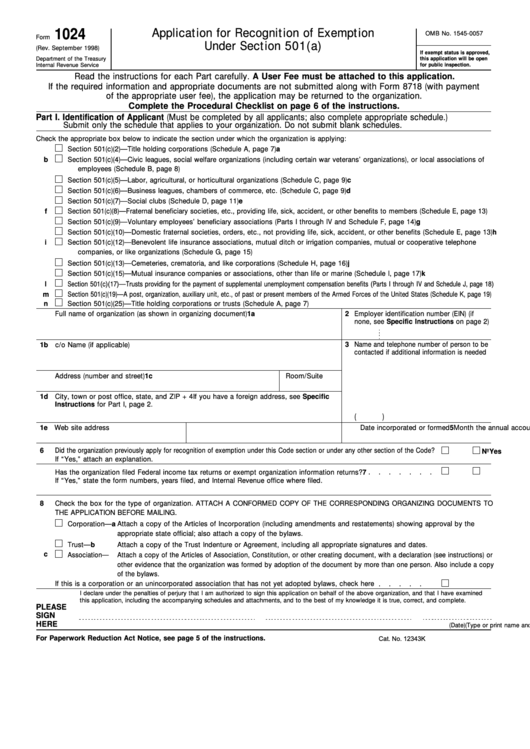

Form Dr 1024

Form Dr 1024 - Web be alert to bogus emails that appear to come from your tax professional, requesting information for an irs form. Web report financial information in united states dollars (specify the conversion rate used). Web according to phillips erb, a real letter from the irs will have a few distinguishing markers, such as an official irs seal, a notice or letter number in the top right corner of the paper,. See the instructions for form 1024 for help in completing this application. Irs doesn’t require life insurance and annuity updates from taxpayers or a tax professional. Don't use form 1024 if you are applying under section 501(c)(3) or section 501(c)(4). Combine amounts from within and outside the united states and report the totals on the financial statements. Web organizations file this form to apply for recognition of exemption from federal income tax under section 501(a) (other than sections 501(c)(3) or 501(c)(4)) or section 521. How to search orange county public judgment records? Organizations use form 1024 to apply for 501(a) exemption or to receive a 501(c) status determination letter.

Web according to phillips erb, a real letter from the irs will have a few distinguishing markers, such as an official irs seal, a notice or letter number in the top right corner of the paper,. Organizations use form 1024 to apply for 501(a) exemption or to receive a 501(c) status determination letter. See the instructions for form 1024 for help in completing this application. Web information about form 1024, application for recognition of exemption under section 501(a), including recent updates, related forms, and instructions on how to file. How to search orange county public judgment records? Irs doesn’t require life insurance and annuity updates from taxpayers or a tax professional. Web organizations file this form to apply for recognition of exemption from federal income tax under section 501(a) (other than sections 501(c)(3) or 501(c)(4)) or section 521. Web report financial information in united states dollars (specify the conversion rate used). Combine amounts from within and outside the united states and report the totals on the financial statements. Don't use form 1024 if you are applying under section 501(c)(3) or section 501(c)(4).

Combine amounts from within and outside the united states and report the totals on the financial statements. Web report financial information in united states dollars (specify the conversion rate used). Organizations use form 1024 to apply for 501(a) exemption or to receive a 501(c) status determination letter. Irs doesn’t require life insurance and annuity updates from taxpayers or a tax professional. How to search orange county public judgment records? Web organizations file this form to apply for recognition of exemption from federal income tax under section 501(a) (other than sections 501(c)(3) or 501(c)(4)) or section 521. Web information about form 1024, application for recognition of exemption under section 501(a), including recent updates, related forms, and instructions on how to file. See the instructions for form 1024 for help in completing this application. One such scam involves fake property liens. Don't use form 1024 if you are applying under section 501(c)(3) or section 501(c)(4).

Form DR462 Download Printable PDF or Fill Online Application for

Don't use form 1024 if you are applying under section 501(c)(3) or section 501(c)(4). How to search orange county public judgment records? Web according to phillips erb, a real letter from the irs will have a few distinguishing markers, such as an official irs seal, a notice or letter number in the top right corner of the paper,. See the.

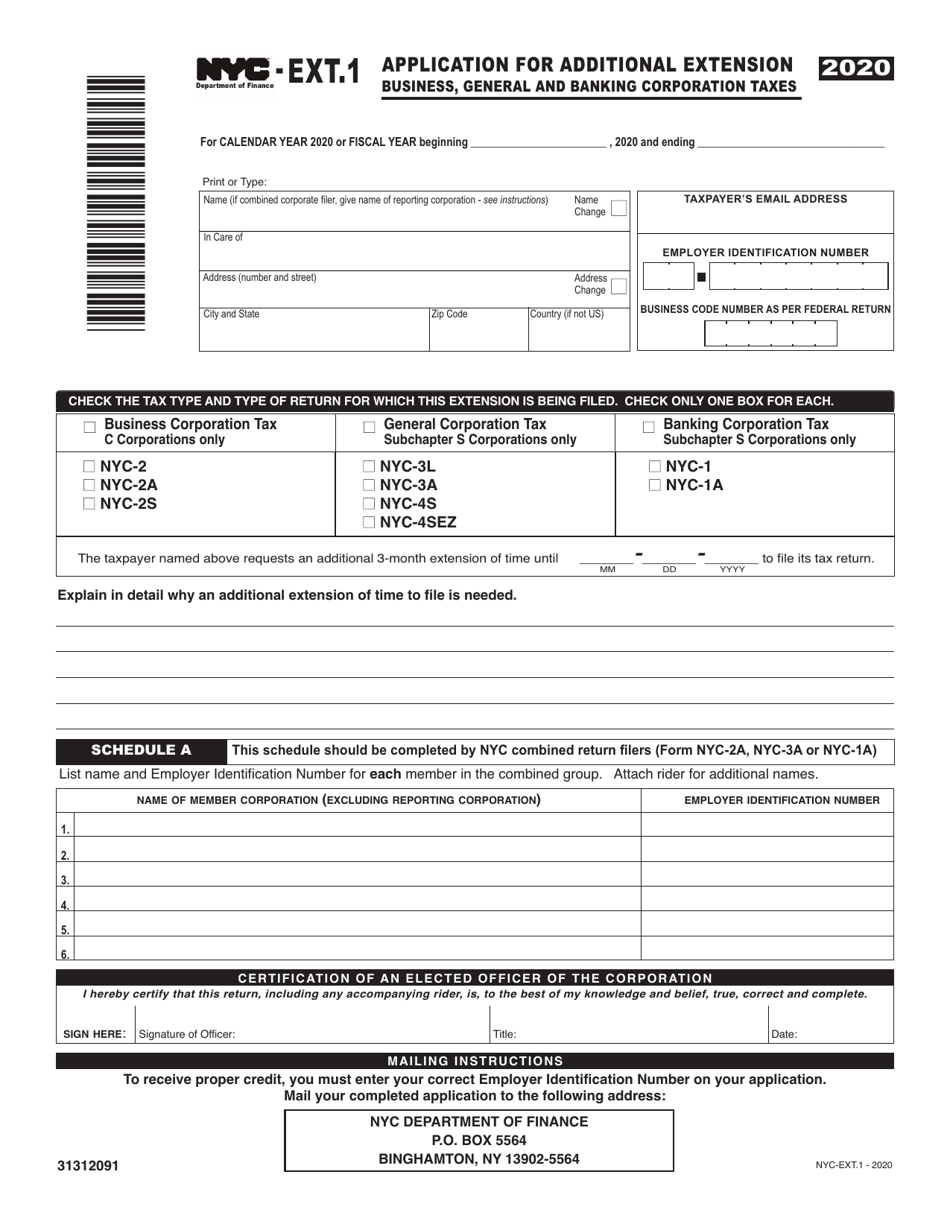

Form NYCEXT.1 Download Printable PDF or Fill Online Application for

Web report financial information in united states dollars (specify the conversion rate used). Combine amounts from within and outside the united states and report the totals on the financial statements. One such scam involves fake property liens. Don't use form 1024 if you are applying under section 501(c)(3) or section 501(c)(4). Irs doesn’t require life insurance and annuity updates from.

Fillable Form 1024 Application For Recognition Of Exemption Under

Irs doesn’t require life insurance and annuity updates from taxpayers or a tax professional. See the instructions for form 1024 for help in completing this application. Don't use form 1024 if you are applying under section 501(c)(3) or section 501(c)(4). Web organizations file this form to apply for recognition of exemption from federal income tax under section 501(a) (other than.

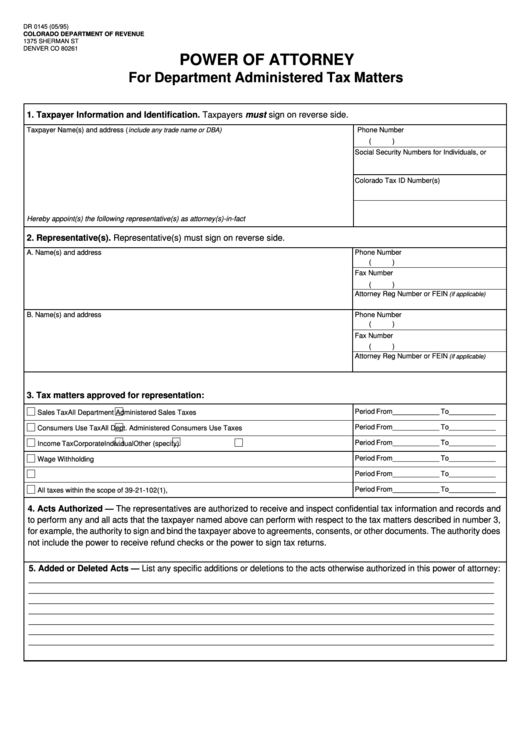

Fillable Form Dr 0145 Power Of Attorney printable pdf download

Web information about form 1024, application for recognition of exemption under section 501(a), including recent updates, related forms, and instructions on how to file. Combine amounts from within and outside the united states and report the totals on the financial statements. Web according to phillips erb, a real letter from the irs will have a few distinguishing markers, such as.

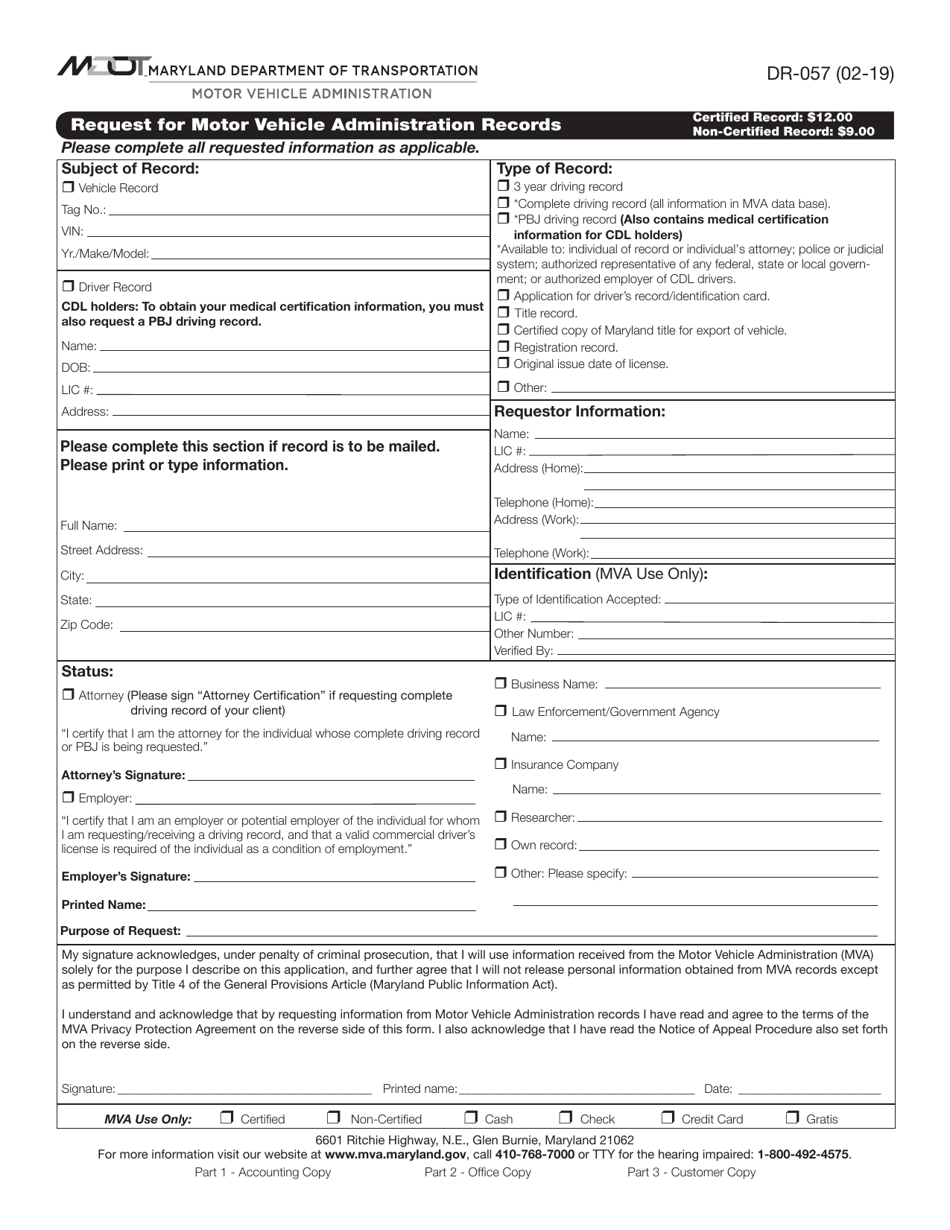

Form DR057 Download Printable PDF or Fill Online Request for Motor

Combine amounts from within and outside the united states and report the totals on the financial statements. Organizations use form 1024 to apply for 501(a) exemption or to receive a 501(c) status determination letter. Don't use form 1024 if you are applying under section 501(c)(3) or section 501(c)(4). Web organizations file this form to apply for recognition of exemption from.

tax processing unit internal processing service Romelia Valenzuela

Web report financial information in united states dollars (specify the conversion rate used). See the instructions for form 1024 for help in completing this application. One such scam involves fake property liens. How to search orange county public judgment records? Organizations use form 1024 to apply for 501(a) exemption or to receive a 501(c) status determination letter.

tax processing unit internal processing service Romelia Valenzuela

Don't use form 1024 if you are applying under section 501(c)(3) or section 501(c)(4). Web organizations file this form to apply for recognition of exemption from federal income tax under section 501(a) (other than sections 501(c)(3) or 501(c)(4)) or section 521. Web be alert to bogus emails that appear to come from your tax professional, requesting information for an irs.

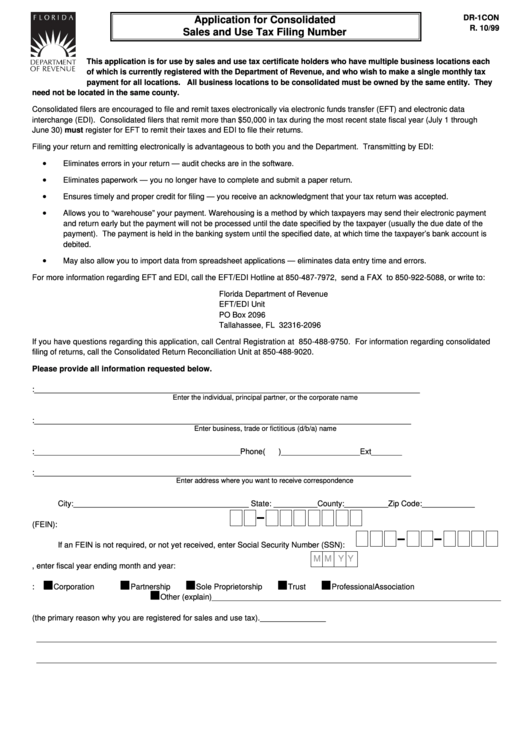

Form Dr1con Application Form For Consolidated Sales And Use Tax

Web be alert to bogus emails that appear to come from your tax professional, requesting information for an irs form. Web organizations file this form to apply for recognition of exemption from federal income tax under section 501(a) (other than sections 501(c)(3) or 501(c)(4)) or section 521. Irs doesn’t require life insurance and annuity updates from taxpayers or a tax.

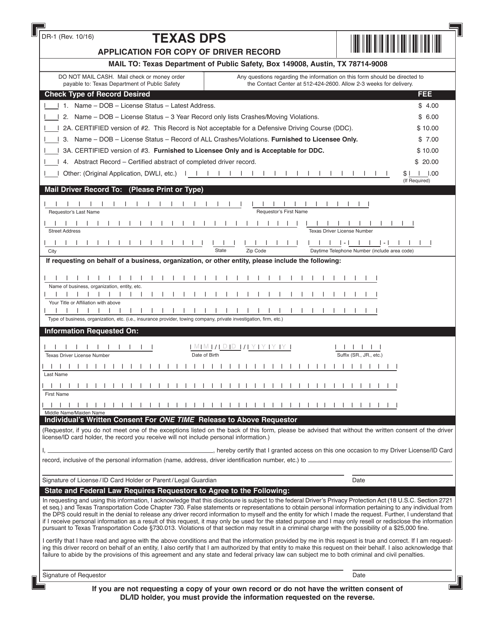

Form DR1 Download Printable PDF or Fill Online Application for Copy of

Web information about form 1024, application for recognition of exemption under section 501(a), including recent updates, related forms, and instructions on how to file. Irs doesn’t require life insurance and annuity updates from taxpayers or a tax professional. See the instructions for form 1024 for help in completing this application. Don't use form 1024 if you are applying under section.

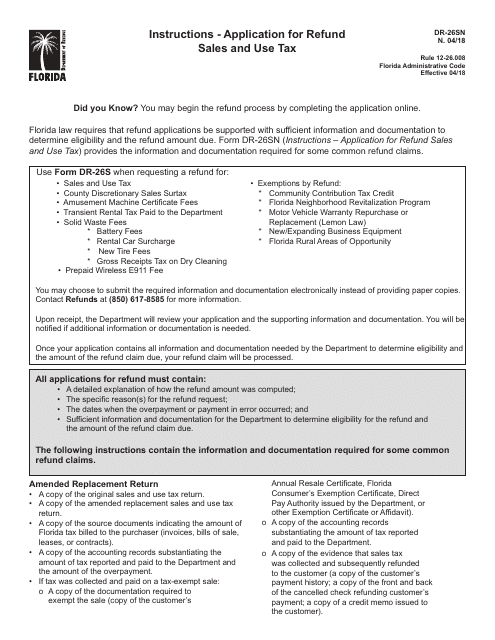

Download Instructions for Form DR26SN, DR26S Application for Refund

One such scam involves fake property liens. Combine amounts from within and outside the united states and report the totals on the financial statements. Irs doesn’t require life insurance and annuity updates from taxpayers or a tax professional. Web organizations file this form to apply for recognition of exemption from federal income tax under section 501(a) (other than sections 501(c)(3).

Irs Doesn’t Require Life Insurance And Annuity Updates From Taxpayers Or A Tax Professional.

Combine amounts from within and outside the united states and report the totals on the financial statements. Organizations use form 1024 to apply for 501(a) exemption or to receive a 501(c) status determination letter. See the instructions for form 1024 for help in completing this application. One such scam involves fake property liens.

Web Organizations File This Form To Apply For Recognition Of Exemption From Federal Income Tax Under Section 501(A) (Other Than Sections 501(C)(3) Or 501(C)(4)) Or Section 521.

Don't use form 1024 if you are applying under section 501(c)(3) or section 501(c)(4). How to search orange county public judgment records? Web information about form 1024, application for recognition of exemption under section 501(a), including recent updates, related forms, and instructions on how to file. Web be alert to bogus emails that appear to come from your tax professional, requesting information for an irs form.

Web Report Financial Information In United States Dollars (Specify The Conversion Rate Used).

Web according to phillips erb, a real letter from the irs will have a few distinguishing markers, such as an official irs seal, a notice or letter number in the top right corner of the paper,.