What Is Form 7203 Used For

What Is Form 7203 Used For - Web up to 10% cash back draft form 7203 for 2022 includes few changes. Use form 7203 to figure potential limitations of your share of the s corporation's deductions, credits, and other items that can be deducted on your. Web starting in tax year 2021, form 7203 replaces the shareholder's basis worksheet (worksheet for figuring a shareholder’s stock and debt basis) in the 1040 return. Web abraham finberg tax tips form 7203 is a new form developed by irs to replace the shareholder’s stock and debt basis worksheet that has previously been. Web purpose of form. Attach to your tax return. This includes their name, address, employer identification number (ein),. Basis from any capital contributions made or additional stock. Web form 7203 is used to calculate any limits on the deductions you can take for your share of an s corporation's deductions, credits, and other items. Web using form 7203, john can track the basis of each stock block separately directly on his income tax return.

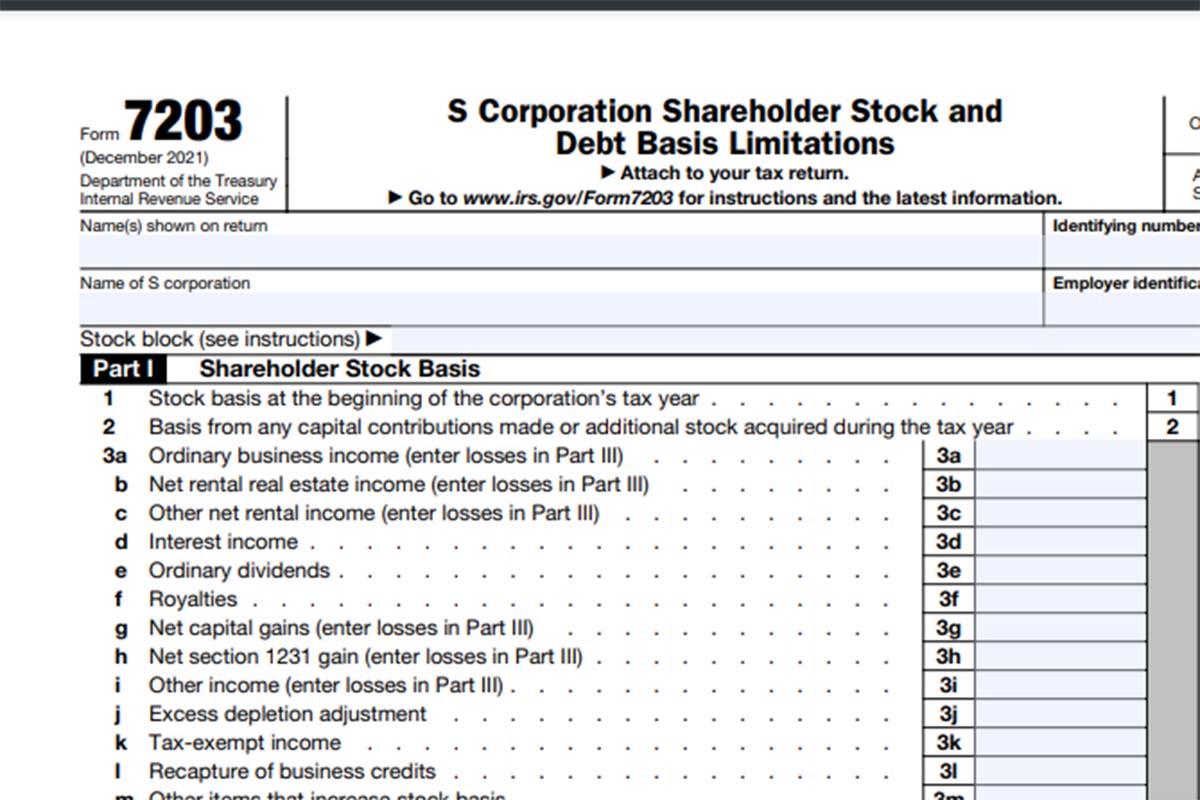

Web purpose of form. Web form 7203 (december 2021) department of the treasury internal revenue service. Web s corporation shareholders use form 7203 to calculate their stock and debt basis. S corporation shareholder stock and debt basis limitations. Stock basis at the beginning of the corporation’s tax year. Web form 7203 is used to calculate any limits on the deductions you can take for your share of an s corporation's deductions, credits, and other items. Web purpose of form use form 7203 to figure potential limitations of your share of the s corporation's deductions, credits, and other items that can be deducted on your return. Web up to 10% cash back draft form 7203 for 2022 includes few changes. Web purpose of form use form 7203 to figure potential limitations of your share of the s corporation's deductions, credits, and other items that can be deducted on your. In 2022, john decides to sell 50 shares of company a stock.

Web form 7203 (december 2021) department of the treasury internal revenue service. The irs changes for s corporations form 7203 was developed to replace the worksheet for figuring a shareholder’s stock and debt basis that was formerly found in. In 2022, john decides to sell 50 shares of company a stock. Web s corporation shareholders use form 7203 to calculate their stock and debt basis. Web up to 10% cash back draft form 7203 for 2022 includes few changes. S corporation shareholder stock and debt basis limitations. Web purpose of form. Use form 7203 to figure potential limitations of your share of the s corporation's deductions, credits, and other items that can be deducted on your. Web form 7203 is used to figure potential limitations of a shareholder's share of an s corporation's deductions, credits, etc. Web using form 7203, john can track the basis of each stock block separately directly on his income tax return.

IRS Issues New Form 7203 for Farmers and Fishermen

This includes their name, address, employer identification number (ein),. The draft form 7203 for tax year 2022 makes only two changes to the 2021 form: Web starting with the 2021 tax year, a new form 7203 replaces the supplemental worksheet for figuring a shareholder’s stock and debt basis. Web form 7203 (december 2021) department of the treasury internal revenue service..

More Basis Disclosures This Year for S corporation Shareholders Need

Use form 7203 to figure potential limitations of your share of the s corporation's deductions, credits, and other items that can be deducted on your. Web form 7203 is used to figure potential limitations of a shareholder's share of an s corporation's deductions, credits, etc. Web purpose of form. Web up to 10% cash back draft form 7203 for 2022.

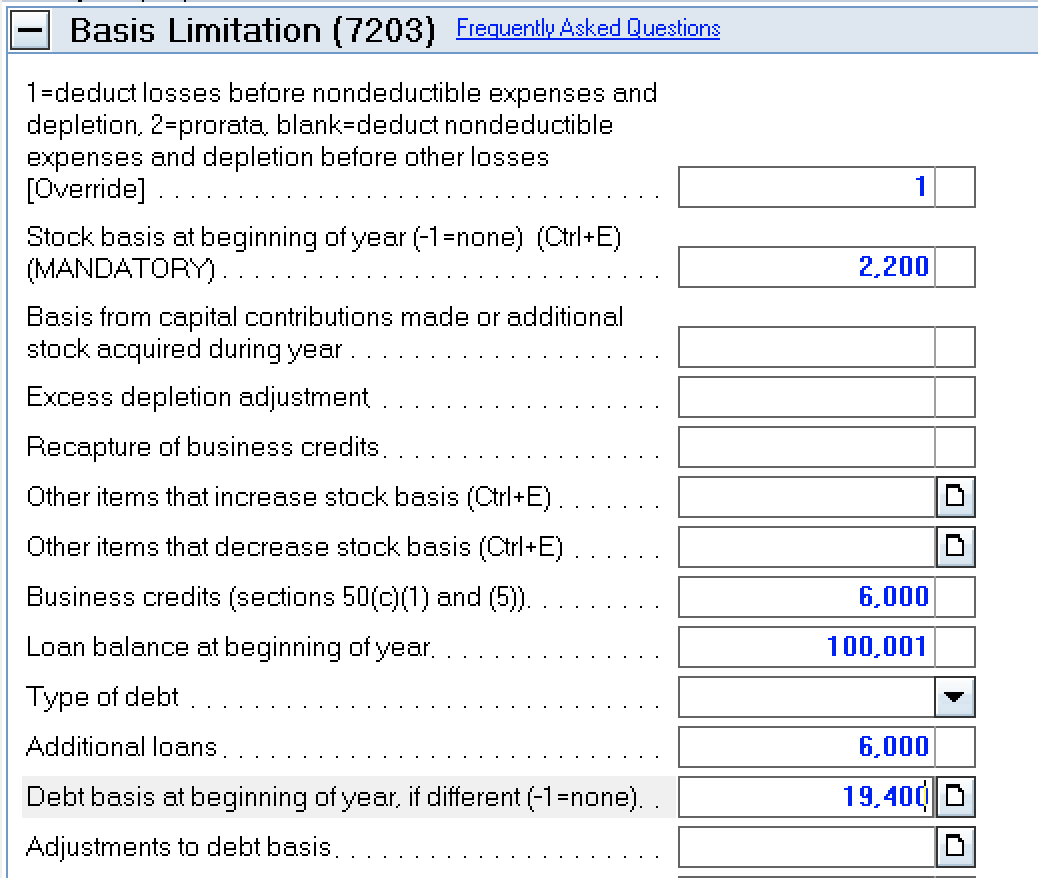

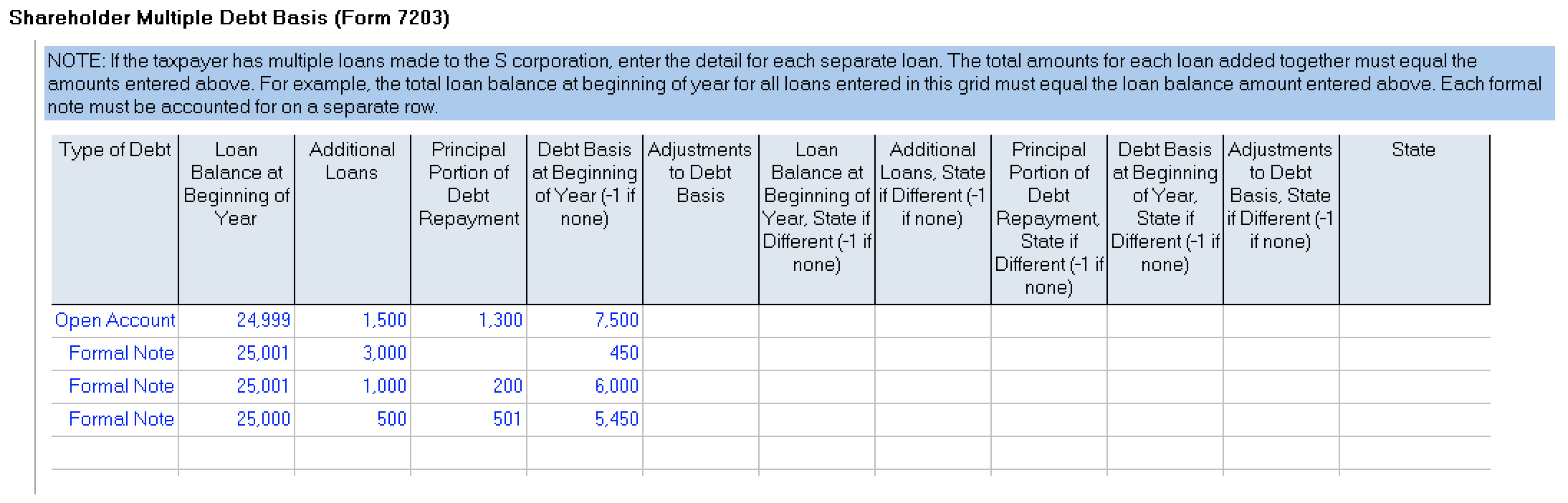

How to complete Form 7203 in Lacerte

Web starting in tax year 2021, form 7203 replaces the shareholder's basis worksheet (worksheet for figuring a shareholder’s stock and debt basis) in the 1040 return. Web s corporation shareholders use form 7203 to calculate their stock and debt basis. In 2022, john decides to sell 50 shares of company a stock. Attach to your tax return. Web form 7203.

National Association of Tax Professionals Blog

Web form 7203 (december 2021) department of the treasury internal revenue service. Web starting in tax year 2021, form 7203 replaces the shareholder's basis worksheet (worksheet for figuring a shareholder’s stock and debt basis) in the 1040 return. Attach to your tax return. Web purpose of form. Web form 7203 is used to figure potential limitations of a shareholder's share.

Peerless Turbotax Profit And Loss Statement Cvp

Web purpose of form. Web purpose of form use form 7203 to figure potential limitations of your share of the s corporation's deductions, credits, and other items that can be deducted on your return. Web starting with the 2021 tax year, a new form 7203 replaces the supplemental worksheet for figuring a shareholder’s stock and debt basis. Web starting in.

National Association of Tax Professionals Blog

Attach to your tax return. View solution in original post february 23,. The draft form 7203 for tax year 2022 makes only two changes to the 2021 form: In 2022, john decides to sell 50 shares of company a stock. Web starting with the 2021 tax year, a new form 7203 replaces the supplemental worksheet for figuring a shareholder’s stock.

Formal Draft of Proposed Form 7203 to Report S Corporation Stock and

Attach to your tax return. Web s corporation shareholders use form 7203 to calculate their stock and debt basis. Web starting in tax year 2021, form 7203 replaces the shareholder's basis worksheet (worksheet for figuring a shareholder’s stock and debt basis) in the 1040 return. In 2022, john decides to sell 50 shares of company a stock. Web purpose of.

Form7203PartI PBMares

Web form 7203 (december 2021) department of the treasury internal revenue service. The irs changes for s corporations form 7203 was developed to replace the worksheet for figuring a shareholder’s stock and debt basis that was formerly found in. Basis from any capital contributions made or additional stock. Web using form 7203, john can track the basis of each stock.

Formal Draft of Proposed Form 7203 to Report S Corporation Stock and

Stock basis at the beginning of the corporation’s tax year. Web purpose of form use form 7203 to figure potential limitations of your share of the s corporation's deductions, credits, and other items that can be deducted on your. Web starting in tax year 2021, form 7203 replaces the shareholder's basis worksheet (worksheet for figuring a shareholder’s stock and debt.

How to complete Form 7203 in Lacerte

Basis from any capital contributions made or additional stock. Use form 7203 to figure potential limitations of your share of the s corporation's deductions, credits, and other items that can be deducted on your. Stock basis at the beginning of the corporation’s tax year. This includes their name, address, employer identification number (ein),. The draft form 7203 for tax year.

Stock Basis At The Beginning Of The Corporation’s Tax Year.

Use form 7203 to figure potential limitations of your share of the s corporation's deductions, credits, and other items that can be deducted on your. Web form 7203 is used to figure potential limitations of a shareholder's share of an s corporation's deductions, credits, etc. Web abraham finberg tax tips form 7203 is a new form developed by irs to replace the shareholder’s stock and debt basis worksheet that has previously been. Web form 7203 is used to calculate any limits on the deductions you can take for your share of an s corporation's deductions, credits, and other items.

The Irs Changes For S Corporations Form 7203 Was Developed To Replace The Worksheet For Figuring A Shareholder’s Stock And Debt Basis That Was Formerly Found In.

This includes their name, address, employer identification number (ein),. Web starting in tax year 2021, form 7203 replaces the shareholder's basis worksheet (worksheet for figuring a shareholder’s stock and debt basis) in the 1040 return. Attach to your tax return. Web form 7203 (december 2021) department of the treasury internal revenue service.

In 2022, John Decides To Sell 50 Shares Of Company A Stock.

View solution in original post february 23,. Web s corporation shareholders use form 7203 to calculate their stock and debt basis. The draft form 7203 for tax year 2022 makes only two changes to the 2021 form: Web starting with the 2021 tax year, a new form 7203 replaces the supplemental worksheet for figuring a shareholder’s stock and debt basis.

Web Purpose Of Form Use Form 7203 To Figure Potential Limitations Of Your Share Of The S Corporation's Deductions, Credits, And Other Items That Can Be Deducted On Your Return.

Web using form 7203, john can track the basis of each stock block separately directly on his income tax return. S corporation shareholder stock and debt basis limitations. Web up to 10% cash back draft form 7203 for 2022 includes few changes. Basis from any capital contributions made or additional stock.