund on behalf of a deceased taxpayer. Web form 1310 is a tax form used by the internal revenue service (irs) in the united states. In the case that the refund is for a joint return, and both taxpayers are deceased, then you would: You are a surviving spouse filing an original or. Web.

Form 1310 Statement of Person Claiming Refund Due a Deceased Taxpayer

In today’s post, i’ll answer some common questions about requesting a tax refund. Web we last updated the statement of person claiming refund due a deceased taxpayer in january 2023, so this is the latest version of form 1310, fully updated for tax year 2022. A return is normally required the decedent did not file prior year return (s) the.

Form 1310 Definition

Web use form 1310 to claim a refund on behalf of a deceased taxpayer. Complete, edit or print tax forms instantly. Web in order to claim a federal tax refund for a deceased person, you may need to file form 1310. If you are claiming a refund on behalf of a deceased taxpayer, you must file form 1310 unless either.

Irs Form 1310 Printable 2020 2021 Blank Sample to Fill out Online

Web irs form 1310 allows you to claim a refund due on behalf of a deceased taxpayer. You are a surviving spouse filing an original or. Complete, edit or print tax forms instantly. See the instructions for the original return for the address. In today’s post, i’ll answer some common questions about requesting a tax refund.

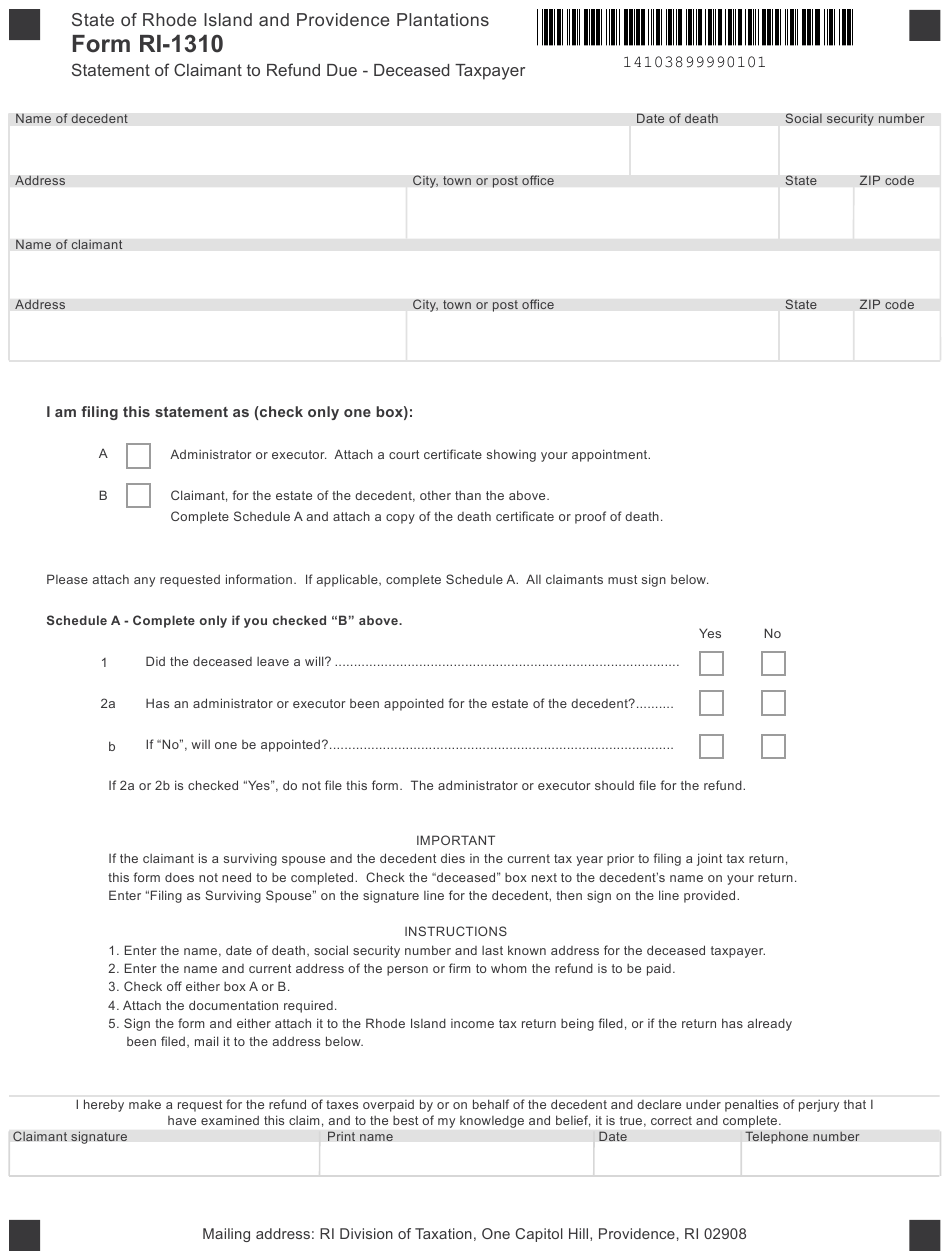

Form RI1310 Download Fillable PDF or Fill Online Statement of Claimant

See the instructions for the original return for the address. In today’s post, i’ll answer some common questions about requesting a tax refund. In the case that the refund is for a joint return, and both taxpayers are deceased, then you would: Complete, edit or print tax forms instantly. A return is normally required the decedent did not file prior.

Form 1310 Edit, Fill, Sign Online Handypdf

The 1310 form is supported in the 1040. Web irs form 1310 allows you to claim a refund due on behalf of a deceased taxpayer. Complete, edit or print tax forms instantly. Web what is the form used for? A return is normally required the decedent did not file prior year return (s) the administrator,.

Fillable Form 1310 Statement Of Person Claiming Refund Due A Deceased

Use form 1310 to claim a refund on behalf of a deceased taxpayer. You are a surviving spouse filing an original or. The 1310 form is supported in the 1040. In the case that the refund is for a joint return, and both taxpayers are deceased, then you would: A return is normally required the decedent did not file prior.

Complete, Edit Or Print Tax Forms Instantly.

Web form 1310 to the internal revenue service center designated for the address shown on form 1310 above. Web this information includes name, address, and the social security number of the person who is filing the tax return. Web if you are claiming a refund on behalf of a deceased taxpayer, you must file form 1310 unless either of the following applies: Only certain people related to the decedent are eligible to make this claim.

Web Form 1310 Can Be Used By A Deceased Taxpayer's Personal Representative, Surviving Spouse, Or Anyone Who Is In Charge Of The Decedent's Property In Order To Claim A.

Web irs form 1310, statement of person claiming refund due a deceased taxpayer, is used to inform the irs that a taxpayer has passed away and a trust or beneficiary will be. Generally, a person who is filing a return for a decedent and claiming a refund must file form 1310 statement of person claiming. Then you have to provide all other required information in the. If you are claiming a refund on behalf of a deceased taxpayer, you must file.

In The Case That The Refund Is For A Joint Return, And Both Taxpayers Are Deceased, Then You Would:

Web usually, there is one decedent’s name. This form is filled out by an individual acting as a decedent’s executor or a surviving. Web what is the form used for? A return is normally required the decedent did not file prior year return (s) the administrator,.

You Are A Surviving Spouse Filing An Original Or.

Web in order to claim a federal tax refund for a deceased person, you may need to file form 1310. Complete, edit or print tax forms instantly. Web we last updated the statement of person claiming refund due a deceased taxpayer in january 2023, so this is the latest version of form 1310, fully updated for tax year 2022. Use form 1310 to claim a refund on behalf of a deceased taxpayer.

:max_bytes(150000):strip_icc()/1310-RefundClaimDuetoDeceasedTaxpayer-1-292bd14843c94bf4abf09ea5d6eb9a4b.png)